The U.S. financial system underwent a monumental transformation due to the Emergency Banking Act of 1933, House Joint Resolution 192 (HJR 192), and key provisions of Title 31 U.S. Code, including 31 U.S.C. § 3123, § 5118, and § 5103. These legislative acts, combined with the Constructive Expansion Policy established by Congress on March 9, 1933, fundamentally reshaped the nature of currency and debt obligations in the United States. This shift not only dismantled the gold standard but also recognized negotiable instruments—including bills of exchange, bonds, and acceptances—as legal currency.

Read on Realworldfare.

1. Constructive Expansion Policy of March 9, 1933

On March 9, 1933, Congress passed legislation as part of the Emergency Banking Act, formalizing a Constructive Expansion Policy designed to stabilize the financial system amid the Great Depression. This policy granted sweeping powers to the federal government, particularly the Secretary of the Treasury and the Federal Reserve, to redefine and expand the concept of currency.

Key Features and Currency Implications

- Expansion of Acceptable Currency Forms: The Constructive Expansion Policy authorized the use of bills of exchange, acceptances, bonds, and other negotiable instruments as lawful currency.

- Liquidation and Liquidity: By elevating these financial instruments to currency status, the policy allowed banks to issue credit and maintain liquidity without relying on gold-backed assets.

- Legislative Support: Title 31 of the U.S. Code codifies these changes by formally recognizing financial instruments as lawful forms of payment.

2. Emergency Banking Act of 1933

The Act granted unprecedented authority to the government to restructure the monetary system.

Impact on Currency

- Removal of Gold as Legal Tender: The Act immediately suspended the gold standard, prohibiting the redemption of currency in gold.

- Use of Negotiable Instruments: By necessity, bills of exchange, bonds, and acceptances were elevated to currency status to support the functioning of banks and commercial transactions.

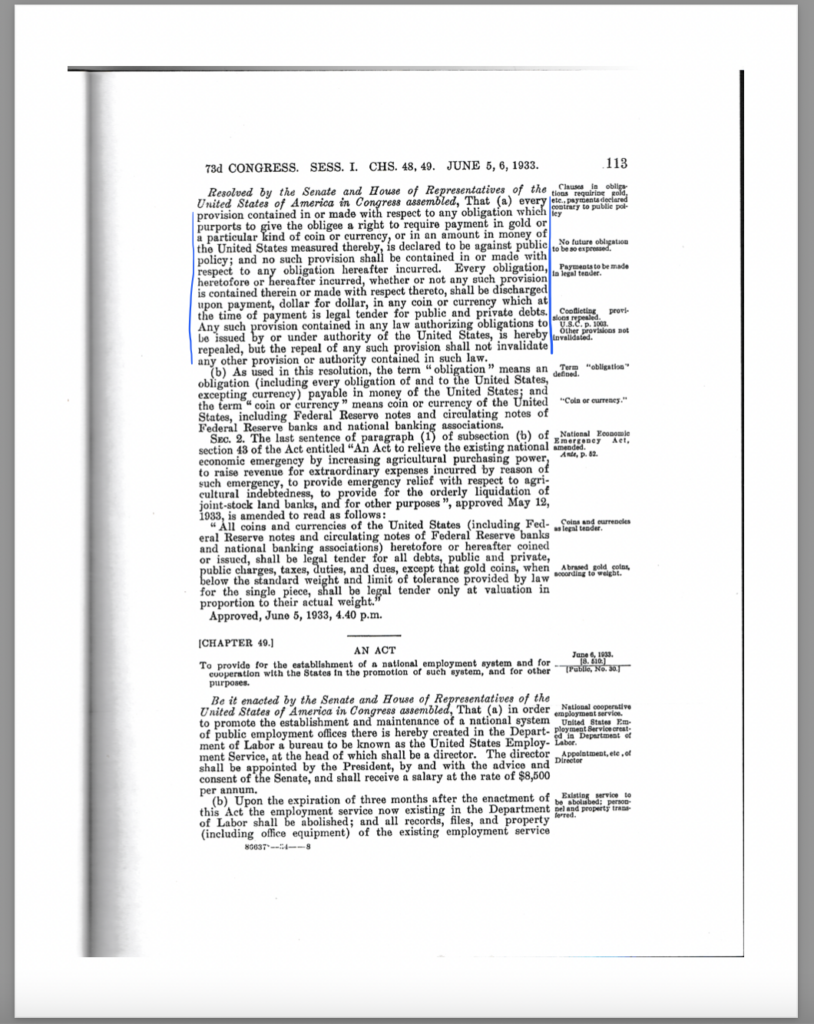

3. House Joint Resolution 192 of 1933 Public Law 73-10 (HJR 192)

Passed on June 5, 1933, HJR 192 declared that obligations requiring payment in gold were void against public policy, effectively mandating the discharge of debts using non-gold instruments.

