In a devastating turn of events for state actors in Riverside County, California, a series of unrebutted affidavits and federally recognized legal filings have revealed a coordinated, unlawful, and criminal conspiracy to violate the constitutional rights of Kevin Lewis Walker, a private American national and non-citizen State Citizen. The facts—now entered into the record, verified, unrebutted, and legally binding—expose a scheme so corrupt and retaliatory that it qualifies as organized racketeering, judicial fraud, and attempted extortion under color of law.

⚖️ Federal Lawsuit Already Filed—State “Charges” Are Retaliatory and Criminal

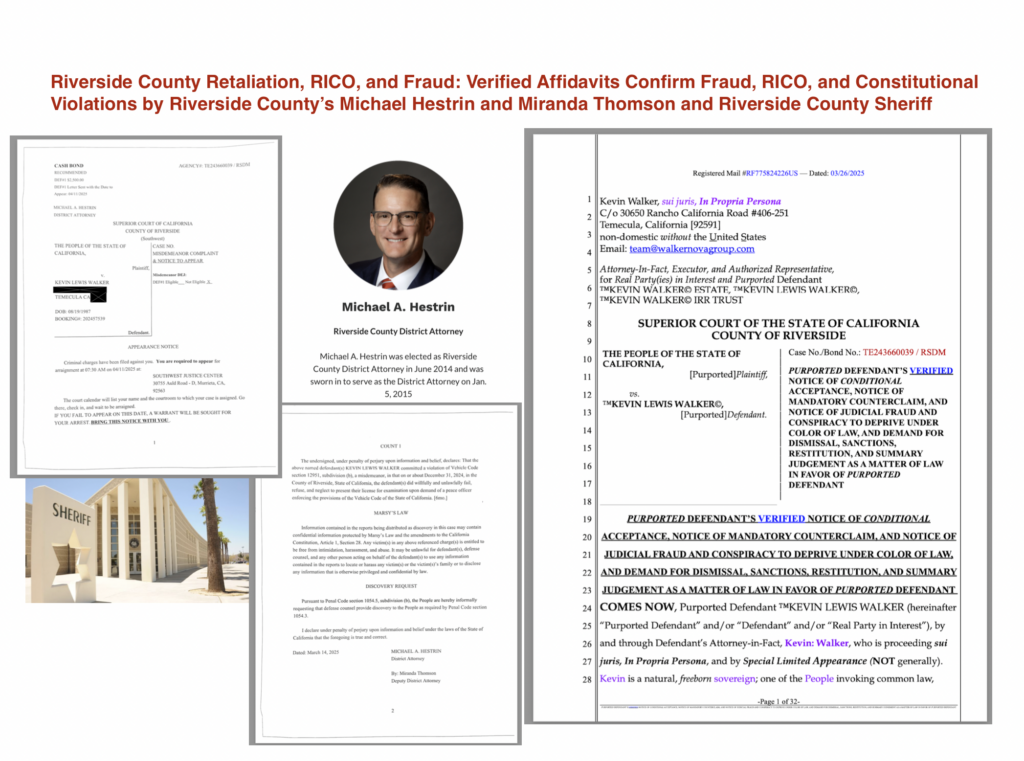

