™WALKERNOVA GROUP©

We are a private educational and administrative support firm focused on matters involving Constitutional rights, private and public law distinctions, secured transactions, trust and estate structuring, negotiable instruments, and lawful remedy under equity, contract, and commercial law.

Our areas of concentration include State Citizenship, national status clarification, lawful trust and contract administration, UCC-based filings, private banking principles, estate planning, foreclosure defense strategies, and lawful documentation involving trusts, deeds, securities, and equity interests.

We believe that rights must be lawfully asserted to be preserved, and that the distinction between rights, privileges, and benefits is critical. Every day, individuals are subjected to actions taken under color of law due to widespread misunderstanding of legal terminology, contract enforcement, and the operation of legal fictions.

We help clarify the proper use and interpretation of commonly misunderstood terms such as:

individual, person, financial institution, national, state Citizen, U.S. citizen, secured party, attorney-in-fact vs. attorney-at-law, and more—ensuring that lawful standing and private rights are clearly distinguished from statutory presumptions.

FEATURED VIDEOS

LATEST NEWS

How the UCC is Codified in EVERY State: A State-by-State Codification of the UCC and Core Commercial Law Principles

UCC §§ 1-103, 3-104, 3-601, and 3-603 operate as the foundation of lawful commercial remedy across all 50 states. Section 1-103 ensures equity, common law, and the Law Merchant remain enforceable alongside UCC processes. Section 3-104 defines what qualifies as a negotiable instrument—an essential element in debt discharge. Section 3-601 codifies the principle that all obligations can be discharged by contract, agreement, or valid performance. Section 3-603 delivers the lethal commercial strike: once lawful tender is made—even if refused—the obligation is discharged as a matter of law. These statutes, codified in every U.S. jurisdiction, are the legal artillery that allow secured parties and private trusts to assert control, tender discharge, and permanently terminate fraudulent or unperfected claims. Use them with precision—or be used by those who will.

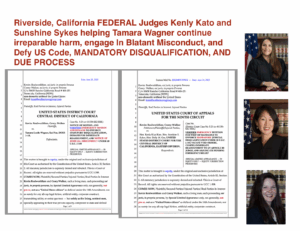

Riverside, California FEDERAL Judges Kenly Kato and Sunshine Sykes helping Tamara Wagner continue irreparable harm, engage In Blatant Misconduct, and Defy US Code, MANDATORY DISQUALIFICATION, AND DUE PROCESS

In an unthinkable display of judicial defiance, the United States District Court for the Central District of California—specifically Judge Kenly Kiya Kato—has openly violated federal disqualification statutes and constitutional protections, triggering a full-scale procedural breakdown. The Plaintiffs, Kevin Realworldfare and Corey Walker, filed a timely and sufficient affidavit of bias under 28 U.S.C. § 144—invoking a mandatory disqualification. Yet, Judge Kato continues to issue orders and direct proceedings as if the law simply does not apply to her. This is not a mere procedural oversight. This is a calculated refusal to follow the law, a violation of the U.S. Constitution, and an unmistakable act of judicial misconduct.

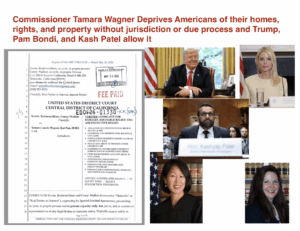

Commissioner Tamara Wagner Deprives Americans of their homes, rights, and property without jurisdiction or due process and Trump, Pam Bondi, and Kash Patel allow it

In an unthinkable display of judicial defiance, the United States District Court for the Central District of California—specifically Judge Kenly

Void Means Void: When Judges Act Without Jurisdiction, Their Orders Are Legal Nullities

When a court acts without lawful jurisdiction—whether through improper removal, lack of subject matter or personal authority, or constitutional violations—its orders are void ab initio and carry no legal force. This article explains how judges who continue to issue rulings after losing jurisdiction are not merely mistaken—they are acting under color of law and are subject to direct civil liability under 42 U.S.C. § 1983. Backed by black-letter case law and statutory authority, this piece dismantles the myth of absolute judicial immunity and affirms a fundamental truth in law: jurisdiction is everything. When it’s gone, so is the court’s power to act.

