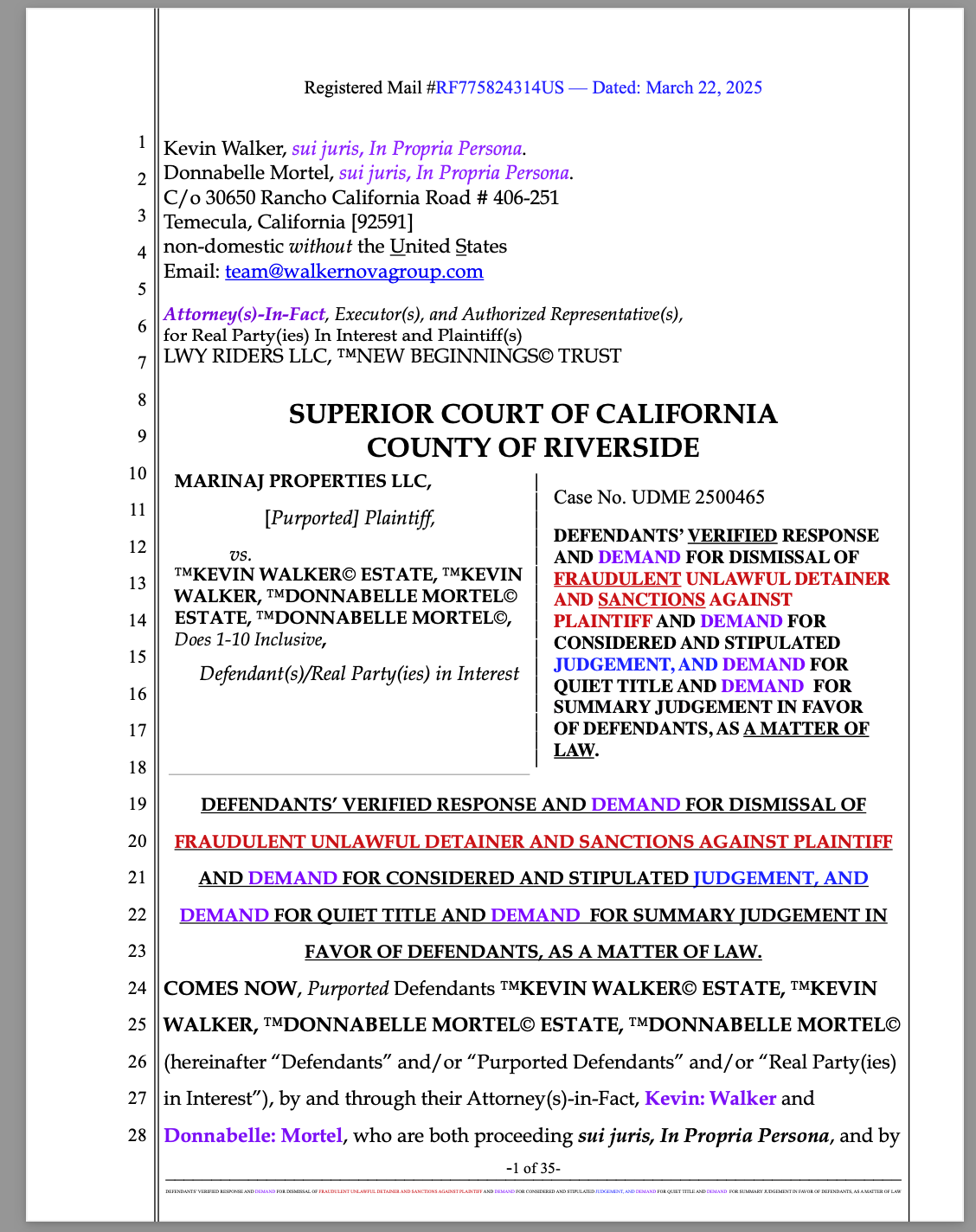

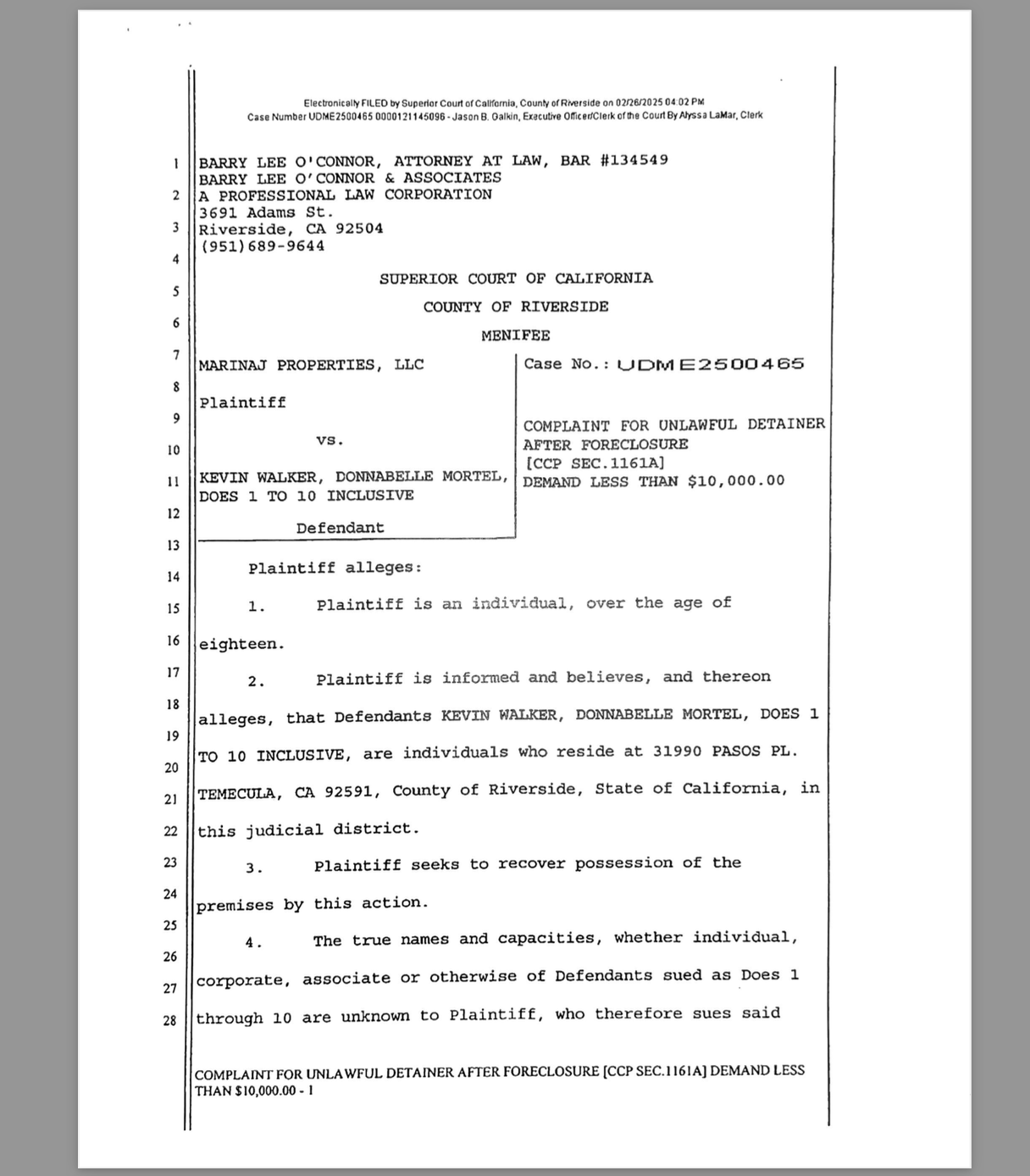

A massive mortgage fraud scheme has been uncovered in Riverside County, California, implicating Naji Doumit, Mary Doumit, Daniel Doumit, MARINAJ PROPERTIES, FOCUS ESTATE INC, and Barry Lee O’Connor & Associates in RICO violations, deed fraud, and fraud upon the court. Sworn affidavits have confirmed a pattern of racketeering, fraudulent foreclosures, and unlawful property seizures, making this a clear case of real estate fraud and conspiracy under the Racketeer Influenced and Corrupt Organizations Act (RICO), 18 U.S.C. § 1961 et seq.

