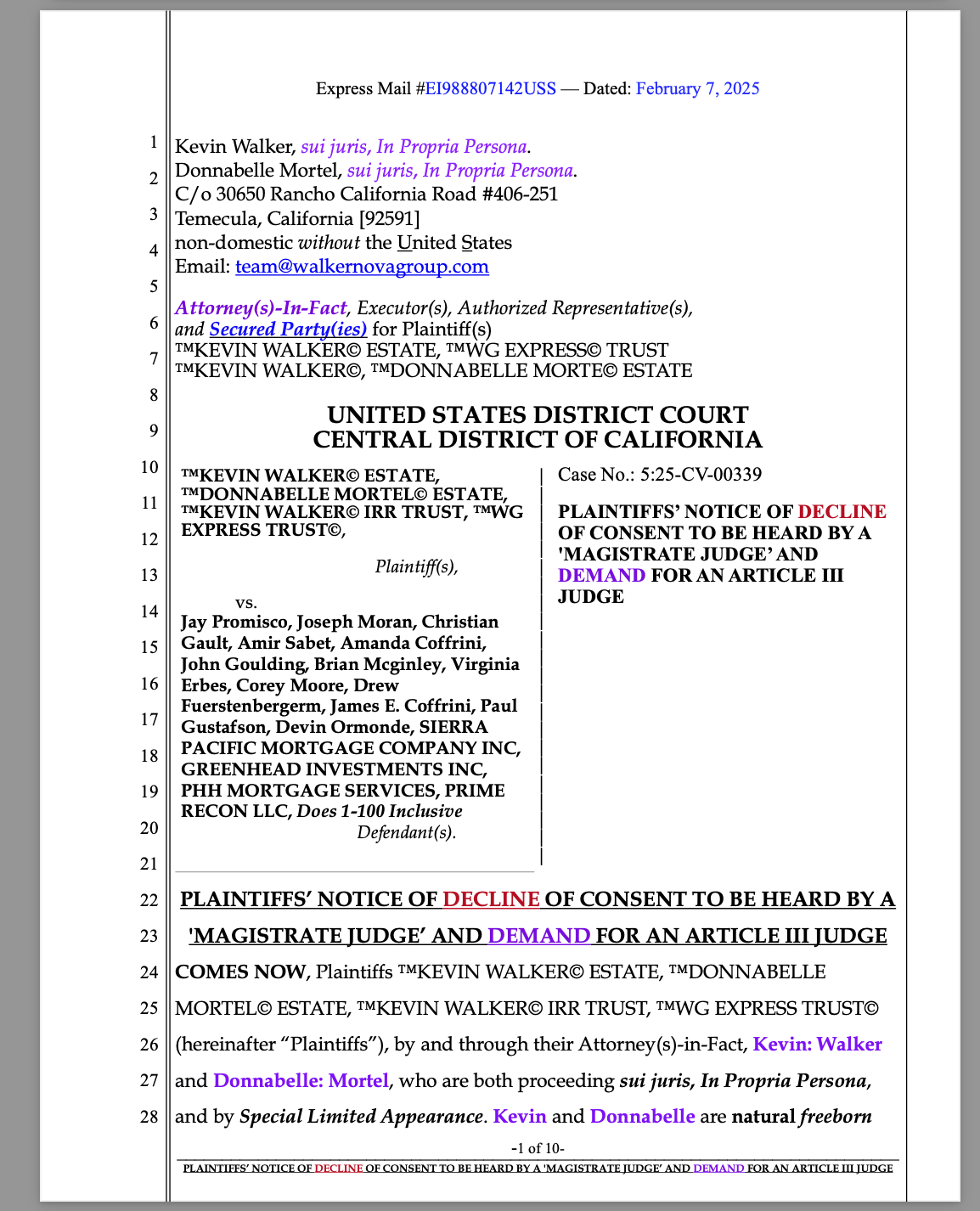

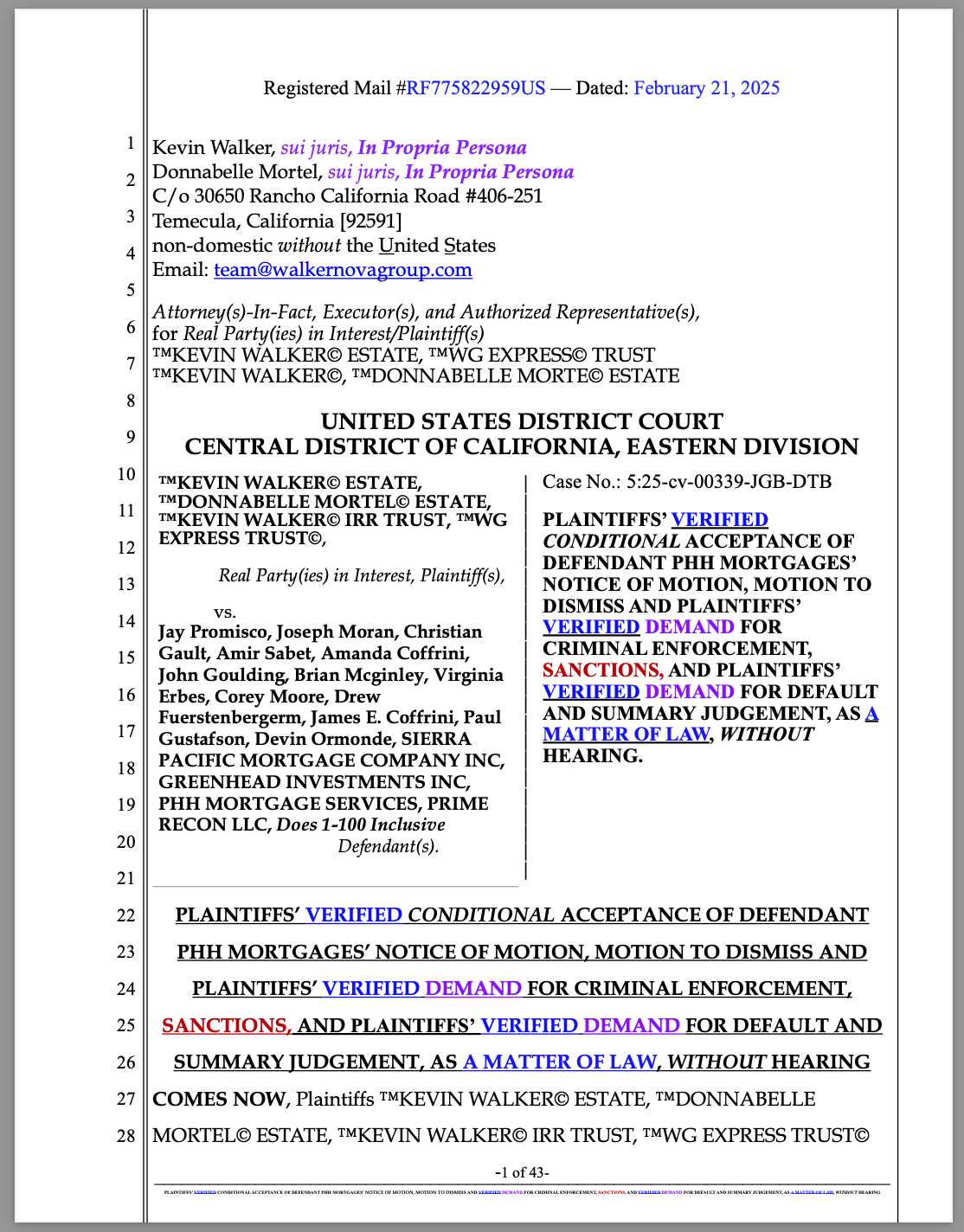

PHH Mortgage Corporation’s Motion to Dismiss in Kevin Walker Estate, et al. v. PHH Mortgage Corporation, et al. is a glaring example of procedural misconduct, constitutional violations, and a deliberate attempt to obstruct justice. The Plaintiffs have conditionally accepted PHH Mortgage’s non-compliant filing, thereby tendering a binding counteroffer that PHH must now rebut. PHH’s continued silence and failure to rebut the conditional acceptance further compounds their non-performance and dishonor. Additionally, the Defendants’ filing, prepared by Neil J. Cooper of HOUSER LLP, violates multiple-defendant court rules, misrepresents the law, displays incompetence and a war against the Constitution, and constitutes blatant obstruction of justice.

