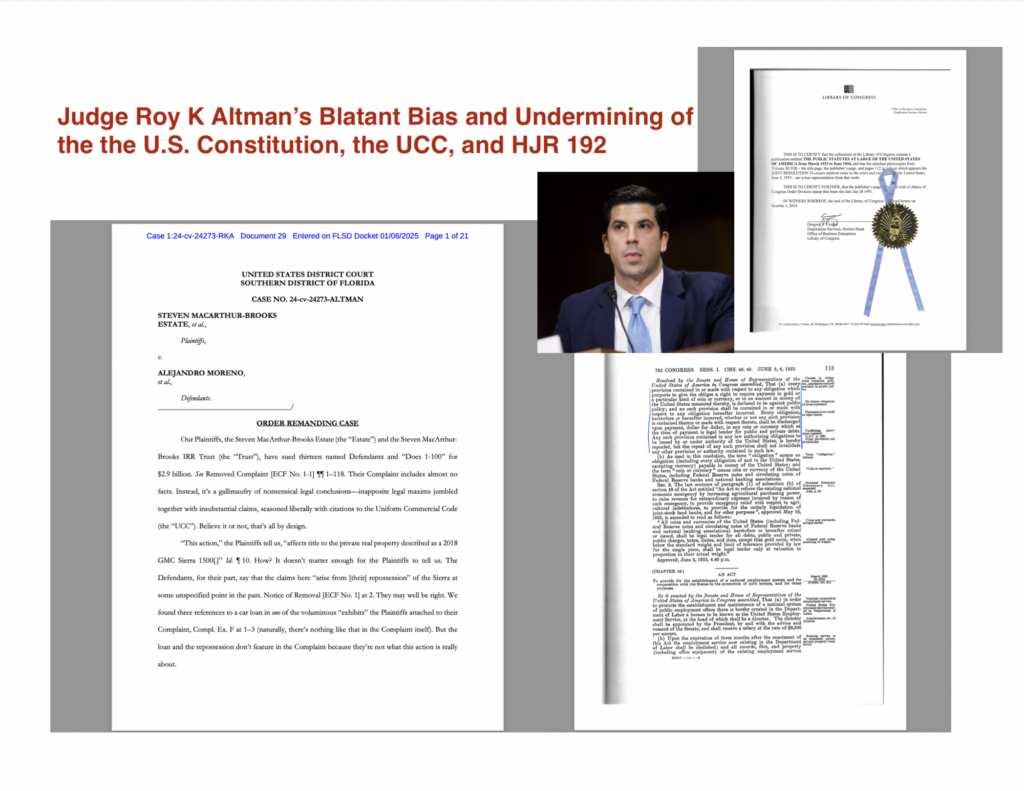

In recent legal proceedings, Judge Altman’s handling of critical commercial and financial laws has raised serious concerns. His dismissal of key sections of the Uniform Commercial Code (UCC) and essential federal statutes, such as House Joint Resolution 192 and 18 U.S.C. § 8, undermines the integrity of the U.S. legal system. These laws are foundational to understanding the complex interplay of U.S. monetary policy, debt discharge, and commercial transactions. In this article, we will dissect the significant legal missteps in Judge Altman’s order, exploring the implications for commercial law, government debt obligations, and the broader judicial system.

Correct Application of Title 18 Claims

To begin, Judge Altman correctly acknowledged that criminal offenses under Title 18 of the U.S. Code necessitate government enforcement. This principle aligns with standard legal practices: only government entities, such as law enforcement or prosecutors, have the authority to enforce criminal statutes, including those related to fraud or extortion. This part of his order is sound and uncontroversial. However, this recognition marks the limit of his accuracy in the case.

Disregarding the UCC Without Justification

Judge Altman’s order takes a dramatic turn for the worse in his treatment of the Uniform Commercial Code (UCC). The plaintiffs cited several UCC provisions—sections 3-603, 3-311, 1-103, 2-202, 2-204, and 2-206—which are essential to U.S. commercial law, particularly in relation to negotiable instruments, contracts, and the sale of goods. Yet, Altman dismissed these references as irrelevant, suggesting they had no bearing on the case. This dismissive approach is both legally indefensible and alarming.

The UCC governs crucial aspects of U.S. commerce. Its provisions are pivotal in the handling of negotiable instruments, the creation of contracts, and the sale of goods. Altman, rather than providing any substantial legal analysis, chose to brush these provisions aside without explanation. This disregard for foundational commercial law undermines the integrity of the judicial process and signals either a fundamental misunderstanding—or possibly deliberate ignorance—of established legal principles.

Dismissing Established Federal Statutes as “Nonexistent” or “Frivolous”

Judge Altman’s outright dismissal of key federal statutes cited by the plaintiffs is deeply troubling. He referred to 12 U.S.C. §§ 411 and 412, 18 U.S.C. § 8, and 31 U.S.C. § 3123 as “nonexistent” or “frivolous.” These statutes are integral to the legal framework governing U.S. law and financial regulation. To dismiss them as such is not only legally incorrect but represents a blatant misrepresentation of U.S. law.

- 12 U.S.C. § 411 governs the issuance of Federal Reserve Notes—the very currency of the United States. For Altman to declare this statute “nonexistent” is absurd, as Federal Reserve Notes are a cornerstone of the U.S. monetary system, and this statute governs their legitimacy. To suggest that this law is irrelevant is to deny the very currency on which the U.S. economy is built.

