The “Posting Rule,” also known as the “Mailbox Rule,” is a legal principle that plays a crucial role in the law of contracts, particularly in the context of offer and acceptance. This rule addresses the moment at which an acceptance of an offer is deemed to be legally effective. According to the Postal Rule, acceptance takes effect when the letter of acceptance is dispatched (that is, placed in the mailbox), not when it is received by the offeror. This principle is significant because it establishes a clear point in time at which a contract is considered to have been formed, even if the acceptance letter is delayed, lost, or never reaches the offeror.

Understanding the lawful principles of offer and acceptance is fundamental to the formation of contracts. An offer is a clear statement of the terms on which one party (the offeror) is willing to enter into a contract, and acceptance is the unqualified agreement to those terms by another party (the offeree). For a contract to be binding, the acceptance must be clearly communicated back to the other party and can be an outright acceptance or conditional acceptance.

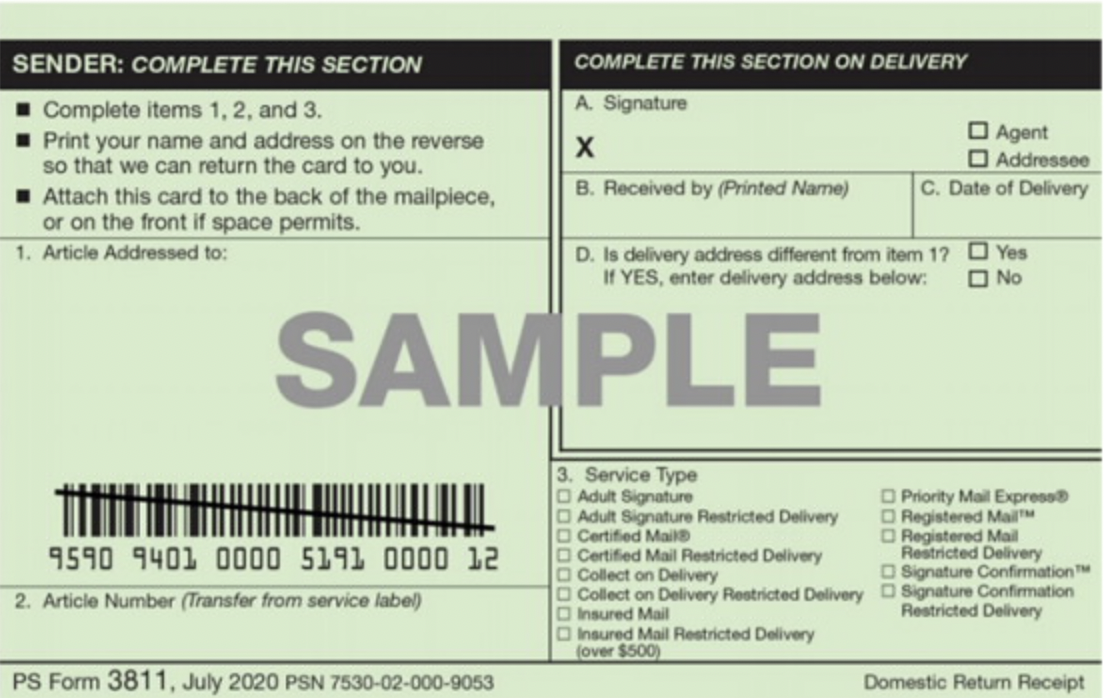

USPS the Financial Institution and Registered Mail, Certified Mail, and Form 3811 Signature:

The United States Postal Service is a financial institution and corporation, owned by the United States (corporation). They sell money orders, handle passports, sells stamps, and they also register and certify documents, when used in the correct way.

The tracking also serves as a third party witness to a document being sent.

The form 3811 Serves as official confirmation the document was “signed for” for the recipient and can even have a “restricted delivery.”

People Accepting Offers Everyday:

Based on research, People are unknowingly accepting offers every day. That is because practically every statement of account (because they aren’t bills, but rather reflections of the amount your straw man’s credit being used) received is therefore an offer which many unknowingly accept through a seemingly intentional lack of education and incompetence.

Once the offer is accepted via mail and returned with payment such as a Debit Card (digital FRNs/Bonds/checks), Check, Money Order, or other debt instrument, they have acquiesced via their actions to allowing the financial institution to take and use their Credit. They have abandoned their intangible secured property (as referenced on the IRS 1099-A instructions).

