™WALKERNOVA GROUP©

We are a private educational and administrative support firm focused on matters involving Constitutional rights, private and public law distinctions, secured transactions, trust and estate structuring, negotiable instruments, and lawful remedy under equity, contract, and commercial law.

Our areas of concentration include State Citizenship, national status clarification, lawful trust and contract administration, UCC-based filings, private banking principles, estate planning, foreclosure defense strategies, and lawful documentation involving trusts, deeds, securities, and equity interests.

We believe that rights must be lawfully asserted to be preserved, and that the distinction between rights, privileges, and benefits is critical. Every day, individuals are subjected to actions taken under color of law due to widespread misunderstanding of legal terminology, contract enforcement, and the operation of legal fictions.

We help clarify the proper use and interpretation of commonly misunderstood terms such as:

individual, person, financial institution, national, state Citizen, U.S. citizen, secured party, attorney-in-fact vs. attorney-at-law, and more—ensuring that lawful standing and private rights are clearly distinguished from statutory presumptions.

FEATURED VIDEOS

LATEST NEWS

From/By the people, for the people: How the U.S. Constitution Establishes ‘Trust’ and “Full Faith and Credit”

Uncover how the principle of full faith and credit positions you as the true creditor behind the financial system. Dive into essential legal foundations such as the U.S. Constitution, 18 U.S.C. § 8, 31 U.S.C. § 5118, and the Gold Reserve Act of 1934, exposing how your trust and credit back all public obligations. Understand how the U.S. operates as a commercial entity under the Clearfield Doctrine, and how debts are lawfully discharged through the U.S. Treasury. Empower yourself with this knowledge and reclaim your rightful position within the system.

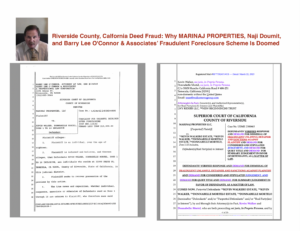

Sworn Affidavits Uncover RICO Violations: Naji Doumit, FOCUS ESTATES, and Barry Lee O’Connor & Associates’ Mortgage Fraud Scheme Exposed

Sworn affidavits reveal a massive real estate fraud scheme, exposing Naji Doumit, Barry Lee O’Connor & Associates, and MARINAJ PROPERTIES for RICO violations, fraudulent foreclosures, and property theft. Discover how fake Trustee’s Deeds and unlawful court filings were used to seize properties illegally.

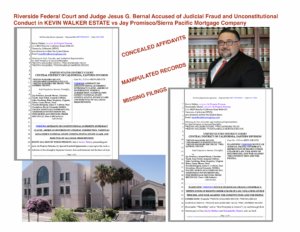

Kevin Walker Estate Exposes Judicial Fraud and Procedural Obstruction by Riverside Federal Court and Judge Jesus G. Bernal

The Kevin Walker Estate has taken decisive legal action against what it describes as judicial fraud, conspiracy, and obstruction of justice within the United States District Court, Central District of California, Eastern Division. Despite filing a Verified Notice of Judicial Fraud, the court has failed to acknowledge it, further solidifying allegations of intentional misconduct and procedural bad faith.

How a W-2 Functions as a Gift to Your Employer and Relates to Gift & Estate Taxation: EPISODE 27

Many individuals are unaware that a W-2 form may function as an implied gift contract, classifying wages as voluntary transfers under IRS gift and estate tax rules. By signing a W-4, employees unknowingly authorize their earnings to be withheld and presumed as taxable income, potentially falling under estate and wealth transfer taxation per 26 U.S.C. § 2501 and § 2511. This article explores how W-2 wages align with Class 2 and Class 5 gift tax classifications, the silent trust relationship created by voluntary withholding, and how to rebut the presumption that earnings were gifted into the tax system. Understanding this hidden legal framework is essential for asserting proper tax classification and protecting your income.

Wells Fargo’s Obvious Fraud Exposed as Unrebutted Affidavits Demand $1 Billion Summary Judgment

Wells Fargo is now subject to a Demand for Summary Judgment after failing to rebut sworn affidavits, thereby admitting—by operation of law—to fraud, dishonor, and lack of standing. Under California law, summary judgment is mandatory when no triable issue of fact exists, and Wells Fargo’s silence serves as a legal admission of liability. This case highlights the bank’s documented history of foreclosure fraud, echoing past rulings where courts have dismissed their claims with prejudice.

