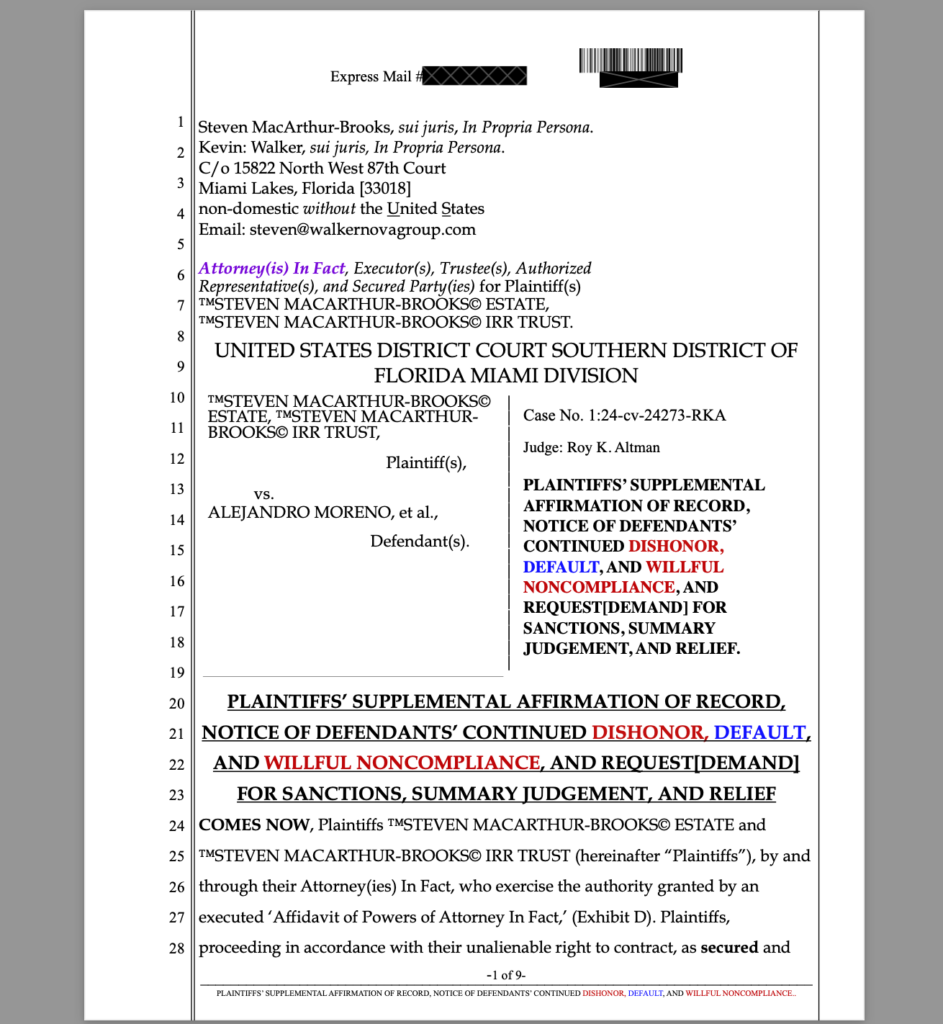

In a decisive move to hold the Defendants accountable for their ongoing misconduct and failure to comply with court orders, the Plaintiffs have filed a “SUPPLEMENTAL AFFIRMATION OF RECORD, NOTICE OF DEFENDANTS’ CONTINUED DISHONOR, DEFAULT, AND WILLFUL NONCOMPLIANCE, AND REQUEST [DEMAND] FOR SANCTIONS, SUMMARY JUDGEMENT, AND RELIEF” in the ongoing litigation before Judge Roy K. Altman. This filing underscores the Plaintiffs’ determination to secure justice and highlights the Defendants’ blatant disregard for the legal process, affirming the legal basis for sanctions, default judgment, and summary judgment in the Plaintiffs’ favor.

Background

The case involves serious claims of breaches of contract, fraud, embezzlement, and other commercial wrongs, with Plaintiffs presenting unrebutted verified affidavits that serve as binding evidence. Despite the clarity and sufficiency of the Plaintiffs’ claims, the Defendants have failed to respond in a timely or valid manner, raising issues of noncompliance and intentional dishonor.

Despite having been granted sufficient time and opportunity to respond and comply with the procedural rules, the Defendants have demonstrated a consistent pattern of delay, providing no valid rebuttal or defense to the Plaintiffs’ claims.

