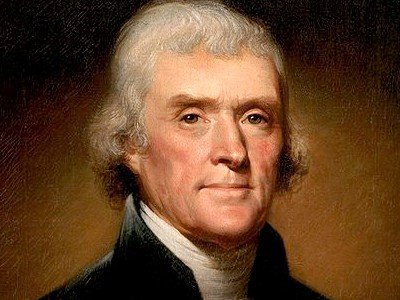

Thomas Jefferson: President of the United States from 1801 to 1809.

Thomas Jefferson (April 13, 1743 – July 4, 1826) was an American statesman, diplomat, lawyer, architect, philosopher, and Founding Father who served as the third president of the United States from 1801 to 1809. He was the primary author of the Declaration of Independence. Following the American Revolutionary War and prior to becoming president in 1801, Jefferson was the nation’s first U.S. secretary of state under George Washington and then the nation’s second vice president under John Adams.

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks…will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.” – Thomas Jefferson in the debate over the Re-charter of the Bank Bill (1809)

“I believe that banking institutions are more dangerous to our liberties than standing armies.” –Thomas Jefferson

“… The modern theory of the perpetuation of debt has drenched the earth with blood, and crushed its inhabitants under burdens ever accumulating.” -Thomas Jefferson

James Madison: President of the United States from 1809 to 1817.

James Madison Jr. was an American statesman, diplomat, and Founding Father who served as the fourth president of the United States from 1809 to 1817. Madison was popularly acclaimed the “Father of the Constitution” for his pivotal role in drafting and promoting the Constitution of the United States and the Bill of Rights. Madison was born into a prominent slave-owning planter family in Virginia

“History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money and its issuance.” -James Madison

