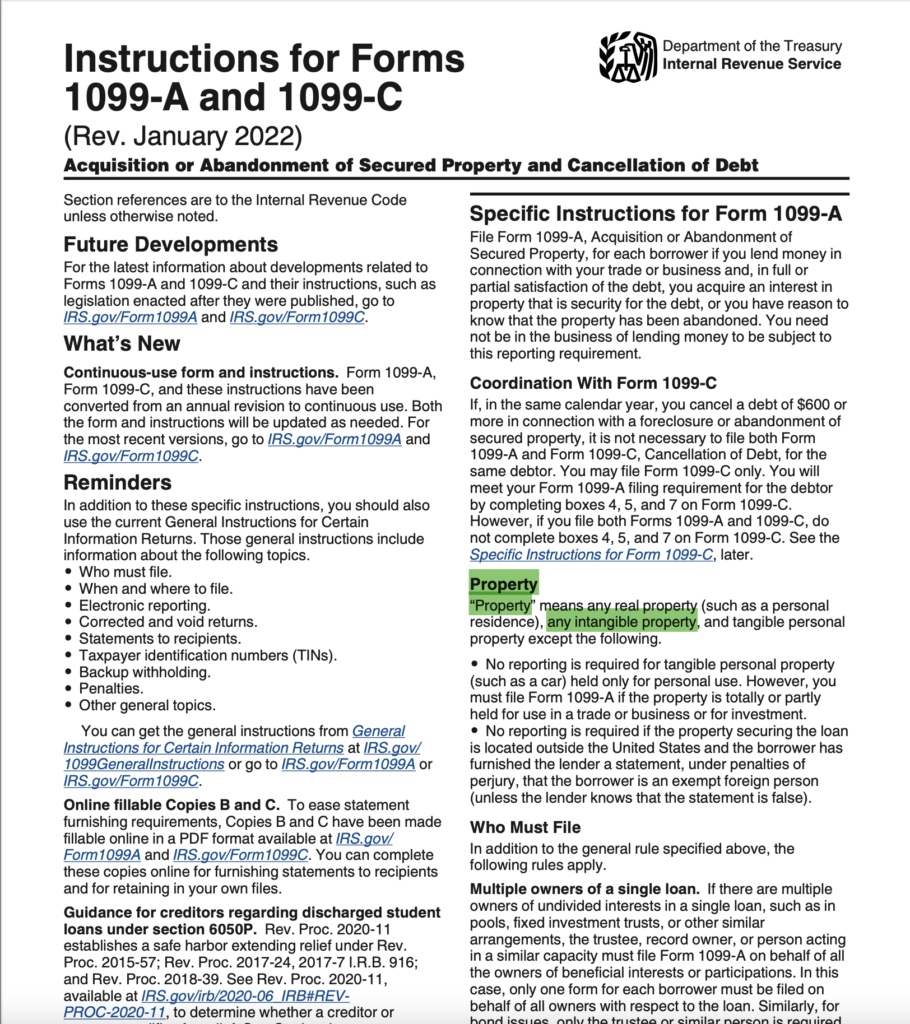

Form 1099-A, titled “Acquisition or Abandonment of Secured Property,” is utilized for the “Abandonment” or “Acquisition” of secured property. The IRS directives from 2022 state:

“Use Form 1099-A, Acquisition or Abandonment of Secured Property, when you lend money in connection with your trade or business and you either acquire an interest in property that is security for the debt, or you know that the property has been abandoned. This reporting requirement applies even if you are not in the business of lending money.”

The IRS further clarifies that “Property” encompasses: “real property (like a personal residence), any intangible property, and tangible personal property, with certain exceptions.”

This leads us to evaluate three key concepts: “Intangible Property,” “Interest,” and “Security.”

“Intangible Property” is defined as property that doesn’t have intrinsic and marketable value on its own but represents or evidences value, such as stock certificates, bonds, promissory notes, checks, dollars/federal reserve notes, credit, debt instruments, UCC1 Filings, and franchises.

“Interest,” particularly in relation to Property, is a broad term covering rights and claims to lands or chattels.

“Security” and “Securities” refer to evidences of debts or property rights and obligations to pay money or participate in earnings and distribution of corporate, trust, and other property assets.

Therefore, when the IRS refers to “obligations” in Form 1099-A, it includes, but is not limited to, promissory notes, deeds, liens, checks, federal reserve notes, deposits, credit payments and use (like car payments, credit card payments, utility bills, etc.).

So, revisiting the IRS instructions with this understanding:

“File Form 1099-A for each borrower if you, in your trade or business, lend money and, as full or partial satisfaction of the debt, acquire an interest in property that serves as security for the debt, or have reason to believe the property has been abandoned. This reporting requirement applies even if you are not primarily in the business of lending money.”

In summary, the filing of a 1099-A is mandatory not just for those in the lending business. It’s required if you have acquired or abandoned any secured property, such as promissory notes, deeds, liens, checks, federal reserve notes, deposits, credit payments and use (like car payments, credit card payments, utility bills, etc.).