- 12 U.S.C. § 412 outlines the powers of the Federal Reserve, including its authority to set monetary policy. To label this statute as frivolous undermines the critical role of the Federal Reserve in the financial system, including how required collateral is dealt with in transactions. For instance, the collateral security described in this statute includes negotiable instruments such as bills of exchange, notes, drafts, and bankers’ acceptances—central elements of U.S. financial dealings.

- 18 U.S.C. § 8 defines “obligation or other security of the United States,” which includes Federal Reserve Notes, Treasury bonds, and other financial instruments. Dismissing this statute as frivolous is a dangerous misunderstanding of financial law and a threat to the integrity of U.S. commercial transactions.

- 31 U.S.C. § 3123 governs the issuance of Treasury bonds and other U.S. Treasury obligations. Altman’s dismissal of this law is not just reckless; it misrepresents U.S. financial practices.

Bias and Inconsistent Application of Sanctions

In addition to these serious missteps, Judge Altman further undermined his order by suggesting sanctions against the defendants for their willful bad faith and improper filings. However, he failed to follow through on this commitment, acting in clear bias against the plaintiffs. This blatant disregard for fairness in judicial proceedings calls into question the integrity of the case.

By making a commitment to sanction the defendants and then failing to do so, while simultaneously acting biased toward the plaintiffs, Judge Altman’s actions not only contradict legal principles but also raise concerns about his impartiality. This failure to adhere to legal norms, coupled with biased orders, undermines the credibility of the decision and casts doubt on the fairness of the judicial process.

