™WALKERNOVA GROUP©

We are a private educational and administrative support firm focused on matters involving Constitutional rights, private and public law distinctions, secured transactions, trust and estate structuring, negotiable instruments, and lawful remedy under equity, contract, and commercial law.

Our areas of concentration include State Citizenship, national status clarification, lawful trust and contract administration, UCC-based filings, private banking principles, estate planning, foreclosure defense strategies, and lawful documentation involving trusts, deeds, securities, and equity interests.

We believe that rights must be lawfully asserted to be preserved, and that the distinction between rights, privileges, and benefits is critical. Every day, individuals are subjected to actions taken under color of law due to widespread misunderstanding of legal terminology, contract enforcement, and the operation of legal fictions.

We help clarify the proper use and interpretation of commonly misunderstood terms such as:

individual, person, financial institution, national, state Citizen, U.S. citizen, secured party, attorney-in-fact vs. attorney-at-law, and more—ensuring that lawful standing and private rights are clearly distinguished from statutory presumptions.

FEATURED VIDEOS

LATEST NEWS

Oath Over Freedom: How Politicians Surrender Natural Rights to Serve the Corporate State

When a politician accepts public office, they operate under a different legal capacity — no longer as a private State Citizen with unalienable rights, but as a U.S. citizen bound to statutory obligations. Their oath of office contracts them into fiduciary duty, placing them under administrative and commercial law, not common law. This transition subordinates natural rights in favor of public trust obligations. Under doctrines like Clearfield Trust and UCC § 1-201(27), politicians act as agents of the corporate UNITED STATES and are subject to public policy, not sovereign authority. In essence, holding office means operating as a trustee of the public, not a free individual.

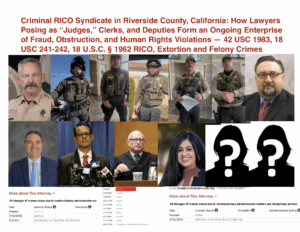

Criminal RICO Syndicate in Riverside County, California: How Lawyers Posing as “Judges,” Clerks, and Deputies Form an Ongoing Enterprise of Fraud, Obstruction, and Human Rights Violations — 42 USC 1984, 18 USC 241-242, RICO, Extortion and more

This exposé reveals a coordinated RICO enterprise operating within Riverside County’s justice system, naming Sheriff Chad Bianco, DA Michael Hestrin, Commissioner Tamara L. Wagner, and others for systemic fraud, extortion, and deprivation of rights under 42 U.S.C. § 1983. It further exposes U.S. District Judge Jesus G. Bernal for judicial obstruction and record concealment, constituting willful interference in violation of federal due process. Backed by an active federal RICO lawsuit under 18 U.S.C. § 1962 before Judge Wesley Hsu, the article outlines a pattern of racketeering, forged instruments, false filings, and unlawful evictions. Officials including Pam Bondi, Rob Bonta, Kash Patel, and the FBI have been formally notified but remain silent. This is not isolated misconduct—it is organized crime under color of law. The piece stands as both public notice and evidentiary documentation for further federal action.

Riverside, California: What a California Court Commissioner Really Is and how Fraudulent “Commissioner” Charles Rogers, Jeremiah Raxter are Engaged in RICO and Felonies

Charles Rogers (Bar #64530) and Jeremiah D. Raxter (Bar #276811) are engaged in an ongoing scheme of judicial fraud and racketeering in Riverside County, California. Both individuals are inactive members of the California State Bar and have no lawful authority to act as judges or commissioners. Their acts — including issuing bench warrants, signing orders, and presiding over court matters — are void ab initio and constitute federal felonies under 18 U.S.C. §§ 241, 242, and 1962. Their actions represent a criminal enterprise under color of law, demanding immediate investigation, disbarment, and prosecution. Public notice is hereby given that all their proceedings are fraudulent and without legal force.

