According to fraudulent documents recorded with Riverside County ASSESSOR CLERK-RECORDER, Peter Aldana, it has been VERIFIED by more than one man and/or woman, and more than one national/non-citizen national/national of the United States, and more than one State Citizen, that the “COMPANIES” known as AFFINIA DEFAULT Services, alongside WELLS FARGO, and SIERRA PACIFIC MORTGAGE, in collaboration with RECON DEFAULT Services, are engaging in a pattern of illegally stealing homes from rightful property owners. These companies, without any legal standing, are committing serious crimes, including fraud, extortion, coercion, and deprivation of rights under the color of law, by attempting to sell properties in Riverside and Los Angeles County. This scheme harms and injures every national, non-citizen national, American, internationally protected person, and national of the United States who is a private property owner or trustee.

Due to the majority of the public not being educated on monetary policy, contract law, trust law, commerce, securities, equity, taxes, estate planning, and banking these fraudsters are filing a fraudulent “NOTICE OF INTENT TO SELL ” and/or “NOTICE OF TRUSTEE SALE,” under the color of law. These fraudsters pretend to be the TRUE Creditor and holder in due course of the NOTE and/or DEED OF TRUST (which gives the holder standing and the authority and capacity to control the subject property) however, this is all a lie and blatant fraud. These men and women are being deprived of their rights, title, and interest “under the color of law.”

It is a known fact amongst the banking and law communities credit is assigned when a man or woman indorses a debt instrument such as a BOND, NOTE, DRAFT, BILL OF EXCHANGE, CHECK, MONEY ORDER, LAWFUL ORDER FOR MONEY, LETTER OF CREDIT, or other SECURITY, CURRENCY, or ASSET.

That means the very asset these fraudsters are claiming they are the holder of, are not theirs at all.

- The COMPANIES did not create the NOTE. The man or woman they are foreclosing on did.

- The COMPANIES did not create the DEED OF TRUST. The man or woman they are foreclosing on did.

- The COMPANIES are not the true “holder in due course.” The man or woman they are foreclosing on actually is.

Even when noticed by way of Administrative Procedure, Registered Mail, Unrebutted Commercial Affidavits, Uniform Commercial Code (UCC) Filings, IRS forms 1099-A, 1099-OID, 1099-C, 1099-B, 3949-A, and more, these fraudster companies willfully and intentionally ignore due contract terms, stipulations, public policy, due process, the Law, regulations, and the Constitution and the fraudster companies continue to bombard private citizens with various fraudulent documents and filings, where these fraudster threaten to sell and seize private property being held in a private trusts.

Regardless of the complaints to the IRS, Attorney General, District Attorney, U.S. Treasury, and Congress, these clearly fraudulent and bad faith actions are allowed to continue, thus also continuing the irreparable injury and harm that Americans are sustaining every day.

The Fraudulent “TRUSTEE SALE” and “Standing”:

In a trustee sale, typically initiated during foreclosure, the trustee is tasked with selling the property to satisfy a debt. However, if the property is held in a non-statutory private trust, and/or the trustee of that trust is not a party to the foreclosure or sale process, the sale cannot legally proceed.

Additionally, if the home owner and/or trustee of the private trust have tendered payment in accordance with UCC 3-311, 3-603, 3-104, 3-402, and House Joint Resolution 192 of June 5, 1933, then the obligation has been satisfied and the debt discharged by operation of law. This means the debt is legally nullified, and no further action, such as a foreclosure or sale, can lawfully proceed.

If the DEED O TRUST and/or NOTE have been claimed and added as collateral to a private UCC Contract trust, then these companies do not have standing and can not legally or lawfully proceed.

Furthermore, if the trustee own and/or is the true holder in due course of the said DEED OF TRUST, NOTE, and other ASSET, the companies do not have standing.

Here’s some reasons why:

- Lack of Authority: The trustee of a private trust holds legal title to the property and manages it for the beneficiaries. If the trustee is not part of the sale process, they have not granted permission for the property to be sold. Without the trustee’s authority, no valid transfer of ownership can occur.