The Loan and Mortgage Illusion: How Your Signature Creates Money/Monetary Instruments and The Hidden Truth About Mortgages, Loans, and Banking: Episode 21

In this eye-opening episode of RealWorldFare, we break down the hidden truth about promissory notes, banking, and financial transactions that most people never question. When you sign a promissory note, are you really borrowing money—or funding the entire transaction yourself?

The UCC Playbook: Unlocking the Power of Contract Law

In a world where everything operates as a contract, understanding the Uniform Commercial Code (UCC) can be the difference between being in control or being controlled. The UCC Playbook: How to Use Contract Law to Secure Your Assets, Family, Freedom, and Enforce Your Rights is a roadmap to reclaiming your financial and legal sovereignty.

Kevin Walker Estate Files Writ of Mandamus, Notice, and Order in Federal Case Demanding Court Enforce $1.1 Billion Contract and Default Judgment, and Sanctions Against Dishonorable Defendants

The Kevin Walker Estate, et al., has intensified its legal fight for rights, accountability, and justice by filing a Writ of Mandamus and an Order Granting Default and Summary Judgment, demanding the court enforce Defendants’ binding default and immediate liability for $1.1 billion. The court has already identified PHH Mortgage Services’ Motion to Dismiss as procedurally defective and subject to striking, further evidencing Defendants’ dishonor. With Chevron deference overturned, the court is bound to rule strictly on constitutional and statutory law, without arbitrary dismissal. Should the court fail to act, Plaintiffs are prepared to escalate the matter through appellate relief, federal enforcement, and sanctions for obstruction of justice. This case has the potential to establish a landmark precedent in ensuring financial institutions and courts adhere to the rule of law.

The Kevin Walker Estate, et al., has intensified its legal fight for rights, accountability, and justice by filing a Writ of Mandamus and an Order Granting Default and Summary Judgment, demanding the court enforce Defendants’ binding default and immediate liability for $1.1 billion. The court has already identified PHH Mortgage Services’ Motion to Dismiss as procedurally defective and subject to striking, further evidencing Defendants’ dishonor. With Chevron deference overturned, the court is bound to rule strictly on constitutional and statutory law, without arbitrary dismissal. Should the court fail to act, Plaintiffs are prepared to escalate the matter through appellate relief, federal enforcement, and sanctions for obstruction of justice. This case has the potential to establish a landmark precedent in ensuring financial institutions and courts adhere to the rule of law.

How to Lawfully Represent Your ‘Trust’ as an “Attorney-in-Fact” in Accordance with 28 U.S.C. § 1654, U.C.C. § 3-402, and Article 1 Section 10 of the Constitution

The authority to represent a trust as an attorney-in-fact is firmly established under federal law, the Uniform Commercial Code (UCC), and longstanding legal precedent. Contrary to common misconceptions, a trust operates as a contractual entity, granting it the ability to be lawfully represented by an authorized agent, including an attorney-in-fact. This article explores the legal framework affirming this right, highlights key statutory provisions, and provides strategies for enforcing it against courts and financial institutions that unlawfully challenge or deny such authority.

The authority to represent a trust as an attorney-in-fact is firmly established under federal law, the Uniform Commercial Code (UCC), and longstanding legal precedent. Contrary to common misconceptions, a trust operates as a contractual entity, granting it the ability to be lawfully represented by an authorized agent, including an attorney-in-fact. This article explores the legal framework affirming this right, highlights key statutory provisions, and provides strategies for enforcing it against courts and financial institutions that unlawfully challenge or deny such authority.

KEVIN WALKER ESTATE’S Conditional Acceptance Exposes PHH Mortgage’s Motion as Procedurally Defective, Deceitful and Dishonest, Unconstitutional, and Legally Void

PHH Mortgage Corporation’s Motion to Dismiss in Kevin Walker Estate, et al. v. PHH Mortgage Corporation, et al. is a glaring example of procedural misconduct, constitutional violations, and a deliberate attempt to obstruct justice. The Plaintiffs have conditionally accepted PHH Mortgage’s non-compliant filing, thereby tendering a binding counteroffer that PHH must now rebut. PHH’s continued silence and failure to rebut the conditional acceptance further compounds their non-performance and dishonor. Additionally, the Defendants’ filing, prepared by Neil J. Cooper of HOUSER LLP, violates multiple-defendant court rules, misrepresents the law, displays incompetence and a war against the Constitution, and constitutes blatant obstruction of justice.

