Corruption within the judicial system, including fraudulent accounting, improper banking practices, and organized crime, poses a severe threat to justice and financial stability. Fortunately, whistleblowers have powerful tools at their disposal to report such misconduct to the Department of the Treasury – Internal Revenue Service (IRS). Two of the most effective mechanisms for exposing financial fraud involving corrupt courts, clerks, judges, and officials are IRS Form 3949-A (Information Referral) and IRS Form 211 (Application for Award for Original Information).

This article will explain how these forms can be used to report organized financial crime and improper accounting by judicial officials, ensuring accountability through federal tax and fraud enforcement.

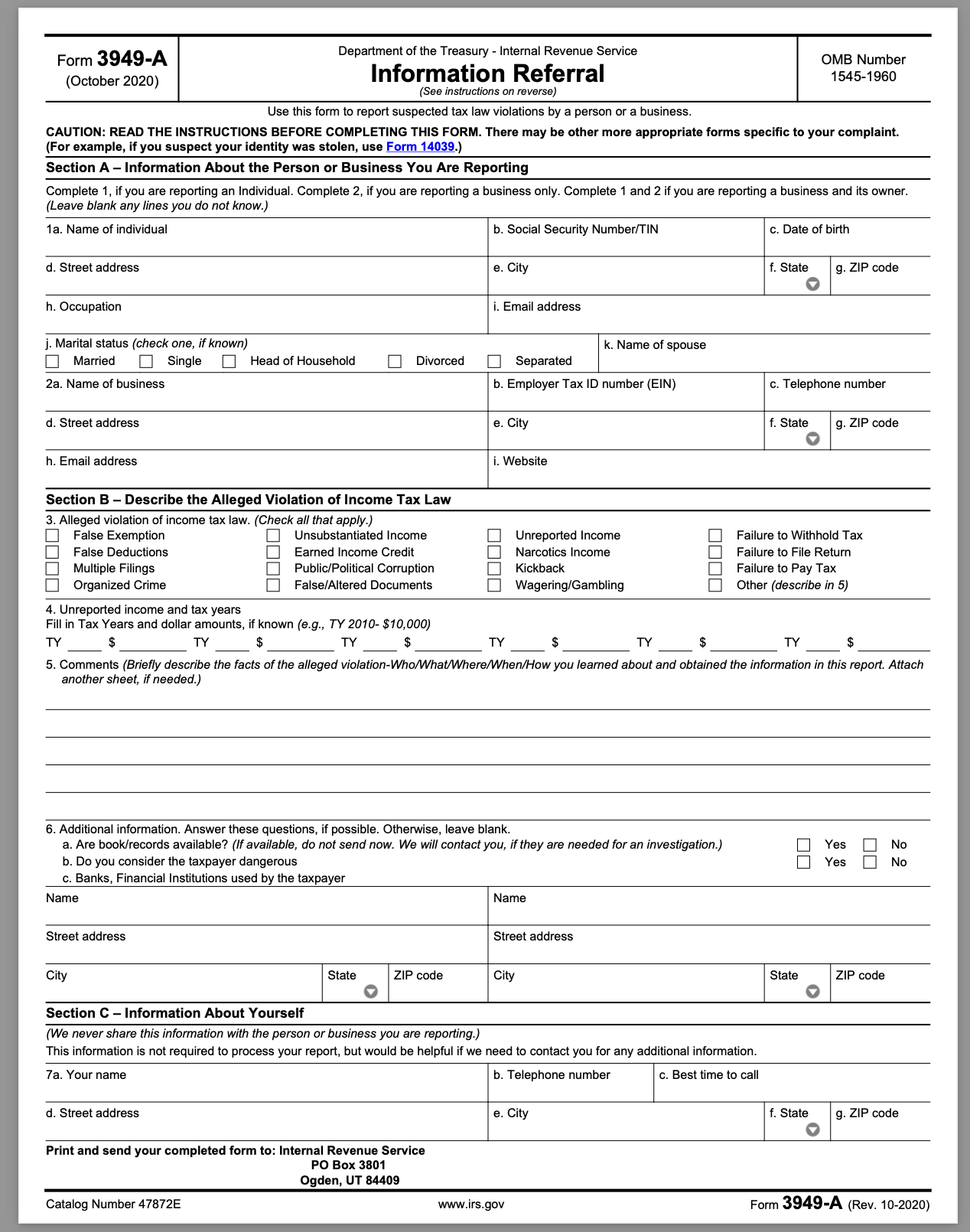

Understanding ‘Department of the Treasury – Internal Revenue Service’ Form 3949-A: Reporting Financial Crimes and Corruption

IRS Form 3949-A is designed for individuals to report suspected tax law violations, including fraud, money laundering, and illicit financial activities. This form is particularly useful for exposing:

- Fraudulent Accounting and Tax Evasion by Courts and Officials – Clerks, judges, and attorneys often engage in fraudulent tax reporting, failing to disclose illicit income or misrepresenting financial records to conceal misconduct.