The Conditional Acceptance:

You do not dispute the charges or facts and conditionally accept them, upon proof of..:

1. Claim

2. Proof that you aren’t committing fraud

3. Proof that you didn’t already receive full payment via a 1099-OID with FIRST MIDDLE LAST listed

4. Proof that the promissory note, bill of exchange, 1099-A, Bond, or other Debt Instrument sent didn’t discharge the obligation as supported by U.C.C. 3-311, 3-603, and/or House Joint Resolution 192 of June 5 1933, public law 73-10.

5. Proof that you didn’t violate Title 12 U.S.C. 1813(L)(1) which stipulates: when the purported borrower gives, deposits, or surrenders or the subsequent supposed loan owner obtains the promissory note, it becomes a CASH item.

6. Proof that you aren’t violating UCC §3-104(f) which stipulates: a promissory note or draft is the equivalent of a check and can be securitized or monetized by direct deposit in a commercial checking, time, thrift, or saving account under Title 12 of the United States Code §1813(l)(1), and upon being deposited, it becomes the equivalent of “money” as outlined under §1813(l)(1).

7. The list goes on….

Changing the Terms of the Contract:

When One is sui juris he/she will then also understand the power he/she wields in handling their own commercial affairs. Said power entails adding new terms to the contract.

e.g.

- an amount due in judgement if no response if received…

- If FRAUDSTER fails to respond within the three (3) days, then it is agreed that they fully, individually, and collectively admit and agree with ALL of the allegations, statements, adjudication, and claims stated here in this Affidavit by TACIT PROCURATION. Silence is Acquiescence.

ESTOPPEL: “We already have this discussion and don’t need to, nor will we again”

Estoppel is based on principles of fairness and equity; it aims to prevent injustice due to inconsistency or deceit. There are several types of estoppel, including but not limited to:

1. Promissory Estoppel: This occurs when a party makes a promise that they reasonably expect to induce action or forbearance on the part of a promisee, and the promisee does act in reliance on the promise. The promisor is then estopped from reneging on the promise even if the original promise was not supported by consideration (which is usually required for a contract to be binding).

2. Estoppel by Representation: This form of estoppel happens when one party makes a factual representation to another, and the latter, relying on the truth of this representation, alters their position to their detriment. The party who made the representation is then estopped from denying the truth of their statement if doing so would harm the party who relied on it.

3. Estoppel by Silence: This occurs when a party has the duty to speak or disclose information but chooses to remain silent, leading another party to adopt a position they would not have taken had the first party disclosed the relevant information. The silent party is estopped from asserting any claims that contradict the position taken in their silence.

4. Collateral Estoppel (Issue Estoppel): Prevents a party from re-litigating an issue that has already been decided by a court in a previous case where the party was a participant.

Estoppel serves as a tool to enforce consistency and integrity, ensuring that parties do not benefit from their own inconsistencies or falsehoods to the detriment of others who have relied on their original position. The application of estoppel can vary significantly between different jurisdictions and legal systems, but its core purpose of promoting fairness and preventing injustice is widely recognized.

So if One then ends the affidavit with something including the following, Estoppel has been established.

ESTOPPEL BY ACQUIESCENCE:

In the event You, Shady CEO, SHADY COMPANY, Does 1-10 Inclusive, and/or any Officer, Employee, or Associate with/of You, Shady CEO, SHADY COMPANY, Does 1-10 Inclusive fails to respond, they individually and collectively admit the statements and claims by TACIT PROCURATION, all issues are deemed settled RES JUDICATA, STARE DECISIS and by COLLATERAL ESTOPPEL. You, Shady CEO, SHADY COMPANY, Does 1-10 Inclusive, may not argue, controvert, or otherwise protest the finality of the administrative findings in any subsequent process, whether administrative or judicial.(See Black’s Law Dictionary 6th Ed. for any terms you do not “understand”).

Your failure to completely answer and respond will result in your agreeing not to argue, controvert or otherwise protest the finality of the administrative findings in any process, whether administrative or judicial, as certified by Notary or Witness Acceptor in an Affidavit Certificate of Non Response and/or Judgement, or similar.Should YOU fail to respond, provide partial, unsworn, or incomplete answers, such are not acceptable to me or to any court of law.See, Sieb’s Hatcheries, Inc. v. Lindley, 13 F.R.D. 113 (1952)., “Defendant(s) made no request for an extension of time in which to answer the request for admission of facts and filed only an unsworn response within the time permitted,” thus, under the specific provisions of Ark. and Fed. R. Civ. P. 36, the facts in question were deemed admitted as true.Failure to answer is well established in the court.Beasley v. U. S., 81 F. Supp. 518 (1948)., “I, therefore, hold that the requests will be considered as having been admitted.”