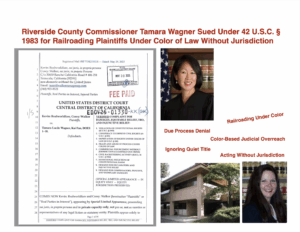

Riverside County Commissioner Tamara Wagner Sued Under 42 U.S.C. § 1983 for Railroading Plaintiffs Under Color of Law Without Jurisdiction

In a federal civil rights lawsuit under 42 U.S.C. § 1983, Plaintiffs Kevin: Realworldfare and Corey: Walker expose Riverside Court Commissioner Tamara L. Wagner’s unlawful railroading under color of law and total absence of jurisdiction. Despite a pending Quiet Title Action and perfected federal removal, Wagner issued void orders to dispossess the Walker Estate—yet the Estate remains lawfully and firmly in possession. Now under Article III jurisdiction, Judge Kenly Kiya Kato presides over the live case, which alleges constitutional violations, commercial fraud, and abuse of process. This is a high-stakes confrontation between equity and overreach—where immunity fails and facts prevail.

Judges Can Be Sued: Public Servants, Oaths, and Liability Under the Clearfield Doctrine AND 42 U.S.C. 1983

Judges are not immune when they operate outside lawful jurisdiction, conspire under color of law, or engage in commercial enforcement without consent. Under the Clearfield Doctrine, they become corporate actors subject to liability like any private party. 42 U.S.C. § 1983 enables civil rights lawsuits against them individually, while 18 U.S.C. §§ 241–242 provides for criminal penalties for conspiracy and deprivation of rights. Through tort law, UCC, and case law like Rankin v. Howard, 633 F.2d 844 (9th Cir. 1980), and Pulliam v. Allen, 466 U.S. 522 (1984), judges can face personal and injunctive accountability.

FEDERAL EXPOSURE AND COMMERCIAL COLLAPSE: The Reckless Legal Simulation and RICO Fraud of Naji Doumit, Marinaj Properties LLC, and Their Counsel John Bailey of BAILEY LEGAL GROUP in Riverside County, California

A devastating legal and commercial collapse is underway for Naji Doumit, Marinaj Properties LLC, and their counsel following a Verified Response that dismantles their fraudulent Cross-Complaint. With unrebutted affidavits, perfected UCC filings, and binding conditional acceptance, the Plaintiffs have closed the commercial record and exposed the Defendants to over $100 million in liability. Unauthorized use of protected trademarks like KEVIN WALKER™ and DONNABELLE MORTEL™ now carries $1 million per-use penalties. The Cross-Complaint stands in dishonor, their legal position is void, and federal enforcement is imminent. There is no path to relief—only escalating consequences.

RIVERSIDE COUNTY RICO CHARGES and BOND CLAIM AND COLLAPSE: VERIFIED CLAIMS, CRIMINAL FRAUD, AND $1 TRILLION LIEN ENFORCEMENT IN MOTION FOR ALL BONDS

Riverside County officials, deputies, and unlicensed “commissioners” are now in verified default, dishonor, and commercial liability for unrebutted RICO, fraud, and color-of-law crimes. Kevin: Realworldfare has removed case MISW2501134 to federal court, triggering lien enforcement and formal demand for disclosure of liability bonds. Evidence includes unrebutted affidavits, a $1 trillion commercial lien, and documented bond fraud by inactive attorneys Jeremiah Raxter and Charles Rogers. Federal claims include kidnapping, extortion, impersonation, and deprivation of rights under 18 U.S.C. §§ 241–242, 1961–1964. Brady-listed deputies remain under active investigation. If justice is not delivered, top national officials will be named in new federal actions for willful neglect and complicity.

Judicial Integrity in Action: Judge Wesley Hsu and Magistrate Maria Audero Honorably Uphold Due Process in Kevin: Walker vs Chad Bianco RICO and 42 U.S.C. 1983 Case

Judge Wesley Hsu’s and/or Magistrate Maria Audero’s Court took a significant step toward restoring judicial integrity by docketing and honorably backdating Kevin: Realworldfare’s VERIFIED Affidavit asserting State Citizenship and constitutional standing in case 5:25-cv-00646-WLH-MAA. This filing directly rebuts prior false presumptions labeling him a U.S. citizen or ward of the State. In contrast to prior judicial misconduct by Judge Jesus G. Bernal, who obstructed identical filings, Hsu and Audero’s actions demonstrate procedural fidelity and impartiality. Their conduct marks a hopeful departure from the systemic corruption plaguing courts in Riverside County. The case highlights growing public scrutiny and demand for lawful adjudication based on record, not presumption.

