The authority to represent a trust as an attorney-in-fact is firmly established under federal law, the Uniform Commercial Code (UCC), and longstanding legal precedent. Contrary to common misconceptions, a trust operates as a contractual entity, granting it the ability to be lawfully represented by an authorized agent, including an attorney-in-fact. This article explores the legal framework affirming this right, highlights key statutory provisions, and provides strategies for enforcing it against courts and financial institutions that unlawfully challenge or deny such authority.

1. The Legal Basis for Representing a Trust as an Attorney-in-Fact

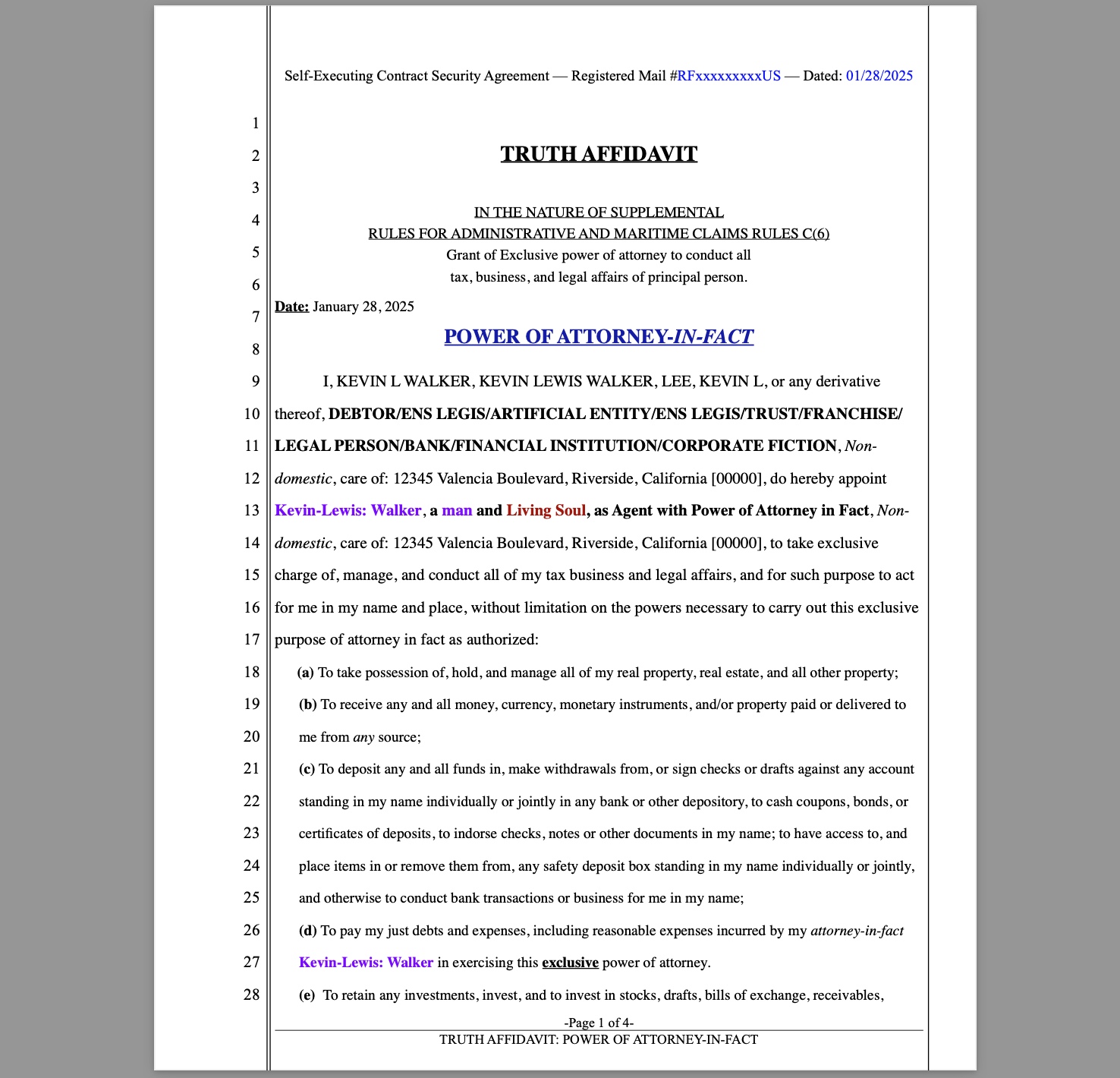

An attorney-in-fact is a person designated to act on behalf of another individual or entity through a legally executed Power of Attorney (POA). Unlike an attorney-at-law, an attorney-in-fact does not need to be a licensed lawyer and derives authority strictly from the executed power of attorney agreement.