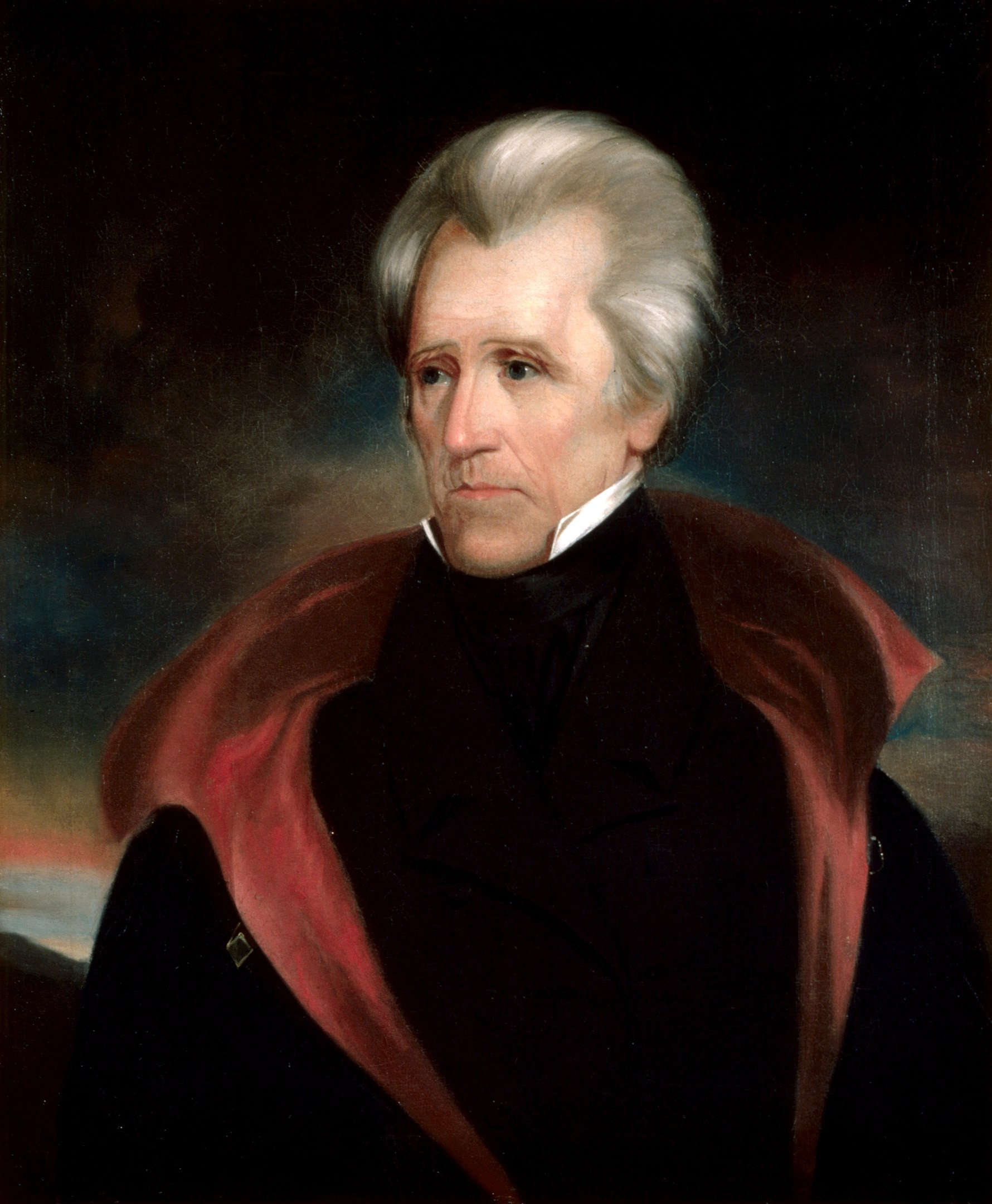

Andrew Jackson: President of the United States from 1829 to 1837.

Andrew Jackson was an American lawyer, planter, general, and statesman who served as the seventh president of the United States from 1829 to 1837. Before his presidency, he gained fame as a general in the U.S. Army and served in both houses of the U.S. Congress.

“If congress has the right under the Constitution to issue paper money, it was given them to use themselves, not to be delegated to individuals or corporations.” -Andrew Jackson

