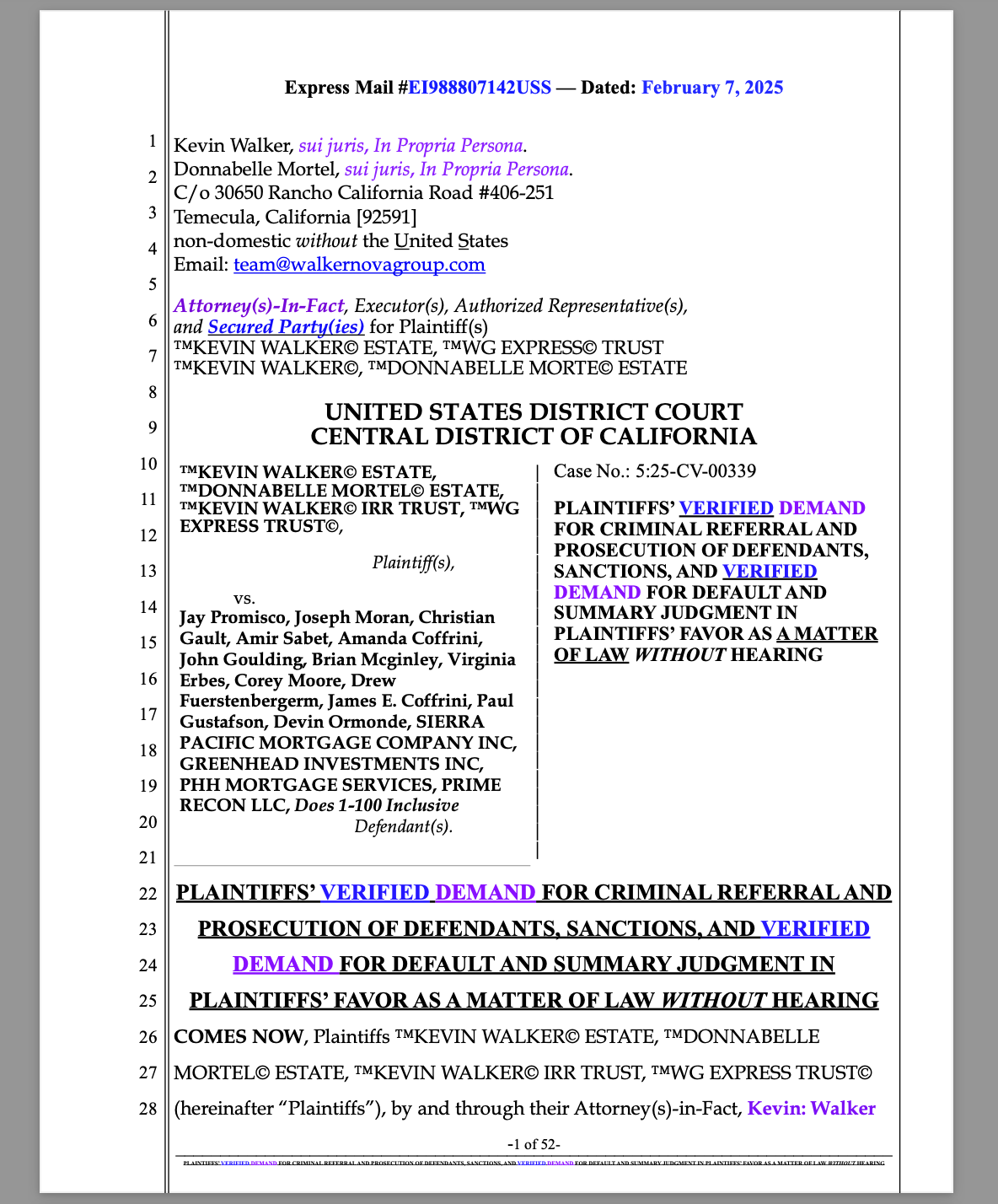

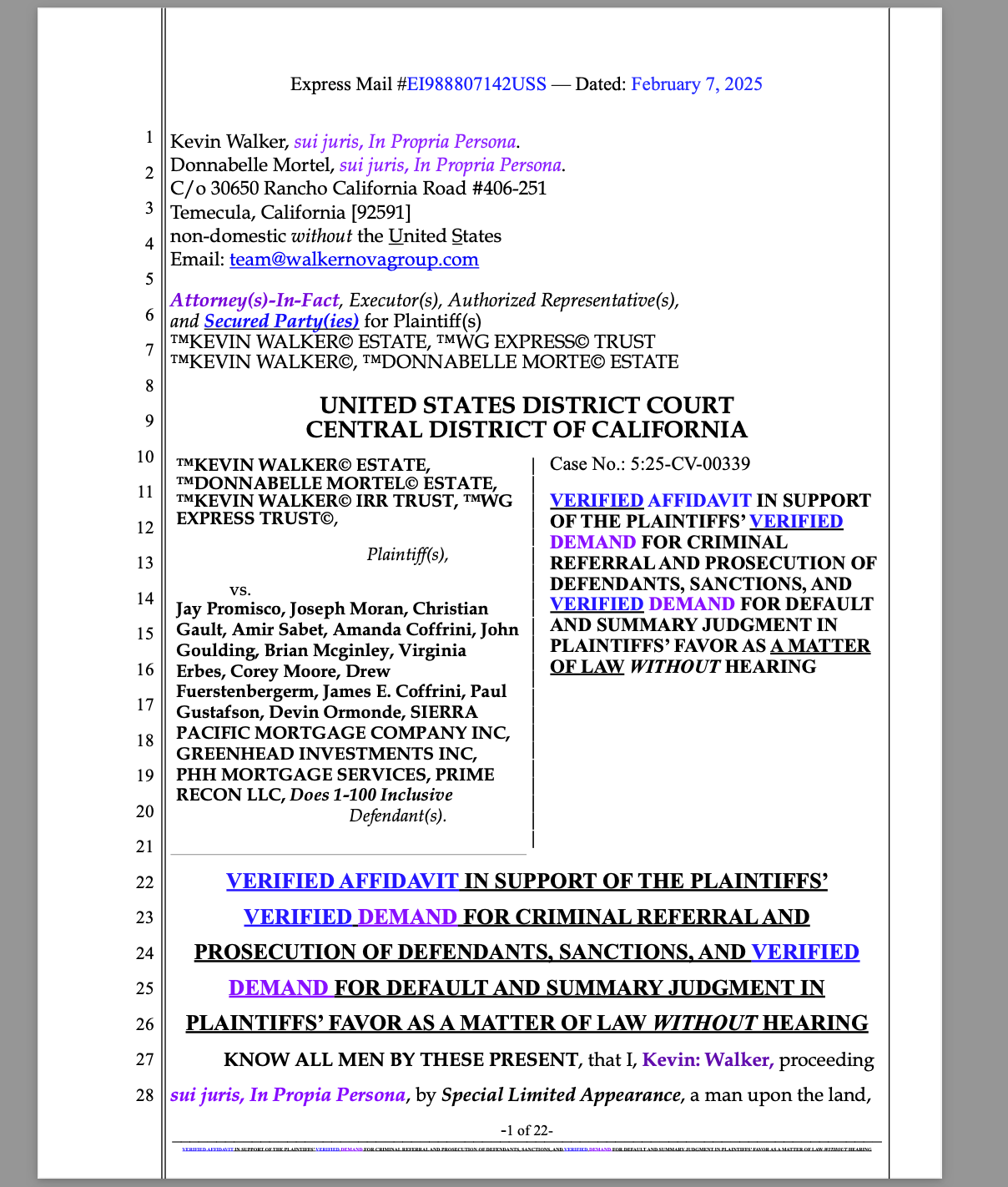

The United States District Court, Central District of California (Riverside), stands accused of obstructing justice, tampering with records, and violating due process by unlawfully refusing to file and docket legitimate pleadings. Plaintiffs KEVIN WALKER ESTATE, et al., hav presented irrefutable evidence of judicial misconduct, calling for criminal prosecution, sanctions, and immediate enforcement. Despite proof of receipt, court officials have concealed filings, manipulated records, and obstructed legal proceedings, in direct violation of 18 U.S.C. §§ 1505, 1512, 1519, and 2071. With Pam Bondi CC’d on the correspondence, high-level authorities have been alerted to this grave constitutional violation that threatens judicial integrity and fundamental rights.

Documented Violations of Federal Law

The deliberate manipulation of court records is not a mere clerical oversight—it is a direct attack on the administration of justice. The following federal statutes explicitly prohibit such conduct:

- 18 U.S.C. § 1512 – Tampering with documents in an official proceeding.

- 18 U.S.C. § 1519 – Destruction, alteration, or falsification of records to obstruct an investigation.

- 18 U.S.C. § 1505 – Obstruction of proceedings before a federal court.

