Wells Fargo is now subject to a Demand for Summary Judgment after failing to rebut sworn affidavits, thereby admitting—by operation of law—to fraud, dishonor, and lack of standing. Under California law, summary judgment is mandatory when no triable issue of fact exists, and Wells Fargo’s silence serves as a legal admission of liability. This case highlights the bank’s documented history of foreclosure fraud, echoing past rulings where courts have dismissed their claims with prejudice.

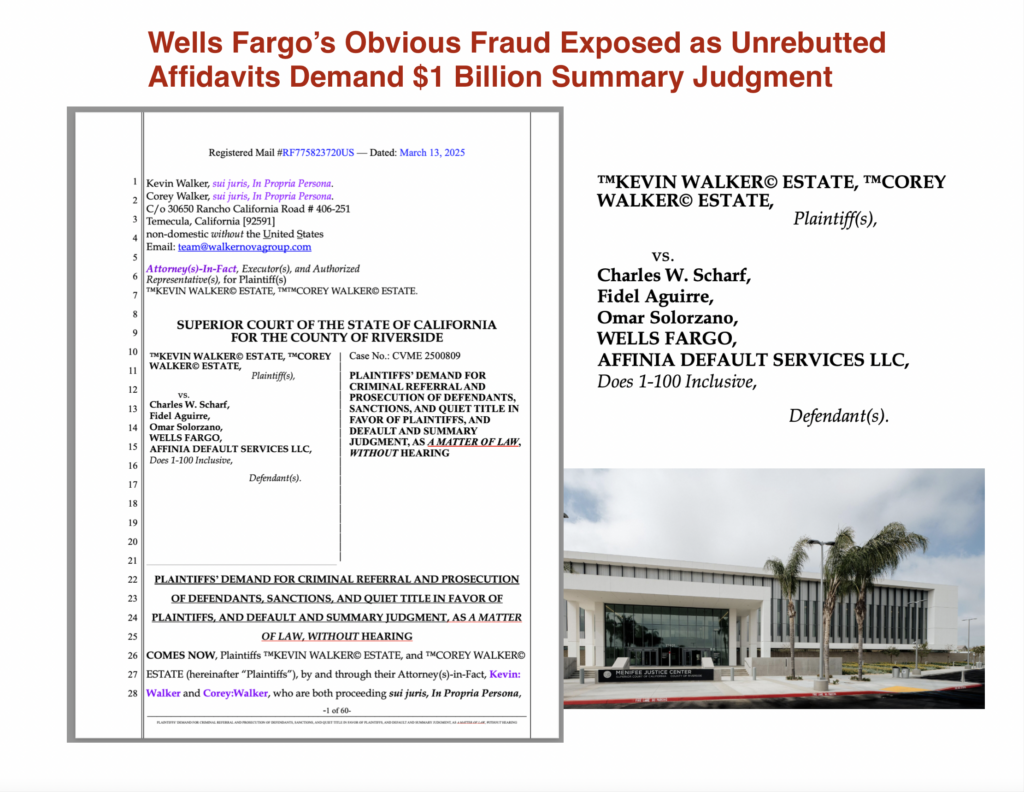

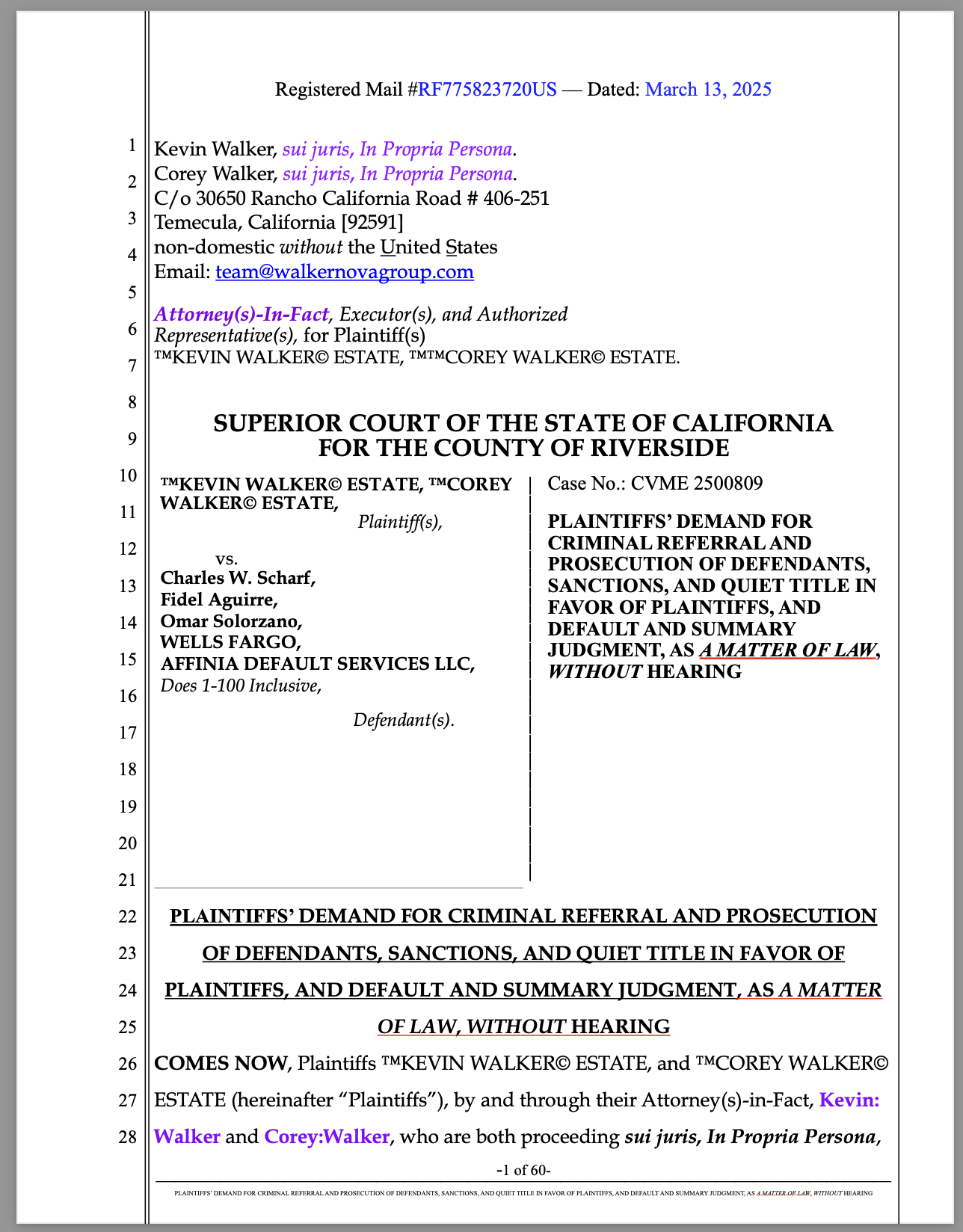

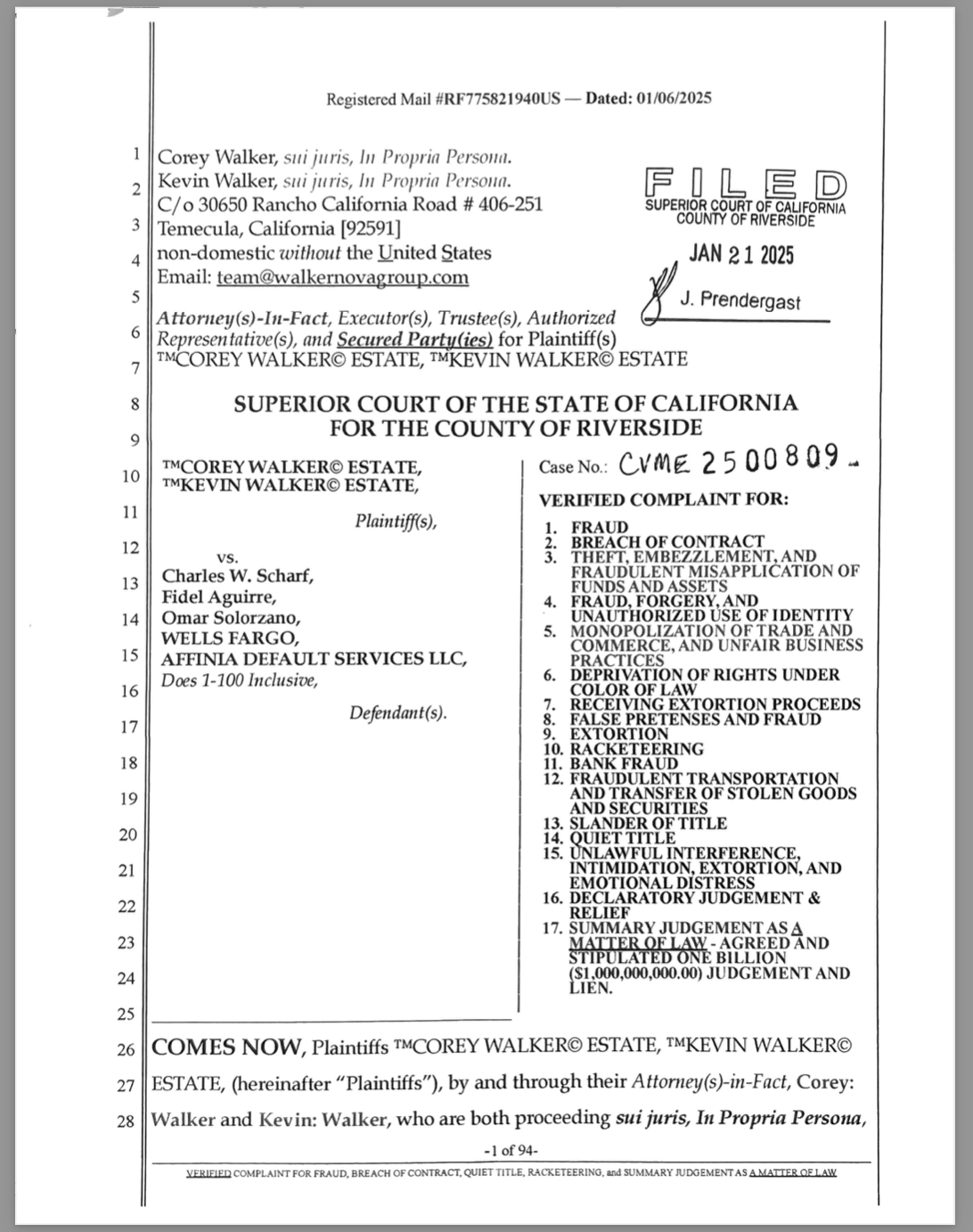

In Walker v. Wells Fargo (Case No. CVME 2500809), plaintiffs KEVIN WALKER ESTATE and COREY WALKER ESTATE, et al have filed a Demand for Summary Judgment, exposing fraudulent conduct, willful dishonor, and lack of lawful standing on the part of Wells Fargo and its co-defendants. Under California Code of Civil Procedure § 