Affidavit Delivered to Judge Wesley Hsu’s Court in Kevin Walker vs Chad Bianco Remains Undocketed — Delay or Concealment? Benefit of the Doubt Extended, For Now

This article exposes a troubling pattern of judicial misconduct in California’s federal courts, where verified affidavits asserting State Citizenship and national status have been received but concealed from the official record. Specifically, it highlights the nondocketing of a key affidavit in Kevin: Walker v. Bianco et al. before Judge Wesley Hsu, while extending temporary benefit of the doubt due to possible administrative backlog. The article also touches on and reconfirms how Judge Jesus G. Bernal falsely claimed non-response in a related case to justify an unlawful dismissal, now under appeal. These actions collectively suggest systemic obstruction, due process violations, and potential criminal liability under multiple federal statutes.

Jurisdiction, Citizenship, and Federal Zones: The Truth Behind Wong Kim Ark and the Buck Act of 1940

This article explores the crucial legal distinctions between a State Citizen and a U.S. citizen (14th Amendment subject) by analyzing the Supreme Court case Wong Kim Ark v. United States and the jurisdictional implications of the Buck Act of 1940. It reveals how federal jurisdiction is not based on geography, but on consent and contractual participation in federal benefit programs. Through detailed legal reasoning, it explains how one can owe allegiance to the United States as a constitutional Republic without being subject to its corporate statutory codes. The piece provides actionable remedies for rebutting federal presumptions and restoring lawful State Citizenship.

Kevin Realworldfare and Donnabella Realworldfare Declare Name Change: A New Dynasty Is Born with Heirs to Carry the Legacy Forward

Kevin and Donnabella Realworldfare have lawfully changed their names, creating a new family dynasty with a name never before used in recorded history. Their children, Adonis and Zoiya Realworldfare, become the first heirs to carry forward this sovereign legacy. The Realworldfare name represents authorship, truth, and freedom from inherited fiction. This name change marks the foundation of a private, self-governed bloodline rooted in purpose and lawful inheritance.

SERVICES & PRODUCTS

BOOKS, DOCUMENTS, RESOURCES

-

Bible Myths And Their Parallels In Other Religions – Year 1882

$0.00 Add to cart -

NATIONAL CURRENCY ACT OF 1864

$0.00 Add to cart -

What is “Accepted For Value” (A4V) and Is it Real?

$0.00 Add to cart -

FRUITS FROM A POISONOUS TREE

$9.99 Add to cart -

Black’s Law Dictionary 8th Edition – 2004

$36.00Original price was: $36.00.$0.00Current price is: $0.00. Add to cart -

1928 CITIZENSHIP TRAINING MANUAL

$0.00 Add to cart -

Its ALL FRAUD: Mortgages, Loans, Credit Agreements, Securitization, Asset Recoupment

$0.00 Add to cart -

COMMON LAW ABATEMENT

$0.00 Add to cart -

PAPER ARROWS – Howard Griswold

$0.00 Add to cart -

Black’s Law Dictionary 4th Edition – 1968

$240.00Original price was: $240.00.$0.00Current price is: $0.00. Add to cart -

BOUVIERS’S LAW DICTIONARY AND CONCISE ENCYCLOPEDIA – VOLUME 3

$0.00 Add to cart -

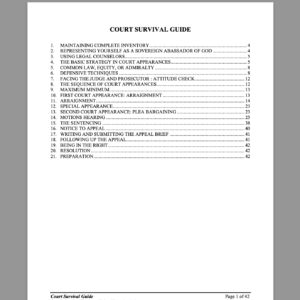

Court Survival Guide – Criminal or Civil? Common Law or Contract Under Colorable Admiralty Jurisdiction?

$0.00 Add to cart

For Smart visionaries

Embrace the Wisdom of Time and Money

In the pursuit of your dreams, remember that money is but a means to an end, a tool in your hands to craft the life you envision. Invest it wisely, not just in financial endeavors, but in experiences that enrich your soul. Time, the most precious currency, is the foundation of your journey. Allocate it with care, for it is the true measure of wealth. Seize each moment, for in its passage lies the essence of a life well-lived. Let your pursuits be guided by purpose, and may every resource at your disposal serve to enhance the tapestry of your existence.