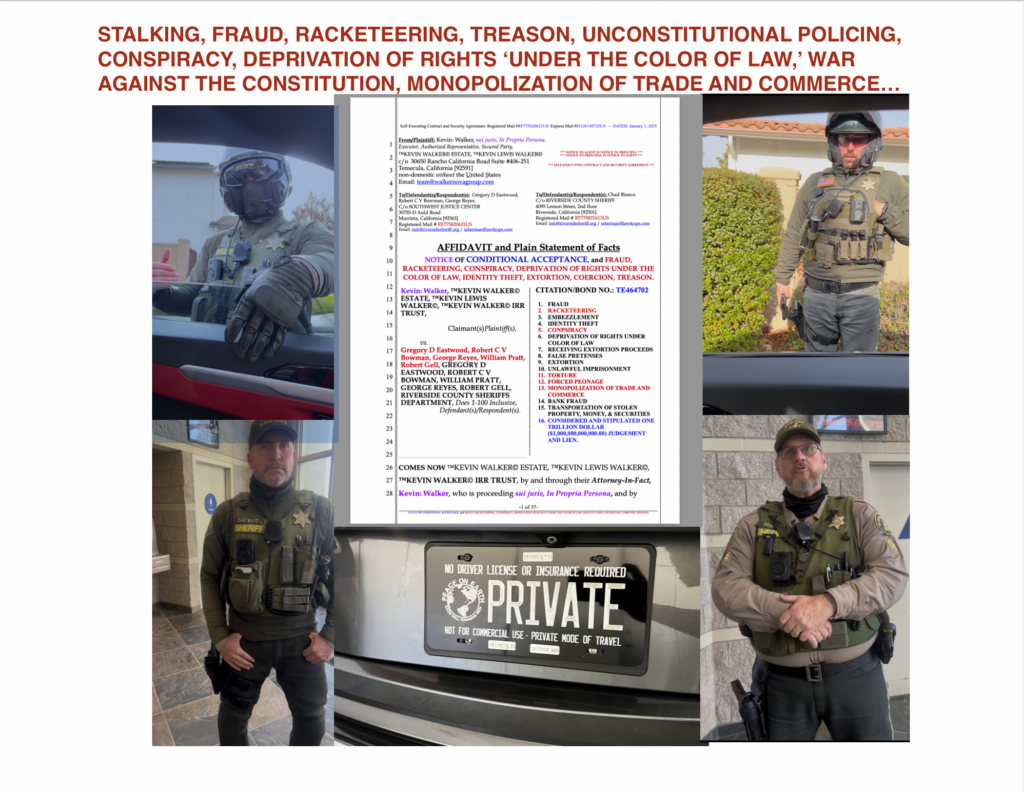

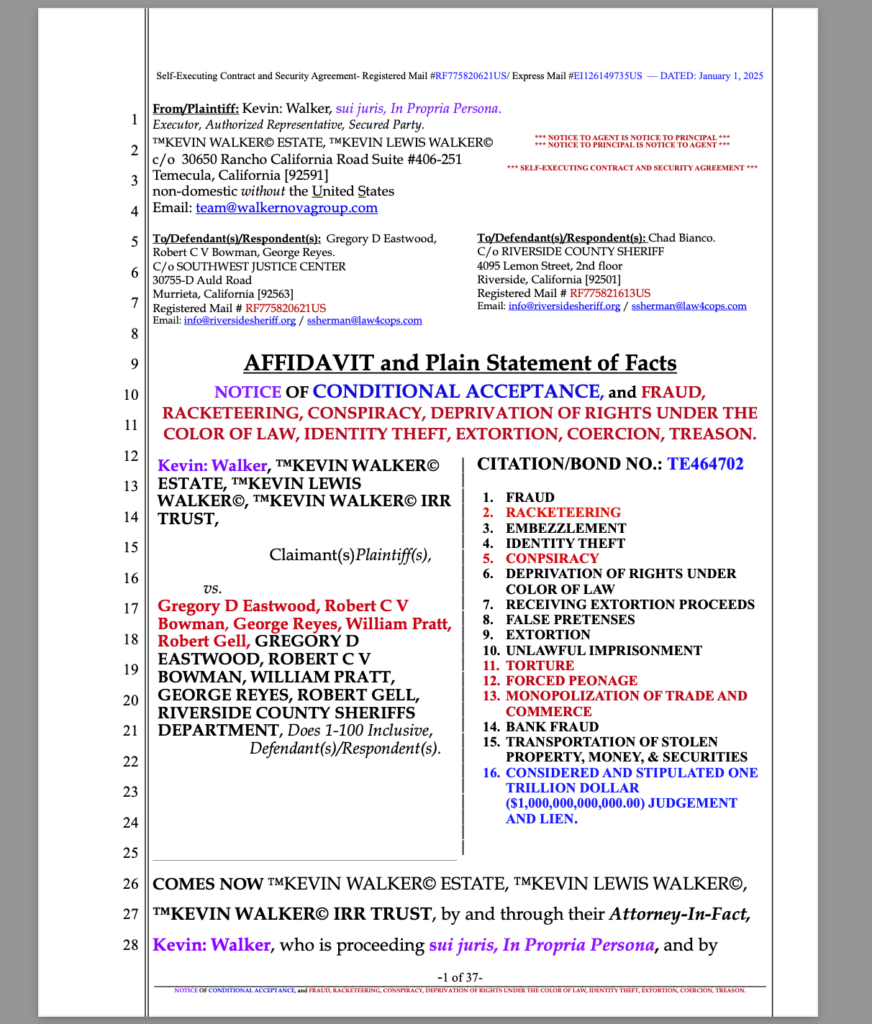

Riverside County Sheriff deputies Gregory D. Eastwood and Robert C. V. Bowman stalked national and private attorney-in-fact Kevin L. Walker through his neighborhood around the corner from his home, then arrested him on a bogus warrant and towed his Lamborghini. There is now an administrative process taking place and a pending One Trillion Dollar ($1,000,000,000,000.00) Federal conspiracy, fraud, forced peonage, and racketeering lawsuit against the deputies and the Riverside County Sheriff Department.

Clearfield Doctrine

Under the Clearfield Doctrine, as established in Clearfield Trust Co. v. United States, 318 U.S. 363 (1943), when governments engage in commercial transactions, they relinquish their sovereign immunity and are subject to the same rules and liabilities as private corporations. By issuing traffic tickets, towing private property, and engaging in revenue-generating activities, municipalities