Legal and Financial Implications

- Debt Discharge Mandate: HJR 192 required that all debts, public and private, be discharged “dollar for dollar” using currency substitutes, such as bonds and bills of exchange.

- Abolition of Gold Clauses: HJR 192 reinforced that financial instruments, rather than gold, were valid for debt settlement.

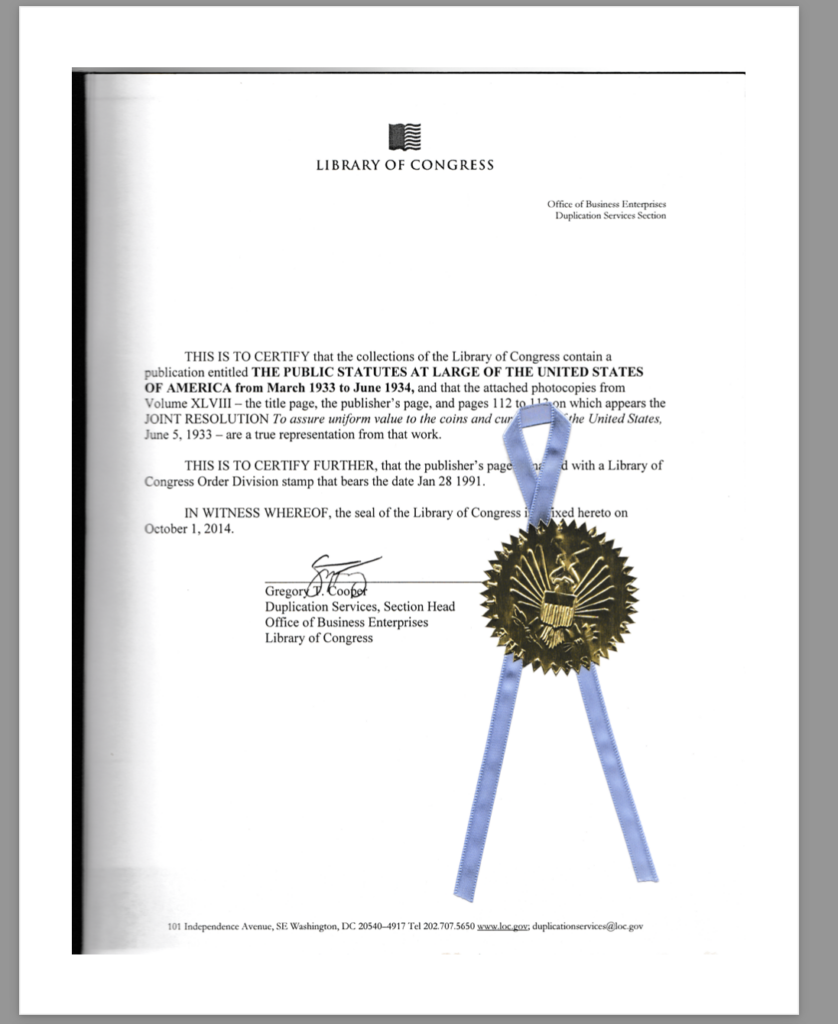

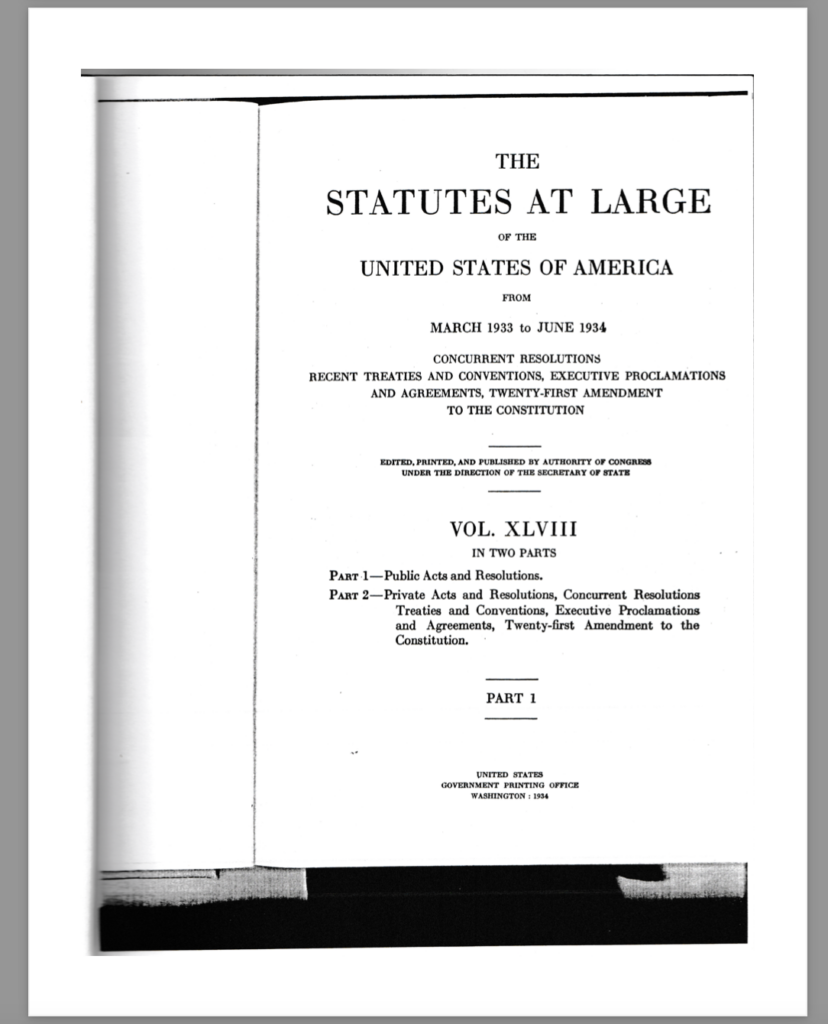

The Public Statutes at Large of the United States of America from March 1933 to June 1934: House Joint Resolution 192 of June 5, 1933, Public Law 73-10:

“every provision contained in or made with respect to any obligation which purports to give the obligee a right to require payment in gold or a particular kind of coin or currency, or in an amount in money of the United States measured thereby, is declared to be against public policy; and no such provision shall be contained in or made with respect to any obligation hereafter incurred. Every obligation, heretofore of hereafter incurred, whether or not any such provision is contained therein or made with respect thereto, shall be discharged upon payment, dollar for dollar, in any coin or currency which at the time of payment is legal tender for public and private debts.”

4. Title 31 U.S.C. and Monetary Obligations

31 U.S.C. § 5118: Abolition of Gold Clauses

This provision formally prohibits U.S. obligations from requiring repayment in gold and aligns with HJR 192 by mandating that debts be discharged in Federal Reserve Notes or other negotiable instruments.

31 U.S.C. § 3123: Payment of Obligations

This section requires the Treasury to ensure the payment of principal and interest on U.S. government obligations:

- Recognition of Financial Instruments: The government’s commitment to honoring its debts underscores the legal status of bonds and other instruments as valid means of payment.

31 U.S.C. § 5103: Definition of Legal Tender

This provision broadly defines U.S. currency to include Federal Reserve Notes and negotiable instruments as lawful tender, consistent with the principles established under the Constructive Expansion Policy.

5. Bills of Exchange, Bonds, and Acceptances as Currency

The elevation of financial instruments to currency status was a direct result of the Constructive Expansion Policy and subsequent legal codifications:

- Bill of Exchange: Recognized as negotiable instruments that serve as orders for payment in trade and finance.

- Bond: Treated as valid forms of legal tender for debt settlement and commercial transactions.

- Banker’s Acceptance (also under U.C.C. 3-409): Short-term credit instruments guaranteed by banks, widely used as a medium of exchange in commerce.

- Other Monetary Instruments: Promissory notes, Letters of Credit, and certificates of deposit are similarly recognized as currency substitutes.

6. Historical and Practical Context

The Constructive Expansion Policy established on March 9, 1933, in conjunction with the Emergency Banking Act, HJR 192 of 1933 (public law 73-10), and Title 31 provisions, fundamentally redefined the U.S. monetary system. These changes:

- Eliminated the Gold Standard: Ensured that debts could no longer be demanded in gold.

- Mandated Debt Discharge: Required the government to discharge debts “dollar for dollar” using currency substitutes.