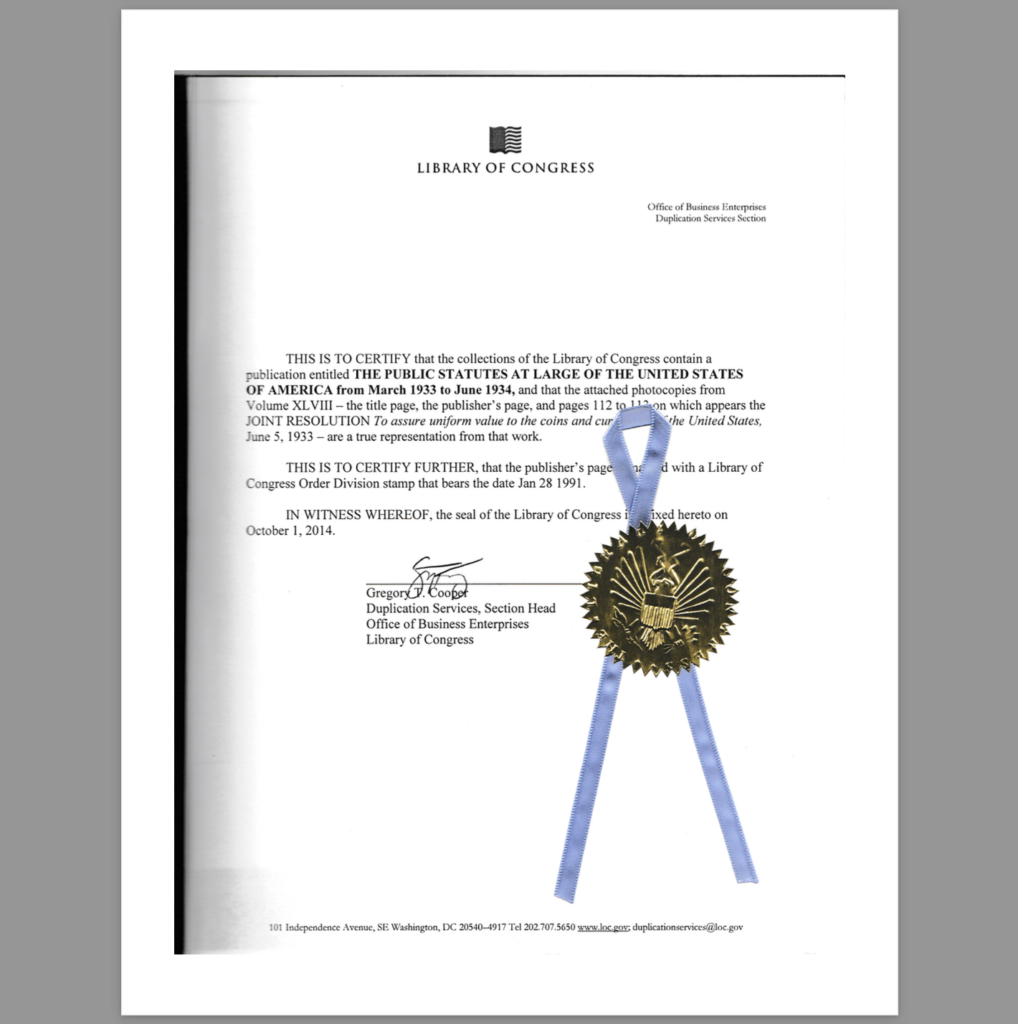

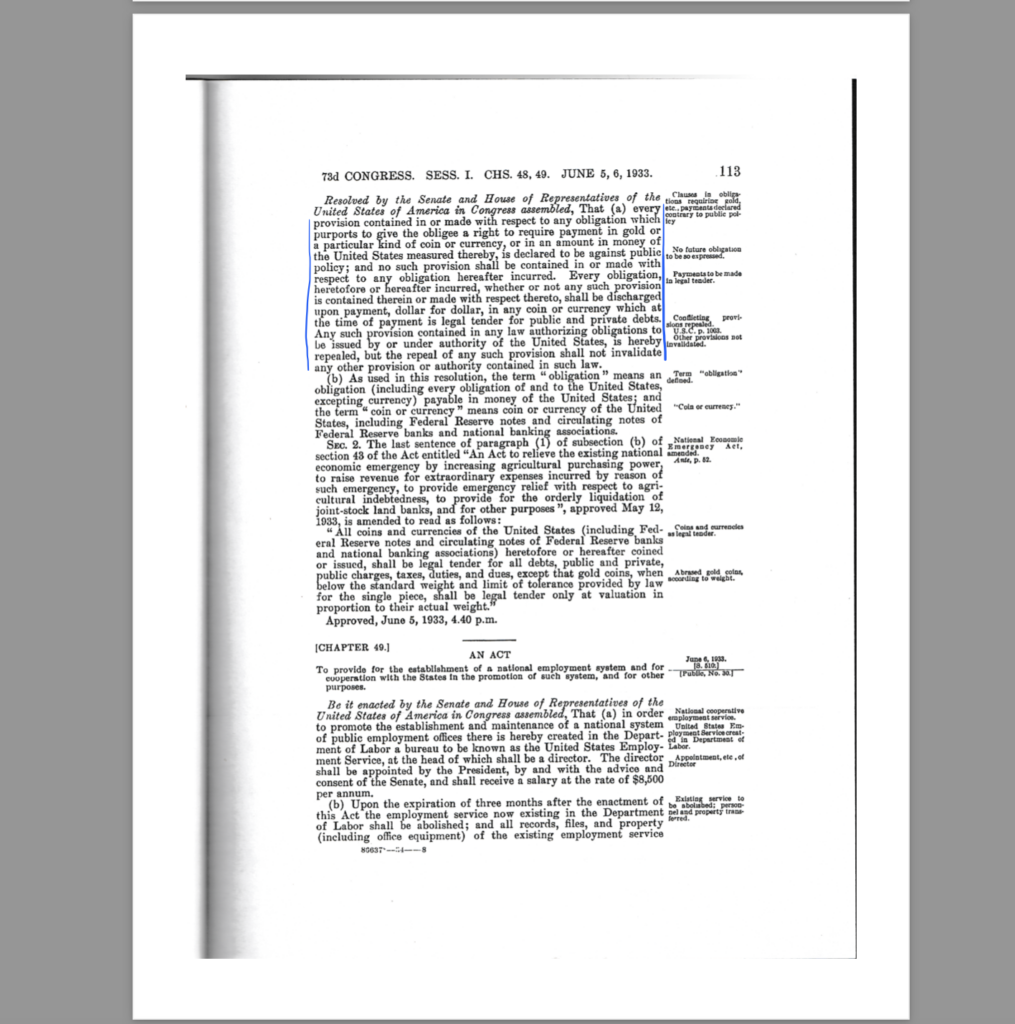

Denying the Legitimacy of House Joint Resolution 192 (Public Law 73-10)

One of the most egregious aspects of Judge Altman’s order is his denial of the legitimacy of House Joint Resolution 192, enacted on June 5, 1933 (Public Law 73-10). This resolution, which dealt with the abandonment of the gold standard, set the framework for Federal Reserve Notes as the legal tender of the United States. It is the legal foundation for the currency in circulation today.

For Altman to dismiss this foundational legislation as irrelevant is nonsensical. House Joint Resolution 192 established that the U.S. government would discharge all debts, both public and private, dollar for dollar, using Federal Reserve Notes. This represented a fundamental shift in U.S. monetary policy, and to call it “nonexistent” or “irrelevant” is a deliberate misreading of U.S. history and law. This resolution set the stage for the modern U.S. financial system and discharges obligations that can only be met with Federal Reserve Notes as legal tender.

DOWNLOAD COPY

The Illusion of Legal Complexity

Judge Altman’s order seems designed to obscure rather than clarify the law. By dismissing vital sections of the UCC and key federal statutes—such as House Joint Resolution 192—without explanation, Altman creates the illusion that these laws are either irrelevant or non-existent. His failure to engage with these critical legal texts leaves the public and plaintiffs without any clear reasoning for why these fundamental provisions were disregarded.

Rather than offering a thoughtful legal analysis, Altman’s approach serves only to confuse the issue. This tactic does not shed light on the law but intentionally obfuscates it, misleading the parties involved about the relevance of these laws in the case at hand.

A Dangerous Precedent

Judge Altman’s disregard for well-established laws like the UCC and key federal statutes—including House Joint Resolution 192—could set a dangerous precedent. If his order is allowed to stand, it could encourage other judges to similarly disregard relevant laws with which they are uncomfortable. Such a move would undermine the integrity of the judicial system and erode public confidence in the law.

A Failure to Engage with the Law

At its core, Judge Altman’s order represents a failure to engage with the law as it stands. The plaintiffs cited real, relevant laws—such as the UCC provisions and federal statutes—that are essential to understanding the legal and financial systems of the United States. Instead of thoughtfully addressing these statutes, Altman chose to dismiss them without explanation, leaving the plaintiffs and the public without any clear reasoning for his dismissal.