Organized Judicial Racketeering in Southern California: How Attorneys Masquerading as Judges Collude with Clerks and Sheriffs to Perpetrate Fraud, Extortion, and Civil Rights Violations Under Color of Law

This exposé reveals a coordinated RICO enterprise operating within Riverside County’s justice system, naming Sheriff Chad Bianco, DA Michael Hestrin, Commissioner Tamara L. Wagner, and others for systemic fraud, extortion, and deprivation of rights under 42 U.S.C. § 1983. It further exposes U.S. District Judge Jesus G. Bernal for judicial obstruction and record concealment, constituting willful interference in violation of federal due process. Backed by an active federal RICO lawsuit under 18 U.S.C. § 1962 before Judge Wesley Hsu, the article outlines a pattern of racketeering, forged instruments, false filings, and unlawful evictions. Officials including Pam Bondi, Rob Bonta, Kash Patel, and the FBI have been formally notified but remain silent. This is not isolated misconduct—it is organized crime under color of law. The piece stands as both public notice and evidentiary documentation for further federal action.

RICO-Fueled Courtroom Corruption in Riverside: Attorney Tamara L. Wagner Implicated for Fraud and Abuse of Office

Tamara L. Wagner (CA Bar #188613), a licensed attorney acting as a judicial officer in Riverside County, is now at the center of a federal removal action citing judicial fraud, civil rights violations, and RICO conspiracy. Defendants allege she is unlawfully practicing law from the bench without constitutional authority, advancing proceedings in open dishonor. Verified affidavits, UCC filings, and summary judgment demands were ignored, leading to claims of railroading and systemic court corruption. The case, removed under 28 U.S.C. §§ 1441, 1443, and 1446, is now pending in federal court.

Fraud, Color of Law, and RICO Violations by Attorney Monika Vermani (Bar #355080) Exposed in Riverside County, California

Attorney Monika Vermani (CA Bar #355080) has been formally named in a high-level commercial fraud and racketeering operation involving Riverside County’s unlawful prosecution of a secured private trust estate. Verified affidavits, unrebutted notices, and perfected UCC filings establish that Vermani is proceeding without lawful jurisdiction, operating under color of law, and aiding in the unauthorized securitization and monetization of private estate assets. The record demands $100 million in damages, immediate dismissal with prejudice, and criminal prosecution under 18 U.S.C. §§ 241, 242, and 1961–1968 (RICO). This case exposes a systemic pattern of commercial fraud, identity theft, and administrative conspiracy masquerading as routine judicial process.

Attorney Monika Vermani (CA Bar #355080) has been formally named in a high-level commercial fraud and racketeering operation involving Riverside County’s unlawful prosecution of a secured private trust estate. Verified affidavits, unrebutted notices, and perfected UCC filings establish that Vermani is proceeding without lawful jurisdiction, operating under color of law, and aiding in the unauthorized securitization and monetization of private estate assets. The record demands $100 million in damages, immediate dismissal with prejudice, and criminal prosecution under 18 U.S.C. §§ 241, 242, and 1961–1968 (RICO). This case exposes a systemic pattern of commercial fraud, identity theft, and administrative conspiracy masquerading as routine judicial process.

Is a U.S. Citizen an Authorized Representative of the United States?

A U.S. citizen does not possess agency on behalf of the United States government unless expressly appointed by statute, contract, or lawful delegation. Mere citizenship does not establish authority to act for or represent the federal government in any legal or commercial capacity. In reality, the U.S. citizen is the governed and regulated party—operating under federal jurisdiction, not within it. Only properly delegated agents—such as public officers, attorneys, or fiduciaries acting under written authority—may speak or act on behalf of the United States. Recognizing this separation is essential in all matters involving legal standing, jurisdiction, and commercial equity.

How to Convene a 12-Panel Grand Jury: Citizen Authority vs. State Monopoly

Learn how private citizens can lawfully initiate grand jury investigations through both statutory and common law means. This article explains the difference between court-convened grand juries and citizen-led panels formed under First Amendment and natural law authority. From submitting affidavits to the U.S. Attorney under 18 U.S.C. § 3332(a), to organizing lawful assemblies that issue true bills, the guide walks through each step. It empowers those facing systemic fraud, corruption, or due process violations with a lawful path to remedy. Grand juries are not just for prosecutors—they are a tool for the people.