Further exacerbating this obstruction, critical documents remain missing from the court docket and record, preventing a full and fair adjudication of the Plaintiffs’ claims. This deliberate suppression of filings by the court and Defendants undermines due process, conceals key evidence, and constitutes judicial misconduct. The failure to properly record and acknowledge Plaintiffs’ filings further demonstrates systematic efforts to manipulate the proceedings in PHH Mortgage’s favor, reinforcing the need for immediate judicial correction, sanctions, and enforcement of Plaintiffs’ default judgment demands.

DOJ Dismantles Unconstitutional Barriers Protecting Corrupt Administrative “Judges”

The Department of Justice (DOJ) has concluded that restrictions on the removal of Administrative Law Judges (ALJs) are unconstitutional, referencing the Supreme Court’s ruling in Free Enterprise Fund v. PCAOB. Acting Solicitor General Sarah Harris notified Senate President Pro Tempore Charles Grassley that the DOJ will no longer defend these protections in court. DOJ Chief of Staff Chad Mizelle emphasized that unelected ALJs have wielded excessive authority without accountability for too long and must be answerable to the President and the American people.

Judicial Misconduct in Riverside, California: Defendant PHH Mortgage’s (“loan servicer”) Baseless Motion and the Court’s Obstruction of Justice

PHH Mortgage’s Motion to Dismiss in Kevin Walker Estate, et al. v. PHH Mortgage Corporation, et al. exemplifies judicial overreach, procedural abuse, and a blatant disregard for constitutional rights. The motion falsely asserts that a trust cannot be represented by an attorney-in-fact, denying individuals their right to self-representation and claiming that only "attorneys at law" can act in court. This contradicts established legal principles, including the American Bar Association’s recognition of power of attorney as a legitimate instrument granting broad authority. Additionally, the court has obstructed the record by refusing to file Plaintiffs’ documents, prompting a writ of mandamus to expose the Riverside Federal Court’s misconduct. This case underscores a broader pattern of legal corruption, defamation, and deprivation of rights under the color of law.

SERVICES & PRODUCTS

BOOKS, DOCUMENTS, RESOURCES

-

Explanation of the 1099 OID and the 1040V (Voucher) An What Impact It Has On Your Alleged Income Tax Liability by UNKNOWN

Read more -

MEMORANDUM OF LAW IN SUPPORT OF 1099OID – ORIGINAL ISSUE DISCOUNT

$0.00 Add to cart -

One Man Out – United States, Securities, Redemption and Fraud

$0.00 Add to cart -

(Signed Copy) The AFFIDAVIT OF WALKER TODD – MORTGAGE FRUAD, SWAP, MONEY OF ACCOUNT AND MONEY OF EXCHANGE

$0.00 Add to cart -

Affidavit of Revocation & Termination of Franchise

$150.00 Add to cart -

SECRETS OF THE SOCIAL SECURITY NUMBER

$0.00 Add to cart -

The Real 13th Amendment: WYOMING

$0.00 Add to cart -

The Real 13th Amendment: MAINE

$0.00 Add to cart -

The Real 13th Amendment: COLORADO

$0.00 Add to cart -

USING YOUR EXEMPTION

$0.00 Add to cart -

THE CONSTITUTION OF THE UNITED STATE OF AMERICA

$0.00 Add to cart -

The Exemption by Moses G. Washington revised on 10/19/2004

$0.00 Add to cart

For Smart visionaries

Embrace the Wisdom of Time and Money

In the pursuit of your dreams, remember that money is but a means to an end, a tool in your hands to craft the life you envision. Invest it wisely, not just in financial endeavors, but in experiences that enrich your soul. Time, the most precious currency, is the foundation of your journey. Allocate it with care, for it is the true measure of wealth. Seize each moment, for in its passage lies the essence of a life well-lived. Let your pursuits be guided by purpose, and may every resource at your disposal serve to enhance the tapestry of your existence.