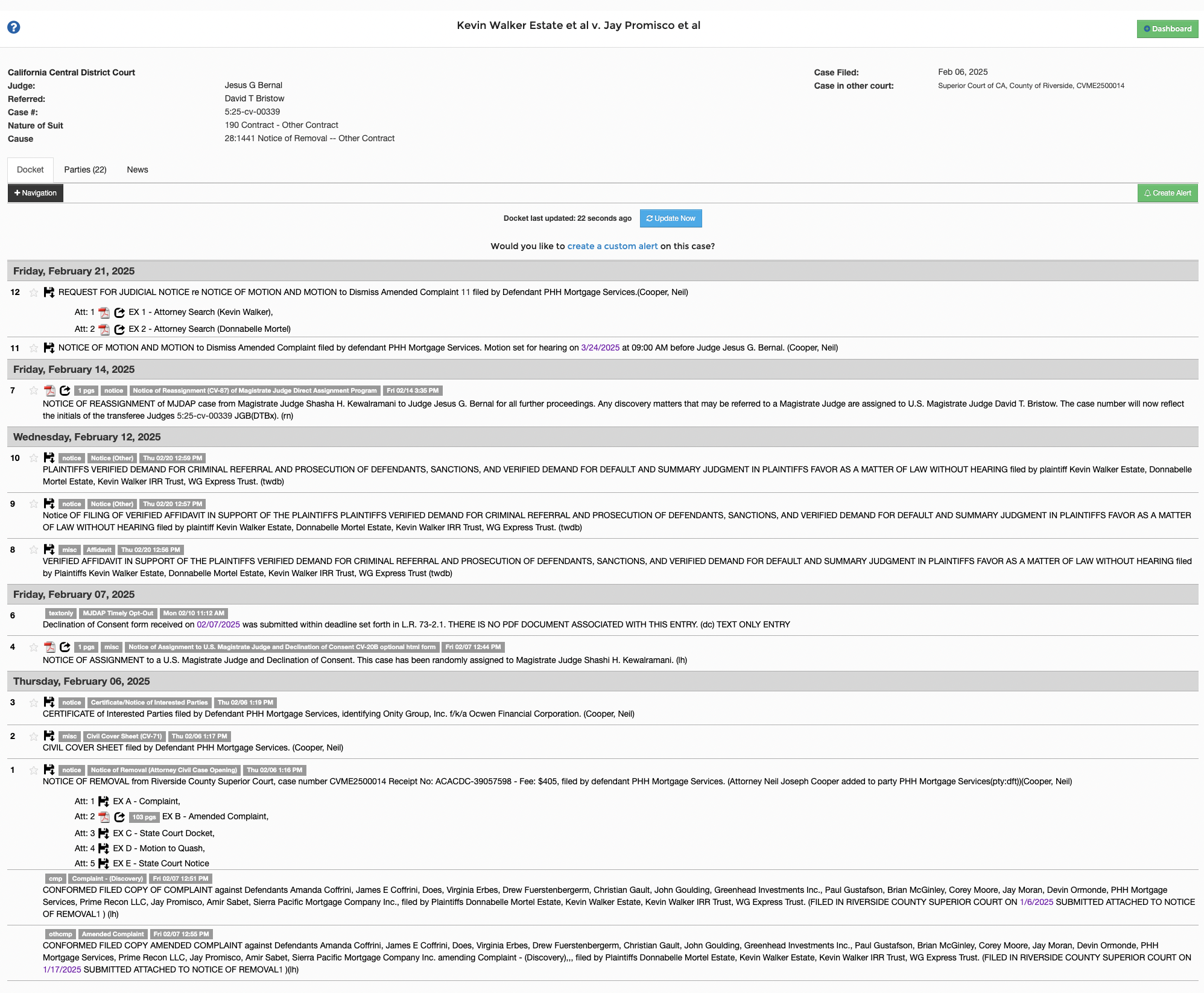

Further exacerbating this obstruction, critical documents remain missing from the court docket and record, preventing a full and fair adjudication of the Plaintiffs’ claims. This deliberate suppression of filings by the court and Defendants undermines due process, conceals key evidence, and constitutes judicial misconduct. The failure to properly record and acknowledge Plaintiffs’ filings further demonstrates systematic efforts to manipulate the proceedings in PHH Mortgage’s favor, reinforcing the need for immediate judicial correction, sanctions, and enforcement of Plaintiffs’ default judgment demands.

