Description

pages total: 24

DOWNLOADABLE COPY.

NO Law requires you to record / pledge your private automobile

As will be made painfully evident herewithin, a Private automobile is not required by any law, code or statute to be recorded. Any recording (pledge) of Private automobile to any agency is strictly voluntary. Any recordation / contract you or a Dealership has done was a fraudulently conveyed act as the recording agency/automobile Dealer told you that you must record your Private Property. The voluntary pledge that was done without just compensation is usually done through fraud, deceit, coercion and withholding of facts, which can only be construed as fraud and unjust enrichment by agency as well as a willful malicious act to unjustly enrich the recording agency and its public servants.

If men, through fear, fraud or mistake, should in terms renounce or give up any natural right, the eternal law of reason and the grand end of society would absolutely vacate such renunciation. The right to freedom being the gift of Almighty God, it is not in the power of man to alienate this gift and voluntarily become a slave. Samuel Adams, our great president.

“Men are endowed by their Creator with certain unalienable rights, -‘life, liberty, and the pursuit of happiness;’ and to ‘secure,’ not grant or create, these rights, governments are instituted. That property which a man has honestly acquired he retains full control of, subject to these limitations: first, that he shall not use it to his neighbor’s injury, and that does not mean that he must use it for his neighbor’s benefit: second, that if he devotes it to a public use, he gives to the public a right to control that use; and third, that whenever the public needs require, the public may take it upon payment of due compensation.” Budd v. People of State of New York, 143 U.S. 517 (1892).

There should be no arbitrary deprivation of life or liberty, or arbitrary spoilation of property. (Police power, Due Process) Barber v. Connolly, 113 U.S. 27, 31; Yick Yo v. Hopkins, 118 U.S. 356.

But whenever the operation and effect of any general regulation is to extinguish or destroy that which by law of the land is the property of any person, so far as it has that effect, it is unconstitutional and void. Thus, a law is considered as being a deprivation of property within the meaning of this constitutional guaranty if it deprives an owner of one of its essential attributes, destroys its value, restricts or interrupts its common, necessary, or profitable use, hampers the owner in the application of it to the purposes of trade, or imposes conditions upon the right to hold or use it and thereby seriously impairs its value. (Statute) 167 Am. Jur. 2d, Constitutional Law, Section 369.

Justice Bandeis eloquently affirmed his condemnation of abuses practiced by Government officials, who were defendants, acting as Government officials. In the case of Olmstead vs. U.S. 277 US 438, 48 S.Ct. 564, 575; 72 L ED 944 (1928) he declared:

NO Law requires you to record / pledge your private automobile Page 1 of 24

“Decency, security, and liberty alike demand that Government officials shall be subjected to the same rules of conduct that are commands to the Citizen. In a Government of laws, existence of the Government will be imperiled if it fails to observe the law scrupulously. Our Government is the potent, the omnipresent teacher.

For good or for ill, it teaches the whole people by its example. Crime is contagious. If the Government becomes a law-breaker, it breads contempt for law; it invites every man to become a law unto himself. It invites anarchy. To declare that, in the administration of the law, the end justifies the means would bring a terrible retribution. Against that pernicious doctrine, this Court should resolutely set its face.”

The Duty of the Licensor / DMV Commissioner

The information created and surrounding the stricti juris doctrine regarding a particular license which may, or may not, be represented by and revealed within the contents and control of a license agreement — “but must be revealed upon demand, and failure to do so is concealment, a withholding of material facts (the enducing, contractual consideration) known by those who have a duty and are bound to reveal.” Dolcater v. Manufacturers & Traders Trust Co., D.C.N.Y., 2F.Supp. 637, 641.

Is an automobile always a vehicle (or motor vehicle)?

ARGUMENT:

Federal;

“‘‘Motor vehicle’’ means every description of carriage or other contrivance propelled or drawn by mechanical power and used for commercial purposes on the highways in transportation of passengers, passengers and property, or property and cargo; … “Used for commercial purposes” means the carriage of persons or property for any fare, fee, rate, charge or other consideration, or directly or indirectly in connection with any business, or other undertaking intended for profit[.]” 18 U.S.C. 31.

“A carriage is peculiarly a family or household article. It contributes in a large degree to the health, convenience, comfort, and welfare of the householder or of the family.” Arthur v Morgan, 113 U.S. 495, 500, 5 S.Ct. 241, 243 S.D. NY 1884).