-

Barry Lee O’Connor – Fraud and extortion in unlawful detainer amidst four (4) unrebutted affidavits

- DOWNLOAD DOCUMENT

Unveiling the Fraud: The Core of the Scheme

The Defendants in MARINAJ PROPERTIES, Naji Doumit v. Kevin Walker Estate, et al have exposed an orchestrated scheme where fraudulent Trustee’s Deeds Upon Sale were used to create false claims to property, allowing Naji Doumit, MARINAJ PROPERTIES, FOCUS ESTATES INC, and Barry Lee O’Connor & Associates to steal real estate under the guise of legal foreclosure and then unlawful detainer proceedings.

How the Scheme Works:

-

Fraudulent Foreclosure Process – The perpetrators falsely claim legal authority to foreclose on properties despite having no valid interest or standing.

-

Fraudulent, Void Ab Initio, and Fake Trustee’s Deeds Upon Sale – Illegitimate documents are recorded to fabricate ownership transfers that have no legal force or effect.

-

Unlawful Court Actions – Armed with void deeds, they file frivolous lawsuits and unlawful detainer actions to forcibly remove rightful property owners.

-

Fraud on the Court – These actions abuse the judicial system, constituting RICO predicate offenses such as mail fraud, wire fraud, and extortion.

Sworn Affidavits Confirm the Fraudulent Scheme

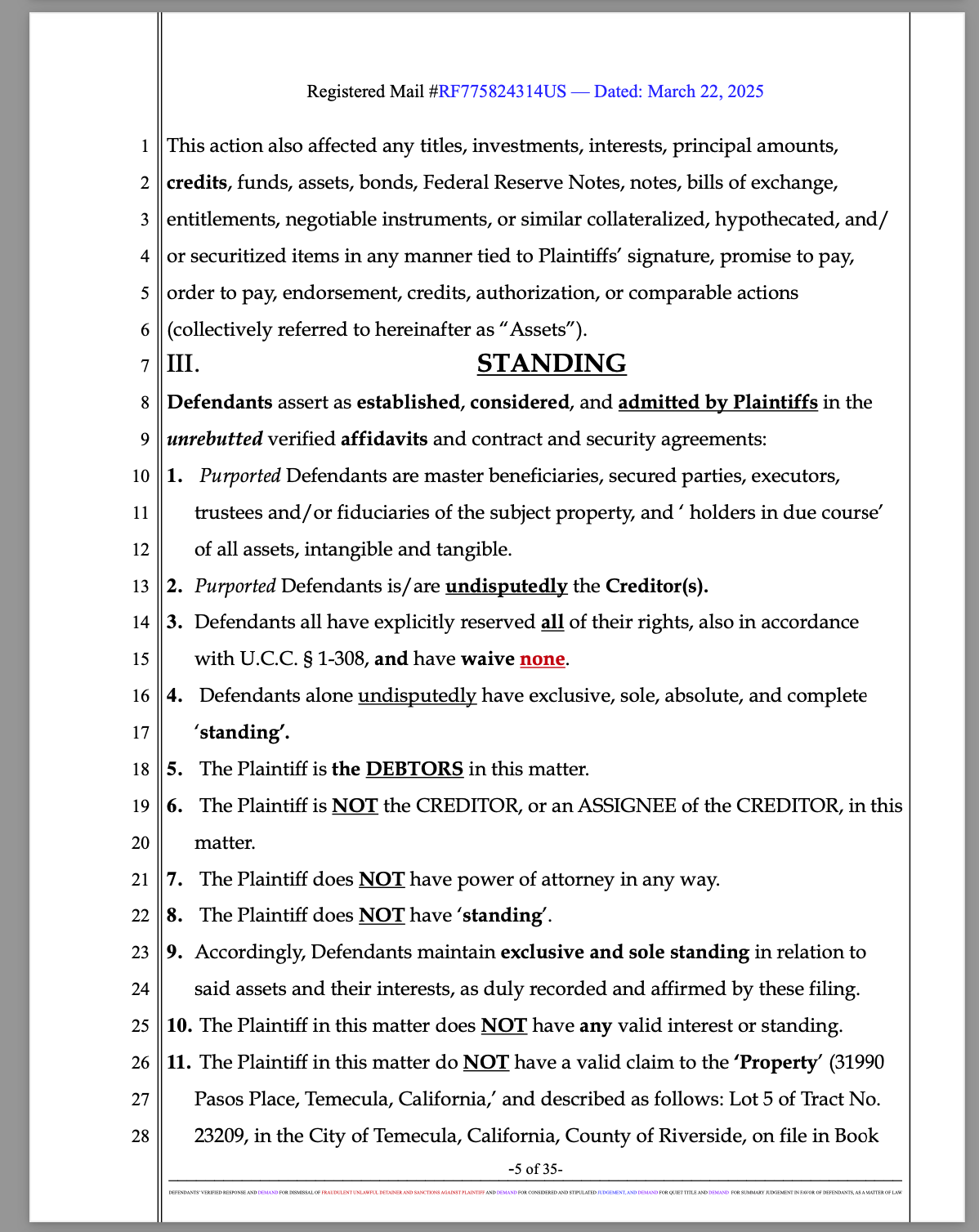

The Defendants’ affidavits expose the entire operation, providing undisputed evidence that the foreclosures and trustee’s deeds are fraudulent and void ab initio. Under UCC 3-505, the failure of the Plaintiff to rebut these affidavits constitutes tacit acquiescence, meaning the court must accept these facts as true.

Key Findings from the Affidavits:

-

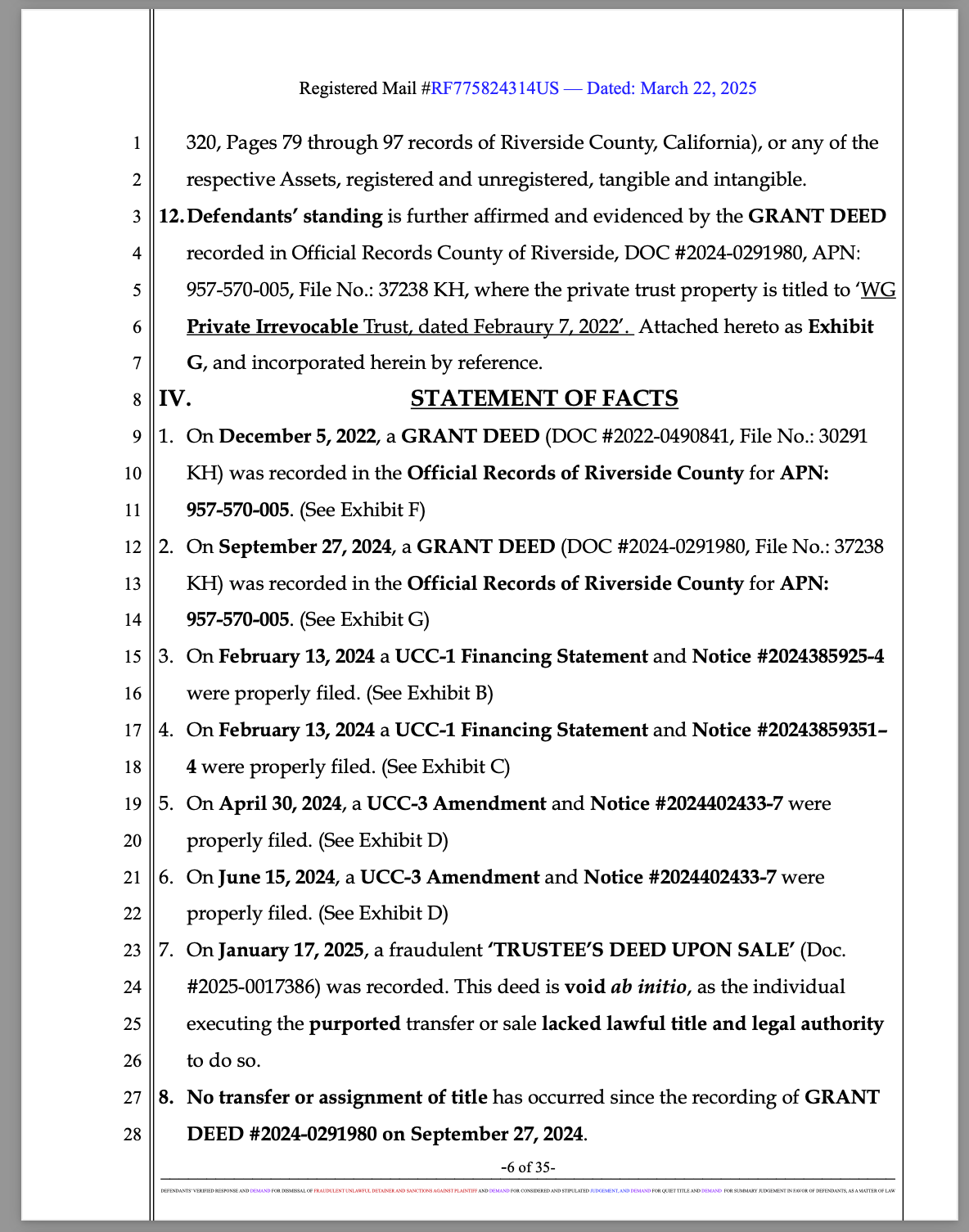

The Trustee’s Deed Upon Sale is Fraudulent – The individual executing the deed had no lawful title or authority to transfer the property.

-

The Foreclosure Was Unlawful – No valid assignment or creditor relationship existed, making the foreclosure process illegitimate and void.

-

RICO Violations Are Evident – The fraudulent transfer of property through deceptive practices, extortion, and false court filings constitutes a clear pattern of racketeering activity.

Since these affidavits stand unrebutted, the law demands dismissal of all claims against the Defendants and legal action against the perpetrators.

RICO Violations and Criminal Implications

The Racketeer Influenced and Corrupt Organizations Act (RICO), 18 U.S.C. § 1961 et seq., provides a framework for prosecuting criminal enterprises engaged in fraud, extortion, and theft through a pattern of illegal activity.

The Key RICO Violations in This Case:

-

Mail Fraud and Wire Fraud (18 U.S.C. §§ 1341, 1343) – Filing fraudulent documents and transmitting false claims through mail and electronic filings.

-

Extortion (18 U.S.C. § 1951) – Unlawfully seizing property under false pretenses and using court threats to force compliance.

-

Securities Fraud (18 U.S.C. § 1348) – Fraudulent conveyance of real estate titles as securities for financial gain.

-

Fraud on the Court (Hazel-Atlas Glass Co. v. Hartford-Empire Co., 322 U.S. 238 (1944)) – Using the judicial system to execute a fraudulent scheme.

