Plaintiffs’ Legal Standing

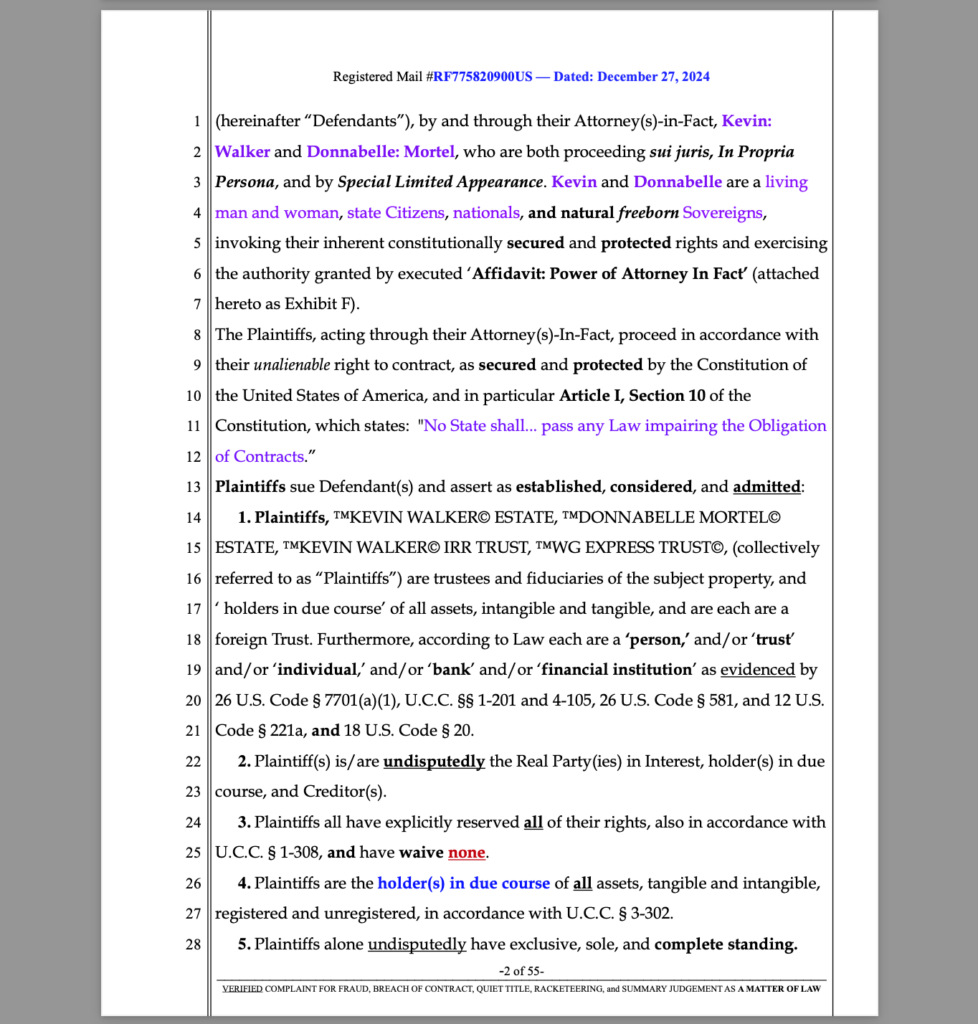

Acting as fiduciaries, trustees, and authorized representatives, the Plaintiffs are the real parties in interest under both state and federal law. They assert their position as creditors and holders in due course in accordance with U.C.C. § 3-302. By filing UCC-1 Financing Statements and UCC-3 amendments with the Secretary of State of Nevada, they have perfected their security interests and liens, securing exclusive rights to the property and associated assets in question.

The Plaintiffs’ standing is further supported by their legal status as foreign trusts and financial institutions under federal statutes, including but not limited to 26 U.S. Code § 7701(a)(1), 26 U.S. Code § 581, 12 U.S. Code § 221a, and 18 U.S. Code § 20. They expressly reserve all rights under U.C.C. § 1-308, affirming that no contractual obligations were entered into knowingly, willingly, or intentionally without their explicit consent.