NO Law requires you to record / pledge your private automobile Page 2 of 24

“The Supreme Court, in Arthur v. Morgan, 112 U.S. 495, 5 S.Ct. 241, 28 L.Ed. 825, held that carriages were properly classified as household effects, and we see no reason that automobiles should not be similarly disposed of.” Hillhouse v United States, 152 F. 163, 164 (2nd Cir. 1907).

“A soldier’s personal automobile is part of his “household goods[.]” U.S. v Bomar, C.A.5(Tex.), 8 F.3d 226, 235″ 19A Words and Phrases – Permanent Edition (West) pocket part 94.

“[I]t is a jury question whether … an automobile … is a motor vehicle[.]” United States v Johnson, 718 F.2d 1317, 1324 (5th Cir. 1983).

State:

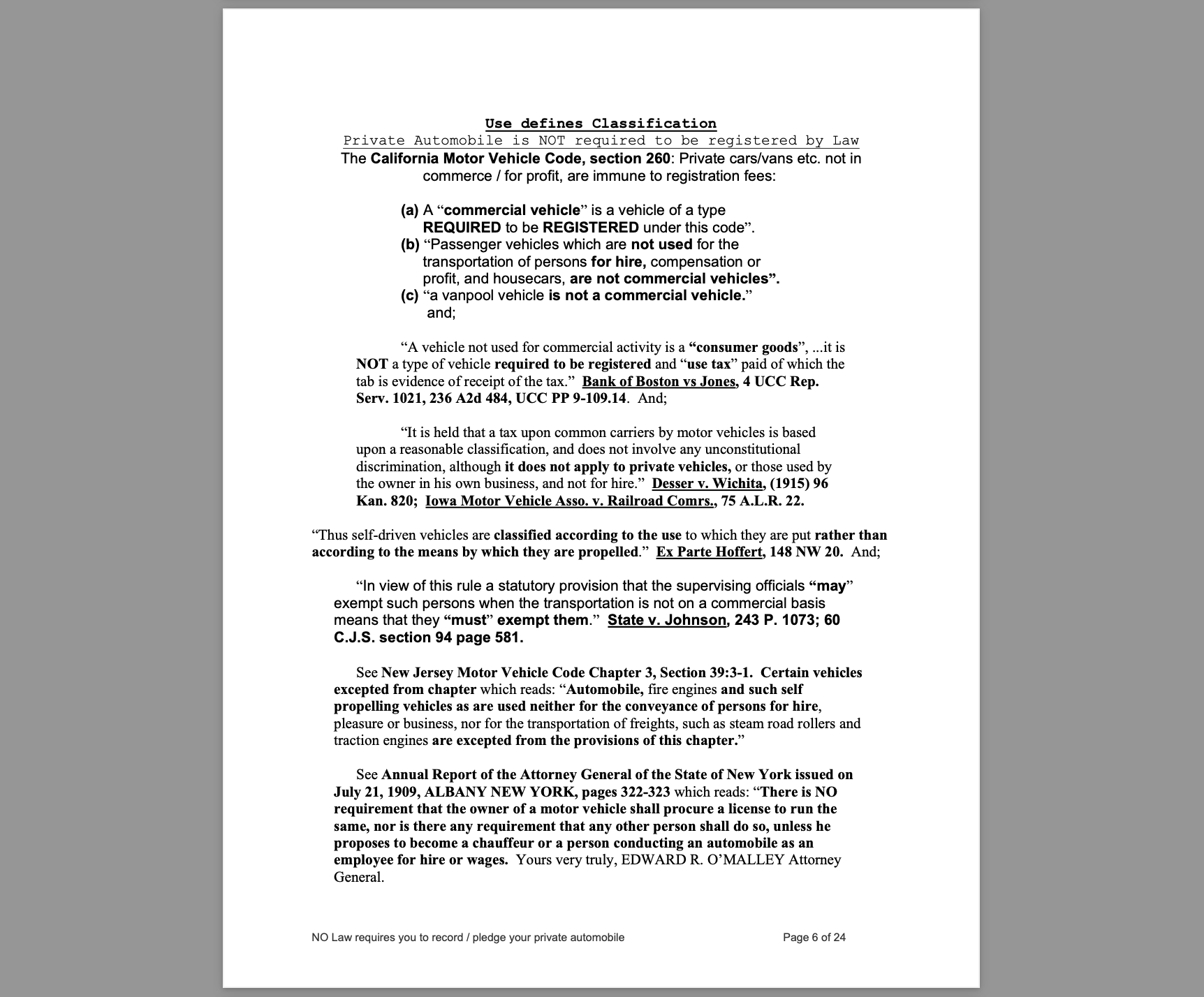

Use determines classification

“In determining whether or not a motor boat was included in the expression household effects, Matter of Winburn’s Will, supra [139 Misc. 5, 247 N.Y.S. 592], stated the test to be “whether the articles are or are not used in or by the household, or for the benefit or comfort of the family”.” In re Bloomingdale’s Estate, 142 N.Y.S.2d 781, 785 (1955).

