ALL bank accounts have two sides to them. A Public (liabilities) side and a Private (assets) side, as substantiated by GAAP (Generally Accepted Accounting Principles) and GAAS (Generally Accepted Auditing Standards). Imagine a bank like a big bookshelf, with two sides, where the first side holds all the things the bank holds or owns. Assets on the private side such as, promissory notes, checks, credit agreements, Notes, Bonds, and other intangible assets. The second side holds all the counterpart-public displaying liabilities such as Dollars/Federal Reserve Notes, Credit Card balances, Line of Credit Balances, Checking and Savings account balances, and Loan balances.

” No State shall…….make any Thing but gold and silver Coin a Tender in Payment of Debts”

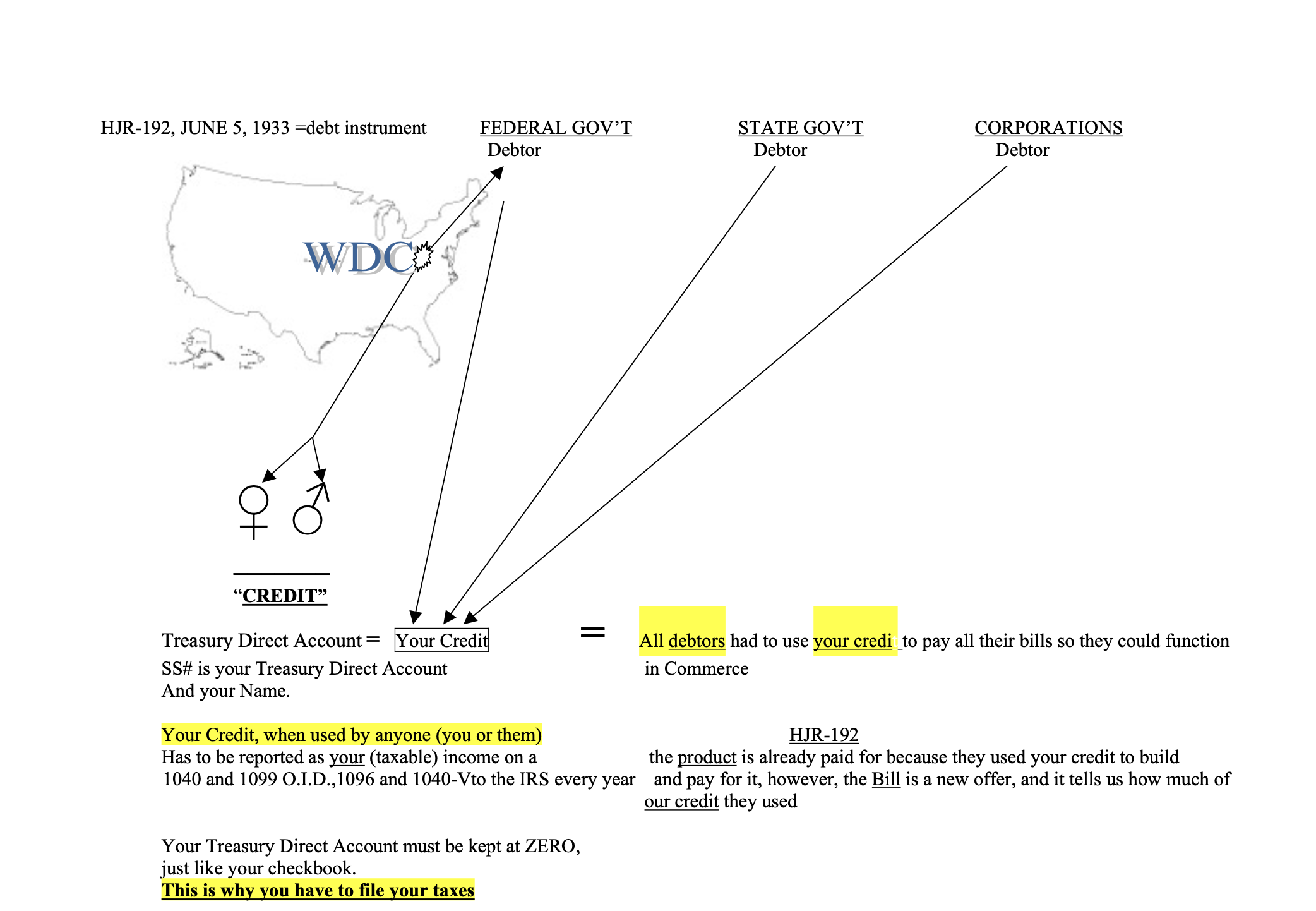

“Now therefore be it resolved by the Senate and House of Representatives of the United States of America in Congress assembled, That (a) every provision contained in or made with respect to any obligation which purports to give the obligee a right to require payment in gold or a particular kind of coin or currency, or in an amount in money of the United States measured thereby, is declared to be against public policy.

Every obligation, heretofore of hereafter incurred, whether or not any such provision is contained therein or made with respect thereto, shall be discharged upon payment, dollar for dollar, in any coin or currency which at the time of payment is legal tender for public and private debts. Any such provision contained in any law authorizing obligations to be issued by or under authority of the United States, is hereby repealed.

Assets aka Money of Account (Private side):

- Mortgage Promissory Notes (asset to American that created it, and liability to purported “lender”)

- Checks

- Bonds

- Bills of Exchange/Exchange Contracts