- Expanded Currency Recognition: Elevated bills of exchange, bonds, and acceptances to currency status, ensuring liquidity and continuity in banking and commerce.

7. Conclusion

The legal and financial framework established by the Emergency Banking Act of 1933, HJR 192 of 1933 (public law 73-10), and the Constructive Expansion Policy of March 9, 1933, remains integral to the modern monetary system. By redefining “currency” to include bills of exchange, bonds, acceptances, and other financial instruments, Congress ensured that the U.S. economy could function without gold-backed currency, creating a flexible system grounded in negotiable instruments as lawful currency.

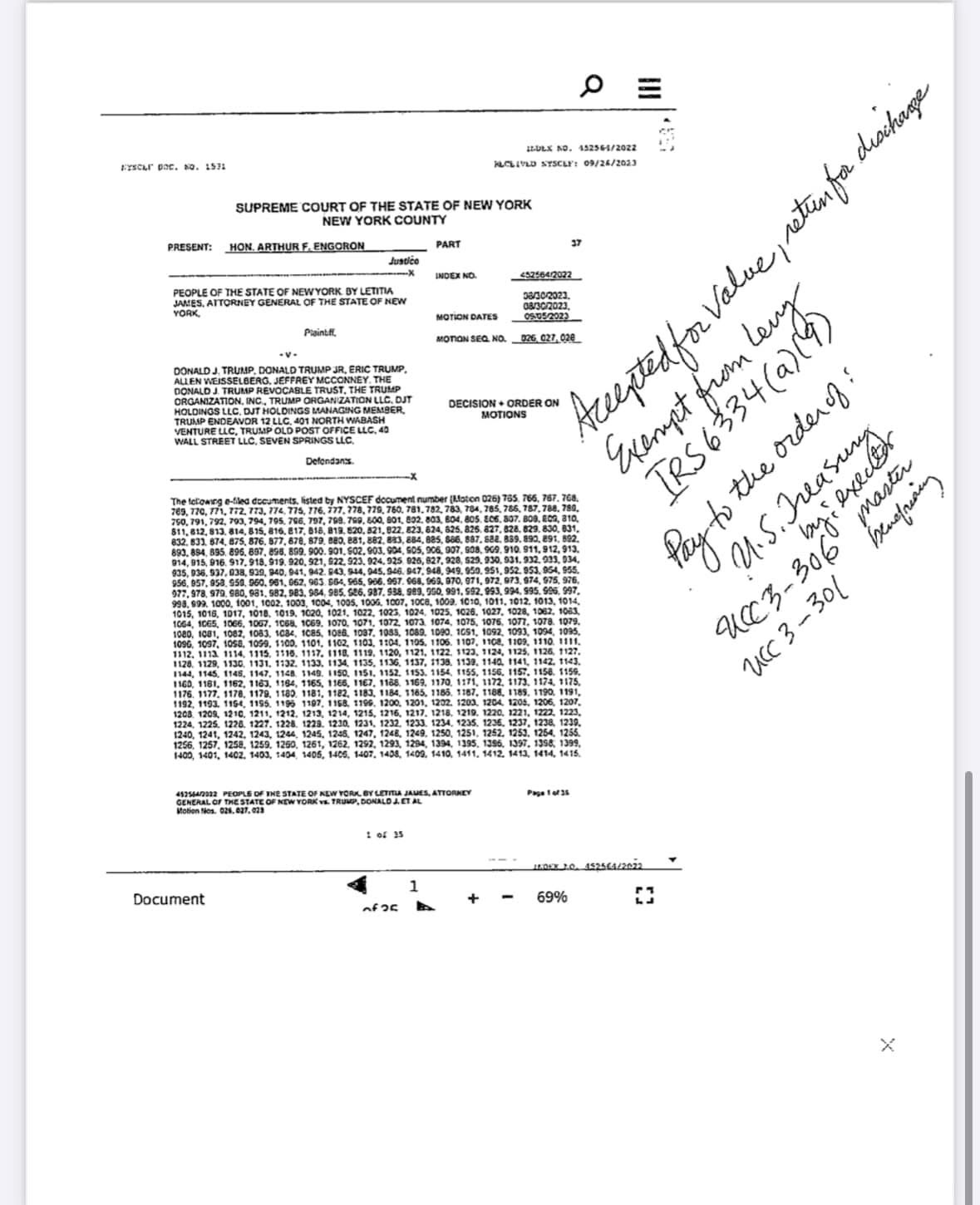

Seemingly even TRUMP knows:

IMG 2921