See article: “KEVIN WALKER estate Files VERIFIED Demand for Writ of Mandamus as Riverside Federal Court Conspires, Violates Plaintiffs’ right, Manipulates Records, and Obstructs Justice”

DOWNLOAD DOCUMENT

1. PHH Mortgage’s Filing is Non-Compliant and Procedurally Defective

PHH’s Motion to Dismiss is riddled with procedural errors that flagrantly violate the established rules for cases involving multiple defendants. The Defendants have failed to address the core legal arguments presented by the Plaintiffs, instead opting to misrepresent the law and manipulate judicial processes.

- Misrepresentation of Legal Standing: PHH falsely asserts that a trust cannot be represented by an attorney-in-fact, directly contradicting established legal doctrines, including UCC § 3-402, which explicitly recognizes an attorney-in-fact’s authority to represent a legal entity.

- Failure to Acknowledge Conditional Acceptance: Plaintiffs have tendered a binding counteroffer via their conditional acceptance, which PHH Mortgage must now rebut. By failing to respond point-for-point to the conditional acceptance, PHH has further defaulted, compounding their dishonor and non-performance.

- Violation of Court Filing Standards: The court has failed to file the Plaintiffs’ documents, thus obstructing the record and violating fundamental due process rights. Plaintiffs have already demanded a writ of mandamus to correct these unlawful obstructions.

2. The Right to Self-Representation and Power of Attorney

One of the most egregious errors in PHH Mortgage’s Motion is the claim that the Plaintiffs, acting as attorneys-in-fact for their respective trusts, “lack standing” to bring the lawsuit because they are not licensed attorneys. This argument is flawed for several reasons:

The Right to Self-Representation:

- The Sixth Amendment and Article I, Section 10, Clause 1 of the U.S. Constitution guarantee the right of individuals to defend their own rights without being forced to hire an attorney.

- Under U.S. Supreme Court precedents, a person does not require a law license to exercise their own rights or act as an agent in contractual matters.

Power of Attorney & UCC Recognition:

- The Uniform Commercial Code (UCC) § 3-402 recognizes that a trust, like any legal entity, can be represented by an authorized agent or attorney-in-fact.

- A trust is a contractual arrangement, not a corporate entity that is required to hire an attorney.

- Case law supports the right of an individual to act as an agent for a trust without a requirement to be a BAR-licensed attorney.

