The Uniform Commercial Code (UCC) provides a structured legal framework for negotiable instruments, obligations, and their discharge. Among its provisions, sections like UCC §§ 3-303, 3-604, 3-104, 3-409, 2-206, and 1-103 reveal a clear foundation for the Accepted for Value (A4V) process. This process allows obligations such as mortgages, loans, or other debts to be addressed through lawful mechanisms of discharge, settlement, or setoff.

Key UCC Provisions Supporting Accepted for Value

UCC § 3-303: Value and Consideration

This section defines when a negotiable instrument is deemed to have value and establishes consideration as the legal basis for enforceability. It sets forth that an instrument issued in payment of a prior obligation or as a security interest carries inherent value.

- A4V Connection: Recognizing an instrument’s value allows it to be treated as pre-paid or already satisfied, a key aspect of A4V when returning an endorsed instrument to discharge obligations.

UCC § 3-604: Discharge by Cancellation or Renunciation

Under § 3-604, a party entitled to enforce an instrument can discharge the obligation through acts such as striking out a signature, adding discharge language, or surrendering the instrument.

- A4V Connection: Endorsing a financial instrument with “Accepted for Value” and returning it for settlement activates § 3-604. This acknowledges that the instrument itself serves as the means to set off the debt.

UCC § 3-104: Definition of a Negotiable Instrument

Section 3-104 identifies checks, promissory notes, and similar documents as negotiable instruments—unconditional promises to pay that can be transferred, endorsed, or discharged.

- A4V Connection: Treating obligations like mortgages as negotiable instruments allows them to be accepted for value and used to extinguish corresponding liabilities.

UCC § 3-409: Acceptance of a Draft

Section 3-409 outlines that a draft is accepted when the drawee signs an agreement to honor it, whether directly on the draft or through a separate written commitment.

- A4V Connection: A properly endorsed draft, including the “Accepted for Value” language, is a legally binding acknowledgment that the instrument will be honored for settlement or discharge. This reinforces the A4V process as a lawful acceptance and agreement to settle.

UCC § 2-206: Offer and Acceptance in Formation of Contract

Section 2-206 specifies that acceptance of an offer can occur in any manner reasonable under the circumstances.

- A4V Connection: The endorsement of an instrument with “Accepted for Value” is a reasonable acceptance, providing a lawful response that satisfies contractual obligations.

UCC § 1-103: General Principles of Equity and Law

This section ensures that where the UCC does not explicitly address a matter, general principles of law, equity, and fairness apply.

- A4V Connection: By integrating equity into UCC processes, § 1-103 legitimizes A4V as a method to achieve settlement through fairness and good faith.

Accepted for Value in Practice

The A4V process involves recognizing financial instruments as carrying inherent value, endorsing them to indicate acceptance, and returning them to the issuer for discharge of obligations. Here’s how it works:

- Acknowledgment of Value:

- A mortgage, tax bill, or similar document is treated as a negotiable instrument representing debt or credit.

- Endorsement:

- The recipient writes “Accepted for Value. Return for Value. Setoff, Settlement, and Closure of All Charges” on the instrument and signs it, invoking UCC §§ 3-604 and 1-103.

- Return to Issuer:

- The endorsed document is sent back to the issuer or their agent (e.g., JP Morgan Chase for the IRS) with instructions for settlement.

- Discharge of Obligation:

- The process leverages the instrument’s value to offset the debt, effectively satisfying the liability in question.