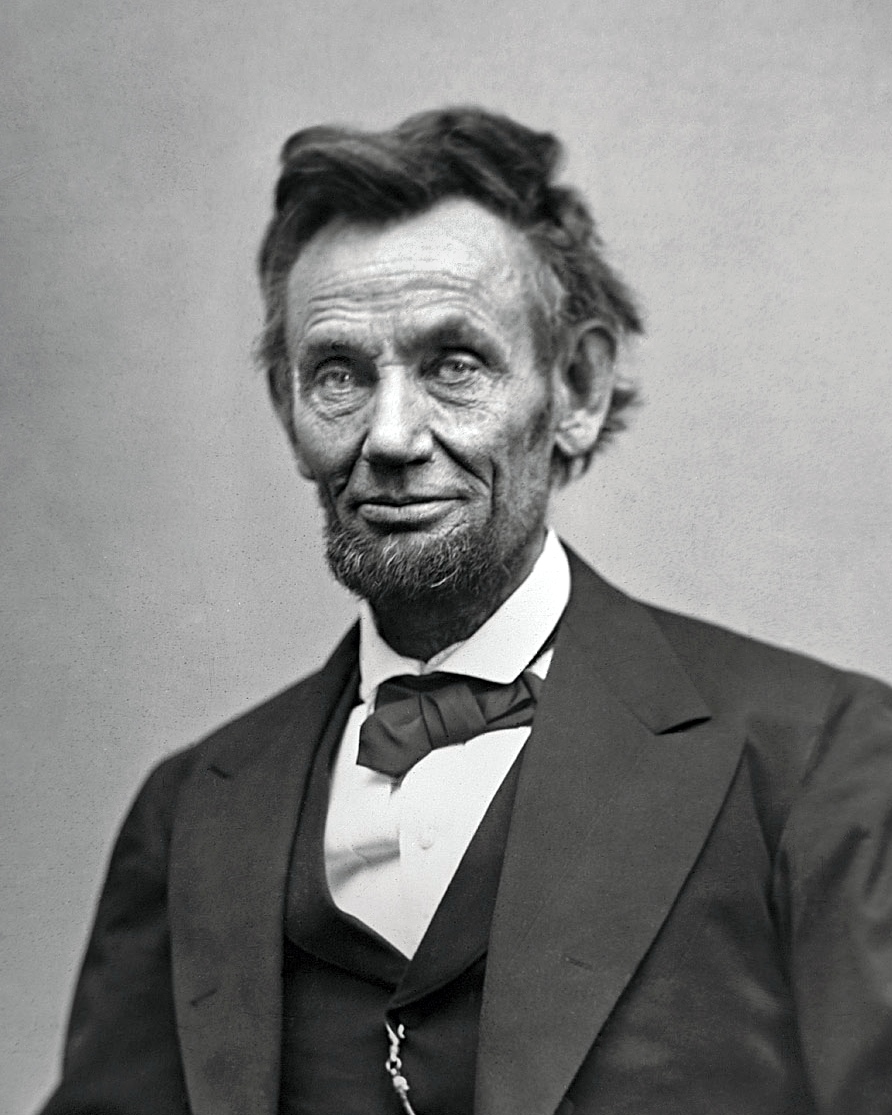

Abraham Lincoln: President of the United States from 1861 to 1865 (American, 1809-1865).

Abraham Lincoln was an American lawyer, politician, and statesman who served as the 16th president of the United States from 1861 until his assassination in 1865.

“The Government should create, issue, and circulate all the currency and credits needed to satisfy the spending power of the Government and the buying power of consumers. By the adoption of these principles, the taxpayers will be saved immense sums of interest. Money will cease to be master and become the servant of humanity.” -Abraham Lincoln

Theodore Roosevelt: President of the United States from 1901 to 1909.

Theodore Roosevelt Jr., often referred to as Teddy or by his initials, T. R., was an American politician, statesman, conservationist, naturalist, and writer who served as the 26th president of the United States from 1901 to 1909.

“Issue of currency should be lodged with the government and be protected from domination by Wall Street. We are opposed to…provisions [which] would place our currency and credit system in private hands.” – Theodore Roosevelt