Notably, Altman seems either unaware of or deliberately ignores the critical point that all obligations are government obligations, as outlined in 18 U.S.C. § 8. This statute establishes that Federal Reserve Notes, as obligations of the U.S. government, are not only a form of currency but also a tool for discharging debts. The government’s role in this process is mandatory, not optional. Altman’s failure to acknowledge this shows either a profound misunderstanding or a deliberate attempt to obfuscate the law.

Furthermore, 12 U.S.C. § 1813(L)(1) explicitly acknowledges that money is “received” by the term “deposit,” indicating that funds deposited into the banking system are legally recognized. This provision further validates Federal Reserve Notes as legitimate and accepted forms of money under U.S. law. Altman’s dismissal of this provision reflects his unwillingness to engage meaningfully with the legal text before him.

The Muddy Waters of HJR 192 and the Federal Reserve System

Given that the case should have been remanded to state court, Judge Altman may have taken the opportunity to muddy the waters with his incorrect statements about the government’s monetary system. His dismissal of House Joint Resolution 192 and statutes like 12 U.S.C. §§ 411 and 412 as “frivolous” not only misrepresents U.S. financial law but also disrespects the foundational statutes that govern the U.S. monetary system. These laws dictate how the government handles debts and obligations, and to label them frivolous is legally indefensible.