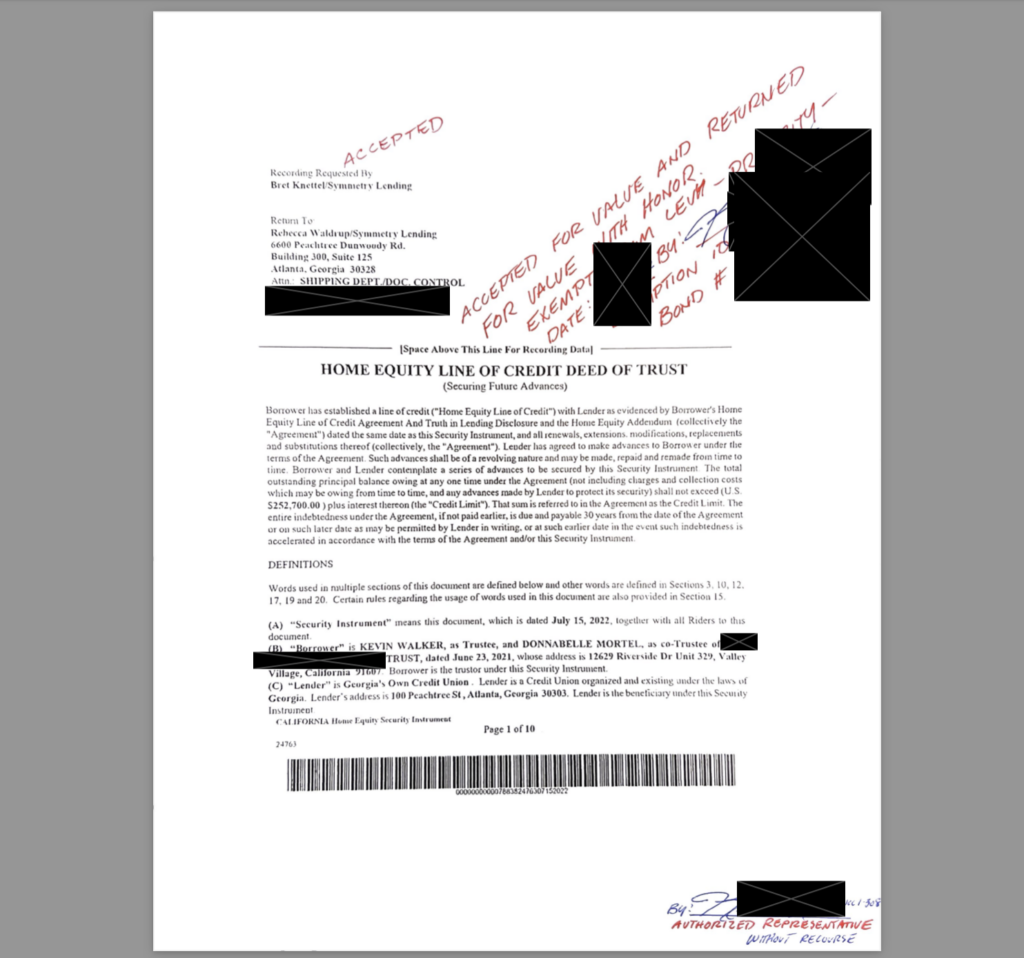

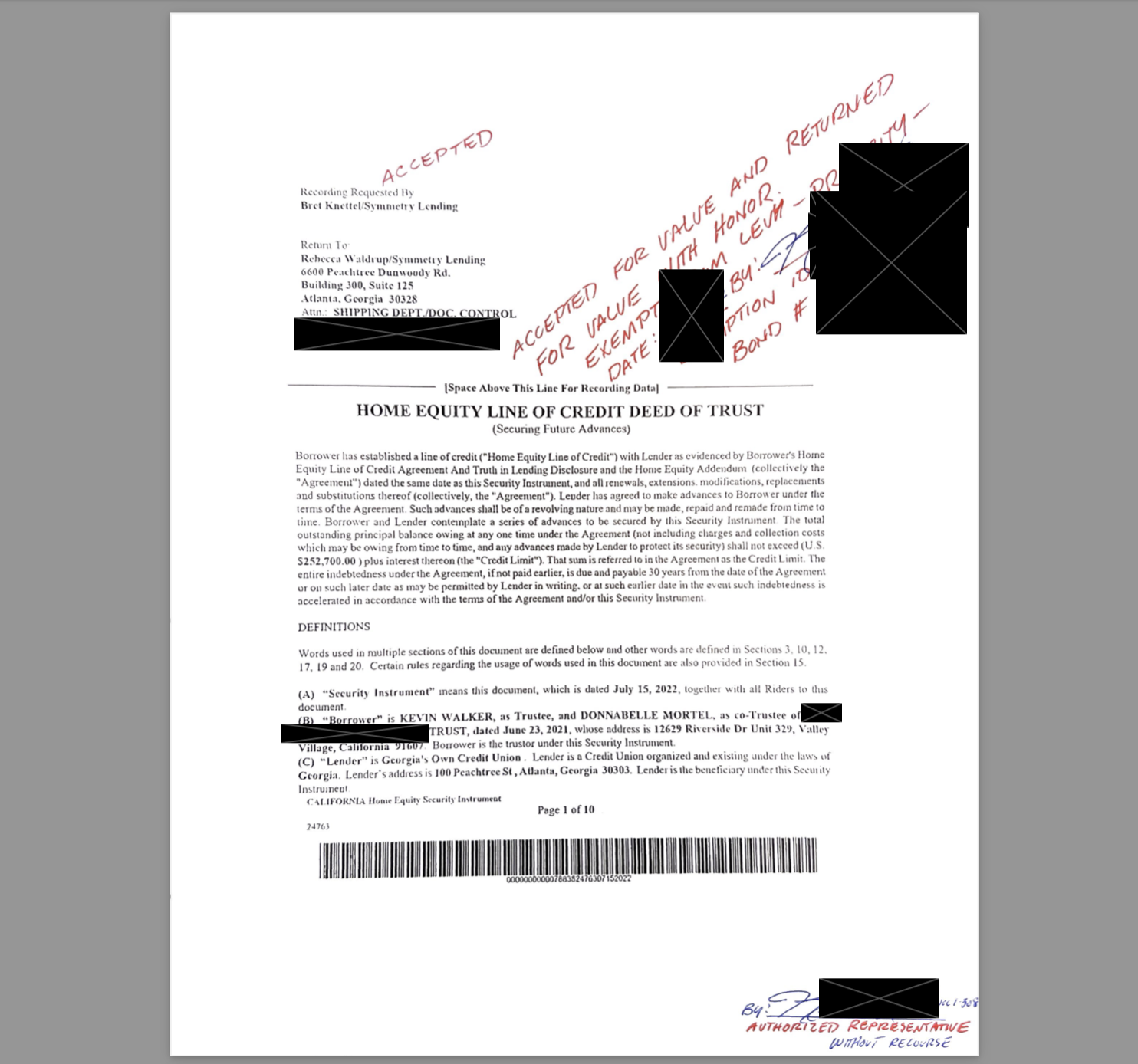

Screen Shot 2024 11 17 at 5.24.01 AM

Example: Discharging a Mortgage

Consider a scenario where an individual seeks to discharge a $200,000 mortgage:

- The mortgage note is acknowledged as a negotiable instrument under UCC § 3-104.

- The homeowner writes “Accepted for Value” on the instrument, recognizing its value and invoking UCC §§ 3-604 and 3-409 for discharge.

- The instrument is returned to the lender, along with a notice of instructions referencing UCC §§ 3-303 and 1-103, requesting setoff and settlement.

- The lender, acting under these provisions, processes the note for settlement, applying its value to satisfy the outstanding balance.

Why Accepted for Value Matters

The A4V process isn’t simply a loophole but rather a lawful mechanism supported by UCC principles to address financial obligations equitably.

- It redefines how negotiable instruments like mortgages or tax bills are perceived—not merely as debts but as evidence of credit.

- By endorsing and returning such instruments, individuals invoke a codified process for discharge, echoing the broader principles of fairness and equity enshrined in UCC § 1-103.

Through this framework, the A4V process provides a pathway to resolve obligations while maintaining compliance with established legal norms.