One of the following two (2) scenarios will likely then occur:

1. Recipient(s)/FRAUDSTER(S) go silent:

- at which point you need to finish your process or walk away knowing you won: but be prepared to resume and finish the process if they resurface, or be prepared to restart and finish the process with a fraudulent 3rd party “debt collector” if the debt is fraudulently sold in bad faith to a debt collector.

OR

2. Recipient(s)/FRAUDSTER(S) respond acting like you’re crazy or speaking nonsense (quite funny to see some of things they write) LOL):

- at which point you must truly be sui juris and understand how to respond, as you will be tested. Just because they responded doesn’t mean their response is effective or valid. Did you state they MUST respond point for point, and the document must be sworn to under the penalty of perjury and signed by a living man or woman?

If they have not responded in accordance with the lawful requirements established in your correspondence, then their response is treated as a “Failure to respond” which is defined as a blank denial, unsupported denial, inapposite denial, such as, “not applicable” or equivalent, statements of counsel and other declarations by third parties that lack first-hand knowledge of the facts, and/or responses lacking verification, all such responses being legally insufficient to controvert the verified statements herewith. See Sieb’s Hatcheries, Inc and Beasley, Supra. Failure to respond can result in their acceptance of personal liability external to qualified immunity and waiver of any decision rights of remedy.

Legal Maxims:

- AN UNREBUTTED AFFIDAVIT STANDS AS TRUTH IN COMMERCE. (12 Pet. 1:25; Heb. 6:13-15;). “He who does not deny, admits.”

- AN UNREBUTTED AFFIDAVIT BECOMES THE JUDGEMENT IN COMMERCE. (Heb. 6:16-17;). “There is nothing left to resolve.”

- TRUTH IS EXPRESSED IN THE FORM OF AN AFFIDAVIT. (Lev. 5:4-5; Lev. 6:3-5; Lev. 19:11-13: Num. 30:2; Mat. 5:33; James 5: 12).

- IN COMMERCE FOR ANY MATTER TO BE RESOLVED MUST BE EXPRESSED. (Heb. 4:16; Phil. 4:6; Eph. 6:19-21). — Legal maxim: “To lie is to go against the mind.” Oriental proverb: “Of all that is good, sublimity is supreme.”

- HE WHO LEAVES THE BATTLEFIELD FIRST LOSES BY DEFAULT. (Book of Job; Mat. 10:22) — Legal maxim: “He who does not repel a wrong when he can occasions it.

- IN COMMERCE TRUTH IS SOVEREIGN. (Exodus 20:16; Ps. 117:2; John 8:32; II Cor. 13:8 ) Truth is sovereign — and the Sovereign tells only the truth.

- ALL ARE EQUAL UNDER THE LAW. (God‘s Law – Moral and Natural Law). Exodus 21:23-25; Lev. 24: 17-21; Deut. 1; 17, 19:21; Mat. 22:36-40; Luke 10:17; Col. 3:25. “No one is above the law”.

California Code:

- California Code of Civil Procedure § 437c(a): Summary judgment is appropriate where there is no triable issue of material fact and the moving party is entitled to judgment as a matter of law. The unrebutted affidavits submitted by Plaintiffs establish that there are no material facts in dispute, and Plaintiffs are entitled to judgment based on the evidence provided, and as a matter of Law.

“Statements of fact contained in affidavits which are not rebutted by the opposing party’s affidavit or pleadings may be accepted as true by the trial court.“ –Winsett v. Donaldson, 244 N.W.2d 355 (Mich. 1976).

Conclusion:

It is up to you to be sui juris and understand how to handle your own commercial affairs.

Most Americans today sadly aren’t correctly educated on the monetary system and the matrix of creating money. Propaganda has convinced many that a straw man is not a function of every day commerce, that the Birth Certificate (Bank Note) is merely a piece of paper and as a result majority don’t even understand the art of offer and acceptance as it pertains to Law.

Let’s teach out children the right way and break the cycle of improper banking!