- Loan (use of American’s credit) agreements

The check, promissory note, credit/loan agreement, or Bond is an asset because given there is no “lawful money” (gold or silver) in circulation and we use debt notes/dollars/federal reserve notes not gold or silver. The living breathing man or woman autographs or signs a check, promissory note, credit/loan agreement, or Bond and a swap occurs (money of account for money of exchange) and the American is provided their own equity back, in the form of Dollars/Federal Reserve Notes.

Liabilities aka Money of Exchange (Public side):

- Dollars/Federal Reserve Notes

- Credit Card balances

- Line of Credit Balances

- Checking and Savings account balances

- Loan balances

The bank is acting as a custodian for the man or woman’s asset(s), so at the same time, the bank owes the man or woman money. They’ve essentially said, “Okay, we’re holding this much is assets for you and you can use $XX amount in the public” Those are liabilities and something they owe based on the assets they are holding for the living breathing man or woman.

Only entities exist in the public and the government and/or its corporations can only interface with artificial entities/trusts/corporations.

See: Meet Your STRAWMAN/ARTIFICIAL ENTITY/TRUST/FRANCHISE.

When you use “dual ledger accounting,” which is a fancy way of keeping books under rules known as GAAP (Generally Accepted Accounting Principles) and GAAS (Generally Accepted Auditing Standards), every action in the bank’s book must be matched on both sides of the bookshelf. For every asset created there must be a respective liability, and for every liability there must be corresponding asset that gave birth to it. You cannot have one, without the other.

So, if you have a purported car or mortgage balance (liability side/public side) then you also have a corresponding asset.