- Separation of Parties: The entity conducting the trustee sale (often a third-party trustee appointed for foreclosure) is separate from the trustee who controls the private trust. Unless the private trust’s trustee consents to the sale, the transaction is legally void as the rightful titleholder has not authorized it.

- Ownership Protection: Private trusts often include provisions to safeguard the property from outside claims or unauthorized sales. If the trustee is not involved, this protection blocks any forced sale or seizure.

- Contractual and Fiduciary Duties: The trustee of a private trust has a fiduciary duty to act in the best interests of the beneficiaries. Selling the property without the trustee’s consent breaches these duties, making the sale unlawful.

- Private Trust Status: If the property is held in a private trust, especially an irrevocable trust, it becomes even more protected and untouchable, as it is outside the jurisdiction of any county assessor or third-party company. This makes it virtually impossible for unauthorized parties to legally interfere with the property.

- Trustee’s Sovereignty: The trustee cannot be forced to sell private trust property. The trust structure ensures that the property is shielded from external pressures or claims, giving the trustee full authority over any decisions regarding the property.

- Tender of Payment: If a man or woman tenders payment in “full satisfaction” in accordance with UCC 3-311, 3-603, 3-104, 3-402, and House Joint Resolution 192 of June 5, 1933, then the obligation has been satisfied and the debt discharged by operation of law. This means the debt is legally nullified, and no further action, such as a foreclosure or sale, can lawfully proceed.