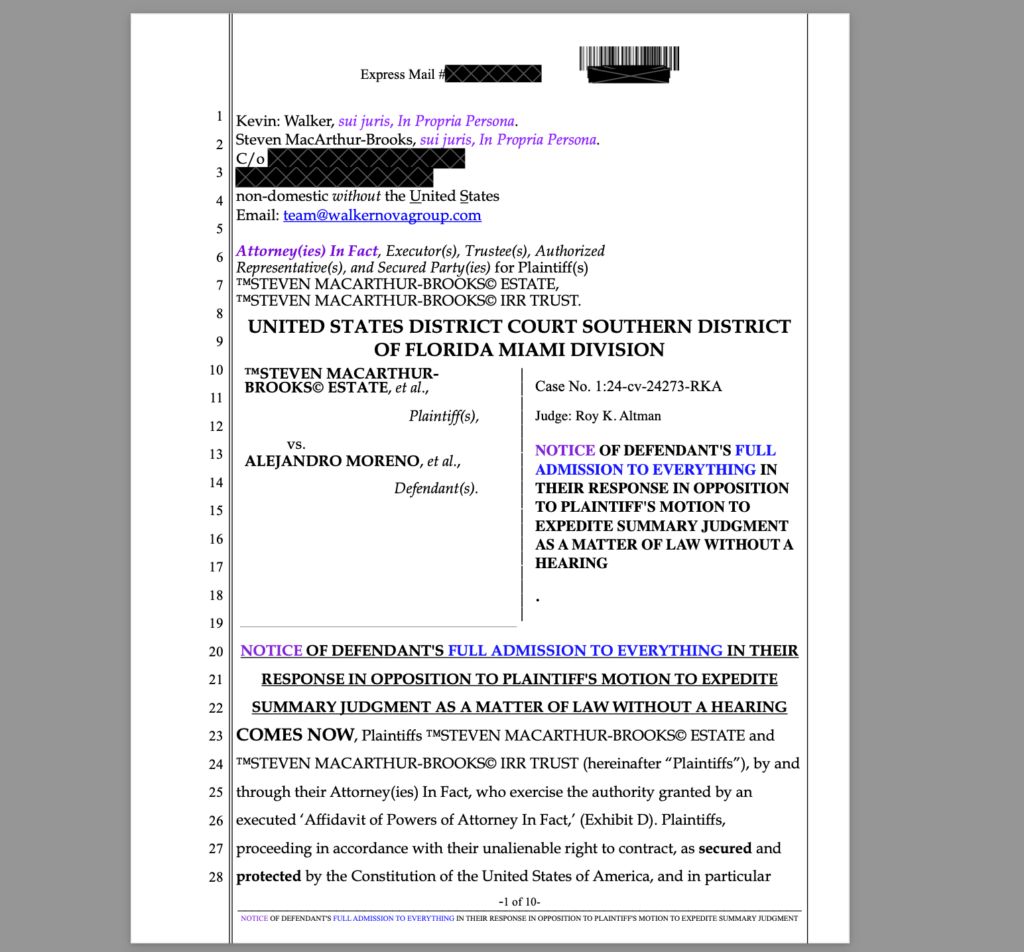

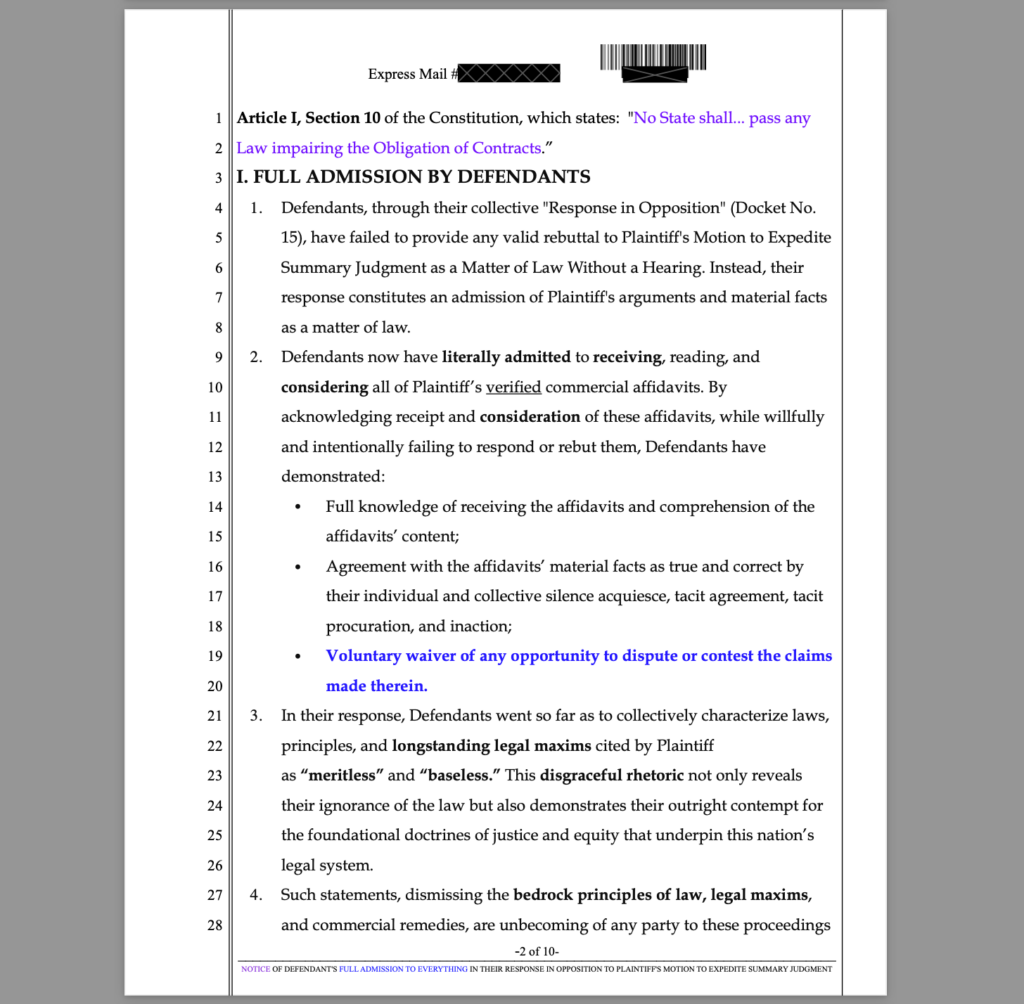

Defendants’ Admission of Receipt and Consideration of Affidavits

From the outset, the Defendants openly admitted in their filings to receiving, reading, considering, and accepting all affidavits submitted by the Plaintiffs.

Despite their acknowledgment of these affidavits, they willfully and intentionally chose not to address or rebut the specific claims or material facts contained within. Instead, they resorted to dismissing the affidavits as “meritless” and “baseless” due to Defendants’ incompetence. This response highlights two critical failures:

- Incompetence in Addressing Legal Obligations: The Defendants’ blanket dismissal of the affidavits without providing point-by-point rebuttals is a glaring procedural failure. In commercial law, unrebutted affidavits stand as truth, and their decision to ignore this principle reveals a gross misunderstanding of their obligations.

- Implicit Admission of Truth: By failing to dispute the facts presented in the affidavits, the Defendants have legally conceded to every claim made by the Plaintiffs. Their response amounts to an admission of all material facts, leaving no room for defense.

DEFENDANTS IN DEFAULT AND DISHONOR

Defendants’ continuous failure to rebut or respond to Plaintiffs’ verified affidavits, despite clear acknowledgment of receipt, demonstrates their deliberate and willful default and dishonor in this case. By their own admission, Defendants have received, read, and considered all the affidavits presented by Plaintiffs. Yet, instead of offering substantive rebuttals or valid responses, they have opted for silence and vague claims, referring to the affidavits as “meritless” and “baseless.” This disregard for the facts and evidence put forth in the affidavits is not just an oversight but a conscious choice to dishonor the Plaintiffs’ claims.

Under the Uniform Commercial Code (U.C.C. § 3-505), dishonor occurs when a party fails to fulfill its obligations, and it is clear that Defendants’ inaction constitutes a direct violation of this principle. Their refusal to address or rebut the material facts presented in the affidavits amounts to a tacit admission of the truth of Plaintiffs’ claims. Silence in the face of a well-documented, properly executed affidavit constitutes agreement to its contents, and by failing to respond, Defendants have entered into a binding acknowledgment of the facts asserted.

Furthermore, their blatant disregard for the Court’s order and failure to comply with procedural obligations only further demonstrates their default. The Court has already issued an order stipulating that Defendants’ filings will be stricken for non-compliance, with the added sanction of penalties for their failure to act in good faith. This continued dishonor and defiance of legal proceedings only strengthens Plaintiffs’ position that they are entitled to the relief they seek, including summary judgment and sanctions against the Defendants for their bad faith conduct.

In essence, Defendants have not only failed to fulfill their contractual and legal obligations but have willfully chosen to dishonor their commitments, which has resulted in their default. This leaves Plaintiffs with no genuine dispute of material facts and reinforces their entitlement to judgment as a matter of law.

