“Under the color of law” refers to actions taken by government Officials or Agents that appear to be within the bounds of their lawful authority but are, in fact, abuses of power or violations of an private citizen/non-citizen national’s constitutional rights. This phrase is often used in legal contexts to describe situations where “law enforcement Officers” or other public officials misuse their positions to commit unlawful acts of injustice and/or or discrimination, such as unlawful arrests, excessive force, unlawful and illegal foreclosures (since all foreclosures are fraud since Executive Order 6102 and House Joint Resolution 192 of June 5, 1933, public law 73-10), unlawful repossessions/thefts, or illegal searches and seizures.

To protect the “big secret” (its all fake) they allow the people to be deprive “under to color of law” which essentially means: “if you are incompetent and unaware of your rights and that you must exercise and protect them, you will deprived of them under the appearance of what you will think is law…”

By Definition:

- Color: appearance, semblance. or simulacrum, as distinguished from that which is real. A prima facie or apparent right. Hence, a deceptive appearance; a plausible, assumed exterior, concealing a lack of reality; a a disguise or pretext. See, Black’s Law Dictionary 1st Edition, page 222.

- Colorable: That which has or gives color. That which is in appearance only, and not in reality, what it purports to be. See, Black’s Law Dictionary 1st Edition, page 2223

The concept underscores the importance of individuals being aware of and actively asserting their rights. If you do not exert your rights, you may inadvertently allow government officials to overstep their legal boundaries, effectively permitting them to violate your rights without accountability. For instance, if an officer conducts a search without a warrant or probable cause, and you do not challenge this action, it can be argued that you implicitly consented to the search, even though it was unlawful.

The legal system operates on the principle that individuals must be vigilant in protecting their own rights. The adage “ignorance of the law is no excuse” reinforces this idea by asserting that individuals cannot escape liability or unfavorable outcomes simply because they were unaware of their rights or the laws governing their situation. This principle means that everyone is expected to know and understand the laws that apply to them, as failing to do so does not provide a valid defense in legal proceedings.

To protect your rights and seek redress for violations, you can utilize specific legal provisions. For instance, 15 U.S. Code § 1122 addresses the liability of the United States and its states, instrumentalities, and officials for trademark infringement. While not directly related to civil rights violations, it sets a precedent for holding government entities accountable under certain circumstances.

More pertinent to civil rights is 42 U.S. Code § 1983, which allows individuals to file civil lawsuits against state officials who violate their constitutional rights under the color of law. This statute is a powerful tool for seeking justice and compensation for unlawful actions by government officials.

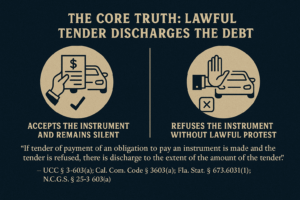

Additionally, UCC 2-202 (Uniform Commercial Code) allows for the creation of new contract terms and the expression and assertion of injury and damages. This provision can be used to establish clear terms and conditions in legal agreements, ensuring that any breach of these terms can be addressed through legal channels. When asserting your rights under UCC 2-202, you can articulate the injury and damages suffered, seek estoppel (a legal principle preventing a party from arguing something contrary to a previous claim or action) and stare decisis (the legal principle of determining points in litigation according to precedent), and ultimately achieve restitution.

Therefore, “under the color of law” can lead to violations of your rights if you do not exert your rights proactively. It is crucial to be informed and assertive to prevent any abuses of power that may occur under the guise of legal authority.

“Under the color of law” refers to actions taken by government officials that appear to be within their lawful authority but are, in fact, abuses of power or violations of an individual’s constitutional rights. This concept is particularly relevant when discussing the rights associated with driving and the right to travel.

Driving and Commercial Regulations

Driving, by law, is considered a commercial activity. When you operate a motor vehicle, you are engaging in a regulated activity that requires adherence to specific laws and licensing requirements. Government officials, such as police officers and Department of Motor Vehicles (DMV) personnel, enforce these regulations to ensure public safety. However, there are instances where these officials may overstep their authority under the color of law, leading to potential rights violations. For example:

– Unlawful Traffic Stops: An officer may pull you over without probable cause or reasonable suspicion. If you do not assert your rights by asking for the reason for the stop, the officer might conduct an unlawful search or detain you without justification.

– Improper Issuance of Tickets: An officer might issue a citation for a violation that did not occur or was misinterpreted. Failing to contest the ticket could result in fines or points on your driving record, impacting your ability to drive commercially.

