- Existing UCC-1 Filing:

- There must already be a valid UCC-1 Financing Statement on file. This UCC-1 serves as the initial public notice of the secured transaction and establishes the secured party’s interest in the collateral listed in the filing.

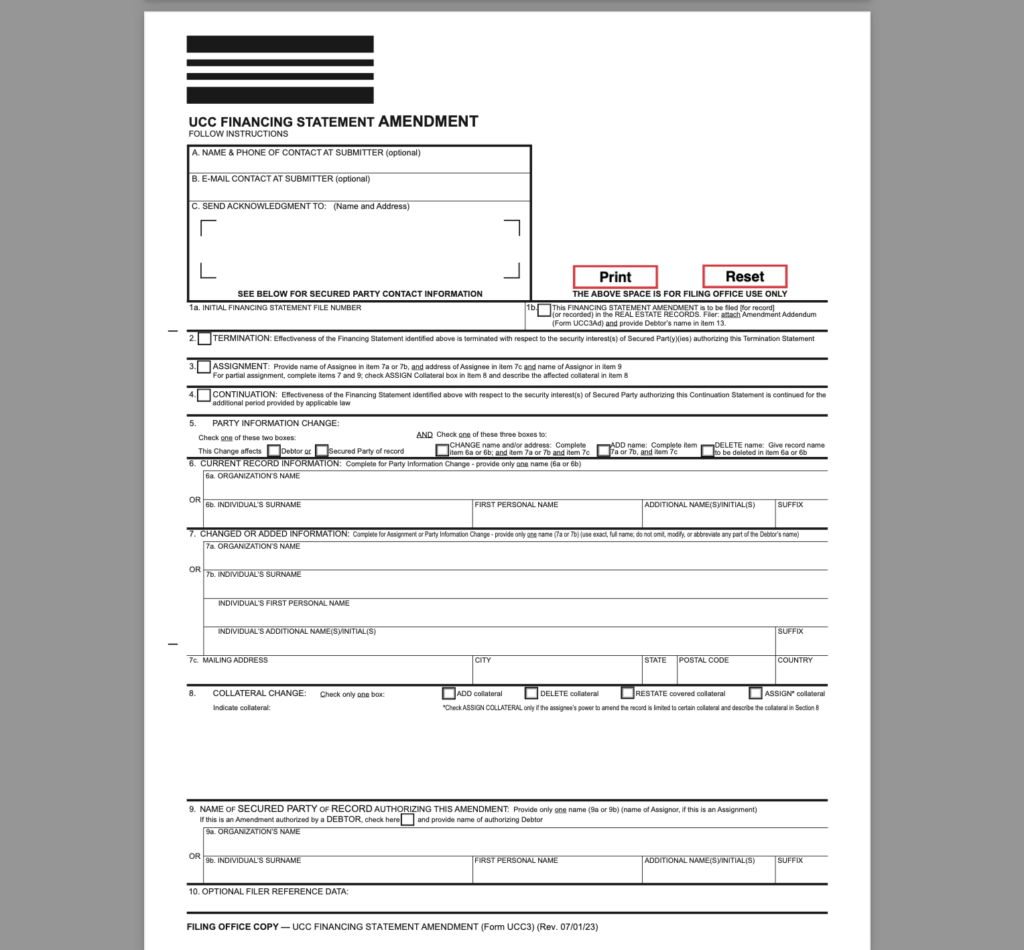

- Amending the Collateral Description:

- A UCC-3 Amendment can be used to update the collateral description in the existing UCC-1. By adding new instruments, property, or assets as collateral, the amendment effectively perfects the secured party’s interest in those newly added items.

- Relation Back to the Original Filing Date:

- The amendment typically relates back to the filing date of the original UCC-1, but only for the originally described collateral. For the newly added collateral, the perfection is effective as of the date the UCC-3 is filed.

- Perfection of the New Collateral:

- Once the UCC-3 is filed and accepted by the appropriate Secretary of State (or relevant filing office), the security interest in the added collateral is perfected. This means the secured party now has an enforceable claim against the added collateral as it pertains to the debtor.

Key Points to Ensure Perfection

- Proper Description of the New Collateral:

- The new collateral must be described with sufficient detail in the UCC-3 Amendment. If the collateral is a negotiable instrument, you might include its type, value, maturity date, or any other identifiers.

- Timely Filing:

- The UCC-3 must be filed promptly to ensure that the new collateral is perfected before other creditors claim an interest.

- No Need for a New UCC-1:

- As long as the existing UCC-1 is valid and active, there is no need to file a new UCC-1. The amendment will update and expand the original filing.

Practical Example

Suppose a secured party initially filed a UCC-1 to perfect an interest in “all investment, commodity and trust deposit accounts contract with attached collateral and proceeds to secure collateral, along with claim of TRADENAME/TRADEMARK, COPYRIGHT/PATENT of the Name KEVIN L WALKER, my mind, body, soul of infants, spirit, and Live Borne Record…” etc etc… Later, the debtor issues a negotiable instrument (e.g., a promissory note, bill of exchange, letter of credit, etc.) or acquires other assets that the secured party wants to secure. The secured party can:

- File a UCC-3 Amendment to add the new negotiable instrument or assets as collateral.

- Once filed and accepted, the security interest in the added collateral is perfected from the date of the UCC-3 filing.

Why a UCC-3 Works in This Case

The UCC-3 functions as an extension or modification of the UCC-1. It allows the secured party to continue using the same financing statement while expanding the scope of the security interest. By adding new collateral via the UCC-3, the secured party maintains the legal framework of the original UCC-1 while updating the agreement to cover additional assets.

Conclusion

A UCC-3 can be a powerful tool for perfecting a security interest in newly added collateral, provided there is an existing UCC-1 Financing Statement to amend. By properly describing the new instrument or property and filing the UCC-3, the secured party ensures that their interest in the new collateral is valid, enforceable, and perfected under the UCC.