PHH Mortgage’s Motion to Dismiss in Kevin Walker Estate, et al. v. PHH Mortgage Corporation, et al. is a blatant example of judicial overreach and procedural abuse. The motion falsely claims that a trust cannot be represented by an attorney-in-fact, denying fundamental rights to self-representation protected by the Constitution. It further asserts that all Americans are mere subjects and slaves, stripping them of their autonomy and falsely claiming that only “attorneys at law” can represent individuals in court. Additionally, the court is actively obstructing the record by failing to file Plaintiffs’ documents, necessitating a writ of mandamus. This case highlights a broader issue of legal corruption, defamation, and deprivation of rights under the color of law.

The American Bar Association (ABA) itself acknowledges the existence and legitimacy of a power of attorney, stating that it is a legally recognized instrument that grants an individual any power conferred upon them by the grantor. This directly contradicts PHH Mortgage’s claim that only licensed attorneys can act in a representative capacity, further exposing the baseless nature of their arguments.

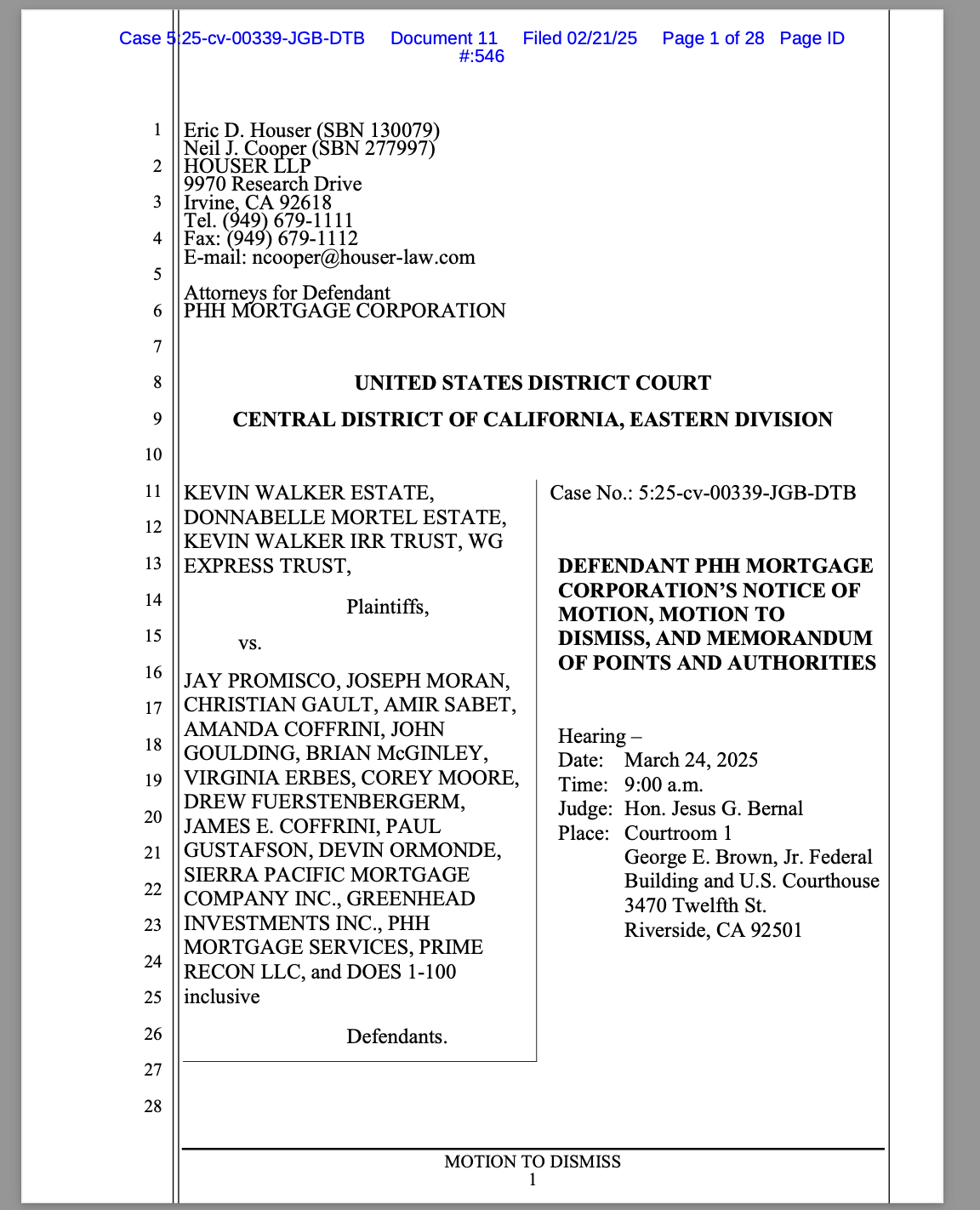

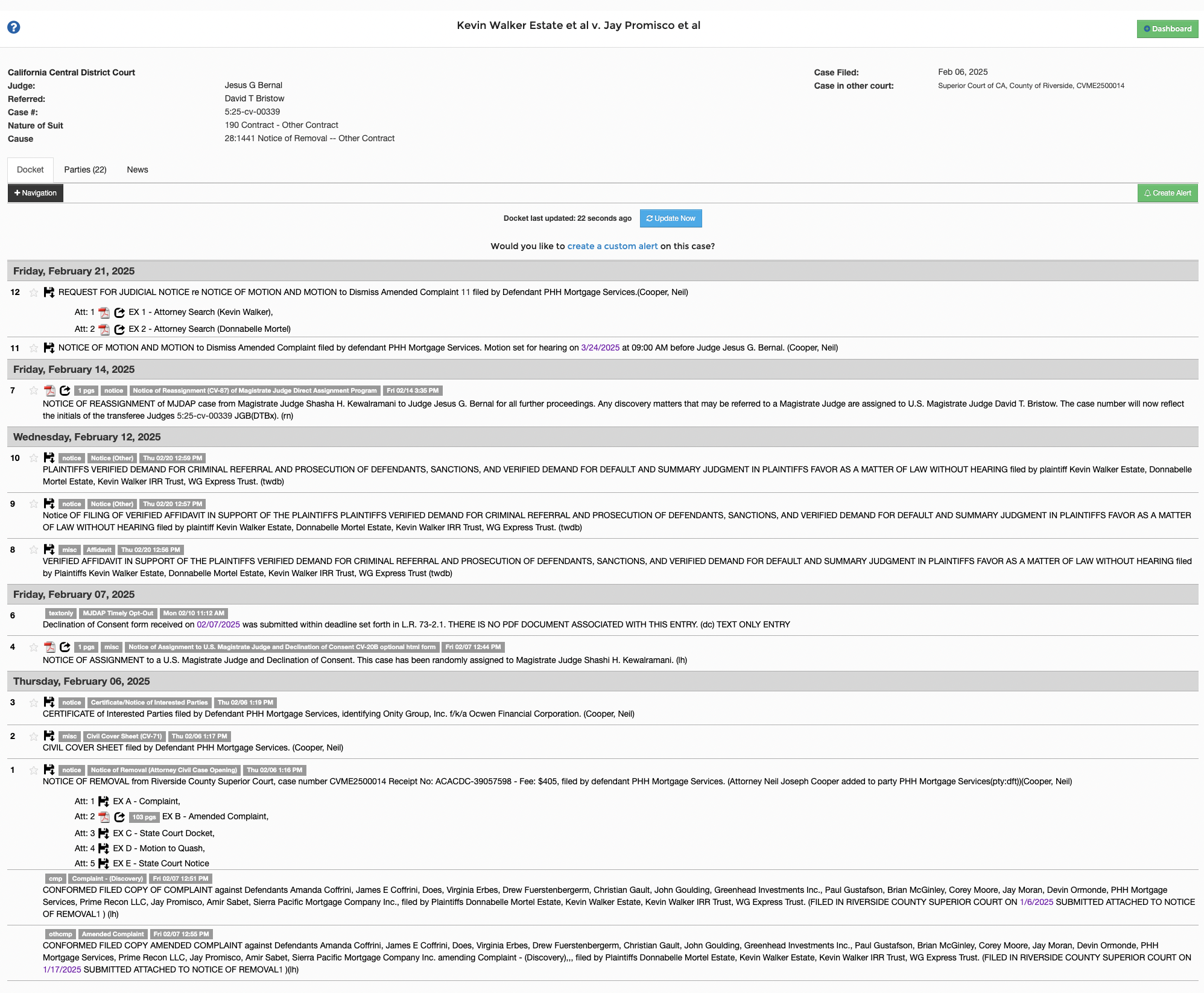

The loan “servicer” PHH Mortgage Corporation’s (Defendant’s) Motion to Dismiss in Kevin Walker Estate, et al. v. PHH Mortgage Corporation, et al. is a clear example of judicial overreach, procedural abuse, and an outright disregard for constitutional rights and established legal doctrines. The motion incorrectly asserts that a trust cannot be represented by an attorney-in-fact or in propria persona, effectively denying the right of self-representation and forcing individuals into a system that mandates attorney representation—a position entirely inconsistent with the Bill of Rights, contract law, and common law principles.

The document falsely conflates a trust with a corporate fiction requiring an attorney, effectively alleging that all men and women are legal slaves to the BAR association and that their only means of access to justice is through a licensed attorney. This position contradicts constitutional protections, the Uniform Commercial Code (UCC), contract law, and longstanding legal precedents affirming one’s right to appoint an attorney-in-fact.