437c(c), summary judgment must be granted when no triable issue of material fact exists. With Wells Fargo’s failure to rebut sworn affidavits, the facts are established as admitted truth under the law, leaving the court no discretion but to rule in favor of the plaintiffs.

Wells Fargo’s Fraudulent Actions Are Now Uncontested

The plaintiffs’ complaint outlines Wells Fargo’s fraudulent conduct, including:

- False claims of standing and authority over the property in question

- Failure to lawfully validate any alleged debt obligation

- Refusal to respond to lawful notices and demands for proof of claim

- Engaging in fraudulent business practices and dishonor under the Uniform Commercial Code (UCC)

The case hinges on unrebutted affidavits, which stand as binding, unrebutted truth in both common law and commerce. The legal principle is clear:

“Statements of fact contained in affidavits which are not rebutted by the opposing party’s affidavit or pleadings may be accepted as true by the trial court.” — Winsett v. Donaldson, 244 N.W.2d 355 (Mich. 1976)

By remaining silent and failing to rebut the affidavits, Wells Fargo has effectively admitted to fraud, dishonor, and lack of standing.

Fraud Vitiates Everything: Wells Fargo Admits Guilt by Silence

Fraud is one of the most serious offenses under the law. It destroys legal standing, voids contracts, and invalidates claims. The plaintiffs’ Verified Complaint explicitly alleges fraud, embezzlement, identity theft, racketeering, bank fraud, and other criminal acts, all of which have been legally admitted by Wells Fargo’s failure to rebut the allegations. Courts have long recognized that silence in the face of an unrebutted affidavit is an admission of guilt:

✅ “He who does not deny, admits.”

✅ “An unrebutted affidavit stands as truth in commerce.”

✅ “An unrebutted affidavit becomes the judgment in commerce.”