- Money Laundering and Unauthorized Banking Practices – Some courts and legal officials misuse funds, operate off-the-books accounts, or participate in schemes where funds are funneled through illegitimate trusts or undisclosed bank accounts.

- Embezzlement and Misappropriation of Public Funds – Judicial officers divert funds meant for court operations, fines, and settlements into personal or private accounts, violating tax laws and fiduciary responsibilities.

- Bribery and Racketeering – Corrupt officials often receive unlawful financial benefits from attorneys, corporations, or criminal enterprises, leading to compromised rulings and selective enforcement of the law.

How to File Form 3949-A

To report these violations, individuals can complete Form 3949-A, providing specific details of the wrongdoing, including:

- Names and Titles of Offenders – List the judges, clerks, attorneys, or officials involved.

- Specific Financial Violations – Describe the nature of the crime, such as false tax filings, bribery payments, or hidden assets.

- Supporting Documentation – Include any evidence, such as bank statements, fraudulent court orders, or financial irregularities.

- Anonymous Submission – The IRS allows submissions without revealing the identity of the whistleblower.

Once completed, the form should be mailed to:

Internal Revenue Service

PO Box 3801

Ogden, UT 84409

The IRS investigates these claims and, if violations are confirmed, legal and financial consequences follow, including asset seizures, fines, and potential criminal charges.