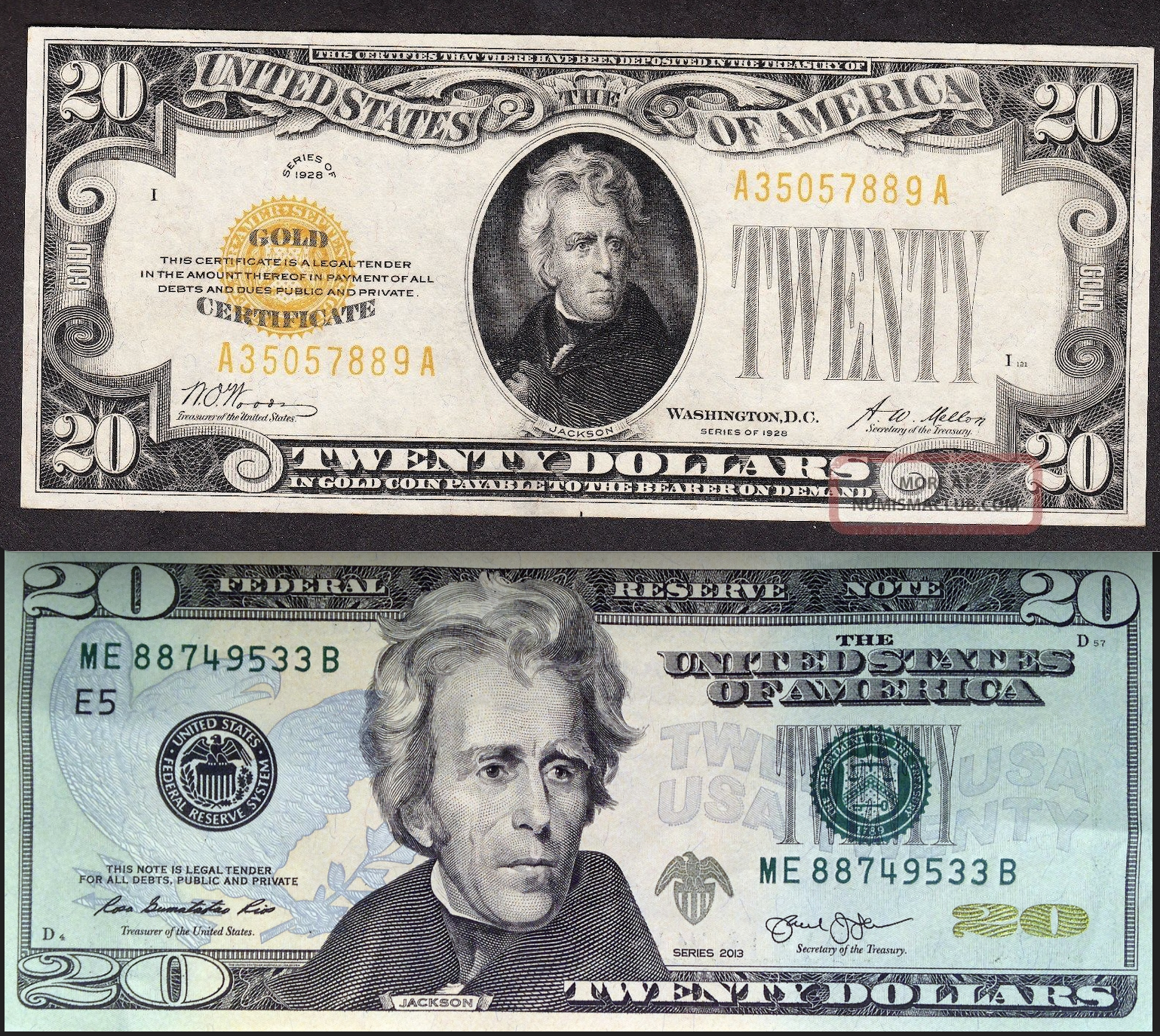

Gold Certificate vs Federal Reserve Notes

Gold Certificates:

redeemed for Gold

Dollars/Federal Reserve Notes:

redeemable for…?