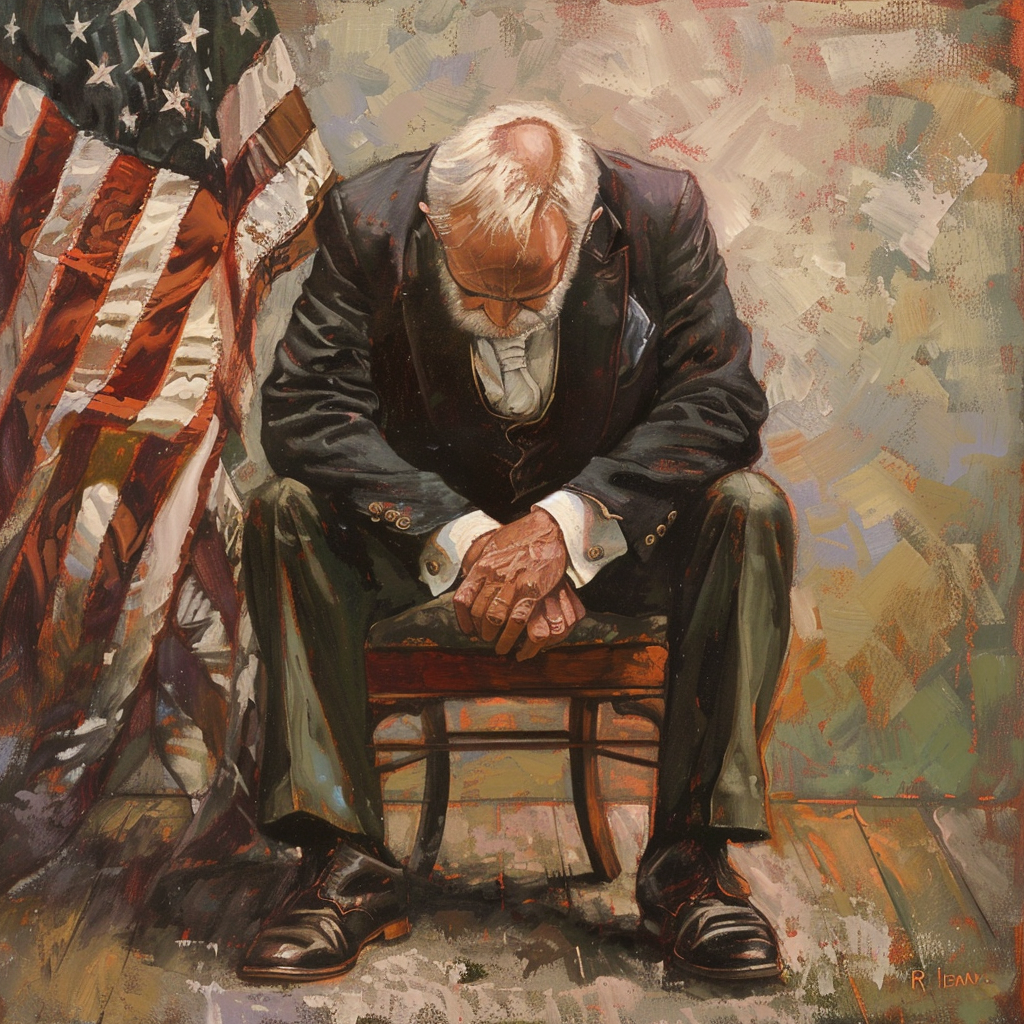

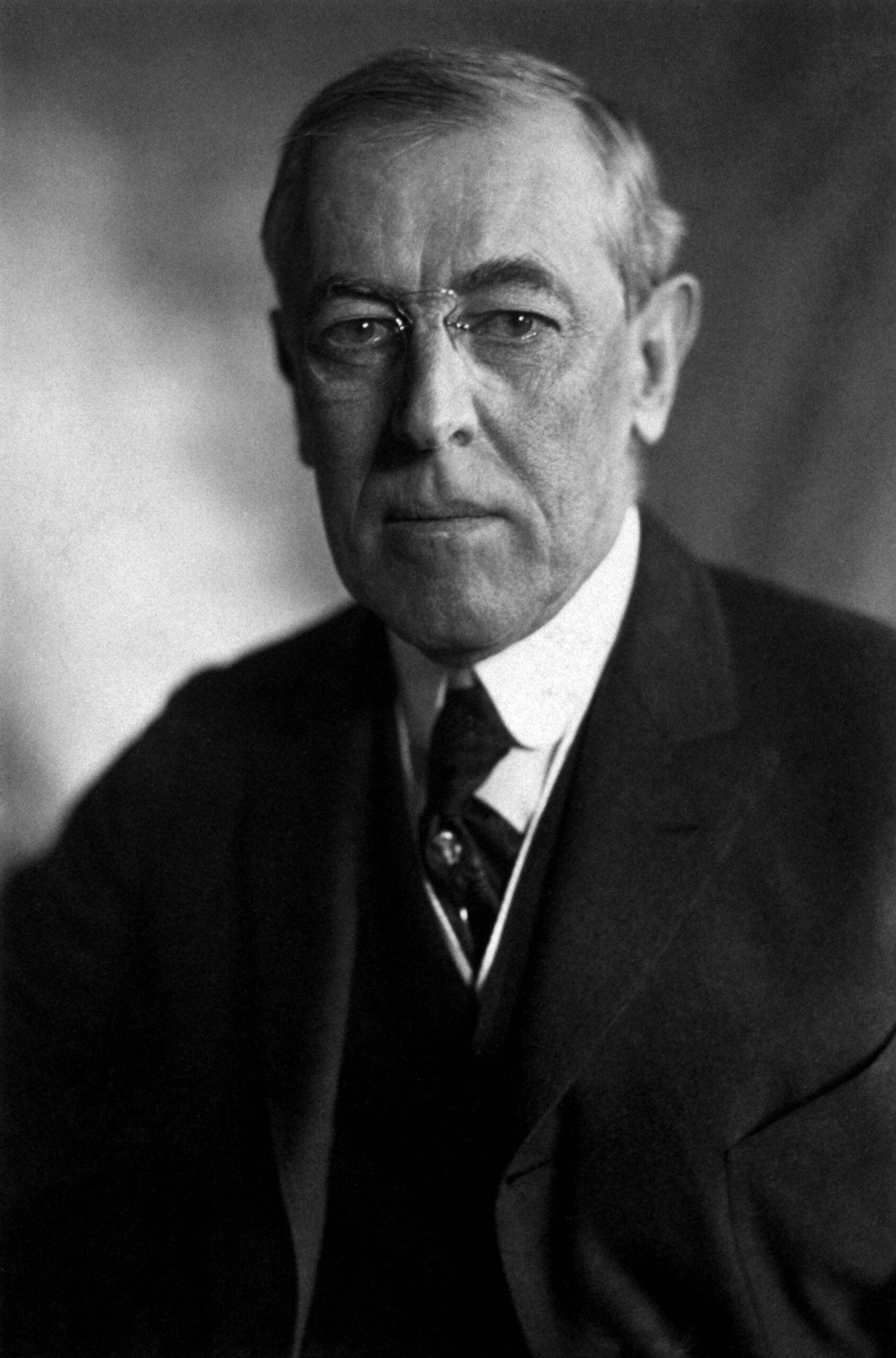

Thomas Woodrow Wilson: President of the United States from 1913 to 1921.