Under 28 U.S.C. § 1654, individuals may plead and conduct their own cases personally or by counsel. This statute affirms the fundamental right to self-representation and extends to those acting under lawful contractual authority, such as attorneys-in-fact.

Additionally, UCC § 3-402 explicitly recognizes that an authorized representative, including an attorney-in-fact, can bind the principal in contractual and financial transactions. This directly contradicts the argument that a trust must be represented exclusively by a licensed attorney.

Key Statutory Protections for Attorneys-in-Fact

- 28 U.S.C. § 1654 – Affirms the right of parties to represent themselves and conduct their own cases.

- UCC § 3-402 – Establishes that an authorized representative, such as an attorney-in-fact, can legally bind the principal in financial and contractual matters.

- 26 U.S.C. § 2203 – Recognizes executors, including attorneys-in-fact, as legally authorized to manage estate administration and tax liabilities.

- 26 U.S.C. § 7603 – Affirms that an attorney-in-fact may lawfully receive and respond to IRS summonses on behalf of a principal.

- 26 U.S.C. § 6903 – Confirms that fiduciaries, including attorneys-in-fact, are legally recognized in tax matters and must act in their principal’s best interest.

- 26 U.S.C. § 6036 – Allows attorneys-in-fact to handle affairs related to decedent estates and trust entities.

- 26 U.S.C. § 6402 – Grants attorneys-in-fact authority to receive and negotiate tax refunds and credits on behalf of the principal.

These provisions affirm that the role of an attorney-in-fact is legally valid and enforceable across multiple areas, including financial transactions, court representation, and tax-related matters.

2. How to Properly Establish and Use a Power of Attorney for Your Trust

To represent your trust as an attorney-in-fact, you must first execute a legally binding Power of Attorney (POA) document. This document should be structured as follows:

A. Essential Elements of a Power of Attorney

- Names of the Principal and Attorney-in-Fact: Clearly identify the trust as the principal and yourself as the appointed attorney-in-fact.

- Scope of Authority: Specify the powers granted, including contractual authority, financial management, and legal representation.

- Acknowledgment Clause: Reference legal statutes such as UCC § 3-402, 28 U.S.C. § 1654, and applicable state laws to reinforce the legal validity of the POA.

- Notarization and Witnessing: To ensure enforceability, have the POA notarized and signed in the presence of witnesses.

B. Enforcing Your Power of Attorney in Court and Financial Transactions

Once the POA is properly executed, you must:

- File it with the Clerk of Court: This ensures that your legal authority is recorded in any ongoing litigation.

- Provide Notice to Financial Institutions: If your trust is engaged in financial transactions, banks and mortgage servicers must acknowledge your POA authority per UCC § 3-402.

- Respond to Legal Challenges with Conditional Acceptance: If a court or institution refuses to acknowledge your attorney-in-fact status, issue a conditional acceptance, requiring them to provide a point-for-point rebuttal under penalty of perjury.

- Cite Statutory and Case Law: When necessary, demand that any objections be substantiated by law, citing UCC § 3-402, 28 U.S.C. § 1654, and relevant IRS codes.

3. Overcoming Unlawful Court and Institutional Obstruction

Despite the clear legal recognition of attorneys-in-fact, courts and financial institutions often attempt to deny this authority. Here’s how to respond:

A. Courts That Attempt to Force Attorney Representation

Some courts falsely claim that a trust must be represented by a BAR-licensed attorney. This is a direct violation of 28 U.S.C. § 1654, which allows individuals to represent their own cases or appoint an attorney-in-fact. The A

Action Steps to Challenge Court Obstruction

- File a Verified Affidavit: State your legal position and include your Power of Attorney, statutory references, and a demand for judicial acknowledgment.