Even the 18 U.S. Code § 31(a)(6) – Definitions, expressly stipulates: The term “motor vehicle” means every description of carriage or other contrivance propelled or drawn by mechanical power and used for commercial purposes on the highways in the transportation of passengers, passengers and property, or property or cargo”

The word “and” means that it MUST also be used for commercial purposes.

Is an ALWAYS always a vehicle (or motor vehicle)?

Federal;

“‘‘Motor vehicle’’ means every description of carriage or other contrivance propelled or drawn by mechanical power and used for commercial purposes on the highways in transportation of passengers, passengers and property, or property and cargo; … “Used for commercial purposes” means the carriage of persons or property for any fare, fee, rate, charge or other consideration, or directly or indirectly in connection with any business, or other undertaking intended for profit[.]” 18 U.S.C. 31.

“A carriage is peculiarly a family or household article. It contributes in a large degree to the health, convenience, comfort, and welfare of the householder or of the family.” Arthur v Morgan, 113 U.S. 495, 500, 5 S.Ct. 241, 243 S.D. NY 1884).

“The Supreme Court, in Arthur v. Morgan, 112 U.S. 495, 5 S.Ct. 241, 28 L.Ed. 825, held that carriages were properly classified as household effects, and we see no reason that automobiles should not be similarly disposed of.” Hillhouse v United States, 152 F. 163, 164 (2nd Cir. 1907).

“A soldier’s personal automobile is part of his “household goods[.]” U.S. v Bomar, C.A.5(Tex.), 8 F.3d 226, 235″ 19A Words and Phrases – Permanent Edition (West) pocket part 94.

“[I]t is a jury question whether … an automobile … is a motor vehicle[.]” United States v Johnson, 718 F.2d 1317, 1324 (5th Cir. 1983).

State:

The “Use” determines classification

“In determining whether or not a motor boat was included in the expression household effects, Matter of Winburn’s Will, supra [139 Misc. 5, 247 N.Y.S. 592], stated the test to be “whether the articles are or are not used in or by the household, or for the benefit or comfort of the family”.” In re Bloomingdale’s Estate, 142 N.Y.S.2d 781, 785 (1955).

“The use to which an item is put, rather than its physical characteristics, determine whether it should be classified as “consumer goods” under UCC 9- 109(1) or “equipment” under UCC 9-109(2).” Grimes v Massey Ferguson, Inc., 23 UCC Rep Serv 655; 355 So.2d 338 (Ala., 1978).

“Under UCC 9-109 there is a real distinction between goods purchased for personal use and those purchased for business use. The two are mutually exclusive and the principal use to which the property is put should be considered as determinative.” James Talcott, Inc. v Gee, 5 UCC Rep Serv 1028; 266 Cal.App.2d 384, 72 Cal.Rptr. 168 (1968).

“The classification of goods in UCC 9-109 are mutually exclusive.” McFadden v Mercantile-Safe Deposit & Trust Co., 8 UCC Rep Serv 766; 260 Md 601, 273 A.2d 198 (1971).

“The classification of “goods” under [UCC] 9-109 is a question of fact.” Morgan County Feeders, Inc. v McCormick, 18 UCC Rep Serv 2d 632; 836 P.2d 1051 (Colo. App., 1992).

“The definition of “goods” includes an automobile.” Henson v Government Employees Finance & Industrial Loan Corp., 15 UCC Rep Serv 1137; 257 Ark 273, 516 S.W.2d 1 (1974).

Household goods

“The term “household goods” … includes everything about the house that is usually held and enjoyed therewith and that tends to the comfort and accommodation of the household. Lawwill v. Lawwill, 515 P.2d 900, 903, 21 Ariz.App. 75″ 19A Words and Phrases – Permanent Edition (West) pocket part 94. Cites Mitchell’s Will below.

“Bequest … of such “household goods and effects” … included not only household furniture, but everything else in the house that is usually held and used by the occupants of a house to lead to the comfort and accommodation of the household. State ex rel. Mueller v Probate Court of Ramsey County, 32 N.W.2d 863, 867, 226 Minn. 346.” 19A Words and Phrases – Permanent Edition (West) 514.

“All household goods owned by the user thereof and used solely for noncommercial purposes shall be exempt from taxation, and such person entitled to such exemption shall not be required to take any affirmative action to receive the benefit from such exemption.” Ariz. Const. Art. 9, 2.

Automobiles classified as vehicles:

““[H]ousehold goods”…did not [include] an automobile…used by the testator, who was a practicing physician, in going from his residence to his office and vice versa, and in making visits to his patients.” Mathis v Causey, et al., 159 S.E. 240 (Ga. 1931).