Thomas Woodrow Wilson was an American politician and academic who served as the 28th President of the United States from 1913 to 1921. Despite these warnings, Woodrow Wilson signed the 1913 Federal Reserve Act. A few years later he wrote:

“I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated Governments in the civilized world no longer a Government by free opinion, no longer a Government by conviction and the vote of the majority, but a Government by the opinion and duress of a small group of dominant men.” -Woodrow Wilson

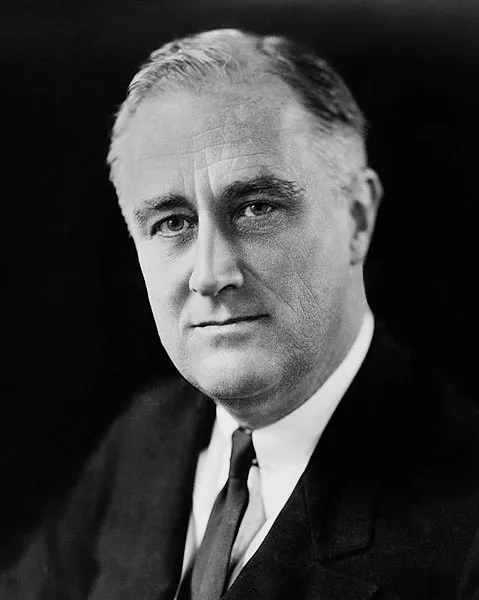

Franklin D. Roosevelt: President of the United States from 1933 to 1945

Years later, reflecting on the major banks’ control in Washington, President Franklin Roosevelt paid this indirect praise to his distant predecessor President Andrew Jackson, who had “killed” the 2nd Bank of the US (an earlier type of the Federal Reserve System). After Jackson’s administration the bankers’ influence was gradually restored and increased, culminating in the passage of the Federal Reserve Act of 1913. Roosevelt knew this history.

The real truth of the matter is,as you and I know, that a financial

element in the large centers has owned the government ever since

the days of Andrew Jackson… -Franklin D. Roosevelt

(in a letter to Colonel House, dated November 21, 1933)

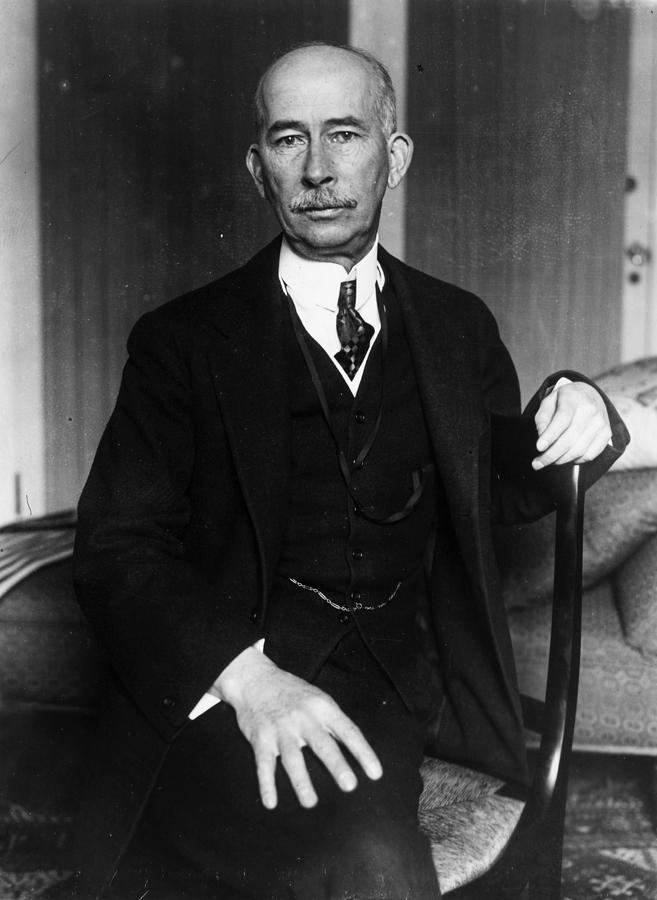

Edward Mandel House 1858-1938. .