Additionally, the Plaintiffs emphasize their separation from the ens legis corporate entities created by the government, represented by ALL CAPS names on birth certificates. They assert that these ens legis are legal fictions used in commercial transactions and are distinct from the living Plaintiffs.

Defendants’ Lack of Standing

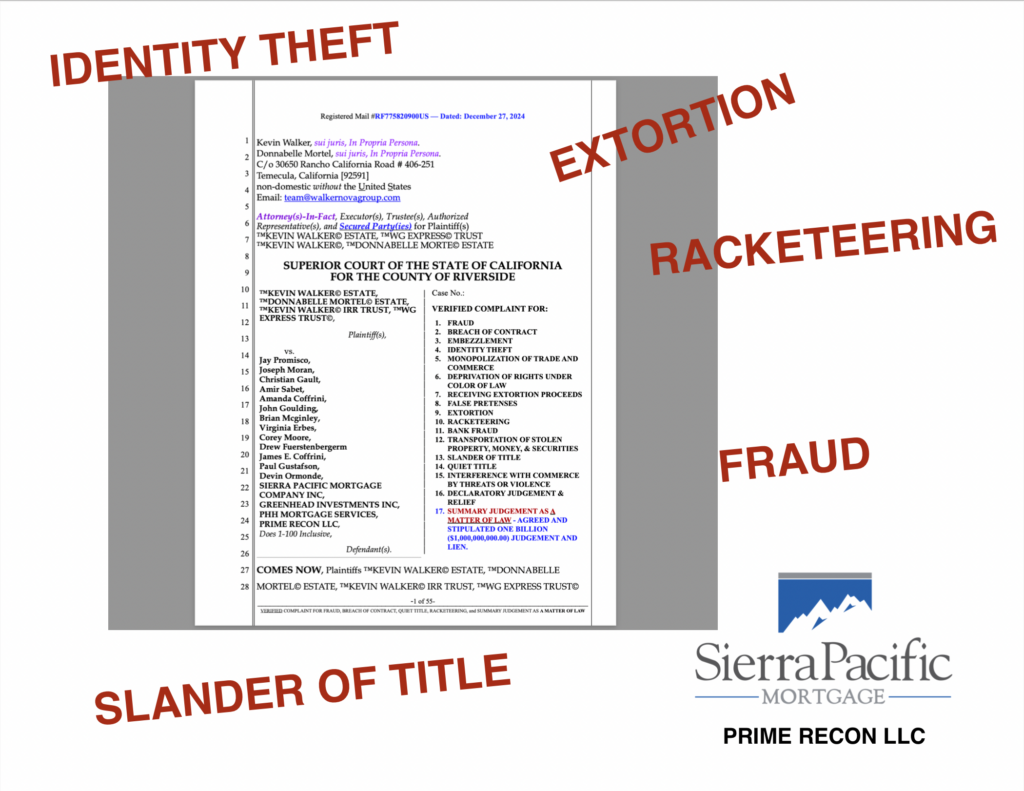

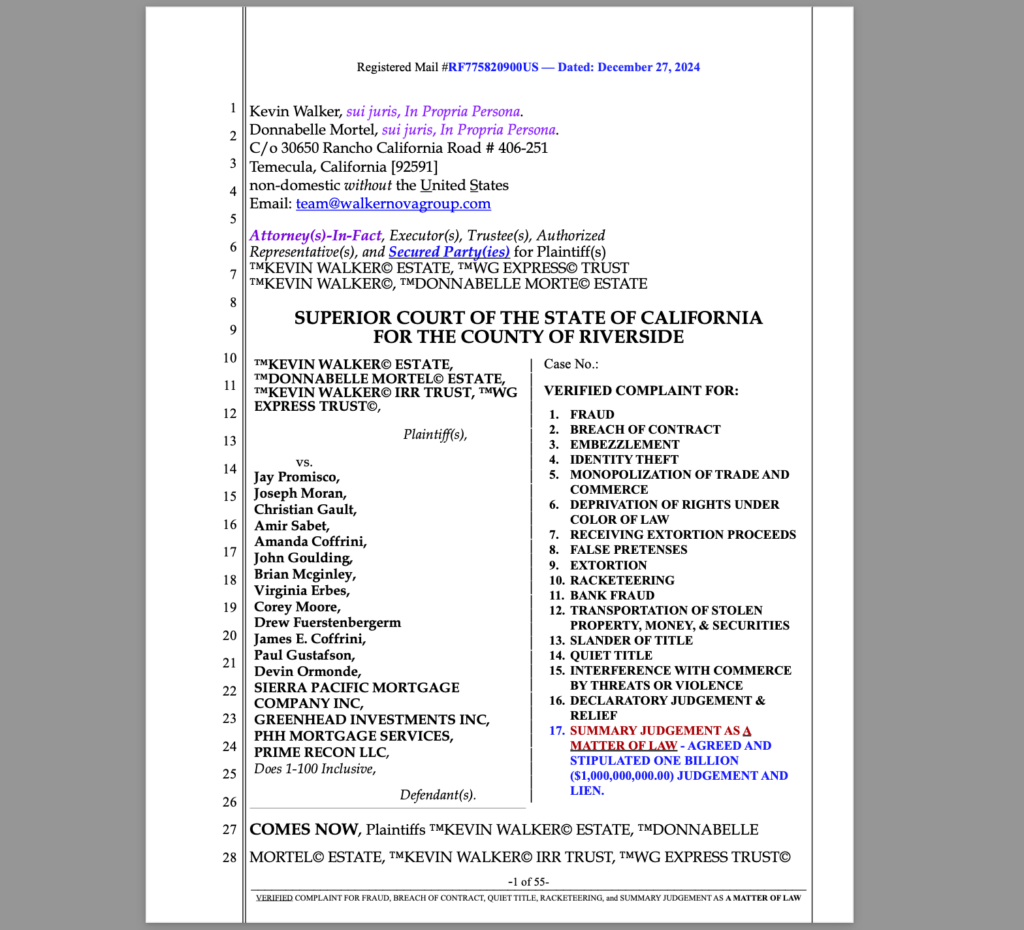

The Defendants, including Sierra Pacific Mortgage Company, PHH Mortgage Services, and others, lack the lawful standing to assert claims or title over the subject property or associated assets. This lack of standing is evidenced by their failure to rebut the Plaintiffs’ affidavits, which conclusively establish the Defendants as debtors in dishonor under U.C.C. § 3-505.

The Plaintiffs have submitted an Affidavit Certificate of Dishonor, Non-response, Default, Judgment, and Lien Authorization, which remains unrebutted and admitted as fact. Furthermore, the Plaintiffs assert that the specific monetary amount for the summary judgment was literally considered, acknowledged, and agreed to by the Defendants through their failure to rebut the Plaintiffs’ affidavits or contest the terms outlined in the contractual agreements. The Defendants’ failure to respond constitutes their tacit agreement, precluding any further dispute under the doctrines of collateral estoppel and estoppel by acquiescence.

Disputed Property and Assets

The contested assets include real estate located in California (address omitted for privacy), as well as intangible assets such as bonds, Federal Reserve Notes, securities, and negotiable instruments. The Plaintiffs assert their rights to these assets under allodial title, free from encumbrances or competing claims.

The Plaintiffs rely on U.C.C. § 1-103, which provides that the Uniform Commercial Code shall be liberally construed to promote its purposes, including simplifying, clarifying, and modernizing the law governing commercial transactions. This section further underscores that the principles of law and equity, including the law merchant and principles of freedom of contract, supplement the provisions of the U.C.C., affirming the Plaintiffs’ lawful claims to the disputed property.