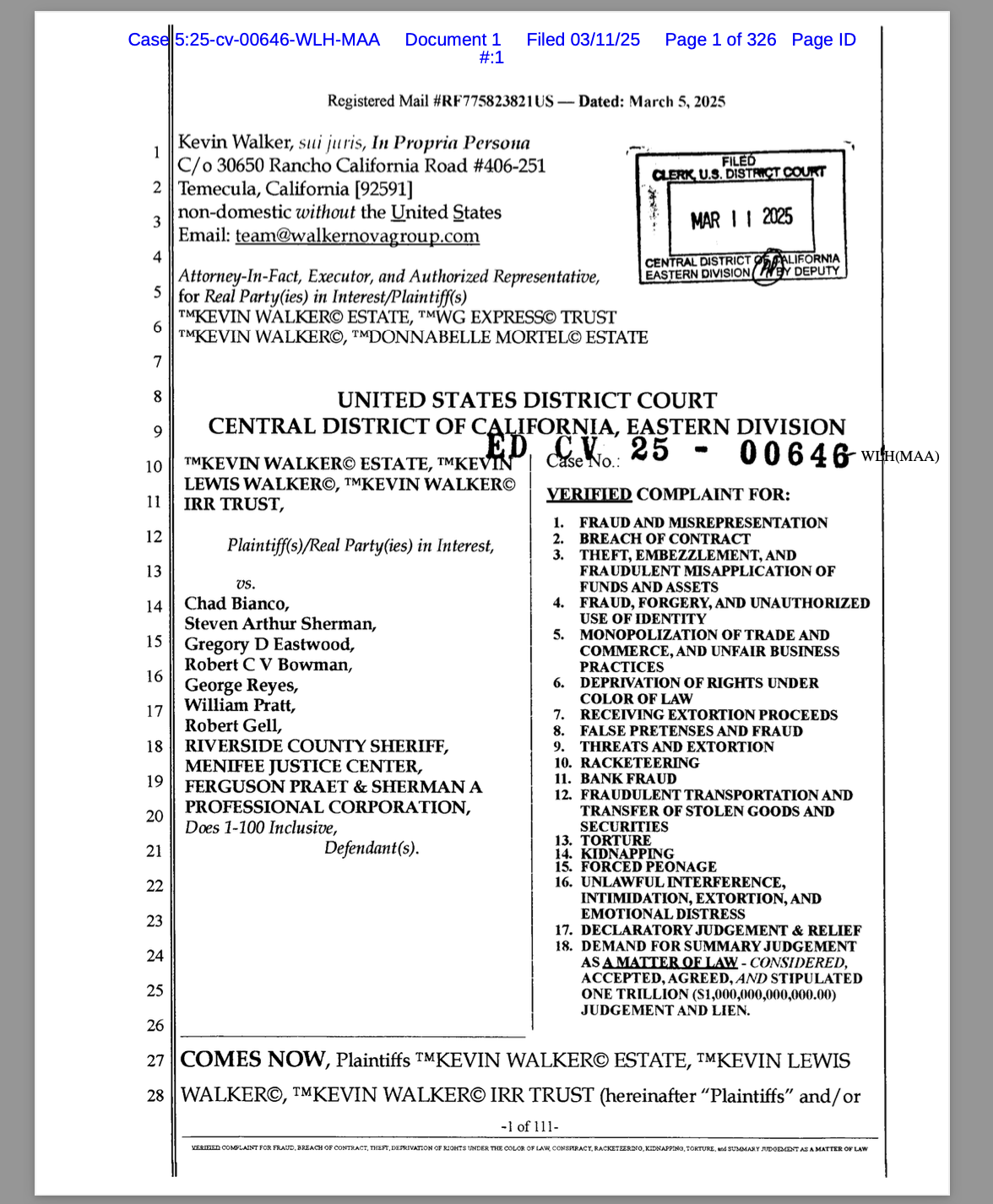

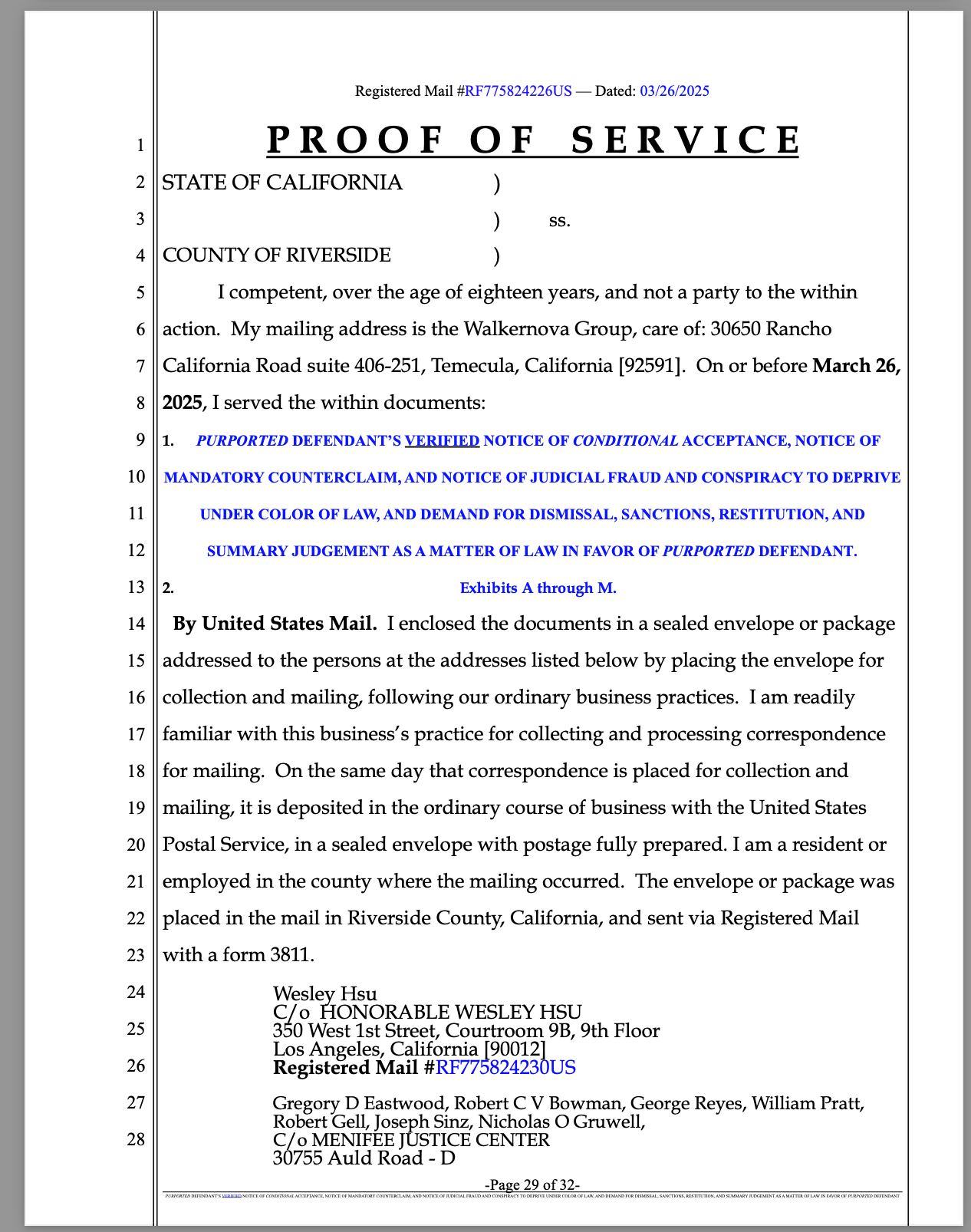

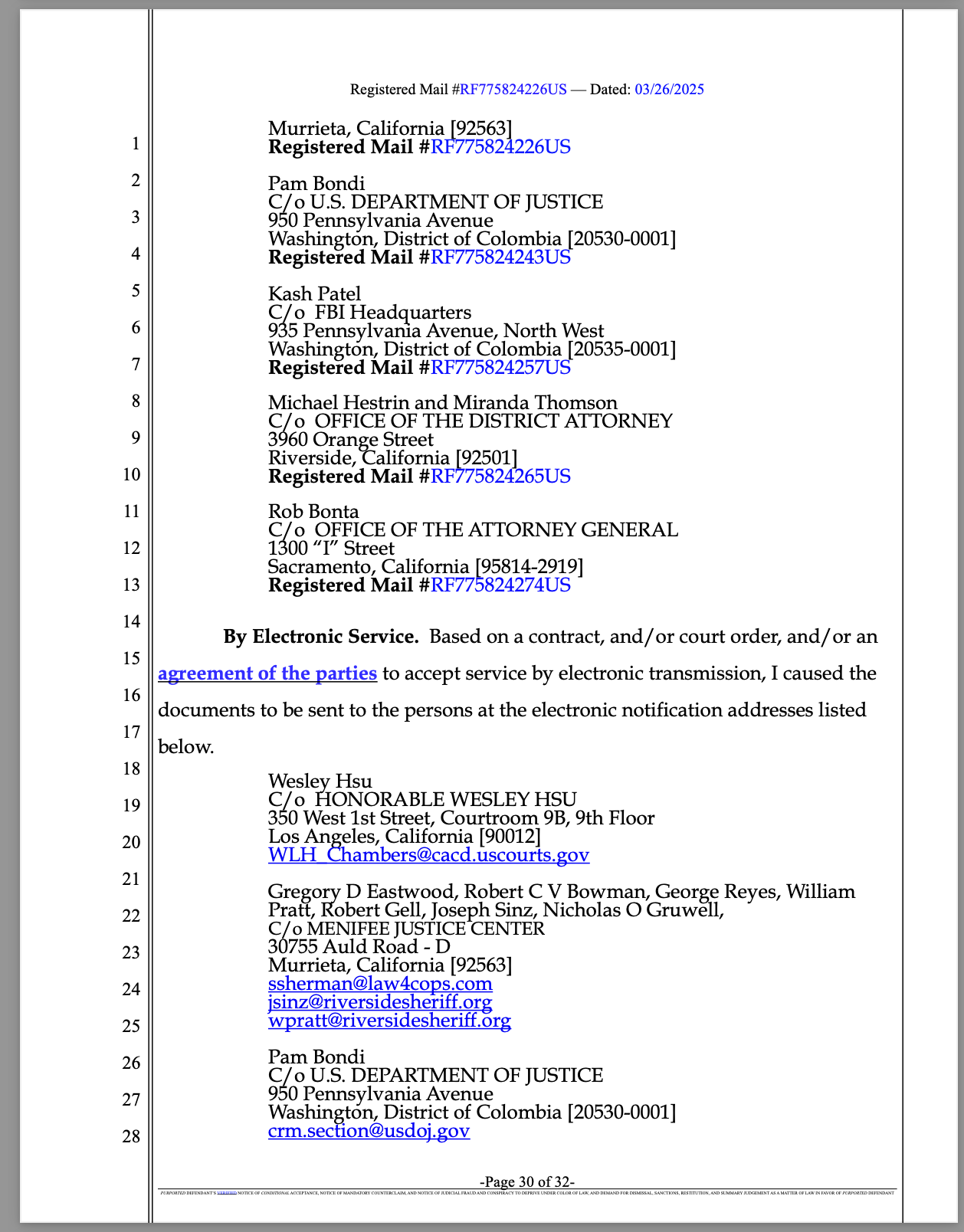

On March 11, 2025, Walker filed Federal Lawsuit Case No. 5:25−cv−00646−WLH−MAA, asserting claims under:

-

42 U.S.C. § 1983 – Deprivation of rights

-

18 U.S.C. § 241 – Conspiracy against rights

-

18 U.S.C. § 242 – Deprivation of rights under color of law

-

18 U.S.C. §§ 1961–1968 – Racketeering (RICO)

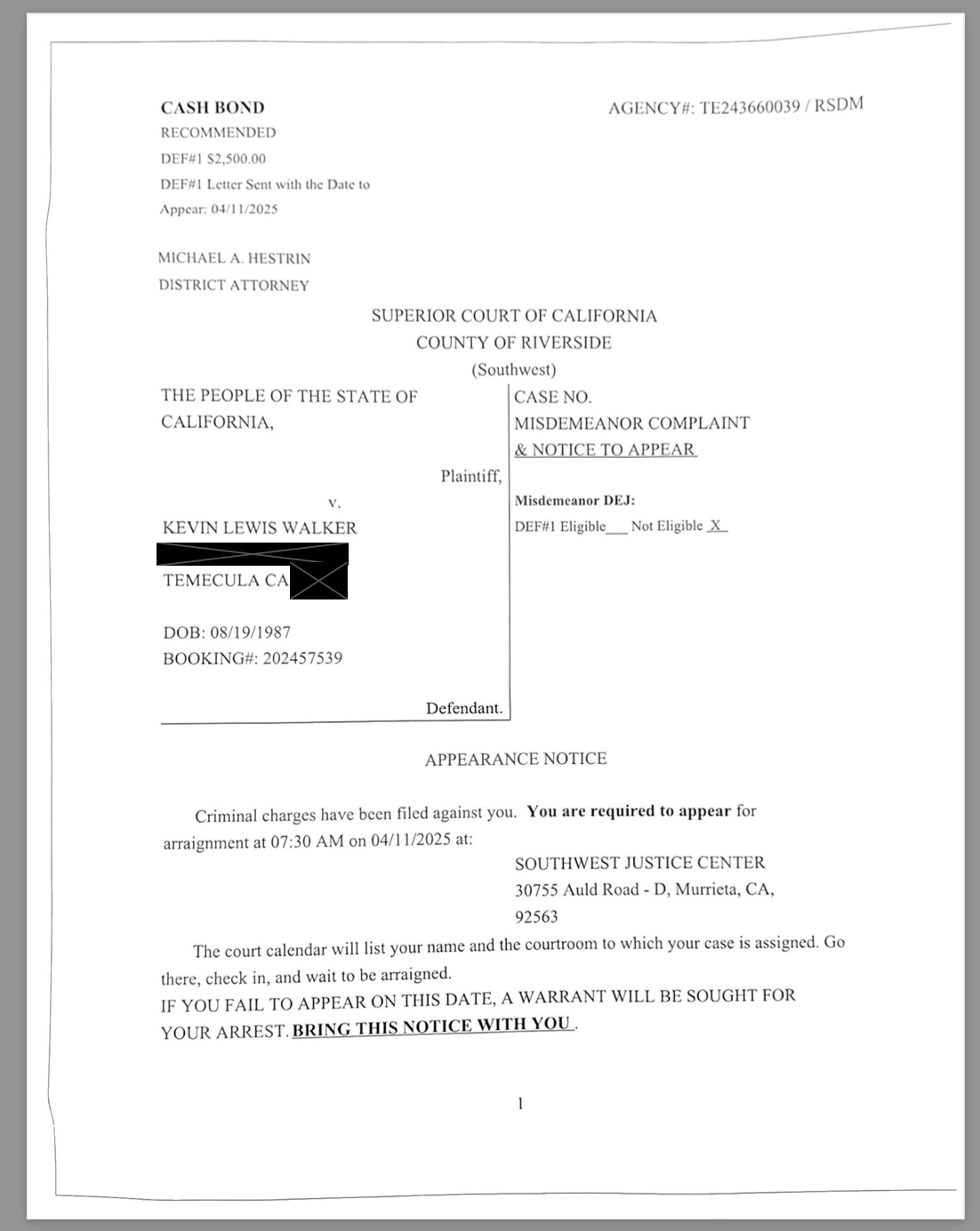

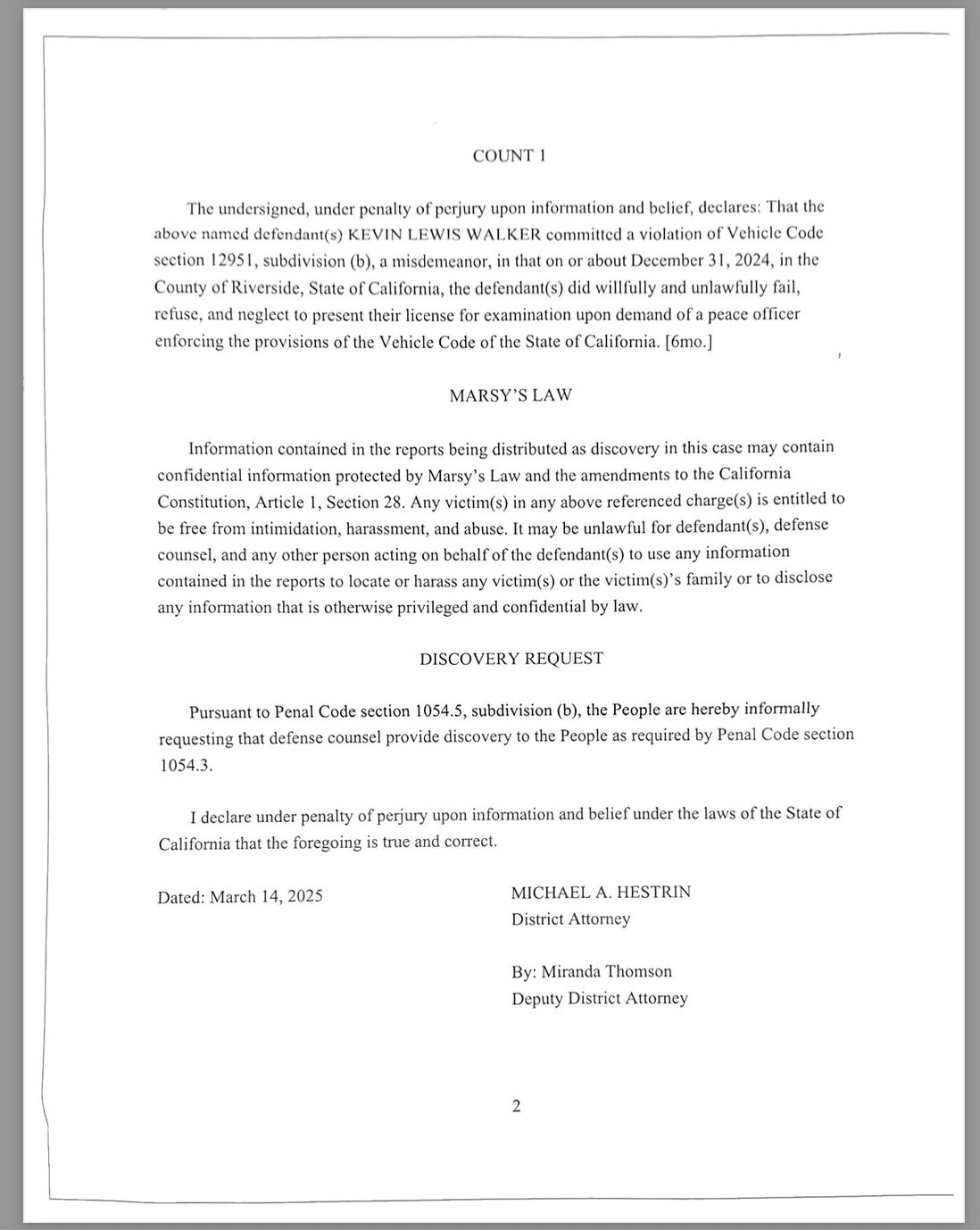

Just three days later, in what can only be described as an act of prosecutorial revenge, the State filed a fraudulent “charge” against Walker, using a fake, unsigned, and unverified instrument, devoid of lawful jurisdiction, lawful authority, or any admissible evidence of wrongdoing.

