An exploration of corporate records reveals surprising links between well-known institutions and corporations, suggesting a deep, interconnected web involving the IRS, the American Bar Association (ABA), and Northern Trust Corporation. These details provide insight into the corporate structure of entities many view as governmental and independent but may, in fact, operate under the same corporate umbrella. Original article on REALWORLDFARE.com.

The IRS: An Incorporated Entity

The IRS was initially incorporated as “INTERNAL REVENUE TAX AND AUDIT SERVICE, INC” on July 12, 1933, under File Number #0325720. This incorporation indicates that the IRS is not merely a government agency but a corporate entity operating under private law. This challenges the common perception of the IRS as a strictly federal tax-collecting agency.

Based on research, the IRS is/was held by Northern Trust Corporation, with its File Number: 0774471. Northern Trust Corporation, incorporated on August 23, 1971, is a general domestic corporation registered in Delaware, with its registered agent listed as The Corporation Trust Company. These details align with the structure and function of corporations, which typically have registered agents and filing numbers.

Northern Trust Corporation: The Hub of Influence

Northern Trust Corporation holds significant influence through its ownership of various major entities, including:

- IRS Company

- JPMorgan Chase & Co.

- Citigroup, Inc.

- American Express Company

- SPDR Gold Shares

- General Electric Co.

- Wells Fargo & Company

- UnitedHealth Group, Inc.

- Bank of America Corporation

This extensive list highlights the corporation’s reach across banking, healthcare, gold reserves, and various sectors of the American economy. Such control suggests a concentration of power and raises questions about how these institutions may be working in concert.

Wells Fargo and the Bar Association

Wells Fargo, one of the largest banks in the United States, is/was owned by the American Bar Association, which itself falls under the control of Northern Trust Corporation. This blurs the lines between legal and financial institutions, suggesting that the ABA, often perceived as a regulatory and advisory body, also plays a significant role in financial activities through its control over banking institutions.

Dunn & Bradstreet’s Ties to the Bar Association

Dunn & Bradstreet, a well-known business credit reporting agency, is/was also owned by the American Bar Association. This ownership implies that the ABA may have access to a vast network of corporate information and financial records, giving it significant leverage over the business and legal landscape.

The Role of Judges and the Legal System

Every time a judge makes a judgment, their affiliation as a member of the Bar is a key factor in the decision. If the Bar Association holds control over major banking institutions and credit agencies, the potential conflict of interest becomes evident. This raises the question: are judgments truly impartial when the judges themselves are members of an organization that controls such vast financial power?