“The use to which an item is put, rather than its physical characteristics, determine whether it should be classified as “consumer goods” under UCC 9- 109(1) or “equipment” under UCC 9-109(2).” Grimes v Massey Ferguson, Inc., 23 UCC Rep Serv 655; 355 So.2d 338 (Ala., 1978).

“Under UCC 9-109 there is a real distinction between goods purchased for personal use and those purchased for business use. The two are mutually exclusive and the principal use to which the property is put should be considered as determinative.” James Talcott, Inc. v Gee, 5 UCC Rep Serv 1028; 266 Cal.App.2d 384, 72 Cal.Rptr. 168 (1968).

“The classification of goods in UCC 9-109 are mutually exclusive.” McFadden v Mercantile-Safe Deposit & Trust Co., 8 UCC Rep Serv 766; 260 Md 601, 273 A.2d 198 (1971).

“The classification of “goods” under [UCC] 9-109 is a question of fact.” Morgan County Feeders, Inc. v McCormick, 18 UCC Rep Serv 2d 632; 836 P.2d 1051 (Colo. App., 1992).

“The definition of “goods” includes an automobile.” Henson v Government Employees Finance & Industrial Loan Corp., 15 UCC Rep Serv 1137; 257 Ark 273, 516 S.W.2d 1 (1974).

Household goods

“The term “household goods” … includes everything about the house that is usually held and enjoyed therewith and that tends to the comfort and accommodation of the household. Lawwill v. Lawwill, 515 P.2d 900, 903, 21 Ariz.App. 75″ 19A Words and Phrases – Permanent Edition (West) pocket part 94. Cites Mitchell’s Will below.

NO Law requires you to record / pledge your private automobile Page 3 of 24

“Bequest … of such “household goods and effects” … included not only household furniture, but everything else in the house that is usually held and used by the occupants of a house to lead to the comfort and accommodation of the household. State ex rel. Mueller v Probate Court of Ramsey County, 32 N.W.2d 863, 867, 226 Minn. 346.” 19A Words and Phrases – Permanent Edition (West) 514.

“All household goods owned by the user thereof and used solely for noncommercial purposes shall be exempt from taxation, and such person entitled to such exemption shall not be required to take any affirmative

action

to receive the benefit from such exemption.” Ariz. Const. Art. 9, 2.

Automobiles classified as vehicles

““[H]ousehold goods”…did not [include] an automobile…used by the testator, who was a practicing physician, in going from his residence to his office and vice versa, and in making visits to his patients.” Mathis v Causey, et al., 159 S.E. 240 (Ga. 1931).

“Debtors could not avoid lien on motor vehicle, as motor vehicles are not “household goods” within the meaning of Bankruptcy Code lien avoidance provision. In re Martinez, Bkrtcy.N.M., 22 B.R. 7, 8.” 19A Words and Phrases – Permanent Edition (West) pocket part 94.

Automobiles NOT classified as vehicles

“Automobile purchased for the purpose of transporting buyer to and from his place of

employment was “consumer goods” as defined in UCC 9-109.” Mallicoat v Volunteer Finance & Loan Corp., 3 UCC Rep Serv 1035; 415 S.W.2d 347 (Tenn. App., 1966).

“The provisions of UCC 2-316 of the Maryland UCC do not apply to sales of consumer goods (a term which includes automobiles, whether new or used, that are bought primarily for personal, family, or household use).” Maryland Independent Automobile Dealers Assoc., Inc. v Administrator, Motor Vehicle Admin., 25 UCC Rep Serv 699; 394 A.2d 820, 41 Md App 7 (1978).

“An automobile was part of testatrix’ “household goods” within codicil. In re

Mitchell’s Will, 38 N.Y.S.2d 673, 674, 675 [1942].” 19A Words and Phrases – Permanent Edition (West) 512. Cites Arthur v Morgan, supra.

“[T]he expression “personal effects” clearly includes an automobile[.]” In re Burnside’s Will, 59 N.Y.S.2d 829, 831 (1945). Cites Hillhouse, Arthur, and Mitchell’s Will, supra.

“[A] yacht and six automobiles were “personal belongings” and “household effects[.]”” In re Bloomingdale’s Estate, 142 N.Y.S.2d 781, 782 (1955).

