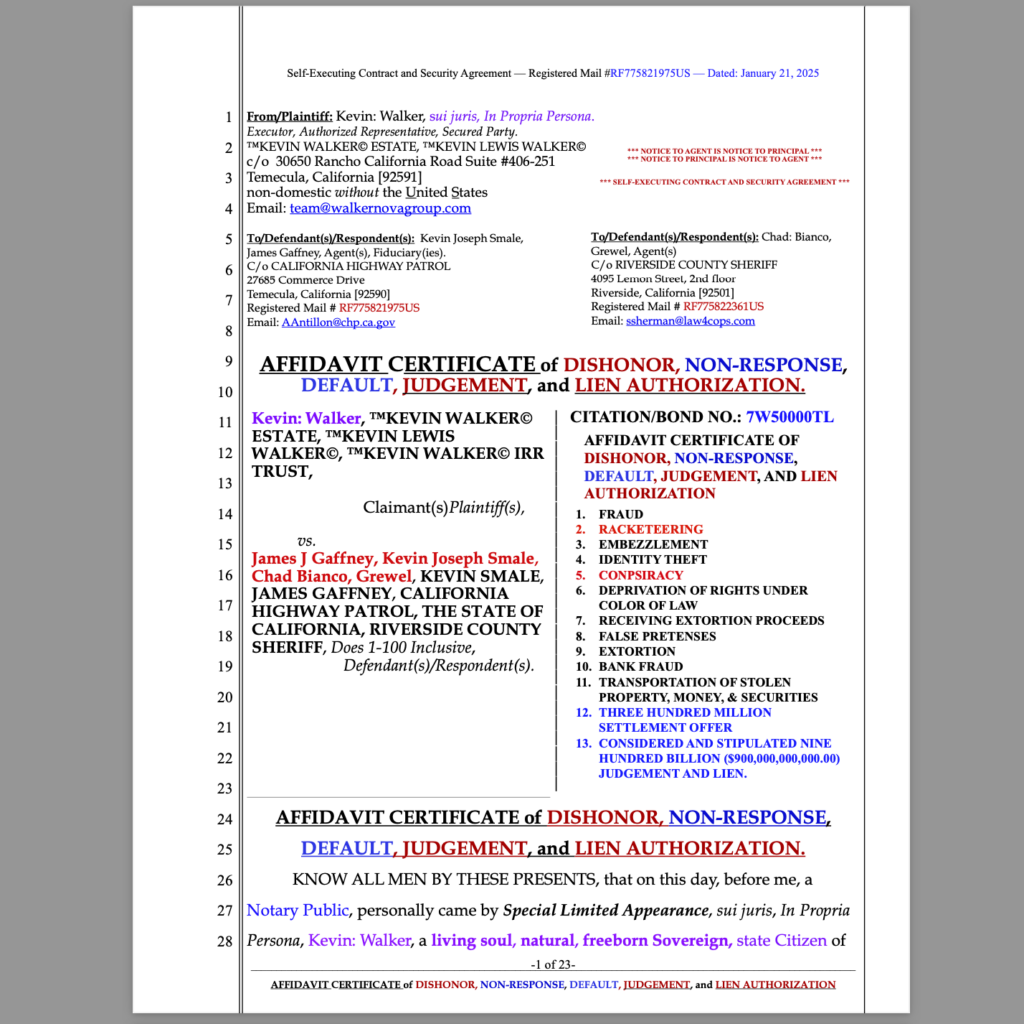

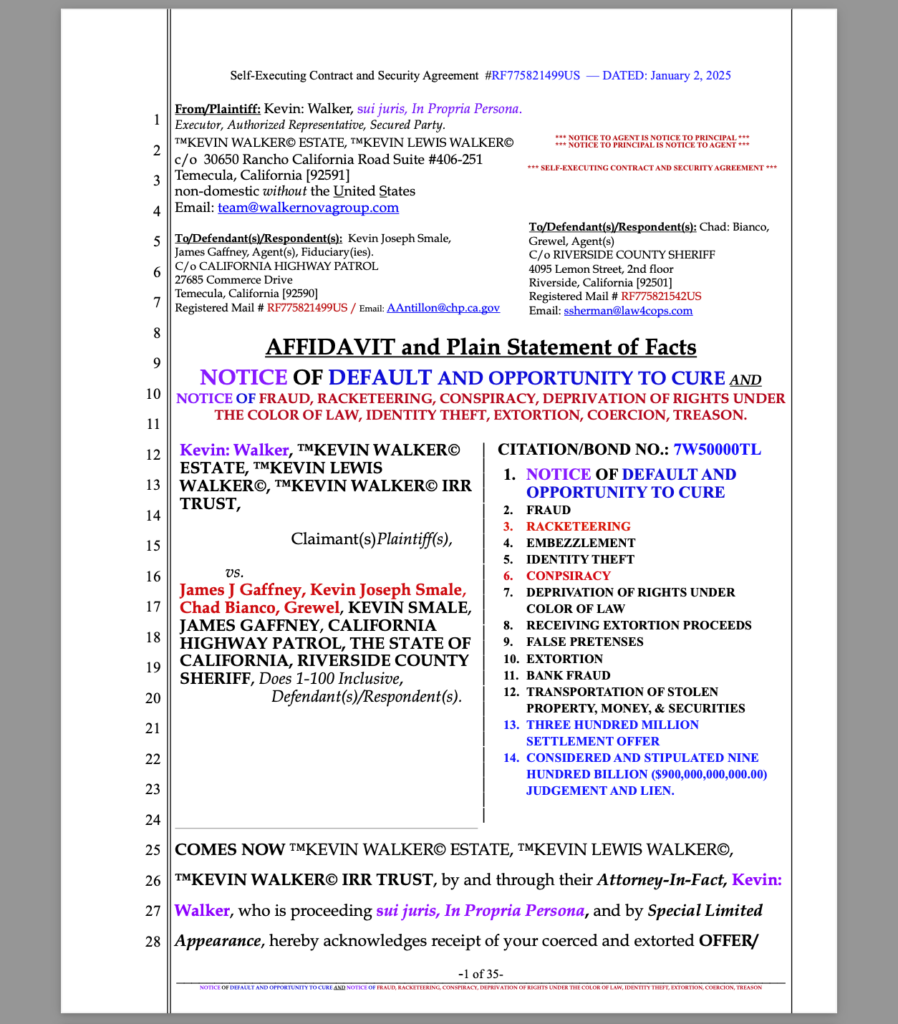

California – The Riverside County Sheriff’s Department, including Deputies Gregory D. Eastwood, Robert C. V. Bowman, William Pratt, and George Reyes, stands in legal default for failing to respond to a formal notice of conditional acceptance and affidavit from Kevin Walker. Under contract law, common law, and principles of fairness, an unrebutted affidavit is deemed conclusive truth. The Sheriff’s Department’s lack of response now confirms all allegations against them as true and legally binding.

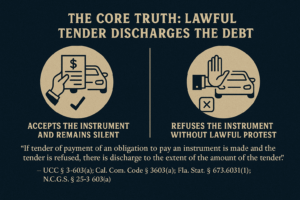

By their own failure to respond and express silent agreement, the Sheriff’s Department has tacitly admitted to allegations of fraud, racketeering, identity theft, extortion, coercion, and conspiracy to deprive rights under the color of law. This result stems from their refusal to comply with the required legal processes under UCC § 3-505, which presumes dishonor in such circumstances.

Weaponizing the System Against Americans

The actions of the Riverside Sheriff’s Department and the California Highway Patrol (CHP) are part of a broader effort to weaponize the legal and enforcement system against American citizens. This coordinated misconduct isn’t just isolated corruption; it represents an intentional strategy to undermine the rights of everyday Americans by exploiting government powers and legal structures for financial gain and control.