“Debtors could not avoid lien on motor vehicle, as motor vehicles are not “household goods” within the meaning of Bankruptcy Code lien avoidance provision. In re Martinez, Bkrtcy.N.M., 22 B.R. 7, 8.” 19A Words and Phrases – Permanent Edition (West) pocket part 94.

Automobiles NOT classified as vehicles:

“Automobile purchased for the purpose of transporting buyer to and from his place of

employment was “consumer goods” as defined in UCC 9-109.” Mallicoat v Volunteer Finance & Loan Corp., 3 UCC Rep Serv 1035; 415 S.W.2d 347 (Tenn. App., 1966).“The provisions of UCC 2-316 of the Maryland UCC do not apply to sales of consumer goods (a term which includes automobiles, whether new or used, that are bought primarily for personal, family, or household use).” Maryland Independent Automobile Dealers Assoc., Inc. v Administrator, Motor Vehicle Admin., 25 UCC Rep Serv 699; 394 A.2d 820, 41 Md App 7 (1978).

“An automobile was part of testatrix’ “household goods” within codicil. In re

Mitchell’s Will, 38 N.Y.S.2d 673, 674, 675 [1942].” 19A Words and Phrases – Permanent Edition (West) 512. Cites Arthur v Morgan, supra.“[T]he expression “personal effects” clearly includes an automobile[.]” In re Burnside’s Will, 59 N.Y.S.2d 829, 831 (1945). Cites Hillhouse, Arthur, and Mitchell’s Will, supra.

“[A] yacht and six automobiles were “personal belongings” and “household effects[.]”” In re Bloomingdale’s Estate, 142 N.Y.S.2d 781, 782 (1955).

s

Private Automobile is NOT required to be registered by LawThe California Motor Vehicle Code, section 260:

Use defines Classification. Private cars/vans etc. not in COMMERCE / FOR PROFIT, are immune to registration fees:

(a) A “commercial vehicle” is a vehicle of a type REQUIRED to be REGISTERED under this code”.

(b) “Passenger vehicles which are not used for the transportation of persons for hire, compensation or profit, and housecars, are not commercial vehicles”.

(c) “a vanpool vehicle is not a commercial vehicle.” and;

“A vehicle not used for commercial activity is a “consumer goods”, …it is NOT a type of vehicle required to be registered and “use tax” paid of which the tab is evidence of receipt of the tax.” Bank of Boston vs Jones, 4 UCC Rep. Serv. 1021, 236 A2d 484, UCC PP 9-109.14. And;

“… In one of the so-called elevator cases, that of Munn v. Illinois, 94 U. S. 113, [24 L. Ed. 77], it is said: ‘When, therefore, one devotes his property to a use in which the public have an interest, he in effect grants to the public an interest in that use, and must submit to be controlled by the public for the common good, to the extent of the interest he has thus created.’ But so long as he uses his property for private use, and in the absence of devoting it to public use, the public has no interest therein which entitles it to a voice in its control. Other case to the same effect are Budd v. New York, 143 U. S. 517, [36 L. Ed. 247, 12 Sup. Ct. Rep. 468]; Weems Steamboat Co. v. People’s Co., 214 U. S. 345, [16 Ann. Cas. 1222, 53 L. Ed. 1024, 29 Sup. Ct. Rep. 661]; Monongahela Nav. Co. v. United States, 148 U. S. 336, [37 L. Ed. 463, 13 Sup. Ct. Rep. 622]; and Del Mar Water Co. v. Eshleman, 167 Cal. 666, [140 Pac. 591, 948]. Indeed, our attention is directed to no authority in this state or elsewhere holding otherwise.” Associated etc. Co. v. Railroad Commission (1917) 176 Cal. 518, 526.

“… That subjecting petitioners’ property to the use of the public as common carriers constitutes a taking of the same, admits of no controversy. ‘Whenever a law deprives the owner of the beneficial use and free enjoyment of his property, or imposes restraints upon such use and enjoyment that materially affect its value, without legal process or compensation, it deprives him of his property within the meaning of the constitution. … It is not necessary, in order to render the statute obnoxious to the restraints of the constitution, that it must in terms or effect authorize the actual physical taking of the property or the thing itself, so long as it affects its free use and enjoyment, or the power of disposition at the will of the owner.’ (Forster v. Scott,136 N. Y. 577, [18 L. R. A. 543, 32 N. E. 976]; Monongahela Nav. Co. v. United States, 148 U. S. 312, 336, [37 L. Ed. 463, 13 Sup. Ct. Rep. 622]. … Mr. Lewis in his work on Eminent Domain, third edition, section 11, says: ‘A law which authorizes the taking of private property without compensation, … cannot be considered as due process of law in a free government.’ (Chicago etc, R. R. Co. v. Chicago, 166 U. S. 226, [41 L. Ed. 979, 17 Sup. Ct. Rep. 581].” Associated etc. Co. v. Railroad Commission (1917) 176 Cal. 518, 528-530.”