NO Law requires you to record / pledge your private automobile Page 4 of 24

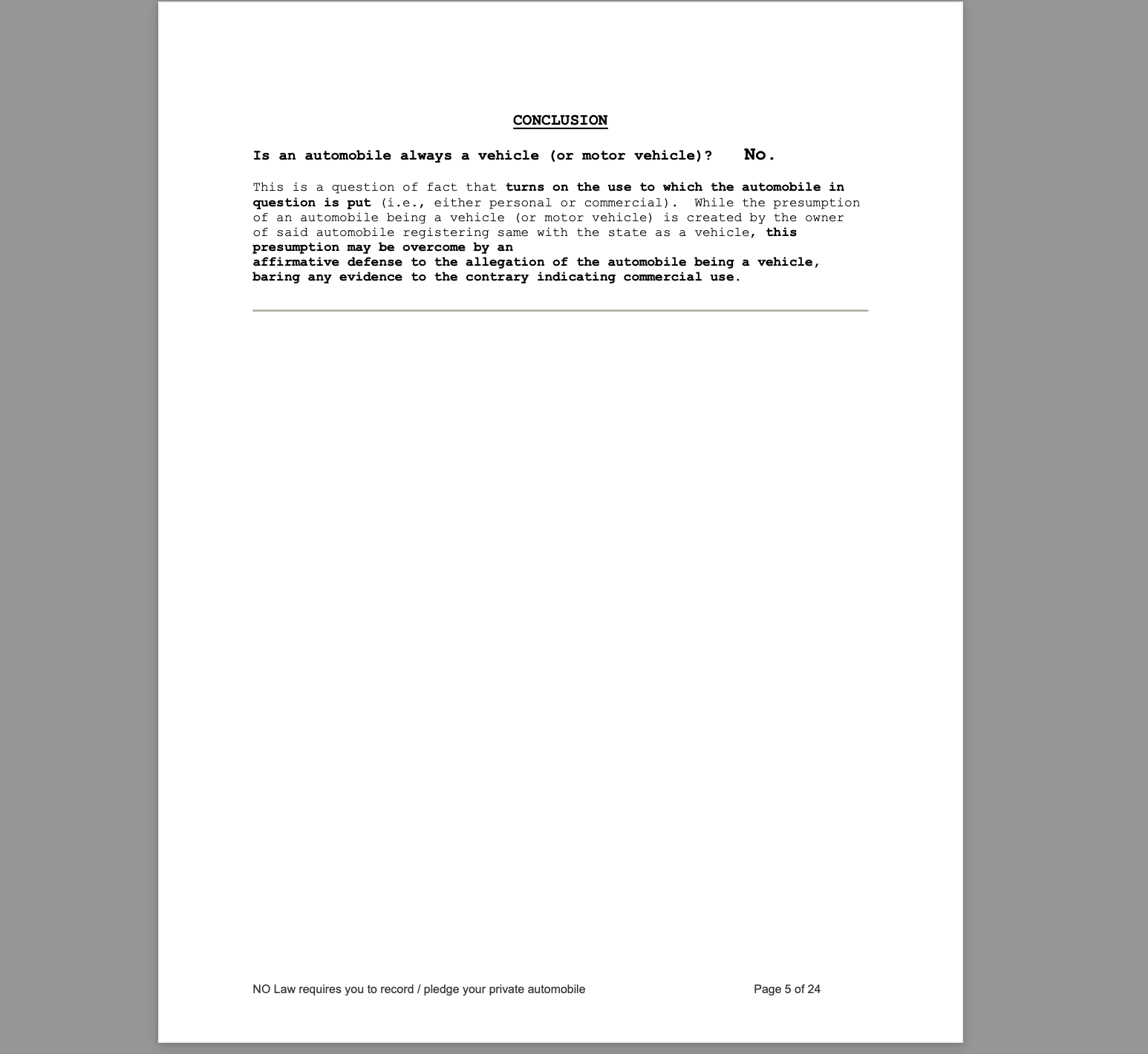

CONCLUSION

Is an automobile always a vehicle (or motor vehicle)? No.

This is a question of fact that turns on the use to which the automobile in question is put (i.e., either personal or commercial). While the presumption of an automobile being a vehicle (or motor vehicle) is created by the owner of said automobile registering same with the state as a vehicle, this presumption may be overcome by an

affirmative defense to the allegation of the automobile being a vehicle, baring any evidence to the contrary indicating commercial use.

NO Law requires you to record / pledge your private automobile Page 5 of 24

Reviews

There are no reviews yet.