In accordance with House Joint Resolution 192 of 1933 (Public Law 73-10), which abolished the gold standard and mandated the discharge of all debts dollar-for-dollar, the Plaintiffs have lawfully accepted, returned for value, and deposited these assets with the U.S. Treasury. This process is further validated under U.C.C. § 3-104, which defines a negotiable instrument as an unconditional promise or order to pay a fixed amount of money. The Plaintiffs assert that the contested negotiable instruments meet this definition and have been appropriately negotiated and discharged.

Furthermore, U.C.C. §§ 3-603 and 3-311 address the discharge of obligations and the use of tendered payment in full satisfaction of a claim, respectively. These sections reinforce the Plaintiffs’ actions in discharging the obligations tied to the disputed assets and preclude the Defendants from asserting competing claims. By applying these provisions, the Plaintiffs maintain that all debts have been legally discharged, and their claims are perfected.

Unrebutted Affidavits and Contractual Agreements

The Plaintiffs rely on the principle that unrebutted affidavits stand as truth in commerce, as supported by U.C.C. § 1-103. This provision ensures that the Plaintiffs’ affidavits, once uncontested, are binding and final.

The Plaintiffs have presented multiple self-executing contracts, including Security Agreements and Notices of Default, to the Defendants. These agreements are further bolstered by U.C.C. § 2-202, which establishes that terms of a contract, once established, cannot be contradicted by external evidence unless agreed otherwise. This ensures the primacy of the Plaintiffs’ contractual terms over any claims or defenses asserted by the Defendants.

The Plaintiffs also invoke U.C.C. §§ 2-204 and 2-206, which govern the formation and acceptance of contracts. Section 2-204 validates the Plaintiffs’ contracts as legally binding, even if some terms are left open, as long as the parties’ intentions to contract are clear. Section 2-206 affirms that the Defendants’ receipt of the Plaintiffs’ documents and failure to respond constitute acceptance of the terms by conduct.

Additionally, U.C.C. § 3-409, which addresses the drawee’s obligation to pay, and § 3-313, regarding the transfer and endorsement of instruments, establish the enforceability of the Plaintiffs’ liens and judgments. By failing to rebut the Plaintiffs’ affidavits or provide contrary evidence, the Defendants have tacitly agreed to the Plaintiffs’ claims.

The Defendants’ failure to respond or rebut within the stipulated timeframes constitutes tacit procuration, binding them to the terms outlined by the Plaintiffs. Under U.C.C. § 2-206, the Defendants’ non-response and acceptance of tendered terms equate to their agreement to the Plaintiffs’ settlement terms. This failure authorizes liens, summary judgments, and enforcement actions in the Plaintiffs’ favor, as recognized under commercial and common law.

