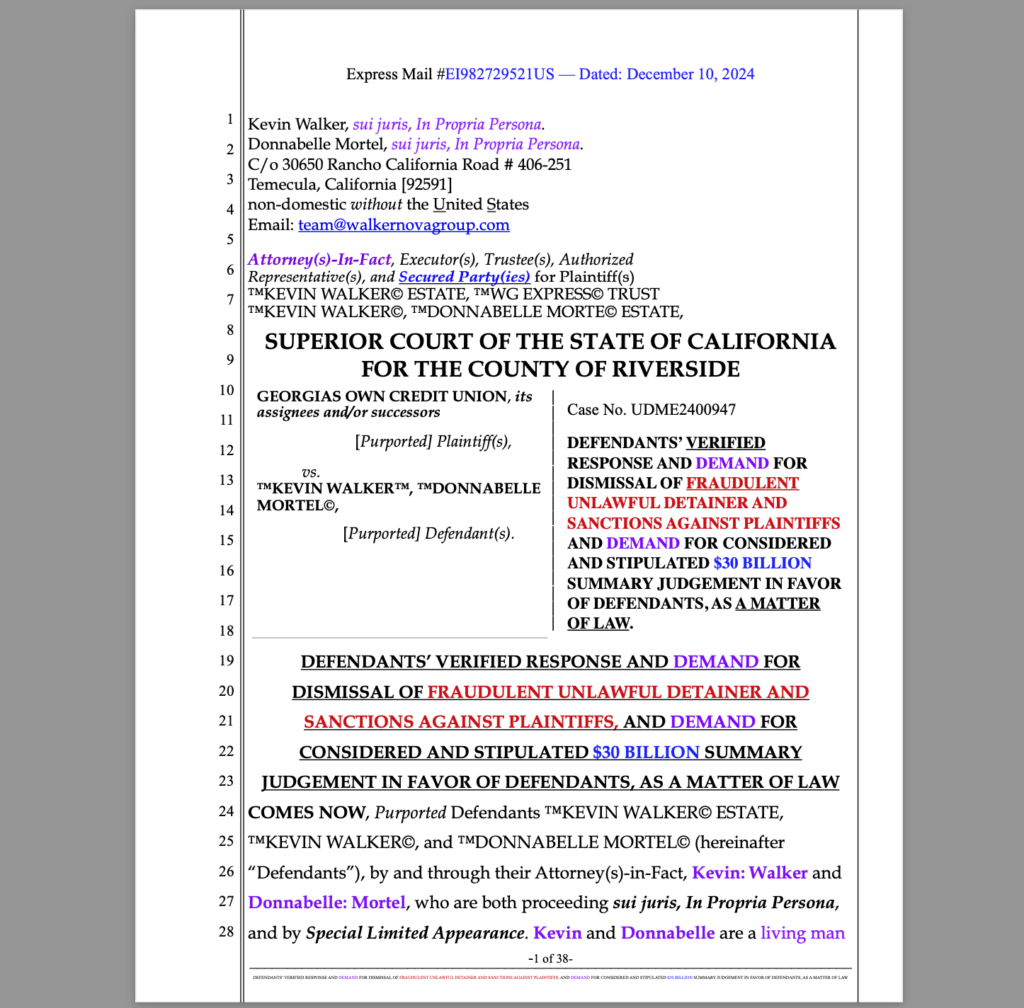

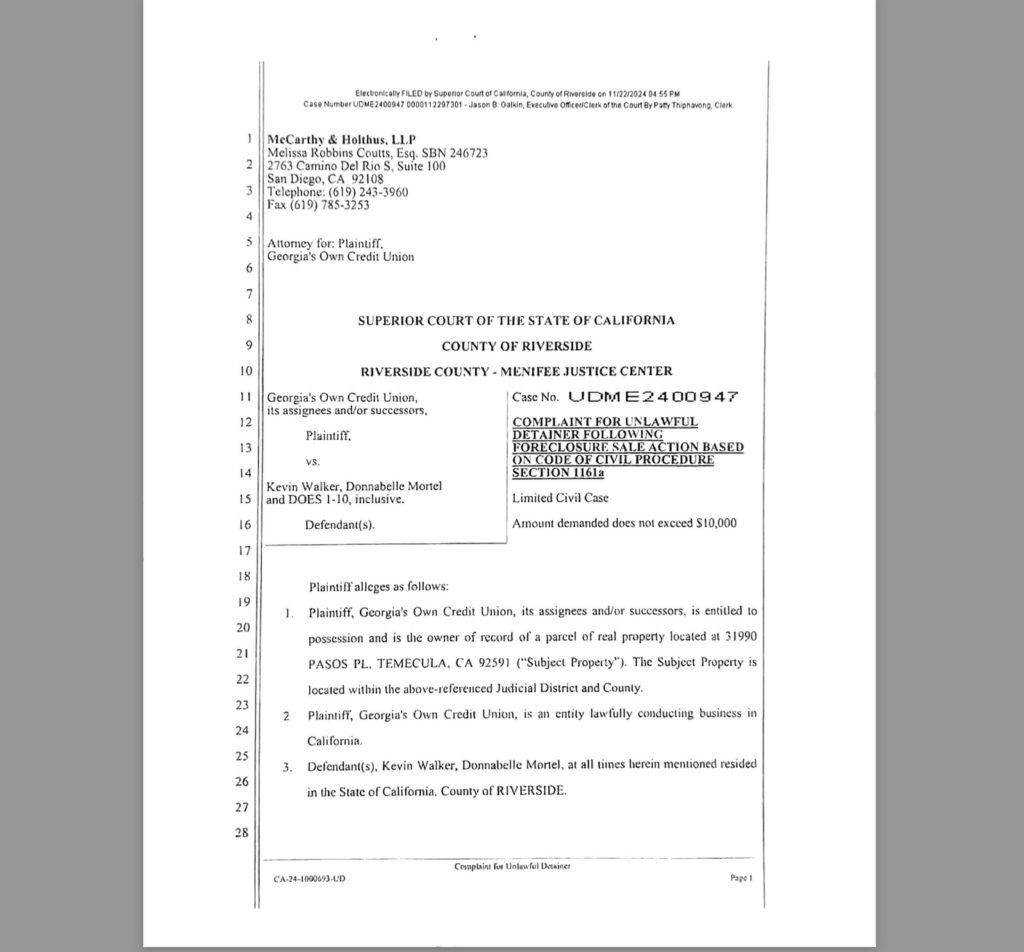

The KEVIN WALKER ESTATE and WALKERNOVA GROUP l have uncovered undeniable fraud, procedural dishonor, and violations of commercial law by Georgia’s Own Credit Union, Quality Loan Service Corporation, Cenlar Federal Savings & Loan, Fidelity National Title Company, and McCarthy & Holthus, LLP. Their verified affidavits and documented evidence confirm the fraud committed and the unlawful attempts to seize property to which these entities have no legal claim.

KEVIN WALKER ESTATE is demanding $30 billion in summary judgment, based on fraud, breach of contract, and violations of UCC provisions, contract law, and legal maxims. The facts are clear, and the evidence is unrebutted, demonstrating the fully admitted wrongful actions of these parties.

Fraud and Lack of Standing: Verified Facts

The purported Plaintiffs, including Georgia’s Own Credit Union, have no standing to assert claims on the property. Their attempts to illegally and unlawfully seize property were made without lawful authority, as evidenced by the allodial title of the Trust, which was lawfully recorded in Riverside County.

Walker and Mortel’s rights are further bolstered by their UCC filings and their use of “Accepted for Value” to settle any alleged debts associated with the property, making any claims against them void. These actions are firmly supported by the Uniform Commercial Code (UCC) and are confirmed by the failure of the Defendants to properly rebut these claims.

“Accepted for Value” under UCC: Legal Foundations and Application

The principle of “Accepted for Value”—where a party accepts a debt instrument for value and returns it to the creditor as a form of settlement—aligns directly with various provisions of the UCC. The legal foundation for this principle is rooted in several key UCC sections:

- UCC § 3-409: This section addresses the transfer and negotiation of instruments, stating that a negotiable instrument may be transferred or accepted in settlement of a debt. When Walker and Mortel accepted the Deed of Trust for value, it was effectively a discharge of the underlying obligation. This section ensures that the instrument is not just an asset but has binding legal implications in extinguishing the debt associated with it.

- UCC § 3-313: This provision establishes the acceptance of a negotiable instrument as conditional or unconditional. By accepting the instrument “for value,” Walker and Mortel discharged any supposed debt, which the Defendants failed to honor or return in good faith. This form of acceptance extinguishes the original obligation, rendering further claims invalid.

- UCC § 3-303: This section further supports the validity of “Accepted for Value,” outlining that an instrument’s acceptance, such as the Deed of Trust, satisfies the debt obligation under commercial law. Acceptance under these conditions converts the instrument into a fully enforceable tool for discharging debts, which the Defendants failed to recognize or respect.

These UCC provisions, among others, confirm the legality and binding nature of Walker and Mortel’s actions in accepting the instruments for value, ensuring that the debt was fully discharged and that no further claims could be made.

The Role of Legal Maxims and Commercial Law

Walker and Mortel’s rights are also protected by well-established legal maxims and commercial law principles:

- “Equity regards as done that which ought to be done.” This maxim asserts that the obligations have been settled and the debt discharged by accepting the instruments for value, making any further claims void.

- “He who seeks equity must do equity.” The Defendants, by refusing to honor the terms of the UCC and accept the debt discharge, fail to meet their own legal obligations.

In addition, UCC § 1-103 affirms that commercial law principles govern all contracts, including the application of “Accepted for Value,” as this principle is aligned with good faith and fair dealing. The actions of the Defendants, therefore, stand in direct opposition to the core tenets of commercial law.