Zillow, Title Fraud, and the Engineered Dispossession of Private Property

Zillow functions as a data monopoly that omits Grant Deeds, Warranty Deeds, and equitable liens from its property reports—concealing true ownership while promoting foreclosure narratives. This article exposes how Zillow, in collusion with county agencies like Riverside County, helps institutional actors ignore lawful private trust conveyances. Public records confirm that MEMORY STARBURST TRUST and WG PRIVATE IRREVOCABLE TRUST lawfully conveyed title, yet those transactions are suppressed under color of law. The result is a fraudulent appearance of foreclosure legitimacy, violating due process and facilitating commercial theft. Zillow’s omission isn’t accidental—it’s a systemic framework of fraud, dishonor, and property rights abuse masked as public information.

Appeal Filed in Walker Estate Action: Exposing Procedural Fraud, Concealment, and Constitutional Violations

On April 2, 2025, the Plaintiffs in Kevin Walker Estate, et al. v. Jay Promisco, et al., Case No. 5:25-cv-00339-JGB, formally filed a Verified Notice of Appeal to the U.S. Court of Appeals for the Ninth Circuit. This filing is not just a procedural formality—it outlines a detailed and extensive challenge to what Plaintiffs describe as gross procedural errors, record tampering, suppression of filings, and constitutional violations by both court officers and defendants.

Equitable Subrogation and Trust Law: The Hidden Remedy for Unjust Enrichment and Property Restitution

Equitable Subrogation along with Natural Law and Trust Law is the Remedy to Stop the Unjust Enrichment. It is for the "Restitution" of our Private God Given Rights which is our PROPERTY. Subrogation means "Substitution". That’s what the Banksters and the Fictional "STATE" did to our Mothers when they were "deceived" into "Registering" our PROPERTY — Our Equitable Rights and Remedies were Subrogated/Substituted.

Unlocking Treasury Discharge: How Private Americans Can Lawfully Set Off Debt

Few Americans realize that in 1933, the U.S. government eliminated real money—but also provided a remedy: the ability to discharge debt through lawful assignment. Under 31 U.S.C. §§ 3123 and 5118, private individuals can lawfully tender value and assign obligations to the U.S. Treasury for dollar-for-dollar discharge, utilizing the same credit-based system banks use every day. This isn’t theory — it’s codified law, commercial equity, and constitutional remedy in motion. When you perfect your interest, assign the obligation, and document the discharge, you don’t just resolve your own debt—you actively contribute to reducing the public burden. The only thing missing? The awareness that it’s been your lawful right all along.

SERVICES & PRODUCTS

BOOKS, DOCUMENTS, RESOURCES

-

OXFORD DICTIONARY OF LAW

$0.00 Add to cart -

The Concise Dictionary of Current English Adapted by H. W. FOWLER and F. G. FOWLER – 1919

$0.00 Add to cart -

The Story of The Social Security Number by Carolyn Puckett

$0.00 Add to cart -

Dealing With Presentments

$0.00 Add to cart -

HOW TO CREATE CURRENCIES FOR LOCAL COMMUNITIES, By Hartford Van Dyke, Commercial Lawyer

$0.00 Add to cart -

The Holy Bible – Geneva Edition 1st Printing, 1st Edition in 1560

$0.00 Add to cart -

CREDIT CLEAN UP – STEPS 1 & 2

$100.00Original price was: $100.00.$0.00Current price is: $0.00. Add to cart -

BIRTH CERTIFICATE BOND COVER LETTER

$0.00 Add to cart -

MORTGAGE VERIFICATION LETTER

$300.00Original price was: $300.00.$9.99Current price is: $9.99. Add to cart -

NOTICE OF DEFAULT TEMPLTE – 2010-01

$150.00Original price was: $150.00.$0.00Current price is: $0.00. Add to cart -

Modern Money Mechanics, By Federal Reserve Bank of Chicago – 1994

$0.00 Add to cart -

Black’s Law Dictionary 3rd Edition – 1910

$197.00Original price was: $197.00.$0.00Current price is: $0.00. Add to cart

For Smart visionaries

Embrace the Wisdom of Time and Money

In the pursuit of your dreams, remember that money is but a means to an end, a tool in your hands to craft the life you envision. Invest it wisely, not just in financial endeavors, but in experiences that enrich your soul. Time, the most precious currency, is the foundation of your journey. Allocate it with care, for it is the true measure of wealth. Seize each moment, for in its passage lies the essence of a life well-lived. Let your pursuits be guided by purpose, and may every resource at your disposal serve to enhance the tapestry of your existence.