It is beyond the power of a State by legislation fiat to convert property used exclusively in the business of a private carrier, into a public utility, or to make the owner a public carrier, for that would be taking private property for public use without just compensation which no State can do consistently with the due process of law clause of the 14th Amendment. (See police power) Producers Transportation Co. v. RR Commission, 251 U.S. 228, 230; Wolff Co. v. Duke, 266 U.S. 570, 578.

“Owner has constitutional right to use and enjoyment of his property.” Simpson v. Los Angeles (1935), 4 C.2d 60, 47 P.2d 474.

“We find it intolerable that one constitutional right should have to be surrendered in order to assert another”. SIMMONS v US, supra.

“When rights secured by the Constitution are involved, there can be no rule making or legislation which would abrogate them.” Miranda vs. Arizona, 384 US 436 p. 491.

“The claim and exercise of a Constitutional right cannot be converted into a crime.” Miller v. U.S. 230 F 2d 486, 489.

History is clear that the first ten amendments to the Constitution were adopted to secure certain common law rights of the people, against invasion by the Federal Government.” Bell v. Hood, 71 F.Supp., 813, 816 (1947) U.S.D.C. — So. Dist. CA.

Economic necessity cannot justify a disregard of cardinal constitutional guarantee. Riley v. Certer, 165 Okal. 262; 25 P.2d 666; 79 ALR 1018.

When any court violates the clean and unambiguous language of the Constitution, a fraud is perpetrated and no one is bound to obey it. (See 16 Ma. Jur. 2d 177, 178) State v. Sutton, 63 Minn. 147, 65 NW 262, 30 L.R.A. 630 Am. 459.

“The ‘liberty’ guaranteed by the constitution must be interpreted in the light of the common law, the principles and history of which were familiar and known to the framers of the constitution. This liberty denotes the right of the individual to engage in any of the common occupations of life, to locomote, and generally enjoy those rights long recognized at common law as essential to the orderly pursuit of happiness by free men.” Myer v. Nebraska, 262 U .S. 390, 399; United States v. Kim Ark, 169 U.S. 649, 654.

“An unconstitutional act is not law; it confers no rights; it imposes no duties; affords no protection; it creates no office; it is in legal contemplation, as inoperative as though it had never been passed.” Norton vs. Shelby County, 118 US 425 p. 442.

“No one is bound to obey an unconstitutional law and no courts are bound to enforce it.” 16 Am Jur 2nd, Sec 177 late 2d, Sec 256.

All laws which are repugnant to the Constitution are null and void. Chief Justice Marshall, Marbury vs Madison, 5, U.S. (Cranch) 137, 174, 176 (1803).

It cannot be assumed that the framers of the constitution and the people who adopted it, did not intend that which is the plain import of the language used. When the language of the constitution is positive and free of all ambiguity, all courts are not at liberty, by a resort to the refinements of legal learning, to restrict its obvious meaning to avoid the hardships of particular cases. We must accept the constitution as it reads when its language is unambiguous, for it is the mandate of the sovereign power. Cook vs Iverson, 122, N.M. 251.

“Right of protecting property, declared inalienable by constitution, is not mere right to protect it by individual force, but right to protect it by law of land, and force of body politic.” Billings v. Hall (1857), 7 C. 1.

“Constitution of this state declares, among inalienable rights of each citizen, that of acquiring, possessing and protecting property. This is one of primary objects of government, is guaranteed by constitution, and cannot be impaired by legislation.” Billings v. Hall (1857), 7 C. 1.

“The state constitution is the mandate of a sovereign people to its servants and representatives. Not one of them has a right to ignore or disregard these mandates…” John F. Jelko Co. vs. Emery, 193 Wisc. 311; 214 N.W. 369, 53 A.L.R., 463; Lemon vs. Langlin, 45 Wash. 2d 82, 273 P.2d 464.

CONCLUSION

Is an automobile always a vehicle (or motor vehicle)?

– No.

This is a question of fact that turns on the use to which the automobile in question is put (i.e., either personal/private or commercial/public). While the presumption of an automobile being a vehicle (or motor vehicle) is created by the owner of said automobile registering same with the state as a vehicle, this presumption may be overcome by an affirmative defense to the allegation of the automobile being a vehicle, and correct the record and and presumption, baring any evidence to the contrary indicating commercial use.

