The journey of a mortgage promissory note from a simple contractual agreement to a complex financial instrument is shrouded in layers of banking procedures rarely disclosed to the average borrower. This article aims to demystify how mortgage companies securitize promissory notes and the little-known fact that all mortgage borrowers have an inherent claim to these notes which have CASH VALUE of your total loan amount and often even more—a claim often lost in the fog of inadequate disclosure and double ledger banking practices.

The Securitization Process:

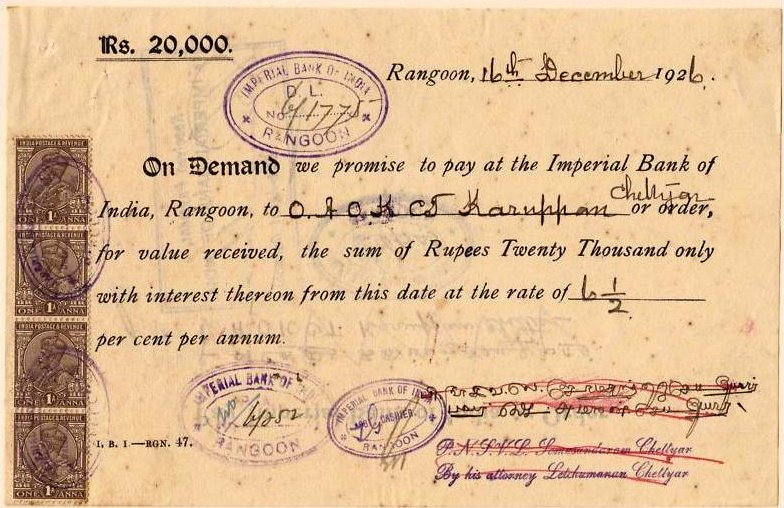

Securitization—the act of transforming loans into securities—begins with a borrower signing a promissory note, which represents a promise to pay back the borrowed amount with interest. This note is a powerful financial tool that, unbeknownst to many signers, becomes a cog in the wheel of a larger economic machine.

The Unseen Value of Promissory Notes:

Upon signing, these promissory notes are recorded as an asset on the lender’s books. What borrowers are not typically told is that this asset entry is mirrored by a cash value entry, effectively creating a financial balance that is not directly acknowledged on the lender’s publicly disclosed financial statements.

Behind the Banking Veil:

In the labyrinth of commercial banking, the creation of a loan simultaneously generates an equal and opposite ledger entry. This practice, often obscured from the borrower, means that the bank considers the loan to be ‘paid’ from an accounting standpoint the moment the promissory note is signed and valued.

Mortgages are the biggest scams and this is a HUGE PUBLIC matter. How is the entire Mortgage Industry a Fraud with improper disclosure and double ledger banking, and double dipping ? You finance your own loans (not the banks), YOUR promissory NOTE has cash value, and if the… pic.twitter.com/i2NdzYjg9Z

— KEVIN L. WALKER ™ (@KevinLWalker) November 16, 2023

The Hidden Claim:

Every borrower, by virtue of their signed promissory note, holds aN ownership and claim to it. Yet, due to the opaque nature of financial disclosures and the complexities of commercial banking, most never exercise this right. The promissory note, once signed, is frequently sold to a trust or Special Purpose Vehicle (SPV), which then issues securities backed by these notes. The capital generated from selling these securities to investors is rarely, if ever, credited back to the borrower.

This is because borrowers never actually make claim, due to lack of disclosure.

A Case for Transparency and Action:

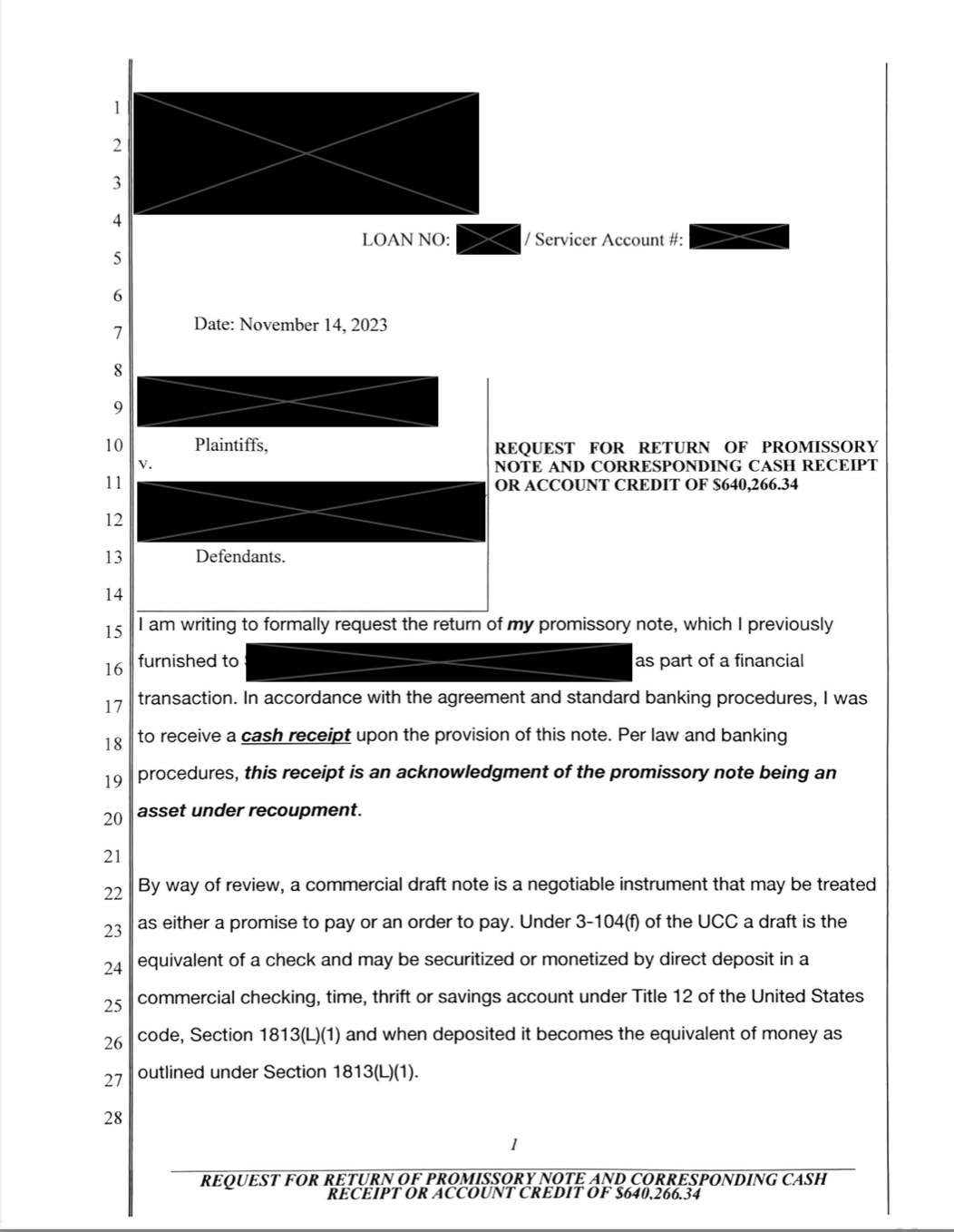

The lack of transparency in disclosing these financial maneuvers to borrowers raises serious ethical concerns. A borrower should be aware that their signed note has been commodified and that they hold a potential claim over it. In an illustrative letter obtained from a credible source, an informed borrower confronted their lender, demanding a cash receipt for the promissory note and the discharge of the remaining balance. This action was grounded in the assertion of their right to claim ownership of the note under equitable principles.

Mortgages are the biggest scams and this is a HUGE PUBLIC matter. How is the entire Mortgage Industry a Fraud with improper disclosure and double ledger banking, and double dipping ? You finance your own loans (not the banks), YOUR promissory NOTE has cash value, and if the mortgage isn’t paid, the insurance company pays it.

The mortgage industry is one of the biggest scams of EVERYONE’S lifetime.

The future of the mortgage industry seems doomed. If you hold a mortgage and have signed a promissory NOTE, also known as a NEGOTIABLE debt instrument, ALL NOTES hold INTRINSIC VALUE and are SECURITIZED. Essentially, with your signature, you’ve financed your own loan. The bank…

— KEVIN L. WALKER ™ (@KevinLWalker) November 16, 2023

Conclusion:

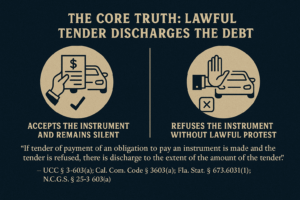

The borrower’s right to claim their promissory note is an overlooked aspect of the mortgage securitization process. While the system is legally sound, the ethical implications of non-disclosure stand in stark contrast to principles of fairness and transparency. It’s crucial for borrowers to be fully informed about their rights and for regulatory bodies to enforce clearer communication from financial institutions. As this understanding permeates the consciousness of mortgage borrowers, it may lead to a significant shift in how lenders operate and interact with their clients.

Many borrowers have the right to recoupment and/or rescission. Understanding how to reclaim their promissory notes and understanding the difference between being a credit and debtor is essential.