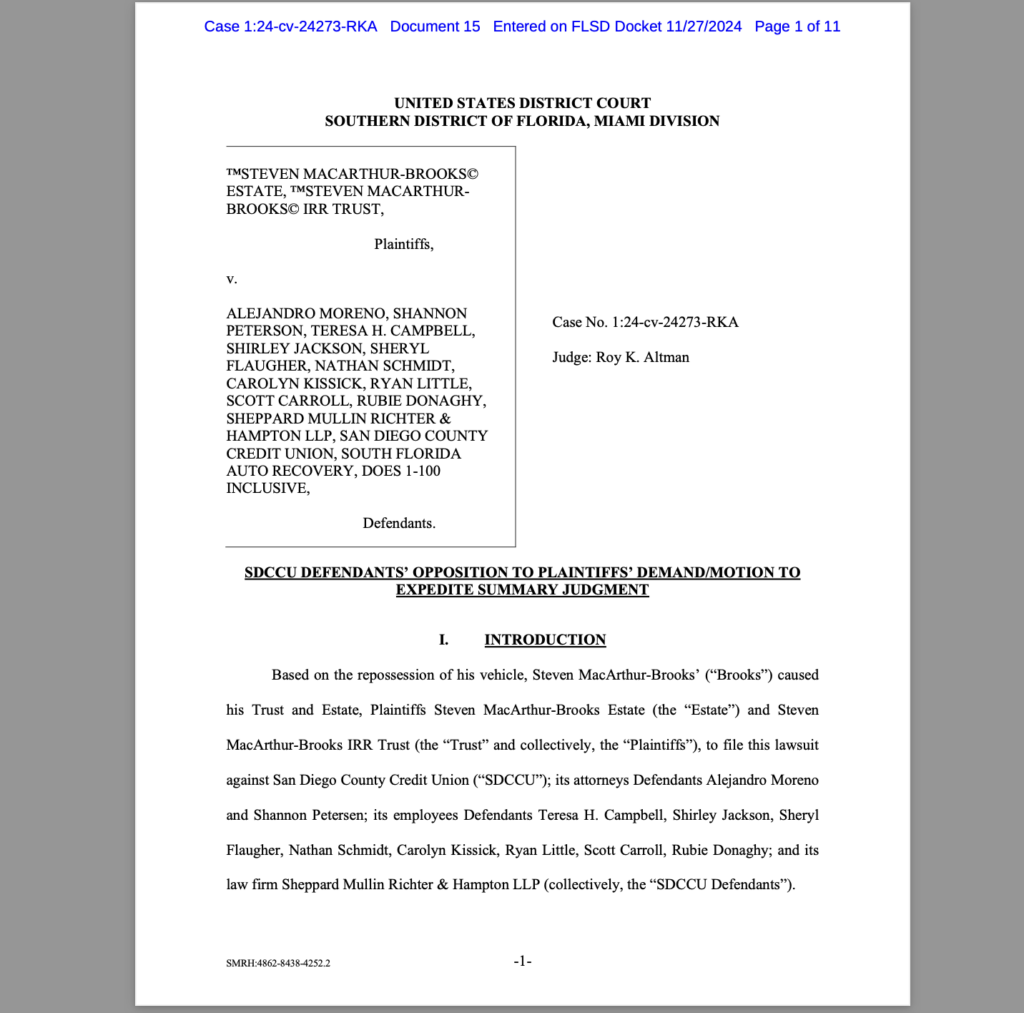

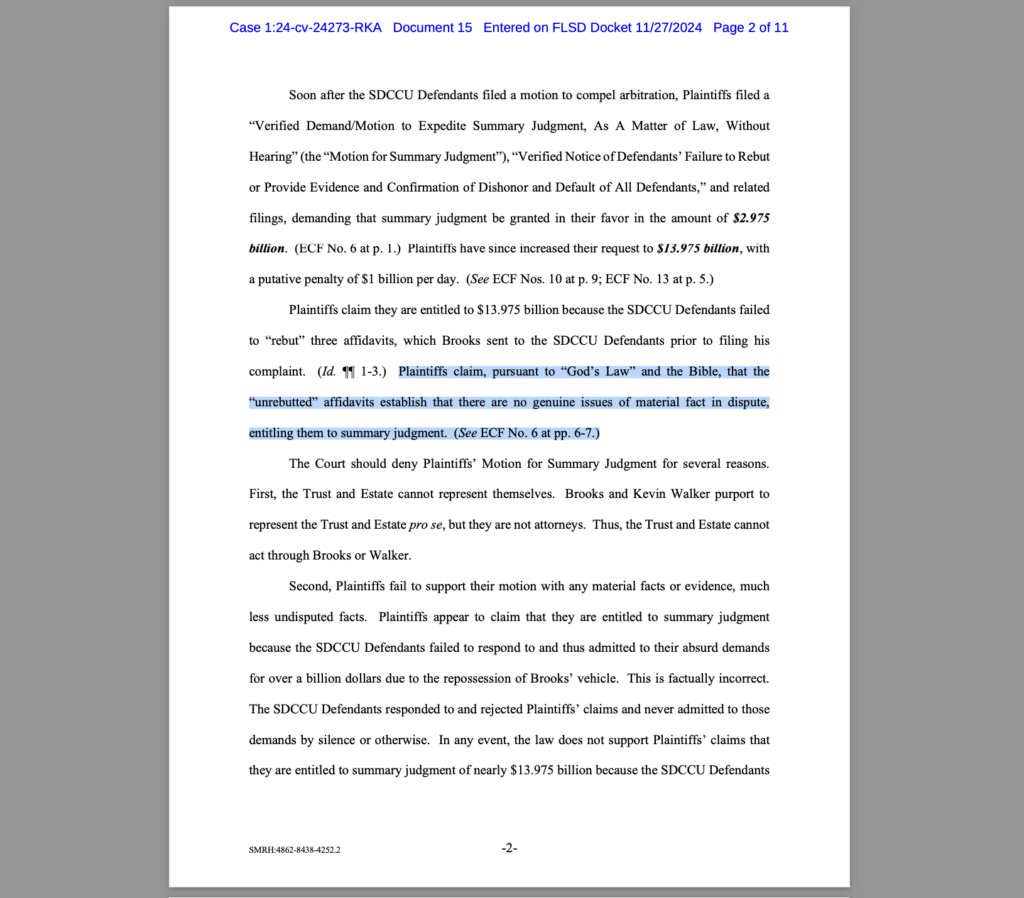

Defendants mocked God and the Law stating:

Plaintiffs claim they are entitled to $13.975 billion because the SDCCU Defendants failed to “rebut” three affidavits, which Brooks sent to the SDCCU Defendants prior to filing his complaint. (Id. ¶¶ 1-3.) Plaintiffs claim, pursuant to “God’s Law” and the Bible, that the “unrebutted” affidavits establish that there are no genuine issues of material fact in dispute, entitling them to summary judgment. (See ECF No. 6 at pp. 6-7.)

Court’s Reprimand and Pending Sanctions

Adding insult to injury, the court has now stepped in to address the Defendants’ noncompliance and procedural dishonor. The court issued an order stating that:

- The Defendants’ filings will be stricken for failure to comply with procedural requirements.

- Sanctions will be imposed on the Defendants for their blatant disregard of the court’s directives and their legal responsibilities.

This court order underscores the severity of the Defendants’ failures. Their inability—or unwillingness—to comply with basic legal standards is not only a disservice to their own case but also an insult to the judicial process.

Good Faith Efforts by Plaintiffs Ignored

The Plaintiffs, acting in good faith and under constitutional protections, made multiple attempts to resolve the matter amicably. Their requests for the return of private Trust property—a 2018 GMC vehicle—were met with silence and stonewalling. The Defendants’ refusal to engage in good-faith discussions or restitution demonstrates bad faith, further compounding their violations.

Instead of addressing the claims with integrity, the Defendants engaged in procedural misconduct, dismissed valid legal instruments as “baseless,” and arrogantly disregarded their obligation to rebut the affidavits in substance.

Defendants’ Procedural Dishonor: Silence and Noncompliance

The Defendants’ actions, or lack thereof, reveal a pattern of procedural dishonor:

- Failure to Rebut: In law and commerce, unrebutted affidavits stand as truth. The Defendants’ failure to rebut the affidavits point-by-point, as required, constitutes a tacit agreement to all claims presented by the Plaintiffs.

- Dismissal as “Meritless”: Rather than engaging in a meaningful defense, the Defendants arrogantly deemed the affidavits “meritless” and “baseless,” further cementing their incompetence.

- Noncompliance with Court Orders: The Defendants ignored procedural rules, prompting the court to order their filings stricken and sanctions imposed. This blatant disregard for judicial authority is both reckless and indicative of their lack of credibility.