- 18 U.S.C. § 2071 – Concealment, removal, or mutilation of public records.

By refusing to file and docket Plaintiffs’ lawful pleadings, Defendants have engaged in criminal obstruction, violating the First Amendment (right to petition for redress of grievances) and the Fifth Amendment (due process protections).

Undeniable Proof of Obstruction

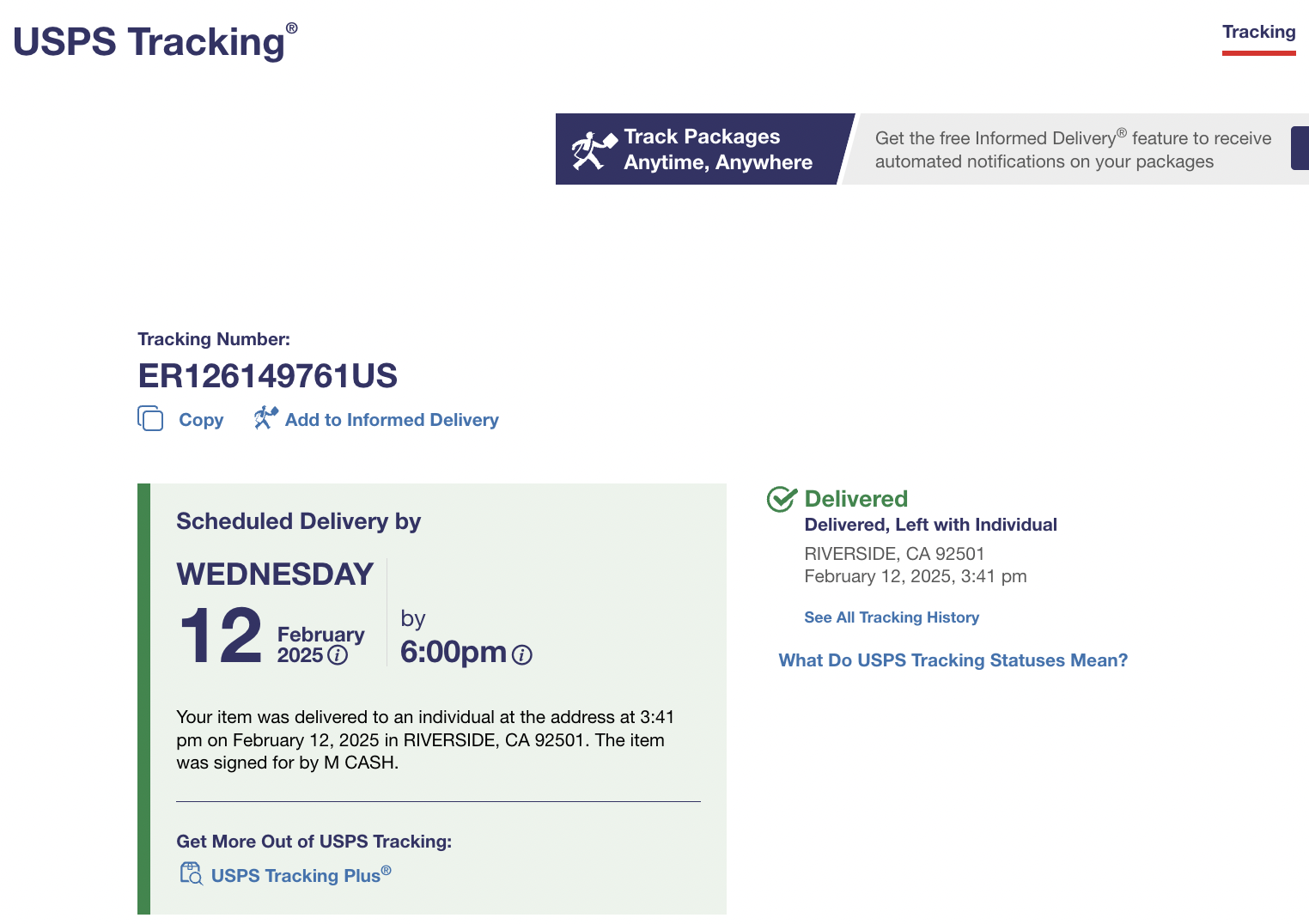

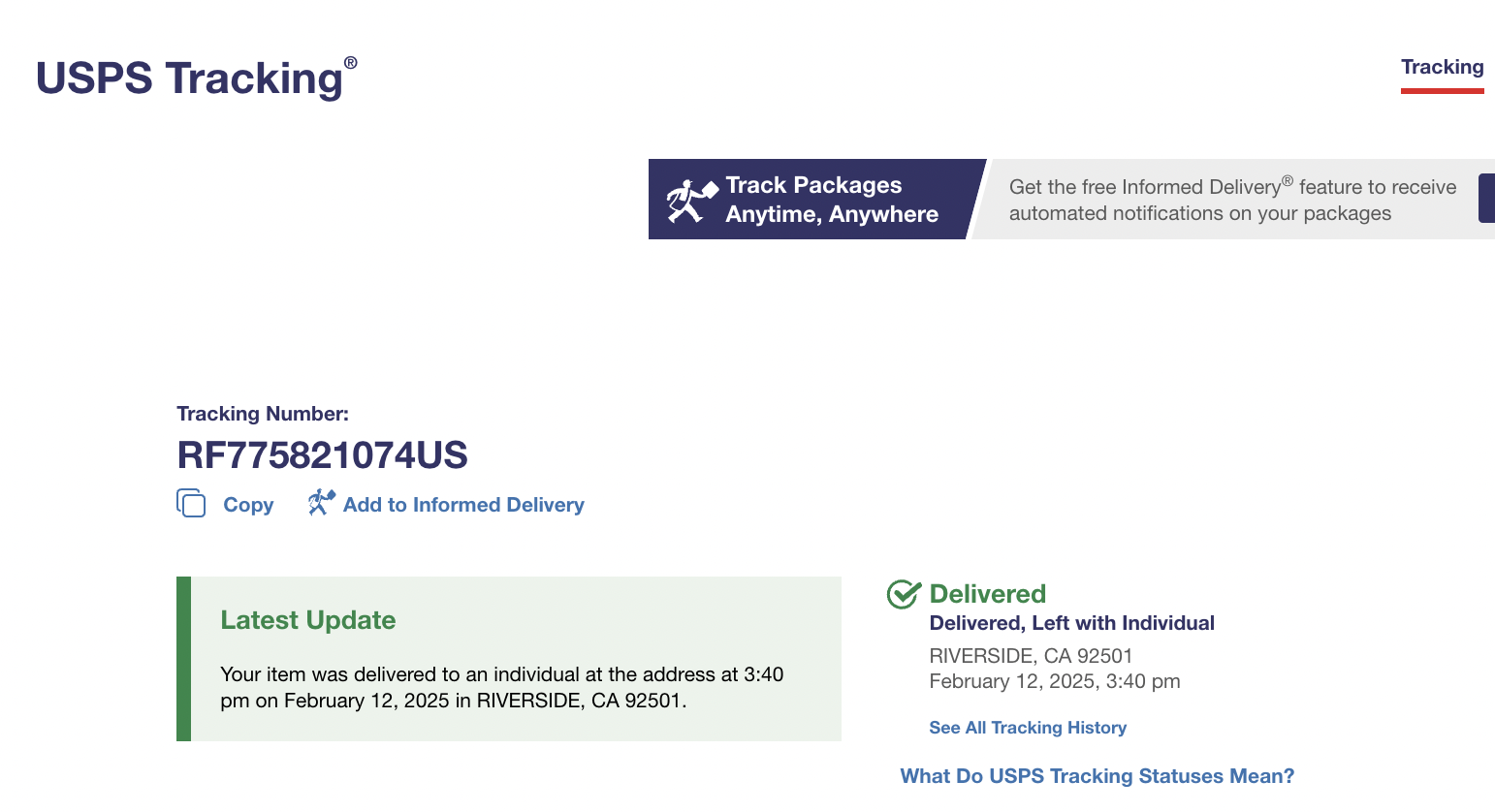

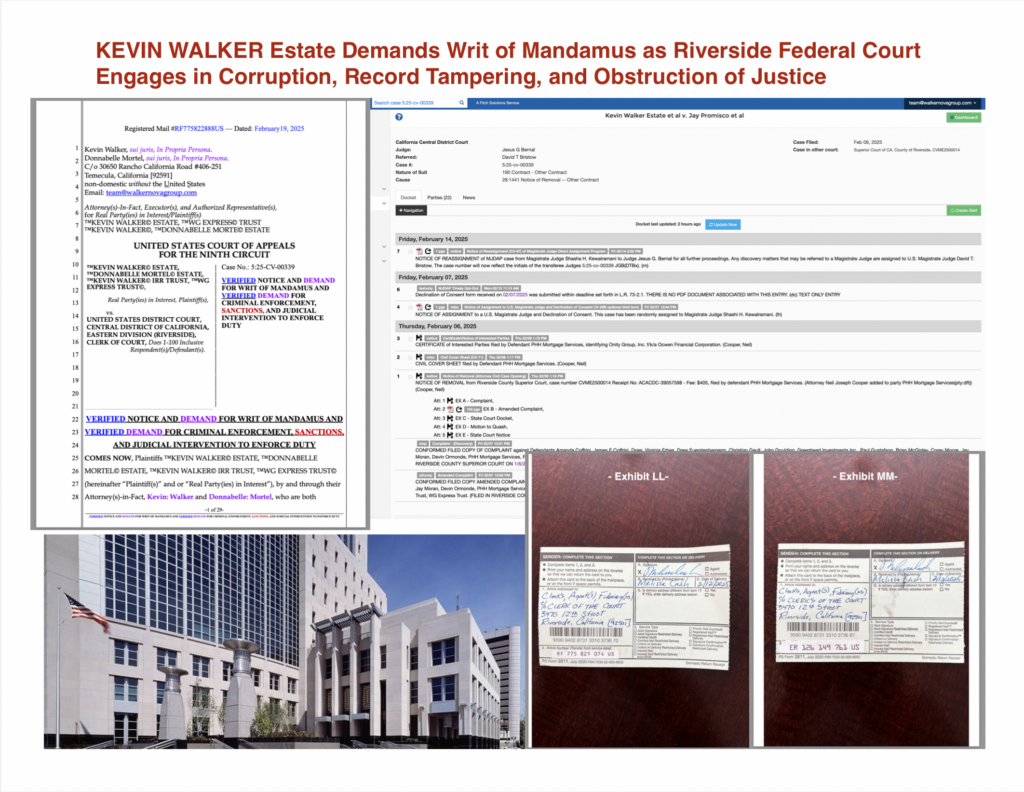

Despite unequivocally receiving the filings—evidenced by Registered Mail #RF775821074US and Express Mail #ER126149761US, along with corresponding USPS Form 3811 receipts—the United States District Court in Riverside has failed to fulfill its mandatory ministerial duty. These receipts, attached as Exhibits LL and MM, conclusively prove that Defendants had actual possession of the filings yet unlawfully obstructed their entry into the official record.

This deliberate suppression of evidence constitutes record tampering and obstruction of justice. No lawful justification has been provided for these actions, demonstrating a clear pattern of bad faith and intentional misconduct.

Demands for Immediate Enforcement and Sanctions