Edward Mandell House was an American diplomat, and an adviser to President Woodrow Wilson. He was known as Colonel House, although his rank was honorary and he had performed no military service. Colonel Edward Mandel House stated in a meeting with Woodrow Wilson that he knew the pledge system was coming

He said in a letter to President Woodrow Wilson [1913-1921]:

“[Very] soon, every American will be required to register their biological property in a National system designed to keep track of the people and that will operate under the ancient system of pledging. By such methodology, we can compel people to submit to our agenda, which will affect our security as a charge-back for our fiat paper currency.

Every American will be forced to register or suffer not being able to work and earn a living. They will be our chattel, and we will hold the security interest over them forever, by operation of the law merchant under the scheme of secured transactions. Americans, by unknowingly or unwittingly delivering the bills of lading to us will be rendered bankrupt and insolvent, forever to remain economic slaves through taxation, secured by their pledges. They will be stripped of their rights and given a commercial value designed to make us a profit and they will be none the wiser, for not one man in a million could ever figure our plans; and, if by accident one or two would figure it out, we have in our arsenal plausible deniability.

After all, this is the only logical way to fund government, by floating liens and debt to the registrants in the form of benefits and privileges. This will inevitably reap to us huge profits beyond our wildest expectations and leave every American a contributor to this fraud, which we will call “Social Insurance (SSI)”.

Without realizing it, every American will insure us for any loss we may incur, and in this manner every American will unknowingly be our servant, however begrudgingly. The people will become helpless and without any hope for their redemption; and we will employ the high office of the President of our dummy corporation to foment this plot against America.”

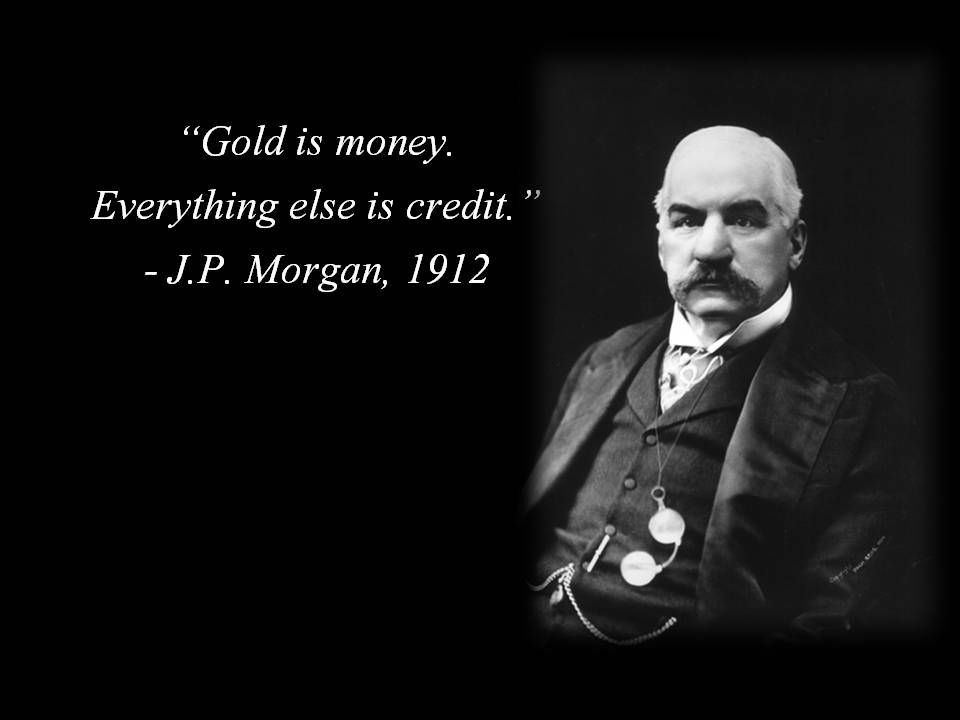

American financier, banker, and art collector (1837–1913).