This alone proves malicious prosecution, obstruction of justice, and an attempt to interfere with a pending federal civil rights action—a federal felony in and of itself.

Kevin_Walker_Estate_et_al_v_Chad__cacdce-25-00646__0001.0.pdf

🧾 Fraudulent “Charges” from Inexperienced Prosecutor and DA’s Office Violate Federal Law

The fabricated citation and charge—issued in the name of Miranda Thomson, an attorney who only joined the bar in November of 2024, and under the auspices of Riverside County District Attorney Michael Hestrin—is not signed by either party or any judicial authority. This fact alone renders the document legally defective, coercive, and evidentiary of fraud.

The absence of a signature is not a clerical error—it is an admission of liability and concealment of personal accountability. The use of Thomson’s name without verification, combined with DA Hestrin’s official office as the cover for the scheme, only strengthens the accusation that this was a malicious attempt to extort Walker and interfere with federal judicial proceedings.

Delivered via U.S. Mail, and issued without proper authority, the fraudulent “charge” constitutes:

-

Mail Fraud (18 U.S.C. § 1341)

-

Extortion under the Hobbs Act (18 U.S.C. § 1951)

-

Forgery and impersonation (18 U.S.C. § 1028)

-

False official document and unauthorized instrument use

-

Securities Fraud, Wire Fraud, and Violation of Constitutional Process

These are not technicalities—they are federal felonies, and the failure to sign the instrument removes any protection or privilege from the issuing parties.