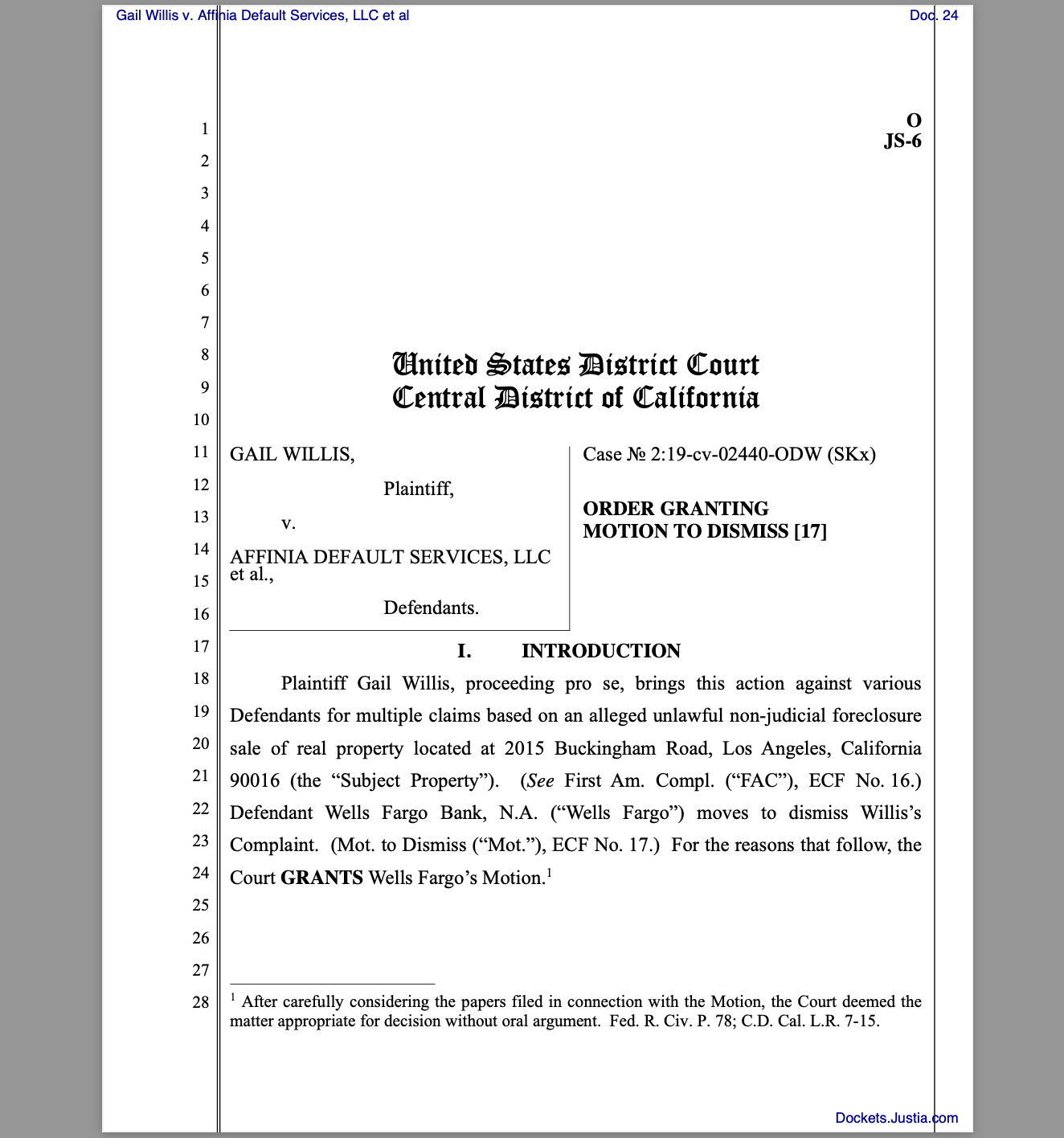

A 2019 case, GAIL WILLIS v. AFFINIA DEFAULT SERVICES, LLC et al., clearly shows how the people are being defrauded for the lack of education and knowledge. A woman had her home stolen right from beneath her because she did not effectively communicate she had “standing.”

JUDGE, OTIS D. WRIGHT, II wrote:

“The Deed of Trust, Notice of Default and Election to Sell Under Deed of Trust, Substitution of Trustee, Notice of Trustee’s Sale, and Trustee’s Deed Upon Sale are properly subject to judicial notice because they are undisputed public documents recorded by the Los Angeles County Recorder’s Office. See, e.g., Grant v. Aurora Loan Servs., Inc., 736 F. Supp. 2d 1257, 1264 (C.D. Cal. 2010) (collecting cases granting judicial notice of documents recorded by the County Recorder’s Office). Accordingly, the Court GRANTS judicial notice of the Deed of Trust, Notice of Default and Election to Sell Under Deed of Trust, Substitution of Trustee, Notice of Trustee’s Sale, and Trustee’s Deed Upon Sale. As neither party disputes the authenticity of the records, and as Willis includes these documents in her First Amended Complaint, they may also be considered under the incorporation by reference doctrine. See Marder, 450 F.3d at 448 (internal quotation marks omitted)”

……

“Wells Fargo moves to dismiss all except the second, fourth, and fifth claims for lack of standing. (Mot. 3–5.) Wells Fargo contends that Willis is not a real party-in- interest with respect to the Subject Property because she was neither a party to the loan nor a record owner of the Subject Property. (Mot. 3–5.) Willis fails to address the issue of standing. (See Opp’n.) Instead, Willis states that she “is the daughter and intended third party beneficiary of the [loan agreement],” the “assignee of her late mother’s interests in the real property,” and “the executor [of] Henrietta Willis’ Estate.” (FAC ¶¶ 13, 14; Opp’n 7)

Standing requires that: (1) the plaintiff has suffered an injury in fact, i.e., “an invasion of a legally protected interest that is concrete and particularized and actual or imminent, not conjectural or hypothetical”; (2) the injury is “fairly traceable to the challenged conduct of the defendant”; and (3) the injury is “likely to be redressed by a favorable judicial decision.” Spokeo, Inc. v. Robins, 136 S. Ct. 1540, 1547–48 (2016) (citing Lujan v. Defs. of Wildlife, 504 U.S. 555, 560–61 (1992)) (internal quotation marks omitted). A plaintiff “cannot rest his claim to relief on the legal rights or interests of third parties.” Warth v. Seldin, 422 U.S. 490, 499 (1975). Accordingly, “a plaintiff who is not a party to a mortgage loan cannot assert a claim . . . for statutory violations, wrongful foreclosure . . . or related foreclosure proceedings.” Bianchi v. Bank of Am., N.A., No. 12-CV-750-MMA (MDD), 2012 WL 11946982, at *1 (S.D. Cal. May 17, 2012) (citing Kruso v. Int’l Tel. & Tel. Corp., 872 F.2d 1416, 1427 (9th Cir. 1989) (holding that the plaintiffs lacked standing for claims that arose out of the transactions at issue because the plaintiffs were not parties to those transactions)).