The Court Order and Defendants’ Noncompliance

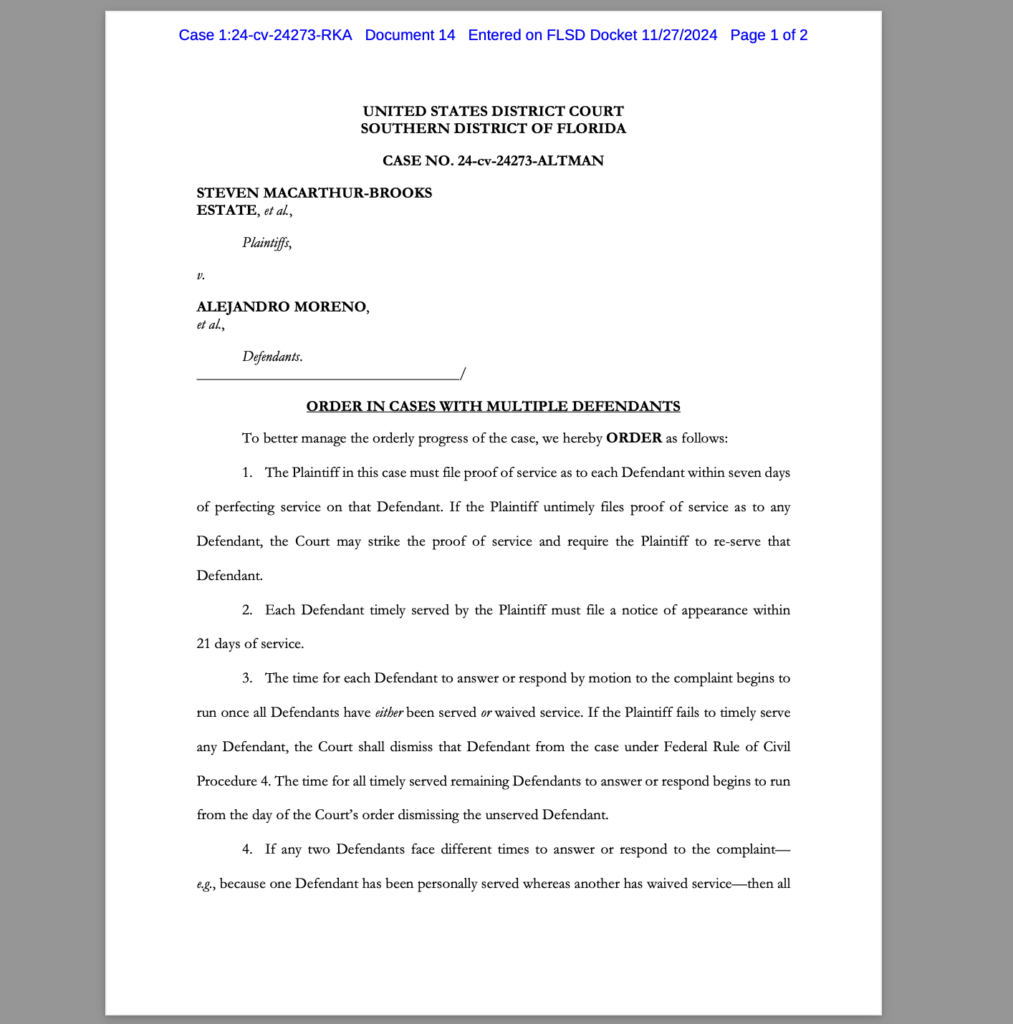

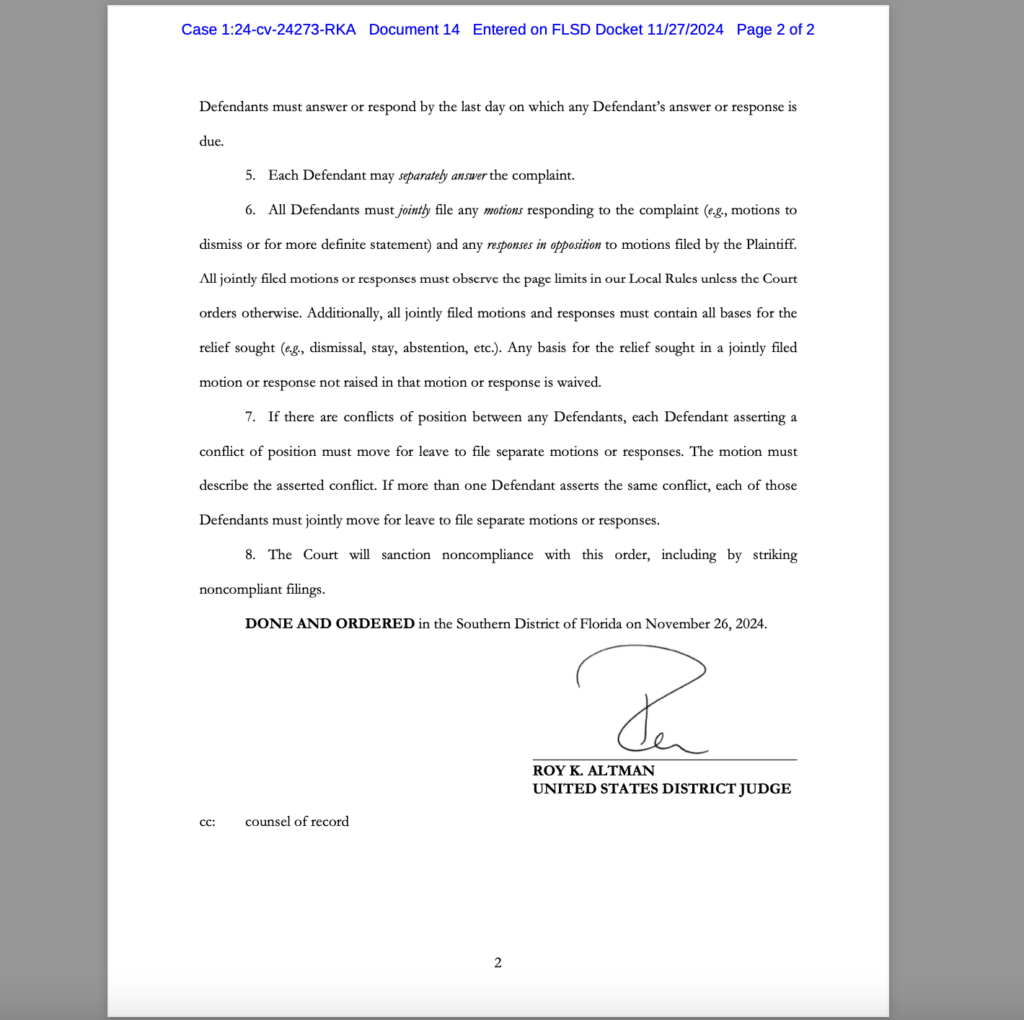

On November 26, 2024, Judge Roy K. Altman issued a Court Order in the case, establishing key procedural requirements to ensure the orderly progress of litigation and the fair treatment of all parties involved. These provisions include deadlines for filing proof of service, notices of appearance, and responses to motions in compliance with the Federal Rules of Civil Procedure.

The Court Order, as issued by Judge Altman, required the following:

- Proof of Service: The Plaintiff was ordered to file proof of service within seven days of completing service on each Defendant. Failure to comply could lead to the striking of proof of service and re-service of the Defendant.

- Notice of Appearance: Defendants were required to file a notice of appearance within 21 days of service, failing which they would be considered in default.

- Timeliness of Responses: Defendants had a limited time to respond or answer the complaint once all Defendants had either been served or waived service. Failure to timely serve any Defendant could lead to their dismissal from the case.

- Joint Motions and Responses: Defendants were required to file joint motions and responses to the complaint, including motions to dismiss or for a more definite statement. Noncompliance with this rule would result in sanctions.

- Sanctions for Noncompliance: Judge Altman specifically ordered that sanctions would be imposed for failure to comply with the Court’s directives, including the potential striking of noncompliant filings.

Plaintiffs’ Supplemental Affirmation and Request for Relief

In light of the Defendants’ continued dishonor, default, and willful noncompliance, the Plaintiffs have submitted their Supplemental Affirmation of Record before Judge Roy K. Altman, which:

- Reaffirms the claims and evidence presented, emphasizing the unrebutted verified affidavits and the Affidavit Certificate of Dishonor, Non-Response, Default, Judgment, and Lien Authorization (Exhibit E).