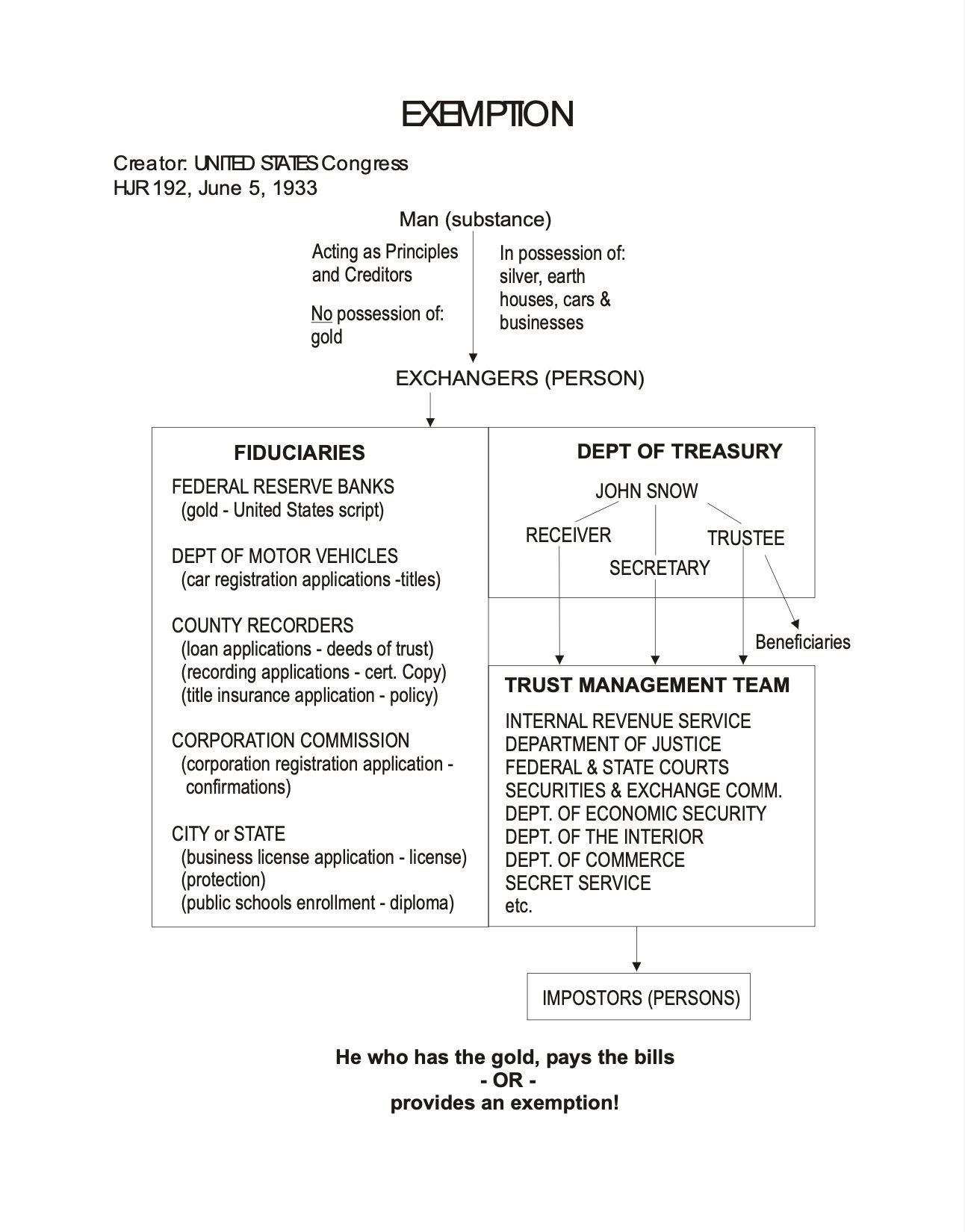

So, a balance of purported “debt” such loan balance, credit card balance, MUST have a corresponding asset of at least the same value. Thus enter the right of any living man or woman, to use their exemption to have their debts public or private, “discharged upon payment, dollar for dollar“–HJR 192 of 1933, public law 73-10.

Depositing a $1,000 Check:

When a man or woman deposits a check, no physical money moves around. It’s not like someone puts cash in a truck and drives it from your account to the bank’s vault. Instead, the bank adjusts the numbers in their big book. The Treasury and the bank’s TTL (Treasury Tax and Loan) account are involved in making sure these numbers match up, but it’s really about adjusting number, not physical cash.

So, in simple terms, when a living breathing man or woman (via their ENS ELGIS) deposits a $1,000 check:

- The bank’s book says they have something new on the books. An asset worth at least $1,000.

- The bank’s book also says they owe the living breathing man or woman (via their ENS ELGIS) money which can be exchanged in the public using the bank’s public ledger.

But no physical money moves; it’s all about adjusting the numbers in the bank’s big book to make sure everything balances.

There is no money.