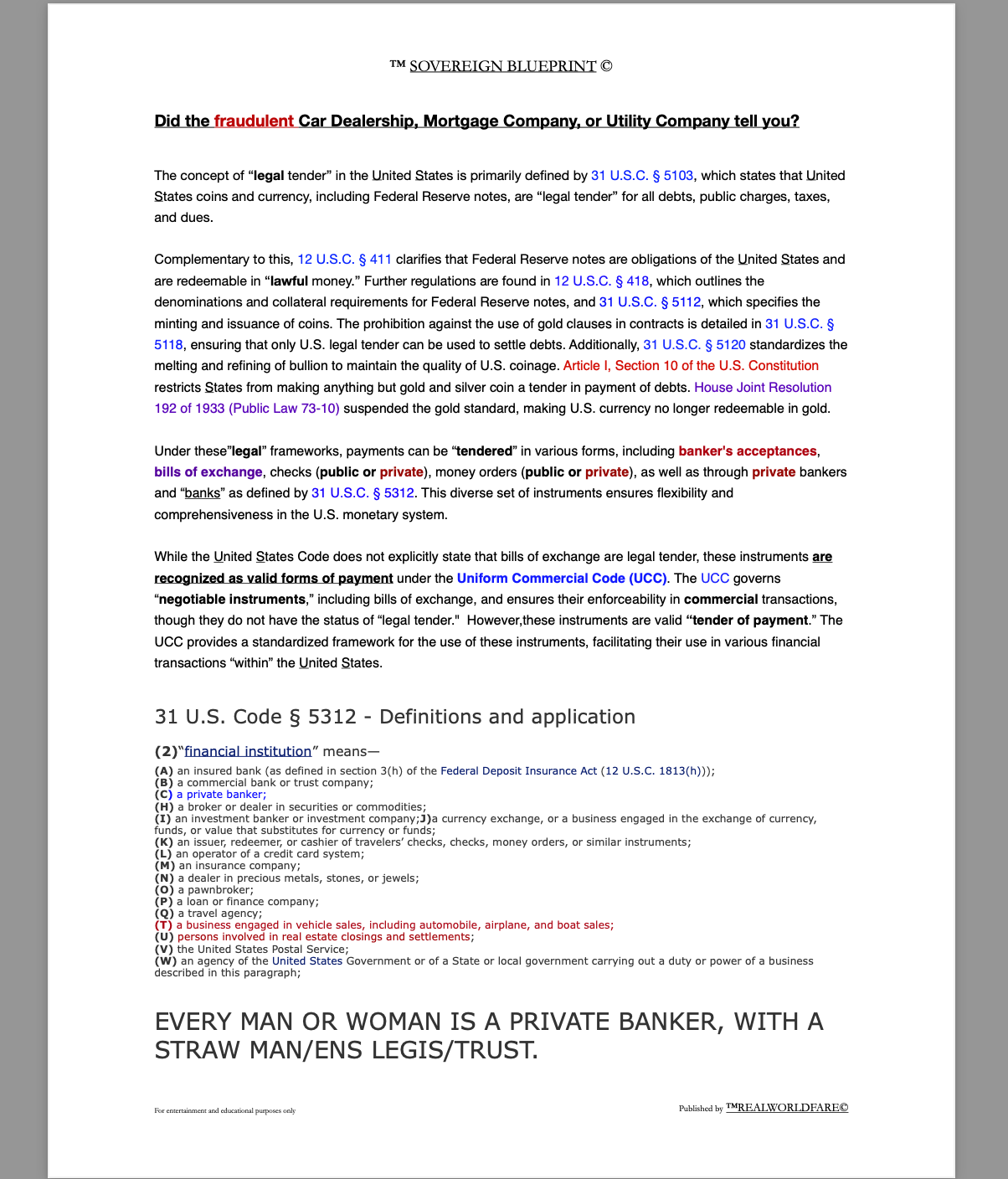

Did the fraudulent Car Dealership, Mortgage Company, or Utility Company tell you?

The concept of “legal tender” in the United States is primarily defined by 31 U.S.C. § 5103, which states that United States coins and currency, including Federal Reserve notes, are “legal tender” for all debts, public charges, taxes, and dues.

Complementary to this, 12 U.S.C. § 411 clarifies that Federal Reserve notes are obligations of the United States and are redeemable in “lawful money.” Further regulations are found in 12 U.S.C. § 418, which outlines the denominations and collateral requirements for Federal Reserve notes, and 31 U.S.C. § 5112, which specifies the minting and issuance of coins. The prohibition against the use of gold clauses in contracts is detailed in 31 U.S.C. § 5118, ensuring that only U.S. legal tender can be used to settle debts. Additionally, 31 U.S.C. § 5120 standardizes the melting and refining of bullion to maintain the quality of U.S. coinage. Article I, Section 10 of the U.S. Constitution restricts States from making anything but gold and silver coin a tender in payment of debts. House Joint Resolution 192 of 1933 (Public Law 73-10) suspended the gold standard, making U.S. currency no longer redeemable in gold.

Under these”legal” frameworks, payments can be “tendered” in various forms, including banker’s acceptances, bills of exchange, checks (public or private), money orders (public or private), as well as through private bankers and “banks” as defined by 31 U.S.C. § 5312. This diverse set of instruments ensures flexibility and comprehensiveness in the U.S. monetary system.

While the United States Code does not explicitly state that bills of exchange are legal tender, these instruments are recognized as valid forms of payment under the Uniform Commercial Code (UCC). The UCC governs “negotiable instruments,” including bills of exchange, and ensures their enforceability in commercial transactions, though they do not have the status of “legal tender.” However, these instruments are valid “tender of payment.” The UCC provides a standardized framework for the use of these instruments, facilitating their use in various financial transactions “within” the United States.

31 U.S. Code § 5312 – Definitions and application

(2)“financial institution” means—

(A) an insured bank (as defined in section 3(h) of the Federal Deposit Insurance Act (12 U.S.C. 1813(h)));

(B) a commercial bank or trust company;

(C) a private banker;

(H) a broker or dealer in securities or commodities;

(I) an investment banker or investment company;J)a currency exchange, or a business engaged in the exchange of currency, funds, or value that substitutes for currency or funds;

(K) an issuer, redeemer, or cashier of travelers’ checks, checks, money orders, or similar instruments;

(L) an operator of a credit card system;

(M) an insurance company;

(N) a dealer in precious metals, stones, or jewels;

(O) a pawnbroker;

(P) a loan or finance company;

(Q) a travel agency;

(T) a business engaged in vehicle sales, including automobile, airplane, and boat sales;

(U) persons involved in real estate closings and settlements;

(V) the United States Postal Service;

(W) an agency of the United States Government or of a State or local government carrying out a duty or power of a business described in this paragraph;

EVERY MAN OR WOMAN IS A PRIVATE BANKER, WITH A STRAW MAN/ENS LEGIS/TRUST.