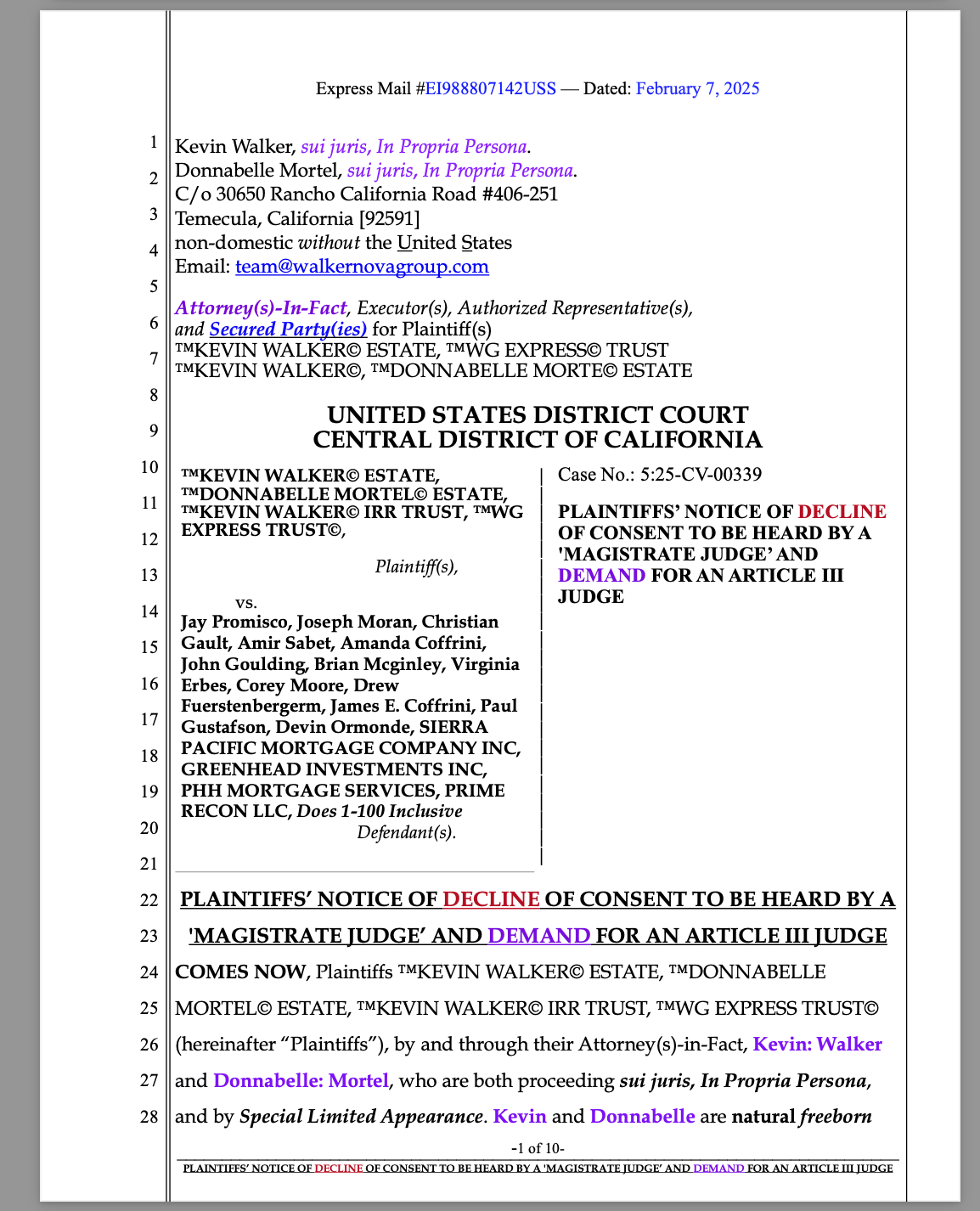

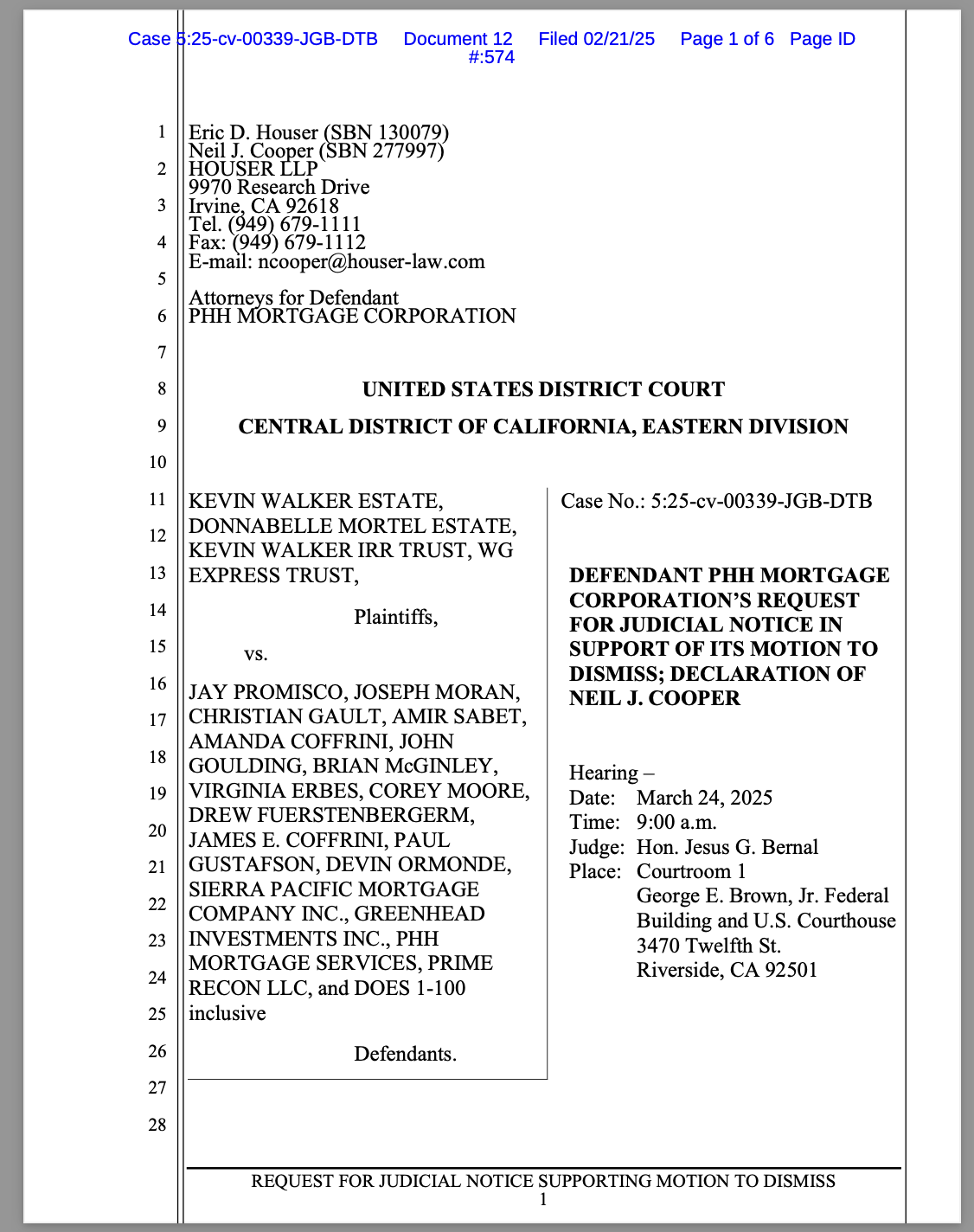

Furthermore, the court itself is obstructing the record by failing to file Plaintiffs’ documents, preventing a full and accurate judicial record. This procedural misconduct has already been challenged via a demand for a writ of mandamus filed with the appeals court, seeking to compel the lower court to adhere to its duty of recordkeeping and procedural fairness. This obstruction is further detailed in Kevin Walker Estate’s Verified Demand for Writ of Mandamus, which exposes the Riverside Federal Court’s conspiracy, violation of Plaintiffs’ rights, manipulation of records, and obstruction of justice (source).

See article: “KEVIN WALKER estate Files VERIFIED Demand for Writ of Mandamus as Riverside Federal Court Conspires, Violates Plaintiffs’ right, Manipulates Records, and Obstructs Justice”

DOWNLOAD DOCUMENT