Only a borrower or her assignee may bring a claim based on the underlying mortgage. See Pena v. Ocwen Loan Servicing, LLC, No. CV 17-2437 FMO (GJSx), 2018 WL 5857983, at *4 (C.D. Cal. Apr. 23, 2018) (finding that the plaintiff lacked standing to bring claims regarding the loan handling and property foreclosure because he was neither the borrower nor the owner of the property); Shetty v. ARLP Securitization Tr. Series 2014-2, No. CV-16-05467-BRO (GJSx), 2016 WL 10999324, at *6 (C.D. Cal. Oct. 28, 2016) (dismissing claims including quiet title because the plaintiff was not the borrower or assignee). Plaintiffs may seek to quiet title only if they currently possess an interest in the property at issue. Shetty, 2016 WL 10999324, at *7.

Here, the documents incorporated by reference and judicially noticed contradict Willis’s conclusory claim of interest. The recorded Deed of Trust lists “Henrietta E Willis, Trustee of the Henrietta E Willis Revocable Living Trust” as the sole borrower and signatory. (Req. for Judicial Notice Ex. B.) The initials “H.E.W.” appear at the bottom of each page of the Deed of Trust. Additionally, the Deed of Trust was executed by “Henrietta E Willis, Trustee.” (Req. for Judicial Notice Ex. B.) The Deed of Trust and related documents demonstrate conclusively that Willis is not the borrower on the loan.

Furthermore, Willis alleges that she was assigned her mother’s interests in the real property. (FAC ¶ 13.) Yet, she fails to substantiate this claim by alleging any facts of when or how she gained ownership of the property. Thus, Willis failed to establish that she was assigned the title to the Subject Property or the obligation of the mortgage on the Subject Property. Shetty, 2016 WL 10999324, at *6.

The Court reiterates that as each of Willis’s claims arise from the non-judicial foreclosure and loan transaction involving Henrietta E. Willis, Willis lacks standing to pursue her claims. Accordingly, the Court GRANTS the motion to dismiss.

The fraudulent documents recorded with the Los Angeles County Recorder “undisputed”. Because WILLIS not a party to the loan or an assignee by way of an authenticated recording (County Recorder or UCC), the complaint was DISMISSED.

DOWNLOAD DOCUMENT

FRAUDULENT Document Recordings and Rebuttals and Filing are being CONCEALED AND OBSTRUCTED by County Recorder and Secretary of State UCC:

COUNTY RECORDERS, such as those in Riverside County and Los Angeles County, are reportedly willfully and intentionally obstructing the filing of essential documents and concealing, falsifying, and mutilating the record. These RECORDERS are being instructed to willfully and intentionally violate the law and commit a felony, and refuse to record documents that could otherwise protect your rights and rebut the false claims against your property.

18 U.S. Code § 2071 – Concealment, removal, or mutilation generally, expressly stipulates:

“(a) Whoever willfully and unlawfully conceals, removes, mutilates, obliterates, or destroys, or attempts to do so, or, with intent to do so takes and carries away any record, proceeding, map, book, paper, document, or other thing, filed or deposited with any clerk or officer of any court of the United States, or in any public office, or with any judicial or public officer of the United States, shall be fined under this title or imprisoned not more than three years, or both. (b) Whoever, having the custody of any such record, proceeding, map, book, document, paper, or other thing, willfully and unlawfully conceals, removes, mutilates, obliterates, falsifies, or destroys the same, shall be fined under this title or imprisoned not more than three years, or both; and shall forfeit his office and be disqualified from holding any office under the United States. “

In such situations, it is imperative to know your rights and take immediate, informed action to counter these fraudulent actions and safeguard your property interests. Affidavits, Notices, UCC Filings, Lawsuits, IRS forms, and Claims can be used to address the unconstitutional actions of these COUNTY RECORDERS. Even the UCC department of the Secretary of State has been confirmed to be intentionally and willfully obstructing lawful UCC filings, depriving Americans of their rights under the color of law, conspiring, and causing injury and harm to living men and women.