- Demand a Writ of Mandamus: If the court refuses to accept your filings, file a writ of mandamus compelling the court to honor your legal right to representation.

- Hold the Court to Its Own Rules: Many courts operate under administrative jurisdiction—demand they prove their authority to override statutory law.

B. Right to Self-Representation and Power of Attorney

One of the most egregious errors in PHH Mortgage’s Motion is the claim that the Plaintiffs, acting as attorneys-in-fact for their respective trusts, “lack standing” to bring the lawsuit because they are not licensed attorneys. This argument is flawed for several reasons:

C. The Right to Self-Representation:

- The Sixth Amendment and Article I, Section 10, Clause 1 of the U.S. Constitution guarantee the right of individuals to defend their own rights without being forced to hire an attorney.

- Under U.S. Supreme Court precedents, a person does not require a law license to exercise their own rights or act as an agent in contractual matters.

D. Power of Attorney & UCC Recognition:

- The Uniform Commercial Code (UCC) § 3-402 recognizes that a trust, like any legal entity, can be represented by an authorized agent or attorney-in-fact.

- A trust is a contractual arrangement, not a corporate entity that is required to hire an attorney.

- Case law supports the right of an individual to act as an agent for a trust without a requirement to be a BAR-licensed attorney.

E. ABA Recognition of Power of Attorney:

The American Bar Association (ABA) defines a power of attorney as a legal document that grants one or more persons the authority to act on behalf of another as their agent. This authority can be limited to specific activities or general in scope. The ABA further emphasizes that a power of attorney is recognized in all states, though the rules and requirements may vary (American Bar Association).

By falsely asserting that only licensed attorneys can represent a trust, PHH’s Motion disregards these established legal principles and attempts to impose an unwarranted barrier to justice.

Exhibit SS

rule 8.4 – defendants will misconduct

F. Financial Institutions That Reject Power of Attorney

Mortgage servicers and banks frequently ignore POAs to avoid legal accountability. They may claim that only a licensed attorney can represent the trust, which is false.

Action Steps to Enforce POA with Financial Institutions

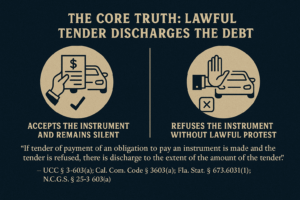

- Issue a Conditional Acceptance: Demand written proof that a POA is not legally valid under UCC § 3-402. Their failure to rebut constitutes tacit acquiescence.

- File a Notice of Default and Dishonor: If they do not rebut your demand point-for-point, issue a formal notice establishing their default and failure to perform.

- Escalate with Regulatory Complaints: File complaints with state financial regulators, the CFPB, and the OCC, citing UCC § 3-402 violations.

4. Case Law and Legal Precedent Supporting Attorney-in-Fact Authority

Several landmark cases reinforce the right to represent a trust as an attorney-in-fact:

- Hale v. Henkel, 201 U.S. 43 (1906) – Affirms the individual’s right to carry on private business without state interference.

- Faretta v. California, 422 U.S. 806 (1975) – Reaffirms the right to self-representation in court.

- Marbury v. Madison, 5 U.S. 137 (1803) – Establishes that unconstitutional laws are void and unenforceable.

These rulings confirm that no state, court, or financial institution can lawfully deny an individual the right to manage their trust under a valid POA.

Conclusion: Enforce Your Rights as an Attorney-in-Fact

If you have executed a lawful Power of Attorney, you have the legal right to:

✅ Represent your trust in court under 28 U.S.C. § 1654.

✅ Bind the trust in financial matters under UCC § 3-402.

✅ Manage tax and estate affairs under 26 U.S.C. § 2203, § 7603, § 6903, § 6036, and § 6402.

Courts and financial institutions that refuse to honor this authority are engaging in fraud and obstruction. By asserting your legal rights with verified affidavits, conditional acceptances, and demands for judicial accountability, you can defend your trust and enforce lawful representation as an attorney-in-fact.