DOWNLOAD 95 PAGE DOCUMENT

Commercial Law and Legal Maxims in Defense

The Defendants’ position is further supported by well-established commercial law and legal maxims, including:

- UCC § 1-103: Confirms the applicability of commercial law and equity to resolve disputes.

- UCC §§ 2-202, 2-204, 2-206: Reinforce the requirement for contracts and actions to be conducted in good faith and mutual understanding.

- “Equity regards as done that which ought to be done.” By discharging the alleged debts, Walker and Mortel fulfilled their legal and equitable obligations, leaving the Plaintiffs no lawful basis for further claims.

Unrebutted Affidavits: Binding Evidence of Fraud

Walker and Mortel have presented unrebutted affidavits, which stand as the truth of the matter under commercial law and UCC guidelines. The Defendants failed to respond within the prescribed time, tacitly acknowledging the facts presented. The affidavits clearly detail the fraudulent actions, procedural misconduct, and violation of commercial law, including the unlawful detainer proceedings initiated by Georgia’s Own Credit Union and the other parties involved.

The affidavits explicitly demonstrate that Walker and Mortel’s rights were violated, their property was unlawfully targeted, and damages were incurred totaling $30 billion due to the Defendants’ actions.

Allodial Title and UCC Filings: Legal and Commercial Protection

The Defendants (KEVIN WALKER ESTATE) hold an allodial title to the property, which confirms their absolute ownership, free from any liens or claims by creditors. The UCC filings further establish their exclusive right to the property, reaffirming that the debt was discharged via the “Accepted for Value” principle.

- UCC § 1-308: This section allows for the reservation of rights without prejudice, ensuring that Walker and Mortel’s legal rights are protected without compromising their position or the truth of the matter.

- UCC § 9-102: This provision confirms that a secured party—Walker and Mortel, in this case—has exclusive rights to the collateral, protecting them from unwarranted claims.

Walker and Mortel’s filings UCC filing via KEVIN WALKER ESTATEfurther confirm that their allodial title and the debt discharge have precedence over any claims made by the Defendants. The failure of Georgia’s Own Credit Union and the other entities to provide rebuttal evidence reinforces the conclusiveness of these facts.

Violation of Debt Discharge Laws: House Joint Resolution 192 of 1933

This case also underscores the continued violation of House Joint Resolution 192, which mandated that all debts be discharged in the event of a gold standard repeal. The Defendants’ actions go against this fundamental principle by attempting to enforce debts that have already been lawfully discharged through the “Accepted for Value” process.

By accepting the Deed of Trust for value and returning it for full discharge, Walker and Mortel effectively nullified any claims against them, as these claims have no basis in law or commercial principles.

The Defendants as the True Creditors and Issuers

The Defendants’ position as true creditors is firmly supported by GAAP, GAAS, and commercial law principles:

- The Promissory Note as Currency: The promissory note issued by Walker and Mortel was securitized and used as collateral, creating the very funds that the Plaintiffs now falsely claim as a debt.

- Discharge of Obligations: By accepting the note for value and returning it, Walker and Mortel satisfied all obligations, rendering any further claims by the Plaintiffs void.

- Violation of Financial Standards: The Plaintiffs’ failure to properly account for the transaction and disclose the monetization of the promissory note violates GAAP and GAAS, exposing their fraudulent intent.

Legal Maxim: “One who comes into equity must come with clean hands.” The Plaintiffs’ actions reveal their bad faith and inequitable conduct.

GAAP and GAAS Standards Violated

Under GAAP and GAAS, the Plaintiffs failed to properly account for the original transaction, conceal the discharge of debt, and refuse to provide a transparent audit trail. Specifically:

- The promissory note issued by the Defendants was monetized but never returned to them as the rightful creditors.

- The Plaintiffs recorded the note as an asset, yet they failed to acknowledge the corresponding discharge of the alleged debt, violating both financial reporting and commercial standards.

- The Plaintiffs retained no equitable interest in the property, as they failed to act in good faith, conceal material facts, and refuse to honor the principles of equity and commercial law.

Legal Maxim: “Equity will not assist a party who acts in bad faith.”

$30 Billion Demand: A Call for Accountability

The $30 billion in damages sought by Walker and Mortel represents a fair and accurate valuation of the harm caused by fraudulent actions, procedural misconduct, and the unlawful attempts to seize property. This figure is based on proven facts, UCC principles, legal maxims, and contract law.

The Defendants’ actions demonstrate a clear disregard for the law, and this demand serves as a necessary step to uphold the rights of property owners and ensure that fraudulent entities are held accountable.

Conclusion: A Victory for Law and Justice

This case illustrates the importance of adhering to commercial law, contract principles, and legal maxims. By invoking the “Accepted for Value” principle and ensuring compliance with UCC provisions, Walker and Mortel have protected their rights and exposed the fraudulent actions of Georgia’s Own Credit Union and other parties.

The verified facts and unrebutted affidavits make clear that the Plaintiffs’ claims are unfounded, and justice demands their immediate dismissal, along with the $30 billion in damages for the harm caused.