™WALKERNOVA GROUP©

We are a private educational and administrative support firm focused on matters involving Constitutional rights, private and public law distinctions, secured transactions, trust and estate structuring, negotiable instruments, and lawful remedy under equity, contract, and commercial law.

Our areas of concentration include State Citizenship, national status clarification, lawful trust and contract administration, UCC-based filings, private banking principles, estate planning, foreclosure defense strategies, and lawful documentation involving trusts, deeds, securities, and equity interests.

We believe that rights must be lawfully asserted to be preserved, and that the distinction between rights, privileges, and benefits is critical. Every day, individuals are subjected to actions taken under color of law due to widespread misunderstanding of legal terminology, contract enforcement, and the operation of legal fictions.

We help clarify the proper use and interpretation of commonly misunderstood terms such as:

individual, person, financial institution, national, state Citizen, U.S. citizen, secured party, attorney-in-fact vs. attorney-at-law, and more—ensuring that lawful standing and private rights are clearly distinguished from statutory presumptions.

FEATURED VIDEOS

LATEST NEWS

IMMUNITY STRIPPED: Verified Complaint for RICO, Bivens Violations, and Constitutional Torts Against Federal and State Judges Sunshine Sykes and Raquel Marquez, and Attorneys John and Therese Bailey for colluding, engaging in fraud, and acting ultra vires and WITHOUT jurisdiction

A groundbreaking verified complaint has been filed in the U.S. District Court for the District of Columbia naming Federal Judge Sunshine Suzanne Sykes, State Judge Raquel A. Marquez, and attorneys John and Therese Bailey in a RICO and Bivens action for fraud, collusion, and ultra vires acts. The suit exposes coordinated judicial misconduct, void orders, and abuse of power carried out without jurisdiction or immunity. This case marks a historic challenge to the illusion of judicial untouchability and a direct demand for accountability before a jury of the People.

THE PEOPLE ARE SOVEREIGN Affirmed by the State Constitutions and the Constitution for the United States of America

This declaration proves what every Constitution in America already affirms — the People are sovereign.

Drawn directly from all fifty State Constitutions and the Constitution for the United States of America, this document exposes how all lawful power originates from the People and is only delegated to government by consent.

It stands as irrefutable, judicially noticeable evidence that judges, attorneys, clerks, sheriffs, and politicians are mere trustees and servants of the People’s authority.

A must-read for anyone ready to understand where real sovereignty and lawful power truly reside.

ALL LOANS, MORTGAGES, AND PUBLIC UTILITY BILLING CONTRACTS OPERATE AS GOVERNMENT OBLIGATIONS

This article exposes how every loan, mortgage, and public utility billing contract operates as a federally recognized government obligation — not a private contract. Backed by statutes like 18 U.S.C. § 8, 12 U.S.C. § 411, and 31 U.S.C. § 3123, the credit you generate is monetized and guaranteed by the United States Treasury. Banks and utility companies merely act as intermediaries, while your signature creates the actual value. This legal breakdown reveals the true debtor-creditor dynamic hidden behind everyday commerce. The truth isn’t theory — it’s codified in law.

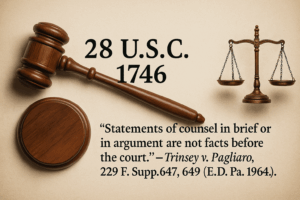

Verified Truth and the Collapse of Jurisdiction: When Courts Ignore 28 U.S.C. § 1746

This article establishes that verified filings under 28 U.S.C. § 1746 constitute sworn evidence equal to notarized affidavits and, when unrebutted, stand as final truth in law. Supported by Rule 8(b)(6) and Rule 56, it demonstrates that verified facts must be admitted and summary judgment becomes mandatory once no genuine dispute remains. Federal precedent confirms that attorney argument is not evidence (Trinsey v. Pagliaro, 229 F. Supp. 647) and that verified complaints carry full evidentiary weight. Under the Clearfield Doctrine, all statutory and public acts are commercial, binding officials to the same evidentiary standards as private parties. Any judicial act ignoring verified truth is ultra vires, void ab initio, and actionable under 42 U.S.C. § 1983 and Bivens v. Six Unknown Agents.

