On April 2, 2025, the Plaintiffs in Kevin Walker Estate, et al. v. Jay Promisco, et al., Case No. 5:25-cv-00339-JGB, formally filed a Verified Notice of Appeal to the U.S. Court of Appeals for the Ninth Circuit. This filing is not just a procedural formality—it outlines a detailed and extensive challenge to what Plaintiffs describe as gross procedural errors, record tampering, suppression of filings, and constitutional violations by both court officers and defendants.

🔔 Summary of the Appeal Filing

The Notice of Appeal, submitted by Kevin Walker and Donnabelle Mortel as Attorneys-in-Fact for the respective trusts and estates, formally contests the Order of Dismissal issued on March 19, 2025, by Judge Jesus G. Bernal. The Plaintiffs allege that the Order is void ab initio, rendered without proper process, and is based on:

-

Defective and untimely filings by the Defendants;

-

Omission of Plaintiffs’ timely responses from the docket;

-

Failure to consider unrebutted affidavits and demands for summary judgment;

-

Refusal to acknowledge proper service and constitutional claims;

-

Judicial bias, including labeling the Plaintiffs’ filings as “sovereign citizen theories” without addressing the substance.

⚖️ Key Legal Challenges Raised in the Appeal

1. Violation of Due Process

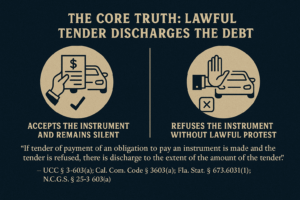

The Plaintiffs claim that the court ignored unrebutted, verified affidavits, improperly failed to docket key filings, and dismissed the matter without a hearing—each constituting serious due process violations under the 5th and 14th Amendments.

2. Improper Dismissal Without Joint Motion

Defendants failed to file a joint motion to dismiss, despite multiple named parties—an action required under procedural rules when several parties are involved. The separate motion filed by PHH Mortgage was therefore allegedly procedurally invalid.

3. Refusal to Acknowledge Valid Special Appearance

Plaintiffs appeared by Special Limited Appearance, under power of attorney and in accordance with statutory and equitable remedies. Their filings included an extensive record of affidavits, conditional acceptances, and demands for criminal referral, none of which were contested in substance.

4. Judicial Bias and Mischaracterization

The dismissal order characterized Plaintiffs’ filings as “frivolous,” “unintelligible,” and based on “sovereign citizen theories.” Plaintiffs argue this constitutes judicial misconduct, defamation, and color of law violation, especially since no findings of fact or hearings were held.

Kevin_Walker_Estate_et_al_v_Jay_Promisco_et_al__cacdce-25-00339__0029.0.pdf

📜 Procedural Posture of the Case

Judge Bernal granted Defendants’ Motion to Dismiss under Rule 12(b)(6), stating that:

-

Plaintiffs could not represent the trusts and estates without a licensed attorney;

-

Plaintiffs failed to file an opposition to the motion;

-

The complaint lacked clarity and failed to state a valid claim.

However, the Plaintiffs argue that:

-

They filed numerous sworn responses, notices of default, and conditional acceptances—which the court failed to recognize;

-

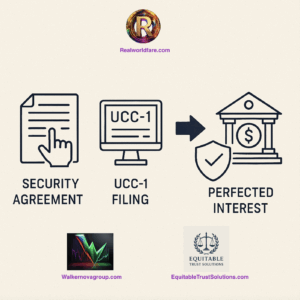

They filed under the lawful right to self-representation via attorney-in-fact, invoking 28 U.S.C. § 1654, U.C.C. § 3-402, and other statutory provisions;

-

They have presented unrebutted affidavits, which under Federal Rule of Civil Procedure 56, demand summary judgment in their favor.

📦 Extensive Evidence Submitted

The Notice of Appeal includes an exhibit list containing over 50 items, ranging from:

-

UCC filings and recorded deeds,

-

IRS 1099-A, 1099-C, and 1099-OID forms,

-

Affidavits of default, dishonor, and non-response,

-

Contracts, bonds, bills of exchange, and notices of claim,

-

Evidence of judicial misconduct and concealment of filings.

🧾 Request for Relief

Plaintiffs request:

-

Reversal of the Dismissal Order;

-

Recognition of unrebutted affidavits and filings as lawful and binding;

-

Corrective action for procedural violations, docket tampering, and constitutional breaches;

-

Restoration of the Plaintiffs’ claims for summary judgment, criminal referral, sanctions, and enforcement.

🧠 Legal Implications

This appeal raises critical questions concerning:

-

The limits of judicial discretion,

-

The treatment of self-represented litigants acting via attorney-in-fact,

-

The court’s duty to docket and consider all valid filings,

-

The constitutional right to access the courts without prejudice or bias.

If the Ninth Circuit rules in favor of the Plaintiffs, it could set a precedent for private administrative remedy processes, the enforcement of paper-based appearances, and the treatment of unrebutted affidavits as self-authenticating legal instruments.