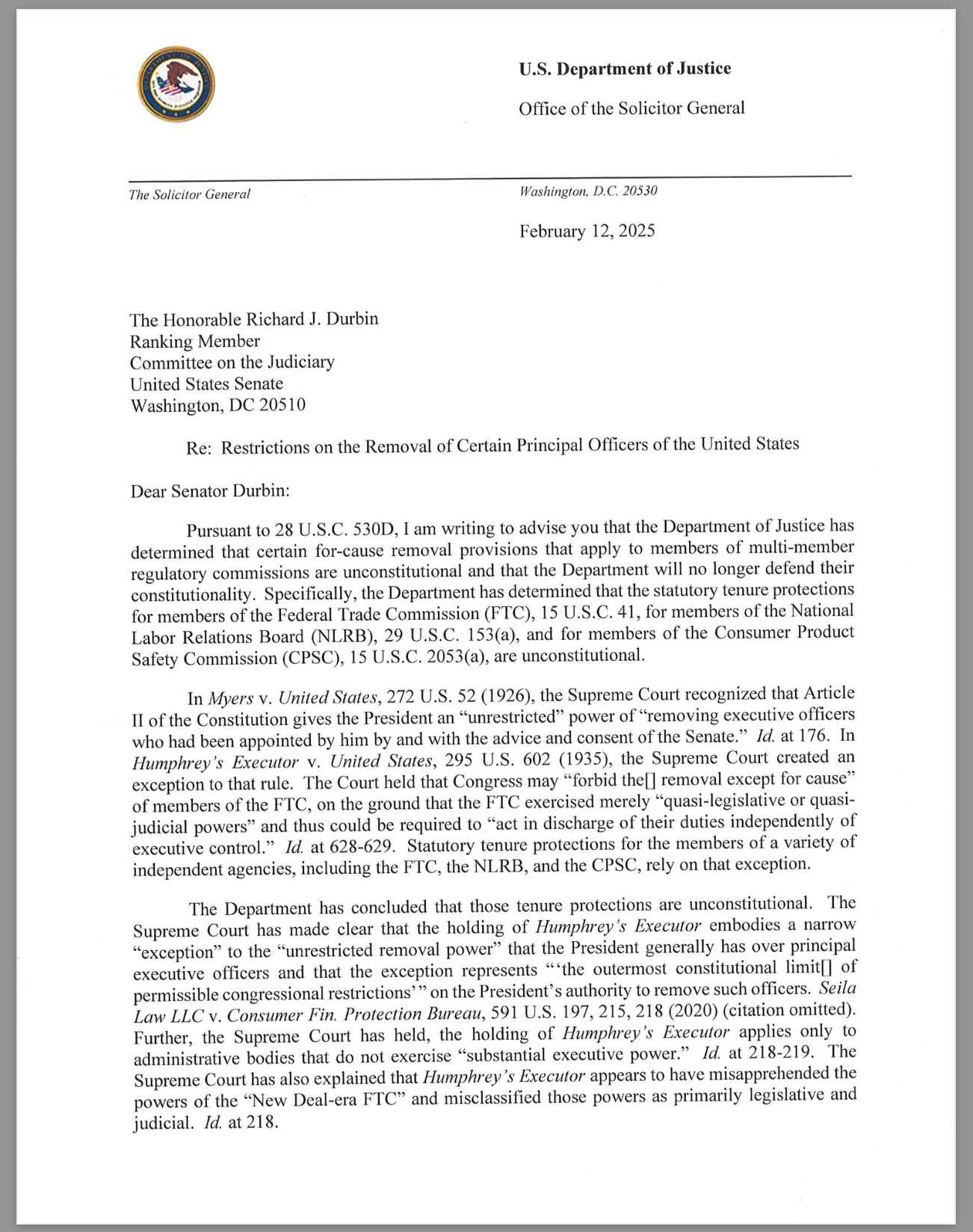

Acting Solicitor General of the US Department of Justice (DOJ) Sarah Harris sent a letter to President Pro Tempore of the US Senate Charles Grassley on Thursday sharing the DOJ’s determination that removal restrictions for administrative law judges (ALJs) are unconstitutional and that the DOJ no longer intends to defend them in court.

The DOJ justified its finding based on the US Supreme Court’s ruling in Free Enterprise Fund v. PCAOB. The court in that case ruled that the president being “restricted in his ability to remove a principal [executive] officer, who is in turn restricted in his ability to remove an inferior [executive] officer,” violates the president’s ability to adhere to his constitutional obligation to “take care that the laws be faithfully executed.”

DOJ Chief of Staff Chad Mizelle stated:

“Unelected and constitutionally unaccountable ALJs have exercised immense power for far too long. In accordance with Supreme Court precedent, the Department is restoring constitutional accountability so that Executive Branch officials answer to the President and to the people.”

ALJs are officials appointed by the heads of executive agencies and serve as the triers of law and fact for disputes concerning an agency’s law. Federal agencies are prohibited from removing their ALJs except “for good cause established and determined by the Merit Systems Protection Board [(MSPB)] on the record after opportunity for hearing before the Board.” Additionally, the members of the board serve seven-year terms and can only be removed by the president “for inefficiency, neglect of duty, or malfeasance in office.”

The Association of Administrative Law Judges (AALJ) found the DOJ’s determination to be an unlawful overreach into the independence of the ALJs’ adjudication proceedings. Judge Som Ramrup stated: “Administrative law judges carry out the law and should be free from political pressures. They are not at-will employees. The DOJ can say that removal protections designed to shield ALJs are unconstitutional, but that is not supported by law.”

The AALJ has encouraged the president to remove policymakers and heads of executive agencies instead of ALJs so that the president can ensure that US laws are faithfully executed while also preserving judicial impartiality.

The DOJ’s determination follows MSPB chair Cathy Harris’s lawsuit against President Donald Trump for removing her without reason. Head of the Office of the Special Counsel Hampton Dellinger also filed a lawsuit against Trump for removing him without reason, asserting that he can be removed by the president only for “inefficiency, neglect of duty, or malfeasance in office.” After a federal district court sided with Dellinger and blocked Trump’s removal, Trump requested the Supreme Court vacate the district court’s order.