and their agents act as corporate entities rather than sovereign bodies. This commercial nature invalidates their claim of sovereign authority when they violate constitutional rights or contractual obligations.

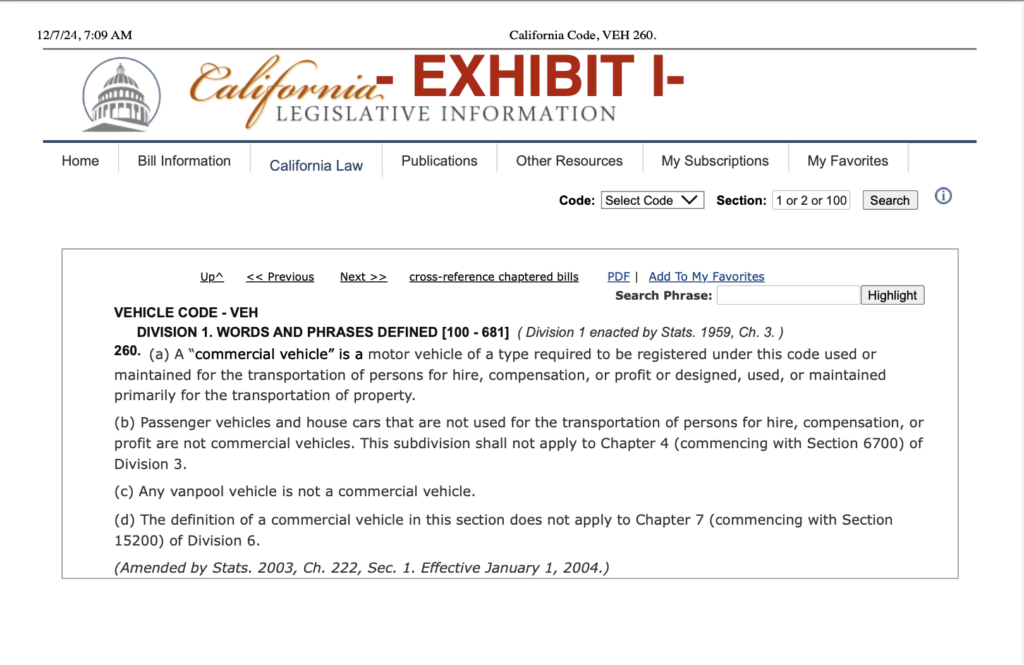

California Vehicle Code § 260

Under California Vehicle Code § 260, only “commercial vehicles” are required to be registered. A “commercial vehicle” is defined as a motor vehicle used or maintained for transporting persons for hire, compensation, or profit, or for the transportation of property. The California DMV further distinguishes between “motor vehicles” and “automobiles,” with the latter referring to private, personal modes of transportation not used for commercial purposes. As such, private automobiles, when not engaged in commerce or profit-driven activities, do not meet the statutory definition of a “commercial vehicle” and are therefore not subject to mandatory registration requirements under this code.