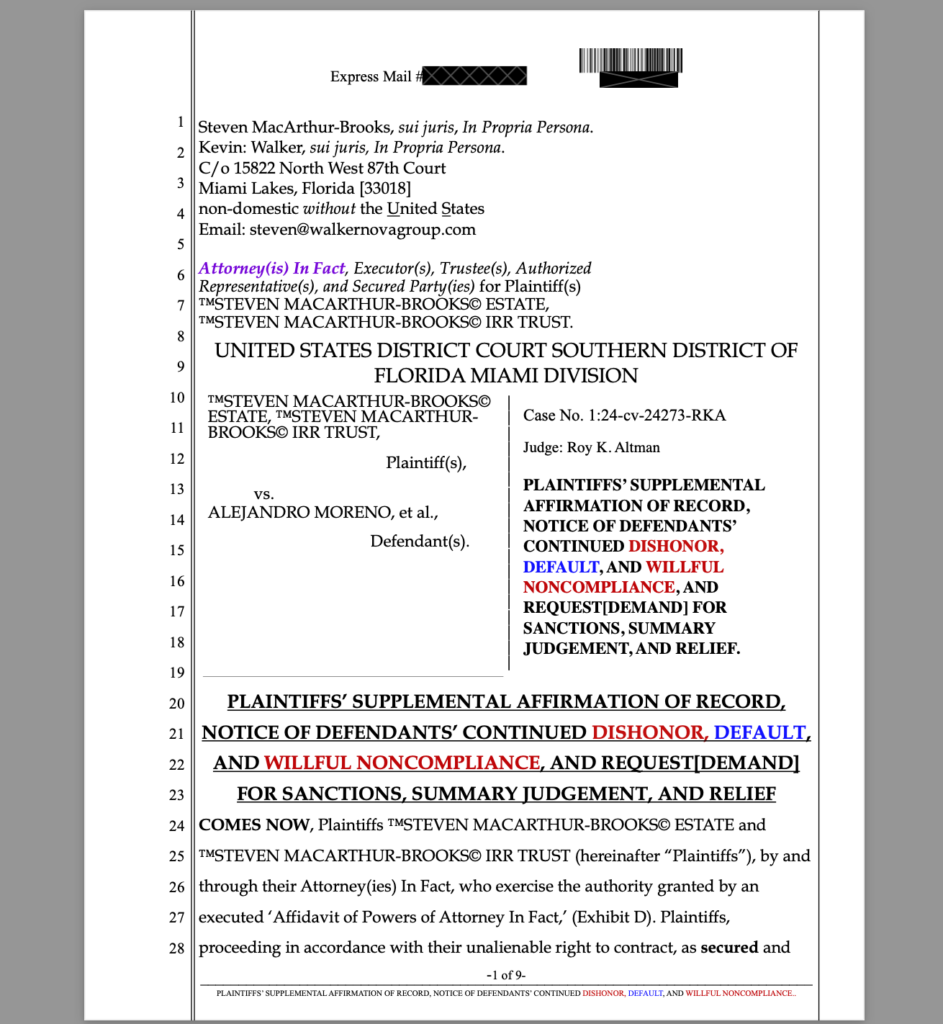

DEFENDANTS’ ERRONEOUS FOCUS ON “PRO SE” IS IRRELEVANT

Defendants’ reliance on the “pro se” designation is not only a baseless mischaracterization but also an indication of their glaring incompetence. Plaintiffs, in fact, are lawful trusts represented by their ‘Attorney(ies) In Fact,’ acting within the full scope of powers granted under an executed ‘Affidavit of Powers of Attorney In Fact.’ This legal representation is clearly protected by the Constitution, particularly in upholding the right to contract. The Plaintiffs proceed ‘In Propria Persona,’ ‘Sui Juris,’ and not ‘pro se’—a critical distinction that the Defendants fail to understand.

The Defendants’ repeated references to irrelevant case law and misinterpretations of legal principles are nothing more than an attempt to distract from their own fundamental failure: their refusal to properly rebut or perform in accordance with their legal obligations. Their ignorance of the difference between ‘pro se’ and an ‘Attorney In Fact’ is not only embarrassing but also a direct reflection of their incompetence. Even the BAR Association’s own website explicitly states that an ‘Attorney In Fact’ has the legal capacity to perform any act within the authority granted in the power of attorney, which in this case is the ‘Affidavit of Attorney In Fact.’ Therefore, the Defendants’ persistent and misguided focus on “pro se” serves only to further expose their inability to engage with the facts and law properly, undermining their credibility in the process.

BAR website LINK HERE:

The Defendants Shannon Peterson and Alejandro Moreno are BAR “Lawyers” and these are their own rules, yet they guide their “cleints” (SDCCU) down a path of frivolously arguing about “Pro Se” status, while the Plaintiffs’ documents and the record reflects they are being represented by their “Attorney(s) In Fact.”

Defendants’ Status as ‘Wards of the Court’

Compounding their failures is the Defendants’ reliance on legal counsel, which under doctrines cited in C.J.S. Attorney & Client, renders them “wards of the court.” This status underscores their inability to act autonomously in legal matters, further explaining their lack of competence and failure to uphold principles of good faith and fair dealing.

In this case, their dependency on representation, combined with their procedural missteps, has left them exposed and without recourse.

Entitlement to Judgment and Remedies

Given the Defendants’ procedural dishonor, bad faith, and failure to rebut, the Plaintiffs are entitled to the following remedies:

- Summary Judgement: With no genuine dispute of material facts, the Plaintiffs are entitled to a judgment in their favor. The unrebutted affidavits, combined with the Defendants’ admissions, provide irrefutable evidence.

- Sanctions: The Plaintiffs seek monetary sanctions under 28 U.S.C. § 1927, totaling $300,000,000 USD, to address the Defendants’ willful noncompliance and procedural misconduct.

- Default Judgement: The Defendants’ procedural failures warrant a default judgment, affirming the Plaintiffs’ claims as binding truth.

- Restitution: The Plaintiffs demand the return of their private trust property and compensation for all damages resulting from the Defendants’ unlawful actions.

Legal Principles Highlighted

The Defendants’ failings serve as a reminder of critical legal principles:

- Unrebutted Affidavits Are Binding: In law and commerce, failure to rebut an affidavit equates to agreement with its terms and claims.

- Silence Equals Consent: The Defendants’ lack of response constitutes acquiescence to the Plaintiffs’ claims.

- Procedural Honor Is Mandatory: Noncompliance with court orders and procedural rules leads to severe consequences, including sanctions and default judgments.

- Accountability Is Inevitable: The court’s decision to strike the Defendants’ filings and impose sanctions highlights the importance of adhering to legal standards.

Conclusion: A Legal Misstep

While Judge Altman’s acknowledgment of the necessity for government enforcement of Title 18 claims is correct, his treatment of the UCC and dismissal of essential federal statutes—including House Joint Resolution 192—is deeply concerning. His failure to engage with the law and his biased approach to the case undermine both the integrity of the judicial process and the principles of fairness and justice.