The Great Overlay: The BAR-Run Conversion of Americans into Wards — The Codification Process From Organic Sovereignty to Corporate Statutory Rule

What began as freedom under Natural Law has been hijacked by statutes, attorneys, and codification into a corporate empire. The Great Overlay dismantles the illusion of justice by showing how BAR-run courts reduce men and women to incompetent wards while enforcing color of law. This is a devastating breakdown of the fraud behind “U.S. citizenship” and the unlawful corporate overlay that replaced the republic.

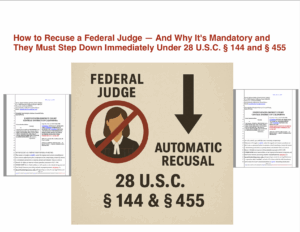

How to Recuse a Federal Judge — And Why It’s Mandatory and They Must Step Down Immediately Under 28 U.S.C. § 144 and § 455

Learn how to lawfully recuse a biased federal judge using 28 U.S.C. §§ 144 and 455. Once a verified motion and affidavit are filed, disqualification is immediate, mandatory, and strips the judge of all jurisdiction. Any continued action by that judge is ultra vires and void ab initio. This article exposes the legal authority behind automatic recusal and outlines your remedies if the judge refuses to step down.Ask ChatGPT

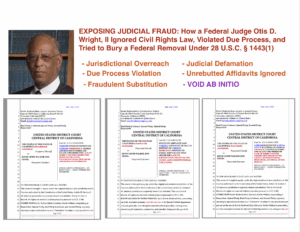

EXPOSING JUDICIAL FRAUD: How a Federal Judge Otis D. Wright, II Ignored Civil Rights Law, Violated Due Process, and Tried to Bury a Federal Removal Under 28 U.S.C. § 1443(1)

A federal judge’s July 2025 order is now under fire for unlawfully striking a removal, misapplying criminal statutes, ignoring unrebutted affidavits, and participating in a fraudulent party substitution. The case, originally removed under 28 U.S.C. § 1443(1), involves severe allegations of constitutional violations, jurisdictional fraud, and due process abuse. Despite clear legal precedent barring time limits on § 1443 removals, the court falsely claimed the removal was untimely and smeared the petitioner with defamatory labels. This article exposes the judicial misconduct, factual distortions, and illegality underlying the void order now being challenged.

EMERGENCY PETITION FOR WRIT MANDAMUS VANISHES: Ninth Circuit Fraud, Tampering, Judicial Collusion, and a Federal Cover-Up Seems Unequivocal

Federal courts are now under scrutiny after a verified Writ of Mandamus vanished from the Ninth Circuit docket without explanation—raising grave concerns of judicial tampering, fraud, and systemic misconduct. Judge Sunshine Sykes defied clear jurisdictional divestiture by issuing rulings on a matter under appellate review, violating 28 U.S.C. § 144 and § 1651. This article exposes a disturbing pattern of ultra vires acts, denial of due process, and potential RICO violations implicating both district and appellate judges.Ask ChatGPT

Petition for Writ of Mandamus Filed with Ninth Circuit — Treason from the Bench: How Judge Otis D. Wright II Denied Due Process, Obstructed Federal Jurisdiction, and Committed Fraud Upon the Court

This explosive exposé reveals how U.S. District Judge Otis D. Wright II unlawfully struck verified federal filings, obstructed civil rights removal under 28 U.S.C. § 1443(1), and defamed the Petitioner as a "sovereign citizen" without cause. The article details a pattern of judicial fraud, denial of due process, and unconstitutional party substitution—all under color of law. A Verified Emergency Petition for Writ of Mandamus has now been filed with the Ninth Circuit to vacate the void order and demand full dismissal. This is a critical case of federal overreach, judicial misconduct, and systemic abuse.

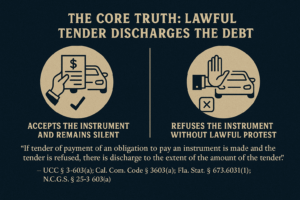

When the Debt Is Discharged but the LIEN Remains: Why Auto and Home Loan Lenders Who Ignore Lawful Tender Are Committing Fraud and Commercial Crimes

This article delivers a devastating legal breakdown proving that lawful tender—once made and unrebutted—discharges auto loan debt under UCC §§ 3-601, 3-603, 3-310, 2-206, and 1-103, as codified in Cal. Com. Code §§ 3601, 3603, 3310, 2206, 1103, Fla. Stat. §§ 673.6011, 673.6031, 673.3101, 672.206, 671.103, and N.C.G.S. §§ 25-3-601, 25-3-603, 25-3-310, 25-2-206, 25-1-103. It exposes refusal to release a lien after lawful discharge as actionable fraud, conversion, embezzlement, and obstruction under state and federal law. With verified case law and commercial principles, it explains how silence equals acceptance and how creditors become commercially estopped. A must-read for secured parties, fiduciaries, and equity claimants demanding lien removal, declaratory relief, and commercial remedy.