By issuing fraudulent citations, coercing individuals into unlawful contracts, and depriving them of their basic constitutional rights, the Riverside Sheriff and CHP have engaged in a calculated scheme to exploit their positions for personal or departmental profit. These government officials and agencies are using their legal authority not to uphold the law, but to create a system of fear and compliance that forces people to pay fines and fees under duress. This weaponization of power not only threatens individual freedoms but also fosters a culture of intimidation that undermines the very purpose of law enforcement.

Racketeering and Conspiracy Between Riverside Sheriff and CHP

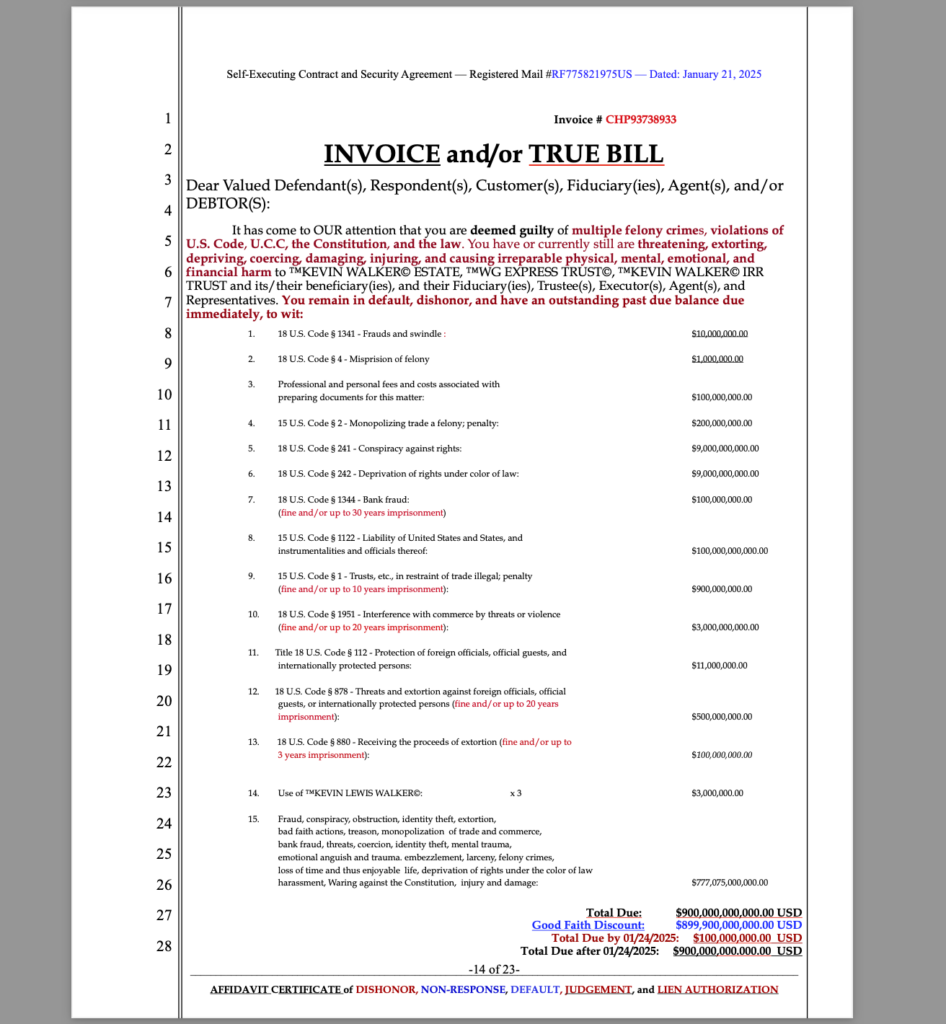

Kevin’s affidavits and security agreements clearly show a coordinated scheme between the Riverside Sheriff’s Department and the CHP, involving racketeering, extortion, and conspiracy. The violations confirmed include:

- Fraudulent Citations and Contracts: Deputies and CHP officers issued citations to private individuals not engaged in commercial activities, treating them as binding contracts without proper disclosure or lawful consideration, making them invalid from the start.

- Deprivation of the Right to Travel: CHP and Riverside Sheriff’s deputies unlawfully stopped and detained people, violating their right to travel freely.