California Vehicle Code § 4000

California Vehicle Code § 4000 applies specifically to “motor vehicles,” which are defined as vehicles used in commerce for transporting persons or property for profit. This distinction excludes private automobiles, which are personal-use conveyances not engaged in commercial activities. Courts, including the U.S. Supreme Court, have upheld the fundamental right to travel on public highways without unreasonable government interference, recognizing that private travel is distinct from regulated commercial activity. Case law such as Thompson v. Smith affirms this right, and statutory interpretation limits the term “motor vehicle” to vehicles used in commerce, making the registration requirement inapplicable to private automobiles.

18 U.S. Code § 31 – Definitions

Under 18 U.S. Code § 31, the term “motor vehicle” is explicitly defined to include only those vehicles used for commercial purposes, as follows:

“(6) Motor vehicle.—

The term ‘motor vehicle’ means every description of carriage or other contrivance propelled or drawn by mechanical power and used for commercial purposes on the highways in the transportation of passengers, passengers and property, or property or cargo.“

The key phrase “and used for commercial purposes” limits the application of the term “motor vehicle” to those contrivances operating in commerce, explicitly requiring the transportation of passengers, passengers and property, or property or cargo for compensation or profit.

Additionally, 18 U.S. Code § 31(10) defines “used for commercial purposes” as:

“The carriage of persons or property for any fare, fee, rate, charge or other consideration, or directly or indirectly in connection with any business, or other undertaking intended for profit.”

This federal definition aligns with California’s Vehicle Code, confirming that vehicles not used for commercial purposes—such as Kevin L. Walker’s Lamborghini—are not “motor vehicles” under statutory definitions. As such, private automobiles used for personal purposes fall outside the scope of registration and licensing requirements applicable to commercial vehicles.

By specifying “and used for commercial purposes,” 18 U.S. Code § 31 establishes that the term “motor vehicle” cannot be applied to private, non-commercial automobiles. This deliberate distinction reinforces that registration and traffic-related enforcement apply only to vehicles engaged in commerce, not private property owned and operated for personal use.

Traveling Is Not a Privilege: Foundational Legal Precedents

The fundamental right to travel has been upheld in numerous landmark cases:

- Chicago Coach Co. v. City of Chicago, 337 Ill. 200, 169 N.E. 22 affirms that no state government has the power to deny passage on highways or waterways, regardless of whether the individual is traveling for business or recreation.

- Kent v. Dulles, 357 U.S. 116, 127 establishes that the right to travel is part of the “liberty” guaranteed under the Fifth Amendment, a right emerging as early as the Magna Carta.

- In Re Archy (1858), 9 C. 47 defines traveling as the act of passing from place to place, an inherent activity that does not depend on statutory permissions.

These precedents unequivocally distinguish between travel, a natural right, and the regulated use of public highways for commercial purposes, which may be subject to licensing and other restrictions.

- “No State government entity has the power to allow or deny passage on the highways, byways, nor waterways… transporting his vehicles and personal property for either recreation or business, but by being subject only to local regulation i.e., safety, caution, traffic lights, speed limits, etc. Travel is not a privilege requiring, licensing, vehicle registration, or forced insurances.” Chicago Coach Co. v. City of Chicago, 337 Ill. 200, 169 N.E. 22.

- The fundamental Right to travel is NOT a Privilege, it’s a gift granted by your Creator and restated by our founding fathers as Unalienable and cannot be taken by any Man / Government made Law or color of law known as a private “Code” (secret) or a “Statute.”

- “Traveling is passing from place to place–act of performing journey; and traveler is person who travels.” In Re Archy (1858), 9 C. 47.

- “Right of transit through each state, with every species of property known to constitution of United States, and recognized by that paramount law, is secured by that instrument to each citizen, and does not depend upon uncertain and changeable ground of mere comity.” In Re Archy (1858), 9 C. 47.

- Freedom to travel is, indeed, an important aspect of the citizen’s “liberty”. We are first concerned with the extent, if any, to which Congress has authorized its curtailment. (Road) Kent v. Dulles, 357 U.S. 116, 127.