1. The Motion Constitutes Defamation, Slander, Libel, Deprivation Under Color of Law, and Fraud

PHH Mortgage Corporation’s Motion to Dismiss is not only legally baseless but also amounts to defamation, slander, libel, fraud, and abuse of the judicial system. The motion is designed to maliciously misrepresent the Plaintiffs, falsely categorize their claims as frivolous, and tarnish their credibility before the court without engaging in substantive legal arguments.

- Defamation, Slander, and Libel:

- The motion makes false, misleading, and defamatory statements about Plaintiffs, branding them as “sovereign citizens” in an attempt to discredit their legitimate legal arguments.

- Such intentional mischaracterization is an act of slander and libel, aimed at influencing the court to dismiss the case based on prejudice rather than merit.

- Deprivation of Rights Under the Color of Law (42 U.S.C. § 1983):

- By obstructing the Plaintiffs’ ability to represent their own interests, PHH, along with the court’s complicity, is engaging in unlawful deprivation of rights under the color of law.

- This motion serves as a tactic to suppress due process rights, violating the First, Fifth, and Fourteenth Amendments.

- Fraud and Abuse of the Judicial System:

- PHH’s motion misrepresents facts and distorts legal doctrines to manipulate the proceedings in their favor.

- The motion deliberately ignores applicable law and relies on bad case law, which has been rendered irrelevant by the overturning of Chevron deference.

- The attempt to obstruct the filing of Plaintiffs’ documents is a fraudulent manipulation of court procedures that further demonstrates abuse of process.

These tactics collectively amount to an orchestrated scheme to defame, discredit, and unlawfully strip Plaintiffs of their rights, ensuring an unjust dismissal of the case based on judicial bias rather than legal merit.