📑 Verified Affidavits Serve as Judicial Estoppel and Prima Facie Evidence

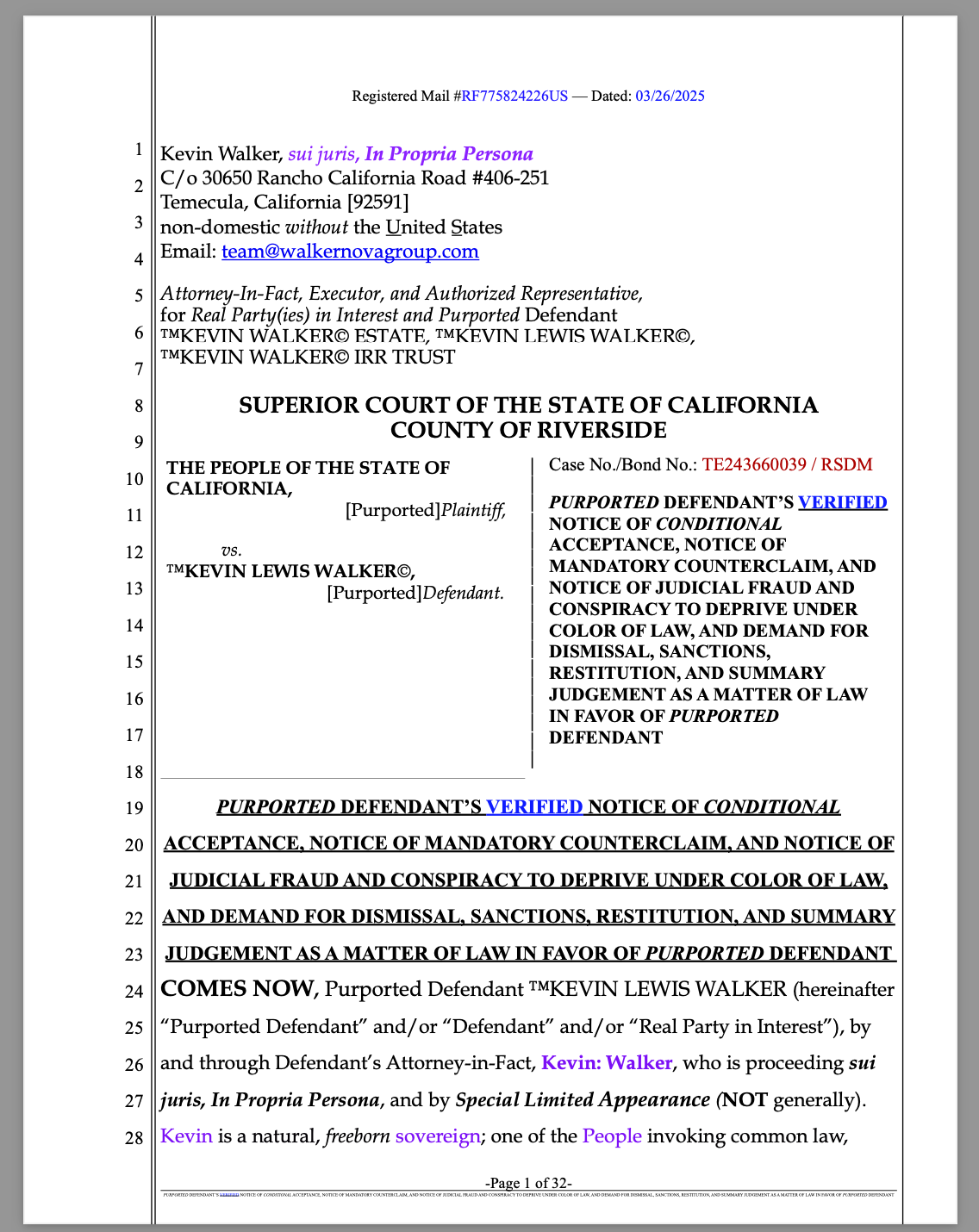

Walker’s Verified Notice of Conditional Acceptance is backed by four notarized Affidavit Contracts and Security Agreements—none of which have been rebutted. Under UCC § 3-505, Wong Sun v. United States, 371 U.S. 471 (1963), and commercial law, the silence of the Plaintiff constitutes:

Moreover, Walker’s instrument has been notarized, registered, and indorsed—qualifying it as a special deposit, monetary instrument, and lawful bond under U.C.C. § 3-104 and 31 U.S.C. § 5312, fully satisfying Rule 67 of the Federal Rules of Civil Procedure.

🔥 Crimes Established by Admission and Default

Due to the Plaintiff’s failure to provide verified rebuttals or proof of claim, the following crimes are legally and factually established as of record:

-

Extortion and Attempted Extortion

-

Conspiracy to Deprive Rights (18 U.S.C. § 241)

-

Deprivation of Rights Under Color of Law (18 U.S.C. § 242)

-

Securities Fraud and Unlawful Instrument Usage

-

Kidnapping, Unlawful Seizure, and False Arrest

-

Obstruction of Justice and Retaliation for Protected Activity

-

Identity Theft and Forgery

-

RICO Violations

-

Constitutional Treason

📣 the Kevin Walker Estate and Kevin Walker Demands Dismissal, Sanctions, and DOJ Criminal Prosecution

Walker has issued formal demand for:

-

Immediate dismissal with prejudice

-

Judicial sanctions and personal liability against all participating parties

-

Restitution in the amount of $100,000,000.00

-

Criminal referral to the U.S. Department of Justice, Office of the Inspector General, and Civil Rights Division

He further declares that any failure to respond constitutes final legal default, and that the Verified Notice itself shall stand as prima facie evidence of criminal activity and serve as the judgment in equity and law.

⚠️ Conclusion: The Record Is Final—And the Fraud Is Now Public

This is not merely a legal dispute—it is an exposé of judicial corruption, lawless prosecution, and state-sponsored extortion. The affidavits are unrebutted. The charges are unsigned. The issuing party is inexperienced. The supervising office is silent. The law is violated in full view of the public record.

Every government agent, official, and agency involved is now on notice. The record stands. The evidence is verified. And the Constitution demands justice.