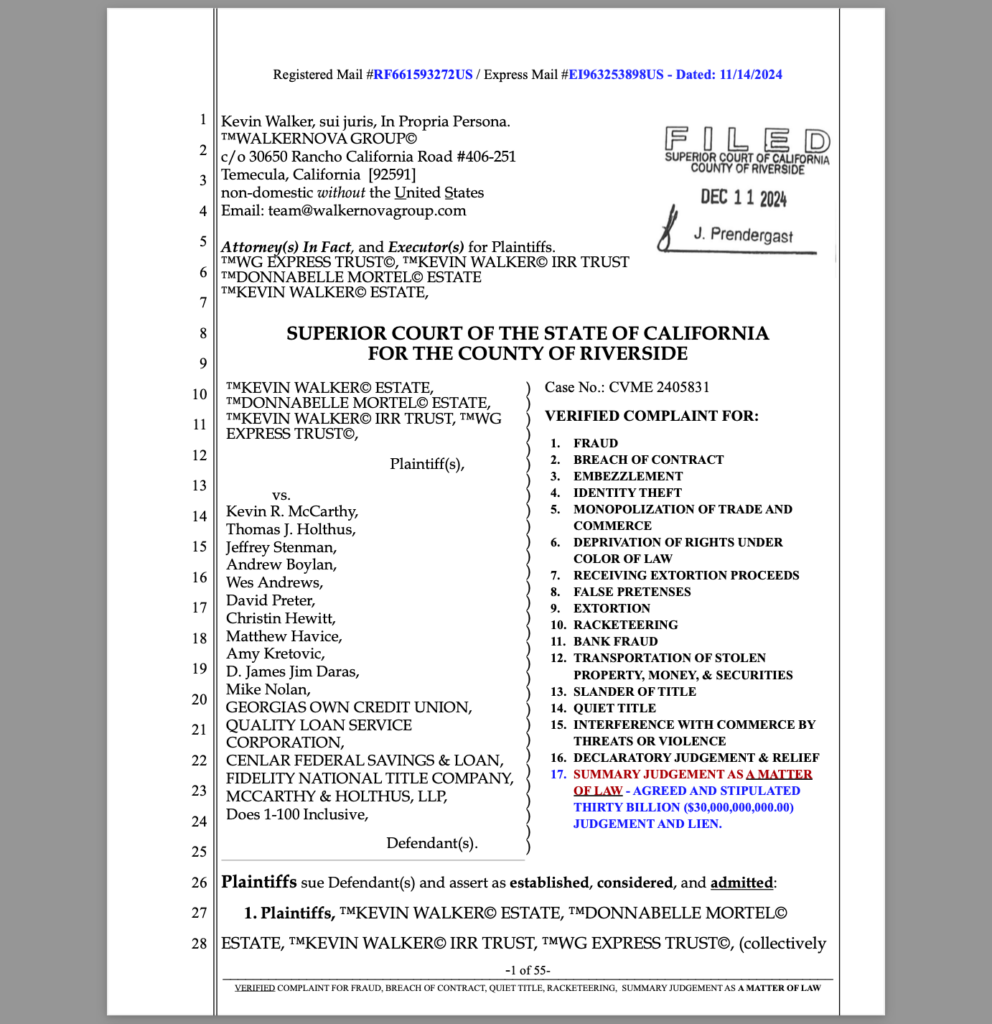

the KEVIN WALKER ESTATE also recently filed a Thirty Billion Dollar ($30,000,000,000.00 USD) lawsuit against Defendants Kevin R. McCarthy, Thomas J. Holthus, Jeffrey Stenman, Andrew Boylan, Wes Andrews, David Preter, Christin Hewitt, Matthew Havice, Amy Kretovic, D. James Jim Daras, Mike Nolan, GEORGIAS OWN CREDIT UNION, QUALITY LOAN SERVICE CORPORATION, CENLAR FEDERAL SAVINGS & LOAN, FIDELITY NATIONAL TITLE COMPANY, MCCARTHY & HOLTHUS, LLP, Does 1-100 Inclusive.

See: $30 Billion Lawsuit: Georgia’s Own Credit Union and Conspirators Caught in UCC Violations and Undeniable and Proven Fraud

See : ™KEVIN WALKER© Estate Files $30 Billion Lawsuit Against Georgia’s Own and McCarthy Holthus, Affirming Fraud, Racketeering, and Other Federal Crime

Also see: How AFFINIA DEFAULT SERVICES, WELLS FARGO, SIERRA PACIFIC MORTGAGE, GEORGIA’S OWN, and more are Stealing Homes and EMBEZZLING ASSETS

Conclusion

This case exemplifies the Plaintiffs’ strategic application of commercial law, federal statutes, and contractual precision to assert and secure their rights. The Plaintiffs’ claims are built upon a foundation of documented truth, unrebutted affidavits, and perfected security interests.

The Defendants’ dishonor, default, and lack of standing have been conclusively established under res judicata, stare decisis, and collateral estoppel. As the Plaintiffs seek enforcement of their rights, this legal action stands as a testament to the power of proper documentation and the rule of law in commerce.