2. The Right to Self-Representation and Power of Attorney

One of the most egregious errors in PHH Mortgage’s Motion is the claim that the Plaintiffs, acting as attorneys-in-fact for their respective trusts, “lack standing” to bring the lawsuit because they are not licensed attorneys. This argument is flawed for several reasons:

The Right to Self-Representation:

- The Sixth Amendment and Article I, Section 10, Clause 1 of the U.S. Constitution guarantee the right of individuals to defend their own rights without being forced to hire an attorney.

- Under U.S. Supreme Court precedents, a person does not require a law license to exercise their own rights or act as an agent in contractual matters.

Power of Attorney & UCC Recognition:

- The Uniform Commercial Code (UCC) § 3-402 recognizes that a trust, like any legal entity, can be represented by an authorized agent or attorney-in-fact.

- A trust is a contractual arrangement, not a corporate entity that is required to hire an attorney.

- Case law supports the right of an individual to act as an agent for a trust without a requirement to be a BAR-licensed attorney.

ABA Recognition of Power of Attorney:

The American Bar Association (ABA) defines a power of attorney as a legal document that grants one or more persons the authority to act on behalf of another as their agent. This authority can be limited to specific activities or general in scope. The ABA further emphasizes that a power of attorney is recognized in all states, though the rules and requirements may vary (American Bar Association).

By falsely asserting that only licensed attorneys can represent a trust, PHH’s Motion disregards these established legal principles and attempts to impose an unwarranted barrier to justice.

3. PHH Mortgage’s Motion Ignores Contract Law & the Mailbox Rule

PHH Mortgage’s dismissal motion also fails to acknowledge basic contract law principles and the mailbox rule:

- Contracts & Acceptance:

- PHH dismisses the claims related to contract breaches by arguing that the Plaintiffs’ claims rely on “sovereign citizen theories,” yet they fail to refute the validity of the contracts presented.

- Under UCC § 1-308, a party can reserve rights in contracts, which is exactly what Plaintiffs did in their filings.

- Mailbox Rule:

- Under common law and the UCC, when an offer is sent via certified mail, it is presumed accepted if not rebutted within the specified timeframe.

- PHH attempts to disregard legally binding documents by ignoring the principles of offer, acceptance, and acquiescence.

These omissions suggest that PHH’s legal team is either willfully ignorant of contract law or attempting to mislead the court.

Beyond its misinterpretation of contract law, PHH’s Motion presents a blatant attack on fundamental constitutional rights, including:

- The Right to Access Courts Without an Attorney:

- Forcing individuals to hire an attorney violates public policy and goes against the U.S. Supreme Court ruling in Faretta v. California, 422 U.S. 806 (1975), which reaffirmed that individuals have the right to represent themselves in court.

- Violation of Public Law & Monetary Policy:

- PHH Mortgage fails to acknowledge the impact of the removal of the gold standard and House Joint Resolution 192 (HJR-192, 1933), which effectively abolished lawful money and established a debt-based economy.

- By rejecting the Plaintiffs’ ability to discharge debts via proper UCC filings, PHH contradicts longstanding monetary policies that legally recognize negotiable instruments as valid means of settlement.

PHH Mortgage’s Motion not only misapplies law but also relies on outdated and bad case law that is no longer controlling due to the overturning of Chevron deference. The recent U.S. Supreme Court decision eliminating Chevron deference has reshaped judicial review, meaning courts can no longer defer to administrative agencies’ interpretations of statutes when the law is ambiguous.

- This invalidates much of the case law PHH relies upon, as courts must now apply independent judicial interpretation rather than deferring to flawed administrative rulings.

- The Motion also attempts to obstruct the record by refusing to acknowledge valid legal filings, a fact that has already necessitated a writ of mandamus to the appeals court.

By relying on outdated legal interpretations and ignoring the new Supreme Court ruling, PHH attempts to bolster its weak arguments with bad precedent that is no longer valid.