- The right to travel is a part of the “liberty” of which the citizen cannot be deprived without due process of law under the Fifth Amendment. So much is conceded by the solicitor general. In Anglo Saxon law that right was emerging at least as early as Magna Carta. Kent v. Dulles, 357 U.S. 116, 125.

- “Even the legislature has no power to deny to a citizen the right to travel upon the highway and transport his property in the ordinary course of his business or pleasure, though this right may be regulated in accordance with public interest and convenience. Chicago Coach Co. v. City of Chicago, 337 Ill. 200, 169 N.E. 22, 206.

- “… It is now universally recognized that the state does possess such power [to impose such burdens and limitations upon private carriers when using the public highways for the transaction of their business] with respect to common carriers using the public highways for the transaction of their business in the transportation of persons or property for hire. That rule is stated as follows by the supreme court of the United States: ‘A citizen may have, under the fourteenth amendment, the right to travel and transport his property upon them (the public highways) by auto vehicle, but he has no right to make the highways his place of business by using them as a common carrier for hire. Such use is a privilege which may be granted or withheld by the state in its discretion, without violating either the due process clause or the equal protection clause.’ (Buck v. Kuykendall, 267 U. S. 307 [38 A. L. R. 286, 69 L. Ed. 623, 45 Sup. Ct. Rep. 324].

- “The right of a citizen to travel upon the highway and transport his property thereon in the ordinary course of life and business differs radically an obviously from that of one who makes the highway his place of business and uses it for private gain, in the running of a stage coach or omnibus. The former is the usual and ordinary right of a citizen, a right common to all; while the latter is special, unusual and extraordinary. As to the former, the extent of legislative power is that of regulation; but as to the latter its power is broader; the right may be wholly denied, or it may be permitted to some and denied to others, because of its extraordinary nature. This distinction, elementary and fundamental in character, is recognized by all the authorities.”

- “ Even the legislature has no power to deny to a citizen the right to travel upon the highway and transport his/her property in the ordinary course of his business or pleasure, though this right may be regulated in accordance with the public interest and convenience.” [“regulated” means traffic safety enforcement, stop lights, signs etc.]—Chicago Motor Coach v. Chicago, 169 NE 22.

- “The claim and exercise of a constitutional right cannot be converted into a crime.”—Miller v. U.S., 230 F 2d 486, 489

- “Owner has constitutional right to use and enjoyment of his property.” Simpson v. Los Angeles (1935), 4 C.2d 60, 47 P.2d 474.

- “There can be no sanction or penalty imposed upon one because of this exercise of constitutional rights.” —Sherar v. Cullen, 481 F. 945

- The right of the citizen to travel upon the highway and to transport his property thereon, in the ordinary course of life and business, differs radically and obviously from that of one who makes the highway his place of business for private gain in the running of a stagecoach or omnibus.”— State vs. City of Spokane, 186 P. 864.

- ”The right of the citizen to travel upon the public highways and to transport his/her property thereon either by carriage or automobile, is not a mere privilege which a city [or State] may prohibit or permit at will, but a common right which he/she has under the right to life, liberty, and the pursuit of happiness.” —Thompson v. Smith, 154 SE 579.

- “The right of the Citizen to travel upon the public highways and to transport his property thereon, in the ordinary course of life and business, is a common right which he has under the right to enjoy life and liberty, to acquire and possess property, and to pursue happiness and safety. It includes the right, in so doing, to use the ordinary and usual conveyances of the day, and under the existing modes of travel, includes the right to drive a horse drawn carriage or wagon thereon or to operate an automobile thereon, for the usual and ordinary purpose of life and business.”— Thompson vs. Smith, supra.; Teche Lines vs. Danforth, Miss., 12 S.2d 784

- “The use of the highways for the purpose of travel and transportation is not a mere privilege, but a common and fundamental Right of which the public and the individual cannot be rightfully deprived.”—Chicago Motor Coach vs. Chicago, 169 NE 22;Ligare vs. Chicago, 28 NE 934;Boon vs. Clark, 214 SSW 607;25 Am.Jur. (1st) Highways Sect.163.

- “The right to b is part of the Liberty of which a citizen cannot deprived without due process of law under the Fifth Amendment. This Right was emerging as early as the Magna Carta.” — Kent vs. Dulles, 357 US 116 (1958)

- “The state cannot diminish Rights of the people.” —Hurtado vs. California, 110 US 516.