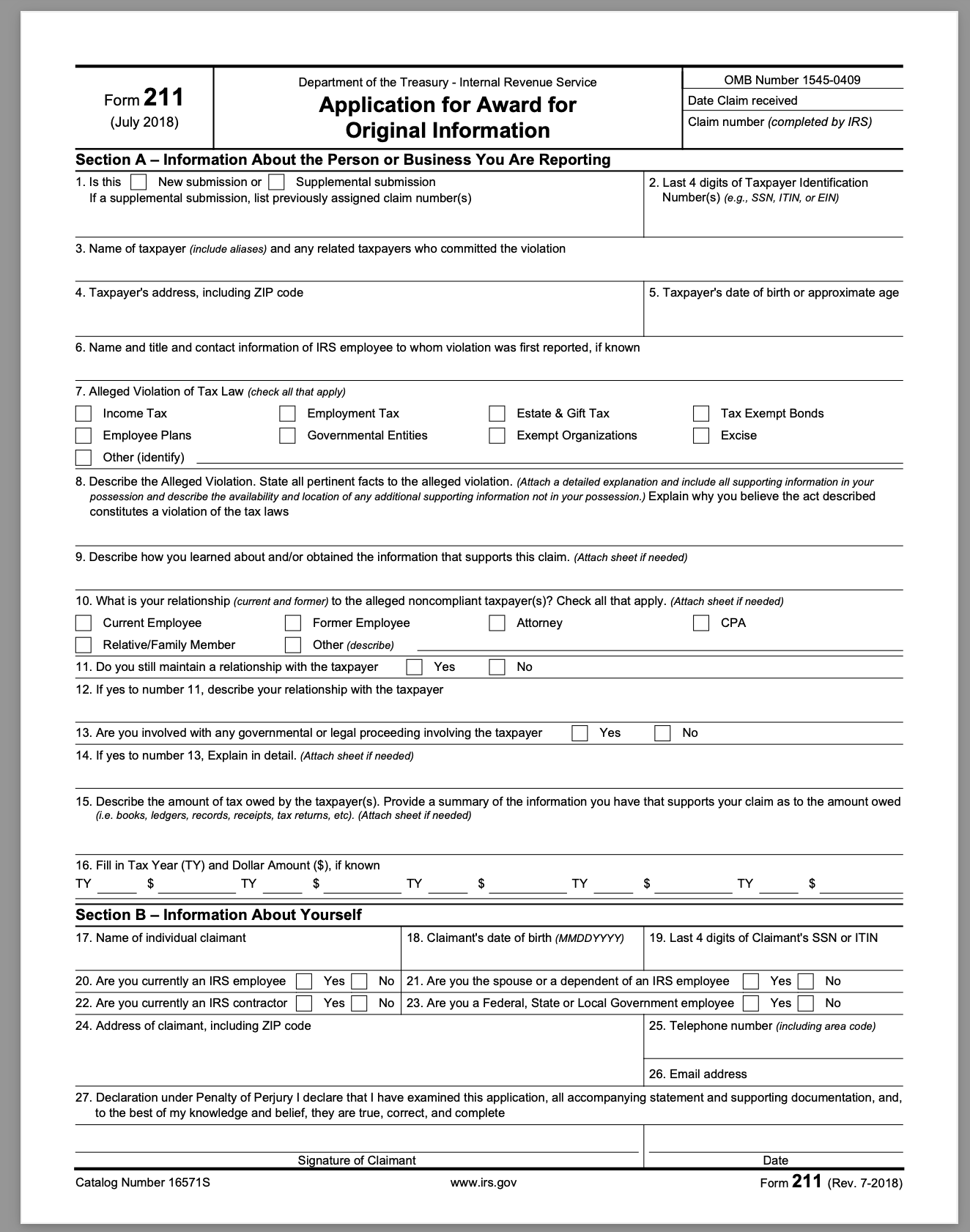

Using ‘Department of the Treasury – Internal Revenue Service’ Form 211: Whistleblower Rewards for Reporting Large-Scale Corruption

For cases involving significant financial fraud, where the IRS recovers $2 million or more, whistleblowers can use IRS Form 211 to report the misconduct and qualify for a financial reward. This form is particularly valuable when exposing:

- Judicial Corruption on a Large Scale – If a judge or court is facilitating multimillion-dollar fraud schemes, this form ensures a financial incentive for those providing actionable intelligence.

- Improper Handling of Court Funds – Clerks or administrative officials who manipulate financial records to launder money or evade taxation.

- Law Firms Engaging in Tax Evasion and Money Laundering – Some attorneys collude with judicial officers to misreport income, shield funds in offshore accounts, or engage in fraudulent financial dealings.

How to File Form 211 and Claim a Reward

-

Gather Evidence – Collect all available documentation proving the fraud, such as fraudulent tax returns, court financial statements, or unauthorized banking transactions.

-

Complete Form 211 – Provide detailed information on the individuals and entities involved, the estimated amount of unpaid taxes, and the method of fraud.

-

Submit to the IRS Whistleblower Office – Send the completed form to:

IRS Whistleblower Office

1973 N. Rulon White Blvd.

M/S 4110

Ogden, UT 84404 -

IRS Investigation and Reward – If the IRS successfully prosecutes and recovers funds based on the provided information, whistleblowers can receive between 15% and 30% of the amount collected.

Why These Forms Matter in Exposing Judicial and Government Corruption

1. Unveiling Hidden Financial Networks

Many corrupt officials exploit their positions to engage in undisclosed banking transactions, fraudulent real estate deals, and money laundering through the courts. IRS investigations can track these illicit transactions and bring perpetrators to justice.

2. Holding Officials Accountable for Tax Crimes

Courts and government officials must comply with tax laws like any other entity. Reporting their financial misconduct ensures that those abusing public trust face tax evasion charges, penalties, and asset forfeitures.

3. Disrupting Organized Crime in the Judicial System

Judicial corruption often intersects with organized crime, racketeering, and banking fraud. The IRS has broad authority to investigate criminal financial enterprises, even when traditional law enforcement fails to act due to internal collusion.

4. Providing a Safe and Rewarding Path for Whistleblowers

Because IRS whistleblower programs allow for anonymous reporting, individuals can safely expose corruption without fear of retaliation. Those who submit Form 211 may also receive substantial financial compensation for their role in exposing tax-related fraud.

Conclusion: A Powerful Tool for Justice

Corrupt courts, clerks, judges, and officials often manipulate financial systems, engage in tax fraud, and collude with organized crime to escape accountability. IRS Forms 3949-A and 211 provide a powerful avenue for whistleblowers to expose these violations, ensuring that fraudulent financial activities are investigated and prosecuted.

By reporting misconduct through the IRS, individuals contribute to transparency, financial accountability, and the dismantling of corruption within the judicial system. Those with evidence of large-scale fraud not only assist in bringing criminals to justice but may also receive substantial monetary rewards.

For those aware of illegal financial activities within the judicial system, now is the time to act. Expose the fraud, protect the integrity of the courts, and ensure justice prevails.