If convicted under RICO, Naji Doumit, MARINAJ PROPERTIES, and Barry Lee O’Connor & Associates could face treble damages, asset forfeiture, and federal prison time.

Why the Defendants Are the Clear Winners

The Plaintiff’s case is built entirely on fraud, while the Defendants have submitted conclusive evidence proving the unlawful nature of the claims. The Trustee’s Deed Upon Sale is void, and the foreclosure was illegitimate—meaning the Plaintiff has no lawful claim to the property.

The Court Must Take Immediate Action:

-

Cancel the fraudulent hearing and dismiss the case with prejudice.

-

Declare the Trustee’s Deed Upon Sale void ab initio and strike it from county records.

-

Grant summary judgment in favor of the Defendants.

-

Sanction the Plaintiff for fraudulent misrepresentation and slander of title.

-

Refer the case for criminal investigation under RICO statutes.

Conclusion: Justice Must Prevail

This case is a textbook example of mortgage fraud, RICO violations, and abuse of the legal system. With sworn affidavits confirming the fraudulent scheme, unlawful foreclosures, and void trustee’s deeds, the Defendants must prevail, and the perpetrators must face legal consequences.

The court has no legal or moral choice but to dismiss the case, restore the rightful property ownership, and hold Naji Doumit, MARINAJ PROPERTIES, and Barry Lee O’Connor & Associates accountable for their fraudulent and criminal actions.