The Right to Travel

The right to travel is a fundamental constitutional right supported by various Supreme Court rulings and the Supremacy Clause of the U.S. Constitution, which establishes that federal law supersedes conflicting state laws. This right includes the freedom to move between states and is not contingent on commercial activity or licensing. Examples of rights violations under the color of law related to the right to travel include:

– Arbitrary Detainment: If a law enforcement officer detains you without a valid reason while you are traveling between states, this could be a violation of your right to travel. For instance, if an officer stops you simply for having out-of-state plates without any traffic violation, this could be an abuse of power.

– Unjustified Search and Seizure: An officer might search your vehicle without probable cause while you are traveling. If you do not assert your Fourth Amendment rights against unreasonable searches and seizures, you may be subject to an unlawful invasion of privacy.

Supreme Court and Supremacy Clause

The Supreme Court has upheld the right to travel in several cases, reinforcing its status as a fundamental right. For example:

- Shapiro v. Thompson (1969): The Supreme Court ruled that the right to travel is a fundamental right protected by the Constitution, invalidating state statutes that imposed residency requirements for welfare assistance.

- Saenz v. Roe (1999): The Court confirmed that the right to travel includes the right to be treated equally in all states, striking down California’s law that limited benefits for new residents.

- The right of the citizen to travel upon the public highways and to transport his/her property thereon either by carriage or automobile, is not a mere privilege which a city [or State] may prohibit or permit at will, but a common right which he/she has under the right to life, liberty, and the pursuit of happiness.”— Thompson v. Smith, 154 SE 579.

- “Even the legislature has no power to deny to a citizen the right to travel upon the highway and transport his/her property in the ordinary course of his business or pleasure, though this right may be regulated in accordance with the public interest and convenience.” [“regulated” means traffic safety enforcement, stop lights, signs etc.]— Chicago Motor Coach v. Chicago, 169 NE 22.

- “The right to travel is part of the Liberty of which a citizen cannot be deprived without due process of law under the Fifth Amendment. This Right was emerging as early as the Magna Carta.”— Kent vs. Dulles, 357 US 116 (1958).

- “Personal liberty largely consists of the Right of locomotion — to go where and when one

pleases — only so far restrained as the Rights of others may make it necessary for the welfare of all other citizens. The Right of the Citizen to travel upon the public highways and to transport his property thereon, by horse drawn carriage, wagon, or automobile, is not a mere privilege which may be permitted or prohibited at will, but the common Right which he has under his Right to life, liberty, and the pursuit of happiness. Under this Constitutional guarantee one may, therefore, under normal conditions, travel at his inclination along the public highways or in public places, and while conducting himself in an orderly and decent manner, neither interfering with nor disturbing another’s Rights, he will be protected, not only in his person, but in his safe conduct.” —II Am.Jur. (1st) Constitutional Law, Sect.329, p.113 - “The use of the highways for the purpose of travel and transportation is not a mere privilege, but a common and fundamental Right of which the public and the individual cannot be rightfully deprived.”—Chicago Motor Coach vs. Chicago, 169 NE 22;Ligare vs. Chicago, 28 NE 934;Boon vs. Clark, 214 SSW 607;25 Am.Jur. (1st) Highways Sect.163.

- “The right of the citizen to travel upon the highway and to transport his property thereon, in the ordinary course of life and business, differs radically and obviously from that of one who makes the highway his place of business for private gain in the running of a stagecoach or omnibus.”— State vs. City of Spokane, 186 P. 864.

- “The right of the Citizen to travel upon the public highways and to transport his property thereon, in the ordinary course of life and business, is a common right which he has under the right to enjoy life and liberty, to acquire and possess property, and to pursue happiness and safety. It includes the right, in so doing, to use the ordinary and usual conveyances of the day, and under the existing modes of travel, includes the right to drive a horse drawn carriage or wagon thereon or to operate an automobile thereon, for the usual and ordinary purpose of life and business.”— Thompson vs. Smith, supra.; Teche Lines vs. Danforth, Miss., 12 S.2d 784.

The Supremacy Clause (Article VI, Clause 2) ensures that federal law takes precedence over state laws. This means that state regulations or actions by state officials that infringe on federally protected rights, such as the right to travel, can be challenged and overturned in federal court.

By understanding and asserting your rights, you can protect yourself from potential abuses of power that take place every day. Whether dealing with commercial “driving” regulations or exercising your fundamental right to “travel,” it is crucial to be informed and proactive in defending your constitutional freedoms.

Original article on REALWORLDFARE.COM