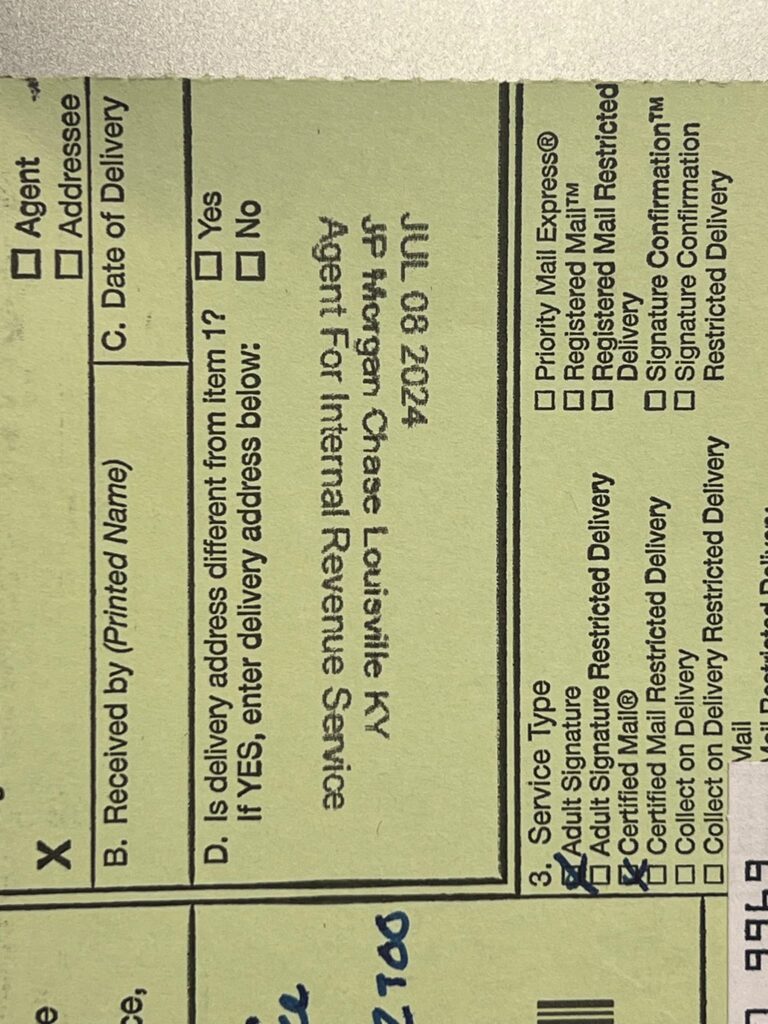

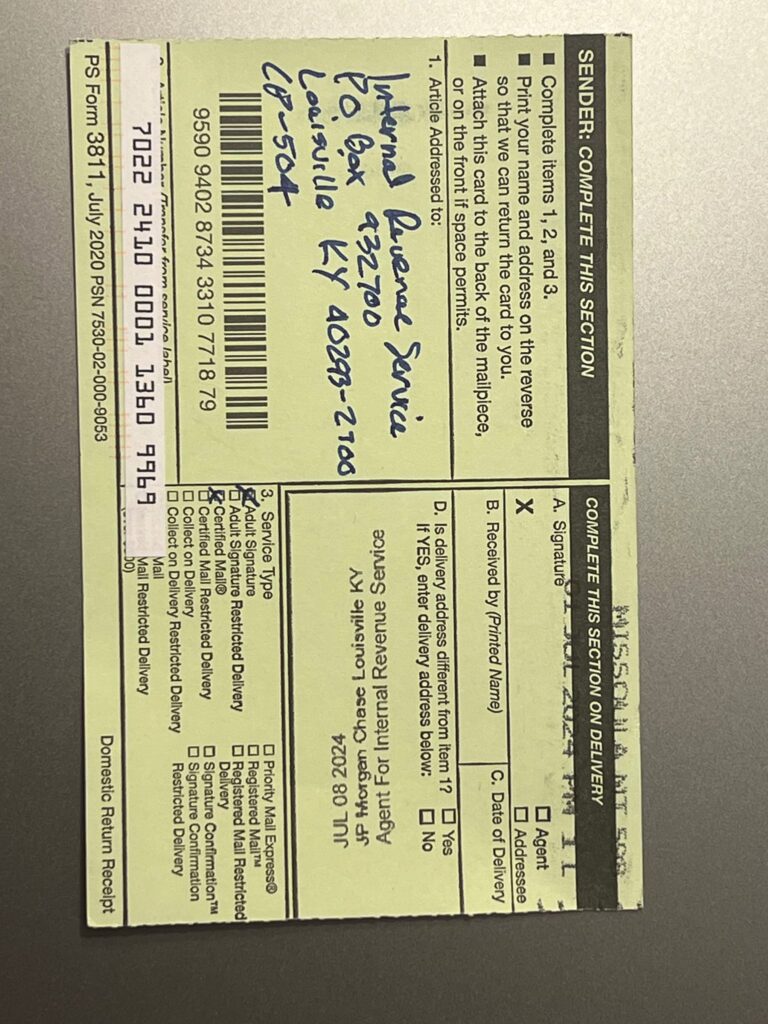

JP Morgan Chase: The IRS’s Receiving Agent

Adding another layer to this network is the role of JP Morgan Chase as the receiving agent for IRS documents. When IRS documents are sent, they are processed through JP Morgan Chase, which acts as an intermediary between the sender and the IRS. This connection further highlights the integration of financial institutions in the operations of what is often seen as a federal agency, suggesting a deeper corporate structure at play.

Historical Patterns and the Fallout

Paperwork was once submitted to support a claim that taxes were not owed, and when this document was admitted as evidence, the law firm involved eventually declared bankruptcy and left the state. This could indicate either a strategic retreat or an acknowledgment of the complexities surrounding these corporate relationships and tax matters.

Conclusion

The connections between the IRS, the American Bar Association, Northern Trust Corporation, and various financial and legal entities suggest a highly integrated system where legal, financial, and governmental powers may not be as separate as they appear. If these entities are indeed tied under one corporate umbrella, it fundamentally changes the understanding of their roles in society.

These connections highlight the importance of questioning corporate and governmental affiliations and remaining vigilant about how these entities influence each other. It serves as a reminder that the distinction between public and private sectors can often be murkier than it seems.