How a Perfected Security Agreement and UCC Filings Strip Servicers of Foreclosure Rights

A properly executed Security Agreement assigning all assets, rights, and interests to a private trust—paired with a UCC-1 financing statement and UCC-3 amendment claiming the Deed of Trust and Note—lawfully establishes the trust as the secured party and real party in interest. This perfected interest, under UCC §§ 9-203, 9-509, 3-301, and supported by controlling case law (e.g., Carpenter v. Longan, Ibanez, Veal), strips any servicer or third-party of standing to foreclose unless they possess the original Note, prove an unbroken chain of title, and rebut the trust’s perfected claim. Without that, all foreclosure attempts become void ab initio, commercial dishonor, and legal trespass on private trust property.

Fraud Upon the Court and Judicial Complicity: Judge Marquez Aids RICO Conspirators and Attempts to Punish “the People”

A federal RICO action filed in the U.S. District Court for the Central District of California unveils a calculated scheme orchestrated by attorneys Barry Lee O’Connor and John Bailey, in concert with MARINAJ PROPERTIES and the Doumit family. The Verified Complaint lays out a detailed pattern of racketeering involving simulated legal proceedings, fraudulent conveyance, and theft of trust assets through a void and defective Trustee’s Deed. Despite perfected title claims and unrebutted affidavits establishing lawful ownership, Judge Rachel A. Marquez has enabled the misconduct by shielding culpable parties and targeting the rightful beneficiaries asserting their rights. The suit cites violations of 18 U.S.C. §§ 1962 (RICO), 241 (conspiracy against rights), and 1341 (mail fraud), along with California Civil Code §§ 1709 (fraud) and 3346 (treble damages for wrongful injury to property). This case exemplifies judicial corruption—where bar-protected insiders act with impunity while private Americans are silenced. The court’s response will reveal whether justice, equity, and due process remain alive in California.

SERVICES & PRODUCTS

BOOKS, DOCUMENTS, RESOURCES

-

OXFORD DICTIONARY OF LAW

$0.00 Add to cart -

The Concise Dictionary of Current English Adapted by H. W. FOWLER and F. G. FOWLER – 1919

$0.00 Add to cart -

The Story of The Social Security Number by Carolyn Puckett

$0.00 Add to cart -

Dealing With Presentments

$0.00 Add to cart -

HOW TO CREATE CURRENCIES FOR LOCAL COMMUNITIES, By Hartford Van Dyke, Commercial Lawyer

$0.00 Add to cart -

The Holy Bible – Geneva Edition 1st Printing, 1st Edition in 1560

$0.00 Add to cart -

CREDIT CLEAN UP – STEPS 1 & 2

$100.00Original price was: $100.00.$0.00Current price is: $0.00. Add to cart -

BIRTH CERTIFICATE BOND COVER LETTER

$0.00 Add to cart -

MORTGAGE VERIFICATION LETTER

$300.00Original price was: $300.00.$9.99Current price is: $9.99. Add to cart -

NOTICE OF DEFAULT TEMPLTE – 2010-01

$150.00Original price was: $150.00.$0.00Current price is: $0.00. Add to cart -

Modern Money Mechanics, By Federal Reserve Bank of Chicago – 1994

$0.00 Add to cart -

Black’s Law Dictionary 3rd Edition – 1910

$197.00Original price was: $197.00.$0.00Current price is: $0.00. Add to cart

For Smart visionaries

Embrace the Wisdom of Time and Money

In the pursuit of your dreams, remember that money is but a means to an end, a tool in your hands to craft the life you envision. Invest it wisely, not just in financial endeavors, but in experiences that enrich your soul. Time, the most precious currency, is the foundation of your journey. Allocate it with care, for it is the true measure of wealth. Seize each moment, for in its passage lies the essence of a life well-lived. Let your pursuits be guided by purpose, and may every resource at your disposal serve to enhance the tapestry of your existence.