- Identity Theft and Extortion: Public officials unlawfully demanded documents and coerced individuals into contracts under duress, committing identity theft and extortion.

- Racketeering and Fraudulent Revenue: The Sheriff’s Department and CHP engaged in a scheme to generate unlawful revenue through fraudulent citations, violating federal racketeering laws (18 U.S.C. § 1962).

- Dishonor Under UCC § 3-505: The failure to respond to lawful notices under UCC § 3-505 confirms dishonor and legal liability for these claims.

These violations are now the basis of two pending lawsuits: one for $1 trillion against the Riverside Sheriff’s Department and another for $900 billion against the CHP and Riverside Sheriff. These cases seek criminal prosecution and injunctive relief.

Legal Maxims Supporting Unrebutted Affidavits

The following legal principles show why the Sheriff’s Department’s silence is a legal admission:

- “He who does not deny, admits.” — Silence is seen as acceptance.

- “Truth is expressed in the form of an affidavit.” — An affidavit is the highest form of truth when unchallenged.

- “An unrebutted affidavit stands as truth in commerce.” — In commercial law, unchallenged affidavits are binding.

- “An unrebutted affidavit becomes the judgment in commerce.” — Once unanswered, it is legally final.

- “He who leaves the battlefield first loses by default.” — Not responding leads to automatic defeat.

- “Silence is agreement when there is a duty to respond.” — Failure to respond is considered acceptance.

The $900 Billion Federal Lawsuit Against the CHP

The confirmed racketeering and conspiracy between the Riverside Sheriff and CHP are linked to the $900 billion federal travel lawsuit against the CHP. This lawsuit highlights the CHP’s dishonor under UCC § 3-505, failure to respond to lawful claims, and involvement in extortion and rights violations.

These breaches match the misconduct by the Riverside Sheriff, demonstrating the need for federal intervention and prosecution. Kevin Walker’s legal team is using these facts to show a broader pattern of abuse targeting private citizens.

Collateral Estoppel, Stare Decisis, and Res Judicata

The facts presented in this case are not merely allegations but are now legally admitted and established. The Riverside Sheriff’s Department and CHP are barred from contesting these facts due to collateral estoppel, which prevents them from relitigating issues that have already been conclusively settled. Furthermore, the legal principles of stare decisis and res judicata ensure that these decisions are binding and cannot be challenged in future litigation. These doctrines reinforce the validity of the claims and confirm that the parties involved have no legal grounds to dispute the established facts.

Summary Judgment is Due as a Matter of Law

Given the admitted facts, the Riverside Sheriff and CHP’s failure to respond, and the legal doctrines in play, summary judgment is due as a matter of law pursuant to California Code of Civil Procedure § 437c and Federal Rule of Civil Procedure 56. The legal standard for summary judgment is met because there are no material facts in dispute, and the law is clear: the defendants are in default and are legally liable for their actions. Under Rule 56, summary judgment should be granted when the movant demonstrates that there is no genuine issue of material fact, and the movant is entitled to judgment as a matter of law.

In this case, the admitted facts and the defendants’ silence bar any dispute, and the law requires judgment in favor of the plaintiff.

Demand for Federal Prosecution

Due to the Sheriff’s default and the seriousness of the conspiracy involving the CHP, this case is moving to federal court. Kevin Walker’s team is calling for criminal prosecution under federal laws, including 18 U.S.C. §§ 241 (Conspiracy Against Rights) and 242 (Deprivation of Rights Under Color of Law), along with violations of the RICO Act. Additional claims of treason and constitutional violations will also be presented.

Justice Must Be Served

The Riverside County Sheriff’s Department and CHP are legally bound by their silence, confirming the truth of the claims against them. Justice will be pursued in federal court to ensure restitution, criminal charges, and injunctive relief.

This case sets an important precedent: silence is not protection—it is an admission. Public officials who violate the rights of the people will face the full force of the law. The weaponization of the legal system to control and exploit citizens must be stopped, and accountability will be sought in the highest courts.