The severity of these violations necessitates immediate enforcement by the proper authorities. Therefore, Plaintiff/Real Party in Interest demands the following actions:

-

Referral for Criminal Investigation & Prosecution

- The Department of Justice, the Office of the Inspector General, or any other relevant federal enforcement body must immediately investigate and prosecute all responsible parties for deliberate obstruction, concealment, and mutilation of judicial records.

-

Mandatory Criminal Referrals for Court Officials

- Under 28 U.S.C. § 535, any judge, clerk, or court officer involved in these unlawful acts must be prosecuted under federal law for tampering with judicial records and obstructing due process.

-

Severe Sanctions Against the Defendants

- Due to the willful and malicious obstruction of justice, financial and procedural sanctions must be imposed against all responsible individuals to deter further misconduct.

-

Immediate Restoration of Concealed Filings

- The court must immediately file, docket, and restore all unlawfully concealed or rejected pleadings.

-

Issuance of a Default Judgment & Judicial Intervention

- Given the court’s obstruction and refusal to process filings, summary judgment and sanctions must be issued without further hearing, as Defendants have failed to rebut Plaintiffs’ verified affidavits, thereby admitting liability under the Federal Rules of Civil Procedure.

Justice Must Prevail

The judicial system cannot function when those entrusted to uphold the law instead choose to manipulate it for their own interests. The United States District Court for the Central District of California, Eastern Division (Riverside) and its personnel have deliberately engaged in obstruction, concealment, and misconduct—actions that demand criminal prosecution and immediate corrective measures.

By informing Pam Bondi, former Attorney General of Florida, Plaintiffs ensure that high-level legal authorities are aware of these blatant violations. This is not merely a procedural issue—this is a constitutional crisis that strikes at the heart of justice, due process, and the rule of law.

This case is bigger than one individual—it is about defending the fundamental right of every individual to access a fair and uncorrupted judicial process. The law is clear, the evidence is indisputable, and the time for enforcement is now.