- Highlights the failure of the Defendants to timely respond or provide evidence to dispute the Plaintiffs’ claims, underscoring that the facts in the affidavits stand as binding under commercial law.

- Details the failure to comply with Court deadlines and procedural requirements, which the Plaintiffs argue has prejudiced their ability to move forward in the case.

The Plaintiffs’ filing demands the following relief:

- Sanctions: Plaintiffs seek the imposition of sanctions on the Defendants for their willful noncompliance with the Court’s order, including striking any noncompliant motions or filings and potentially holding the Defendants in contempt of court.

- Summary Judgment: Given the unrebutted affidavits and the absence of any timely or valid rebuttal from the Defendants, the Plaintiffs request that summary judgment be granted in their favor, as there is no material dispute over the facts.

- Financial Penalties: The Plaintiffs are seeking financial penalties based on the accrual of $1,000,000,000.00 per day for each day the Defendants remain in default. As of November 29, 2024, the amount owed by the Defendants is $16,975,000,000.00, and continues to increase daily.

Conclusion

The Supplemental Affirmation of Record, filed by the Plaintiffs before Judge Roy K. Altman, is a forceful request for sanctions, summary judgment, and relief in response to the Defendants’ failure to comply with the Court’s orders and engage meaningfully with the legal process. The Plaintiffs reaffirm that their claims are supported by unrebutted affidavits, and the Defendants’ actions amount to continued dishonor, default, and willful noncompliance.

The Plaintiffs respectfully demand that Judge Roy K. Altman grant the requested relief, including the imposition of financial penalties, the entry of summary judgment, and sanctions for the Defendants’ ongoing failure to comply with legal obligations and Court orders. The Plaintiffs remain resolute in their pursuit of justice, seeking to hold the Defendants fully accountable for their misconduct and secure a fair and timely resolution of the matter.