Americans are compelled to use a private administrative process, through a commercial affidavit, to rebut fraudulent presumptions and defend their private property rights. When they attempt to privately notify involved parties, their communications are accepted but ignored, leaving living men and women unable to file essential documents with the County Recorder or the California Secretary of State’s UCC Department. This monopolized control over public notice in California effectively prevents private citizens from asserting their rights and protecting their private property.

False Pretenses:

18 U.S. Code § 1025 – False pretenses on high seas and other waters:

- 18 U.S. Code § 1025 – False pretenses on high seas and other waters, expressly stipulates: Whoever, upon any waters or vessel within the special maritime and territorial jurisdiction of the United States, by any fraud, or false pretense, obtains from any person anything of value, or procures the execution and delivery of any instrument of writing or conveyance of real or personal property, or the signature of any person, as maker, endorser, or guarantor, to or upon any bond, bill, receipt, promissory note, draft, or check, or any other evidence of indebtedness, or fraudulently sells, barters, or disposes of any bond, bill, receipt, promissory note, draft, or check, or other evidence of indebtedness, for value, knowing the same to be worthless, or knowing the signature of the maker, endorser, or guarantor thereof to have been obtained by any false pretenses, shall be fined under this title or imprisoned not more than five years, or both.

Monopolization of trade:

5 U.S. Code § 2 – Monopolizing trade a felony; penalty:

- Every person who shall monopolize, or attempt to monopolize, or combine or conspire with any other person or persons, to monopolize any part of the trade or commerce among the several States, or with foreign nations, shall be deemed guilty of a felony, and, on conviction thereof, shall be punished by fine not exceeding $100,000,000 if a corporation, or, if any other person, $1,000,000, or by imprisonment not exceeding 10 years, or by both said punishments, as expressly stipulated by, 5 U.S. Code § 2 – Monopolizing trade a felony; penalty.

Deprivation of rights under the color of law:

18 U.S. Code § 241 – Conspiracy against rights:

-

If two or more persons conspire to injure, oppress, threaten, or intimidate any person in any State, Territory, Commonwealth, Possession, or District in the free exercise or enjoyment of any right or privilege secured to him by the Constitution or laws of the United States, or because of his having so exercised the same; or

If two or more persons go in disguise on the highway, or on the premises of another, with intent to prevent or hinder his free exercise or enjoyment of any right or privilege so secured—

They shall be fined under this title or imprisoned not more than ten years, or both; and if death results from the acts committed in violation of this section or if such acts include kidnapping or an attempt to kidnap, aggravated sexual abuse or an attempt to commit aggravated sexual abuse, or an attempt to kill, they shall be fined under this title or imprisoned for any term of years or for life, or both, or may be sentenced to death.

Frauds and Swindles:

18 U.S. Code § 1341 – Frauds and swindles:

- Whoever, having devised or intending to devise any scheme or artifice to defraud, or for obtaining money or property by means of false or fraudulent pretenses, representations, or promises, or to sell, dispose of, loan, exchange, alter, give away, distribute, supply, or furnish or procure for unlawful use any counterfeit or spurious coin, obligation, security, or other article, or anything represented to be or intimated or held out to be such counterfeit or spurious article, for the purpose of executing such scheme or artifice or attempting so to do, places in any post office or authorized depository for mail matter, any matter or thing whatever to be sent or delivered by the Postal Service, or deposits or causes to be deposited any matter or thing whatever to be sent or delivered by any private or commercial interstate carrier, or takes or receives therefrom, any such matter or thing, or knowingly causes to be delivered by mail or such carrier according to the direction thereon, or at the place at which it is directed to be delivered by the person to whom it is addressed, any such matter or thing, shall be fined under this title or imprisoned not more than 20 years, or both. If the violation occurs in relation to, or involving any benefit authorized, transported, transmitted, transferred, disbursed, or paid in connection with, a presidentially declared major disaster or emergency (as those terms are defined in section 102 of the Robert T. Stafford Disaster Relief and Emergency Assistance Act (42 U.S.C. 5122)), or affects a financial institution, such person shall be fined not more than $1,000,000 or imprisoned not more than 30 years, or both