- ””Personal liberty largely consists of the Right of locomotion — to go where and when one pleases — only so far restrained as the Rights of others may make it necessary for the welfare of all other citizens. The Right of the Citizen to travel upon the public highways and to transport his property thereon, by horse drawn carriage, wagon, or automobile, is not a mere privilege which may be permitted or prohibited at will, but the common Right which he has under his Right to life, liberty, and the pursuit of happiness. Under this Constitutional guarantee one may, therefore, under normal conditions, travel at his inclination along the public highways or in public places, and while conducting himself in an orderly and decent manner, neither interfering with nor disturbing another’s Rights, he will be protected, not only in his person, but in his safe conduct.” —II Am.Jur. (1st) Constitutional Law, Sect.329, p.1135

Use defines classification:

-

- It is well established law that the highways of the state are public property, and their primary and preferred use is for private purposes, and that their use for purposes of gain is special and extraordinary which, generally at least, the legislature may prohibit or condition as it sees fit.” Stephenson vs. Rinford, 287 US 251; Pachard vs Banton, 264 US 140, and cases cited; Frost and F. Trucking Co. vs. Railroad Commission, 271 US 592; Railroad commission vs. Inter-City Forwarding Co., 57 SW.2d 290; Parlett Cooperative vs. Tidewater Lines, 164 A. 313

- The California Motor Vehicle Code, section 260: Private cars/vans etc. not in commerce / for profit, are immune to registration fees:

- (a) A “commercial vehicle” is a vehicle of a type REQUIRED to be REGISTERED under this code”.

- (b) “Passenger vehicles which are not used for the transportation of persons for hire, compensation or profit, and housecars, are not commercial vehicles”.

- (c) “a vanpool vehicle is not a commercial vehicle.”

- 18 U.S. Code § 31 – Definition, expressly stipulates, ”The term “motor vehicle” means every description of carriage or other contrivance propelled or drawn by mechanical power and used for commercial purposes on the highways in the transportation of passengers, passengers and property, or property or cargo”.

- A vehicle not used for commercial activity is a “consumer goods”, …it is NOT a type of vehicle required to be registered and “use tax” paid of which the tab is evidence of receipt of the tax.” Bank of Boston vs Jones, 4 UCC Rep. Serv. 1021, 236 A2d 484, UCC PP 9-109.14.

- “ The ‘privilege’ of using the streets and highways by the operation thereon of motor carriers for hire can be acquired only by permission or license from the state or its political subdivision. “—Black’s Law Dictionary, 5th ed, page 830.

- “It is held that a tax upon common carriers by motor vehicles is based upon a reasonable classification, and does not involve any unconstitutional discrimination, although it does not apply to private vehicles, or those used by the owner in his own business, and not for hire.” Desser v. Wichita, (1915) 96 Kan. 820; Iowa Motor Vehicle Asso. v. Railroad Comrs., 75 A.L.R. 22.

- “Thus self-driven vehicles are classified according to the use to which they are put rather than according to the means by which they are propelled.” Ex Parte Hoffert, 148 NW 20.

- In view of this rule a statutory provision that the supervising officials “may” exempt such persons when the transportation is not on a commercial basis means that they “must” exempt them.” State v. Johnson, 243 P. 1073; 60 C.J.S. section 94 page 581.

- “The use to which an item is put, rather than its physical characteristics, determine whether it should be classified as “consumer goods” under UCC 9- 109(1) or “equipment” under UCC 9-109(2).” Grimes v Massey Ferguson, Inc., 23 UCC Rep Serv 655; 355 So.2d 338 (Ala., 1978).

- “Under UCC 9-109 there is a real distinction between goods purchased for personal use and those purchased for business use. The two are mutually exclusive and the principal use to which the property is put should be considered as determinative.” James Talcott, Inc. v Gee, 5 UCC Rep Serv 1028; 266 Cal.App.2d 384, 72 Cal.Rptr. 168 (1968).

- “The classification of goods in UCC 9-109 are mutually exclusive.” McFadden v Mercantile-Safe Deposit & Trust Co., 8 UCC Rep Serv 766; 260 Md 601, 273 A.2d 198 (1971).

- “The classification of “goods” under [UCC] 9-109 is a question of fact.” Morgan County Feeders, Inc. v McCormick, 18 UCC Rep Serv 2d 632; 836 P.2d 1051 (Colo. App., 1992).

- “The definition of “goods” includes an automobile.” Henson v Government Employees Finance & Industrial Loan Corp., 15 UCC Rep Serv 1137; 257 Ark 273, 516 S.W.2d 1 (1974).