Since Wells Fargo’s fraud is now proven and unrebutted, they have no lawful standing to enforce any claims. This means:

- Any contracts, claims, or liens asserted by Wells Fargo are void.

- Their failure to rebut affidavits serves as an admission of fraud and dishonor.

- They have no legal grounds to contest the summary judgment motion.

By law, summary judgment is the only lawful outcome under these conditions.

California Law Requires Summary Judgment Be Granted

Under California Code of Civil Procedure § 437c(c), summary judgment must be granted when:

- No triable issue of material fact exists.

- The moving party is entitled to judgment as a matter of law.

This standard is reaffirmed by the California Supreme Court in Aguilar v. Atlantic Richfield Co., 25 Cal. 4th 826, 843 (2001):

“Once the moving party has met its burden, the court must grant summary judgment if the opposing party fails to produce evidence of a triable issue.”

In this case, Wells Fargo has produced no evidence and has failed to rebut the sworn affidavits. Since all material facts are established and uncontested, the court has no discretion—it must grant summary judgment in favor of the plaintiffs.

Wells Fargo’s Own History of Fraudulent Practices Further Supports the Case

This is not the first time Wells Fargo has been caught engaging in fraudulent mortgage practices and attempting to enforce claims without legal standing. The following existing case law already highlights Wells Fargo’s involvement in unlawful lending, misrepresentation, and foreclosure fraud:

Jurisdiction and Standing in Court

-

Wells Fargo Bank v. Byrd, 178 Ohio App.3d 285 (2008):

“If plaintiff has offered no evidence that it owned the note and mortgage when the complaint was filed, it would not be entitled to judgment as a matter of law.” -

Indymac Bank v. Bethley, 880 N.Y.S.2d 873 (2009):

“The Court is concerned that there may be fraud on the part of plaintiff or at least malfeasance. Plaintiff INDYMAC (Deutsche) must have ‘standing’ to bring this action.”

Since Wells Fargo has failed to establish ownership and standing in previous cases, their claims in this case are equally void.

Fraud and Misrepresentation in Mortgage Cases

Courts have dismissed foreclosure cases with prejudice against Wells Fargo due to their fraudulent practices:

-

Wells Fargo, Litton Loan v. Farmer, 867 N.Y.S.2d 21 (2008):

“Wells Fargo does not own the mortgage loan… Therefore, the matter is dismissed with prejudice.” -

Wells Fargo v. Reyes, 867 N.Y.S.2d 21 (2008):

“Dismissed with prejudice, Fraud on Court & Sanctions. Wells Fargo never owned the Mortgage.”

These cases mirror the current situation, where Wells Fargo has again failed to provide any lawful evidence of ownership or standing.

Wells Fargo’s Silence is an Admission of Fraud and Guilt

Wells Fargo has now been formally accused and found guilty by their own silence. The plaintiffs’ Verified Complaint explicitly states that:

- Wells Fargo is in default under U.C.C. § 3-505 due to dishonor and non-response.

- Wells Fargo’s failure to rebut the Verified Complaint serves as a tacit admission of guilt.

- Wells Fargo has stipulated to a $1,000,000,000.00 judgment by failing to contest the claims.

Since all claims are now deemed admitted, Wells Fargo is legally and factually liable for:

- Fraud and fraudulent misrepresentation

- Breach of contract

- Embezzlement

- Identity theft

- Bank fraud

- RICO (racketeering) violations

- Extortion

As a result, summary judgment must be entered, and all fraudulent claims by Wells Fargo must be stricken as void ab initio (invalid from the beginning).

Final Action Required by the Court

Since no factual dispute remains and Wells Fargo’s fraud is unrebutted, the court is required to act as follows:

✅ Grant summary judgment in favor of the plaintiffs

✅ Recognize the validity of the unrebutted affidavits as final truth

✅ Enter a final judgment securing quiet title for the plaintiffs

✅ Enforce financial damages and any lawful remedies sought

Wells Fargo’s silence is an admission of fraud and dishonor. The law dictates that summary judgment must be granted, and any claims made by the defendants must be stricken as void ab initio (invalid from the beginning).

Wells Fargo’s Fraud is Fully Exposed—The Law is Clear

This case adds to the long list of cases where Wells Fargo has been caught falsifying mortgage claims, violating federal laws, and attempting to enforce debts without standing. The court must uphold the law and grant summary judgment in favor of the plaintiffs.