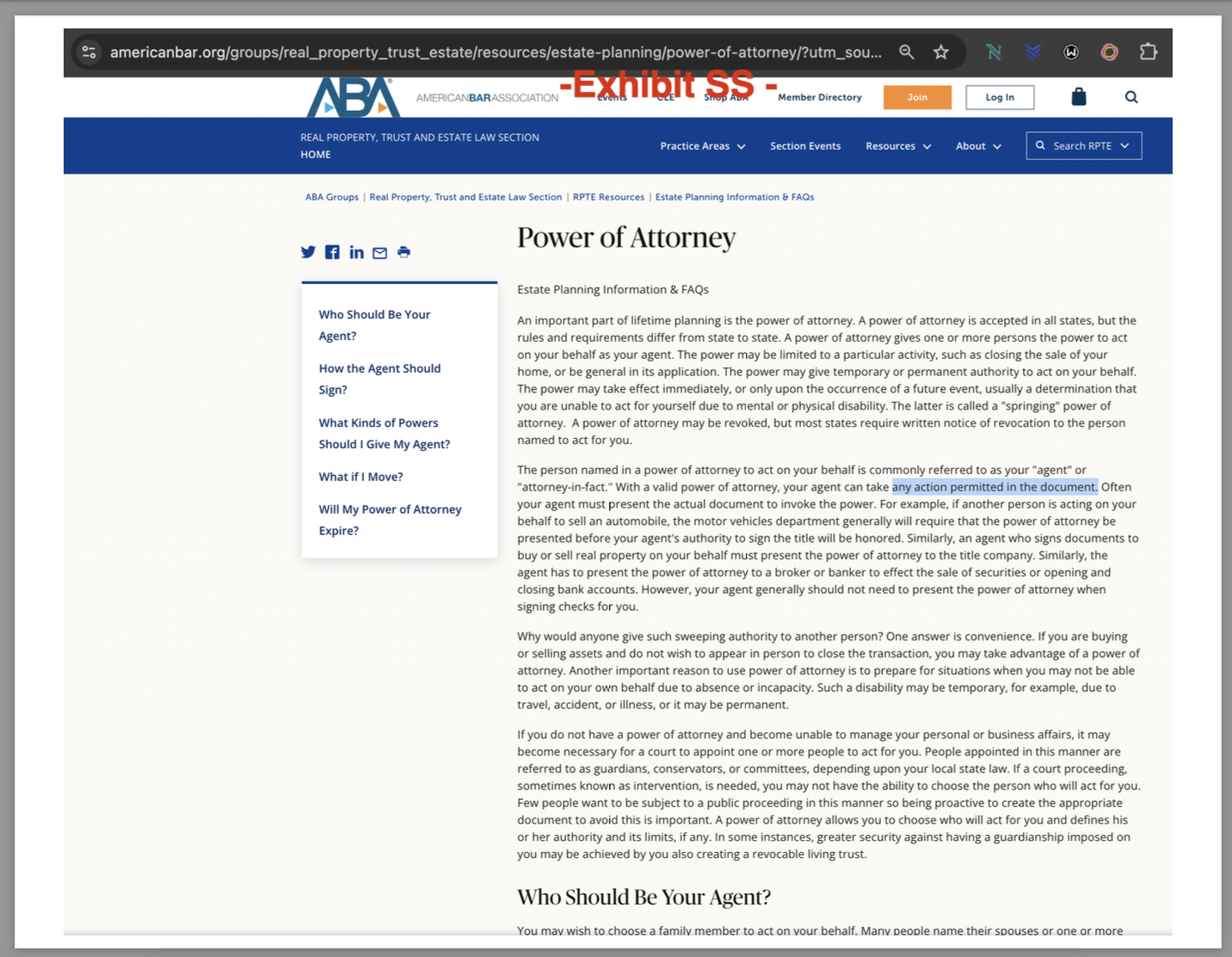

ABA Recognition of Power of Attorney:

The American Bar Association (ABA) defines a power of attorney as a legal document that grants one or more persons the authority to act on behalf of another as their agent. This authority can be limited to specific activities or general in scope. The ABA further emphasizes that a power of attorney is recognized in all states, though the rules and requirements may vary (American Bar Association).

By falsely asserting that only licensed attorneys can represent a trust, PHH’s Motion disregards these established legal principles and attempts to impose an unwarranted barrier to justice.

Exhibit SS

rule 8.4 – defendants will misconduct

3. Statutory and U.C.C. Recognition of ‘Attorney-in-Fact’ Authority

The authority of an attorney-in-fact is explicitly recognized in various statutory and commercial codes, reinforcing its binding nature:

- U.C.C. § 3-402: Establishes that an authorized representative, including an attorney-in-fact, can bind the principal in contractual and financial transactions.

- 28 U.S.C. § 1654: Confirms that “parties may plead and conduct their own cases personally or by counsel”, reinforcing the Plaintiffs’ right to self-representation and the use of an attorney-in-fact.

- 26 U.S.C. § 2203: Recognizes executors, including attorneys-in-fact, in matters of estate administration and tax liability.

- 26 U.S.C. § 7603: Acknowledges that an attorney-in-fact may lawfully receive and respond to IRS summonses on behalf of the principal.

- 26 U.S.C. § 6903: Confirms that fiduciaries, including attorneys-in-fact, are recognized in tax matters and are legally bound to act in their principal’s best interest.

- 26 U.S.C. § 6036: Establishes that attorneys-in-fact can handle affairs related to the administration of decedent estates and trust entities.

- 26 U.S.C. § 6402: Grants attorneys-in-fact the authority to receive and negotiate tax refunds and credits on behalf of the principal.

4. PHH Mortgage’s Motion Constitutes Defamation, Fraud, and Abuse of Process

PHH’s filing is not a lawful legal motion but rather a strategic attempt to defame, slander, and libel the Plaintiffs, while depriving them of their constitutional rights under the color of law.

- Defamation and False Representation: PHH falsely labels Plaintiffs as “sovereign citizens,” a defamatory term designed to discredit legitimate legal claims. The courts have long held that mischaracterizing litigants to evade legal responsibility is an act of malicious misrepresentation.

- Fraudulent Misrepresentation of Law: PHH deliberately ignores Public Law 73-10 (HJR-192, 1933), which abolished lawful money and mandates that all debts be discharged dollar-for-dollar. Their attempt to enforce an unlawful debt contradicts binding monetary policy and Supreme Court precedent.