John Pierpont Morgan (April 17, 1837 – March 31, 1913)cwas an American financier and investment banker who dominated corporate finance on Wall Street throughout the Gilded Age and Progressive Era. As the head of the banking firm that ultimately became known as J.P. Morgan and Co.

J.P. Morgan famously said this in his testimony before Congress in 1912:

“Gold is money. Everything else is credit.”

POLITICIANS

“When a government is dependent upon bankers for money, they and not the leaders of the government control the situation, since the hand that gives is above the hand that takes… Money has no motherland; financiers are without patriotism and without decency; their sole object is gain.” – Napoleon Bonaparte, Emperor of France, 1815

“The death of Lincoln was a disaster for Christendom. There was no man in the United States great enough to wear his boots and the bankers went anew to grab the riches. I fear that foreign bankers with their craftiness and tortuous tricks will entirely control the exuberant riches of America and use it to systematically corrupt civilization.” Otto von Bismark (1815-1898), German Chancellor, after the Lincoln assassination

“Money plays the largest part in determining the course of history.” Karl Marx writing in the Communist Manifesto (1848).

“That this House considers that the continued issue of all the means of exchange – be they coin, bank-notes or credit, largely passed on by cheques – by private firms as an interest-bearing debt against the public should cease forthwith; that the Sovereign power and duty of issuing money in all forms should be returned to the Crown, then to be put into circulation free of all debt and interest obligations…” Captain Henry Kerby MP, in an Early Day Motion tabled in 1964.

“Banks lend by creating credit. They create the means of payment out of nothing. ” Ralph M Hawtry, former Secretary to the Treasury.

“… our whole monetary system is dishonest, as it is debt-based… We did not vote for it. It grew upon us gradually but markedly since 1971 when the commodity-based system was abandoned.” The Earl of Caithness, in a speech to the House of Lords, 1997.

BANKERS

“The bank hath benefit of interest on all moneys which it creates out of nothing.” William Paterson, founder of the Bank of England in 1694, then a privately owned bank

“Let me issue and control a nation’s money and I care not who writes the laws.” Mayer Amschel Rothschild (1744-1812), founder of the House of Rothschild.

“The few who understand the system will either be so interested in its profits or be so dependent upon its favours that there will be no opposition from that class, while on the other hand, the great body of people, mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear its burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests.” The Rothschild brothers of London writing to associates in New York, 1863.

“I am afraid the ordinary citizen will not like to be told that the banks can and do create money. And they who control the credit of the nation direct the policy of Governments and hold in the hollow of their hand the destiny of the people.” Reginald McKenna, as Chairman of the Midland Bank, addressing stockholders in 1924.

“The banks do create money. They have been doing it for a long time, but they didn’t realise it, and they did not admit it. Very few did. You will find it in all sorts of documents, financial textbooks, etc. But in the intervening years, and we must be perfectly frank about these things, there has been a development of thought, until today I doubt very much whether you would get many prominent bankers to attempt to deny that banks create it.” H W White, Chairman of the Associated Banks of New Zealand, to the New Zealand Monetary Commission, 1955.

OTHERS

“Money is a new form of slavery, and distinguishable from the old simply by the fact that it is impersonal – that there is no human relation between master and slave.” Leo Tolstoy, Russian writer.

“It is well enough that people of the nation do not understand our banking and money system, for if they did, I believe there would be a revolution before tomorrow morning.” Henry Ford, founder of the Ford Motor Company.

“The modern banking system manufactures money out of nothing. The process is, perhaps, the most astounding piece of sleight of hand that was ever invented. Banks can in fact inflate, mint and un-mint the modern ledger-entry currency.” Major L L B Angus.

“The study of money, above all other fields in economics, is one in which complexity is used to disguise truth or to evade truth, not to reveal it. The process by which banks create money is so simple the mind is repelled. With something so important, a deeper mystery seems only decent.” John Kenneth Galbraith (1908- ), former professor of economics at Harvard, writing in ‘Money: Whence it came, where it went’ (1975).As Nicolas Trist – secretary to President Andrew Jackson – said about the incredibly powerful privately owned Second Bank of the United States, “Independently of its misdeeds, the merepower, — the bare existence of such a power, — is a thing irreconcilable with the nature and spirit of our institutions.” (Schlesinger, The Age of Jackson, p.102)