Bank Fraud:

18 U.S. Code § 1344 – Bank fraud:

- Whoever knowingly executes, or attempts to execute, a scheme or artifice— (1) to defraud a financial institution; or (2) to obtain any of the moneys, funds, credits, assets, securities, or other property owned by, or under the custody or control of, a financial institution, by means of false or fraudulent pretenses, representations, or promises; shall be fined not more than $1,000,000 or imprisoned not more than 30 years, or both.

Trusts in Restraint of Trade:

15 U.S. Code § 1 – Trusts, etc., in restraint of trade illegal; penalty:

- Every contract, combination in the form of trust or otherwise, or conspiracy, in restraint of trade or commerce among the several States, or with foreign nations, is declared to be illegal. Every person who shall make any contract or engage in any combination or conspiracy hereby declared to be illegal shall be deemed guilty of a felony, and, on conviction thereof, shall be punished by fine not exceeding $100,000,000 if a corporation, or, if any other person, $1,000,000, or by imprisonment not exceeding 10 years, or by both said punishments, in the discretion of the court

Interference with Commerce by Threats or Violence (foreclosure and seizure):

18 U.S. Code § 1951 – Interference with commerce by threats or violence:

- (a) Whoever in any way or degree obstructs, delays, or affects commerce or the movement of any article or commodity in commerce, by robbery or extortion or attempts or conspires so to do, or commits or threatens physical violence to any person or property in furtherance of a plan or purpose to do anything in violation of this section shall be fined under this title or imprisoned not more than twenty years, or both. (b) As used in this section—(1) The term “robbery” means the unlawful taking or obtaining of personal property from the person or in the presence of another, against his will, by means of actual or threatened force, or violence, or fear of injury, immediate or future, to his person or property, or property in his custody or possession, or the person or property of a relative or member of his family or of anyone in his company at the time of the taking or obtaining. (2) The term “extortion” means the obtaining of property from another, with his consent, induced by wrongful use of actual or threatened force, violence, or fear, or under color of official right. (3) The term “commerce” means commerce within the District of Columbia, or any Territory or Possession of the United States; all commerce between any point in a State, Territory, Possession, or the District of Columbia and any point outside thereof; all commerce between points within the same State through any place outside such State; and all other commerce over which the United States has jurisdiction.

CONCLUSION AND SUMMARY:

In summary, a trustee sale cannot proceed if the property is held in a private trust and the trustee is not involved. Any such sale would lack legal authority and be invalid and equate to fraud.

The fraud being committed carries stipulations of 30-50+ years of imprisonment and due a corrupt system Americans are being deprived of their rights.

The actions of AFFINIA DEFAULT Services, WELLS FARGO, SIERRA PACIFIC MORTGAGE, and RECON DEFAULT Services go beyond mere procedural errors—they represent a coordinated effort of racketeering, organized crime, and bank fraud. These entities are falsely asserting standing to conduct trustee sales under false pretenses and engaging in slander of title and color of title to unlawfully transfer ownership. Their deliberate misrepresentation of their authority is not only fraudulent but also constitutes treasonous activity, as it undermines the very legal framework that protects property rights and ownership.

This systematic exploitation of the legal system and abuse of foreclosure procedures amounts to embezzlement, larceny, identity theft, and a host of other felonies. By targeting private property owners and trustees, they are causing severe harm, violating civil rights, and committing acts that must be held accountable under both state and federal law for their widespread criminal activity.