- Deprivation of Rights Under Color of Law (42 U.S.C. § 1983): PHH, in collusion with the court, is actively suppressing the Plaintiffs’ right to self-representation and contract enforcement. This constitutes a willful violation of constitutional protections under the First, Fifth, and Fourteenth Amendments.

5. Plaintiffs’ Right to Self-Representation and Power of Attorney

One of the most egregious misrepresentations in PHH’s Motion is its assertion that Plaintiffs, acting as attorneys-in-fact, lack standing to bring suit. This is legally and factually false.

- Constitutional Right to Self-Representation: The Sixth Amendment and Article I, Section 10 of the U.S. Constitution guarantee individuals the right to defend their own rights and appoint an attorney-in-fact to act on their behalf.

- Power of Attorney and UCC Recognition: Under UCC § 3-402, a trust can be represented by an authorized agent or attorney-in-fact, negating PHH’s fraudulent claim that a trust must be represented by a BAR-licensed attorney.

- Judicial Overreach and Obstruction: The court’s refusal to acknowledge the Plaintiffs’ verified power of attorney filings is an attempt to unlawfully restrict access to justice and a direct attack on contract law principles.

6. PHH’s Motion Ignores Contract Law & the Mailbox Rule

PHH Mortgage’s Motion to Dismiss completely ignores fundamental contract law principles, including the Mailbox Rule, which establishes that an offer is presumed accepted if not rebutted within a specified timeframe.

- PHH’s Motion Fails to Address Binding Contracts: Plaintiffs reserved their rights under UCC § 1-308, making PHH’s claims legally invalid.

- Undisputed Acceptance of Claims: PHH’s failure to rebut the Plaintiffs’ multiple verified affidavits and notices of default constitutes acceptance and agreement via tacit procuration.

- Fraudulent Denial of Legally Binding Documents: PHH’s argument that the Plaintiffs’ claims are based on “sovereign citizen theories” is not only false but a deliberate attempt to suppress legally binding UCC filings and contract law principles.

7. PHH’s Motion Represents a War Against the Constitution

PHH Mortgage’s filing is more than just legally deficient—it is a direct attack on constitutional rights and public policy.

- Violation of the Right to Access Courts Without an Attorney: The Supreme Court’s ruling in Faretta v. California, 422 U.S. 806 (1975) confirms that individuals have the right to represent themselves, making PHH’s arguments legally unsound.

- Willful Misrepresentation of Public Law and Monetary Policy: PHH’s refusal to acknowledge House Joint Resolution 192 (HJR-192, 1933) and the removal of the gold standard is a blatant attempt to ignore the reality of modern debt law.

- Reliance on Bad Case Law & Judicial Bias: PHH’s motion heavily relies on outdated and overturned case law, ignoring the U.S. Supreme Court’s recent elimination of Chevron deference, which requires courts to apply independent judicial interpretation rather than deferring to agency interpretations.

8. PHH’s Conduct Warrants Criminal Sanctions and Default Judgment

Given PHH Mortgage’s egregious misconduct, Plaintiffs have demanded criminal enforcement, sanctions, and summary default judgment.

- Criminal Fraud and Obstruction: PHH’s deliberate misrepresentation of contract law, constitutional principles, and procedural requirements constitutes fraud upon the court.

- Summary Judgment as a Matter of Law: The Defendants’ failure to rebut the Plaintiffs’ verified affidavits and legal claims has established a legally binding judgment by default, requiring an immediate ruling in favor of the Plaintiffs.

- Judicial Misconduct and Complicity: The court’s continued obstruction of recordkeeping and refusal to recognize the Plaintiffs’ rightful legal standing demands a writ of mandamus to enforce judicial compliance.

DOWNLOAD DOCUMENT

Conclusion: A Call for Judicial Integrity

PHH Mortgage’s Motion to Dismiss is a mockery of the rule of law. It is procedurally defective, legally invalid, and an outright act of fraud, obstruction, and constitutional violation. The Plaintiffs’ conditional acceptance stands as a binding counteroffer that PHH must rebut, yet PHH’s continued non-response further compounds their dishonor and non-performance.

The only lawful resolution is the outright denial of PHH’s Motion to Dismiss, immediate entry of default judgment in favor of the Plaintiffs, and criminal sanctions against PHH Mortgage and its legal representatives for their fraudulent misrepresentation and bad faith litigation tactics.