™WALKERNOVA GROUP©

We are a private educational and administrative support firm focused on matters involving Constitutional rights, private and public law distinctions, secured transactions, trust and estate structuring, negotiable instruments, and lawful remedy under equity, contract, and commercial law.

Our areas of concentration include State Citizenship, national status clarification, lawful trust and contract administration, UCC-based filings, private banking principles, estate planning, foreclosure defense strategies, and lawful documentation involving trusts, deeds, securities, and equity interests.

We believe that rights must be lawfully asserted to be preserved, and that the distinction between rights, privileges, and benefits is critical. Every day, individuals are subjected to actions taken under color of law due to widespread misunderstanding of legal terminology, contract enforcement, and the operation of legal fictions.

We help clarify the proper use and interpretation of commonly misunderstood terms such as:

individual, person, financial institution, national, state Citizen, U.S. citizen, secured party, attorney-in-fact vs. attorney-at-law, and more—ensuring that lawful standing and private rights are clearly distinguished from statutory presumptions.

FEATURED VIDEOS

LATEST NEWS

Perfected Claim, Perfected Remedy: How to Enforce Your Rights After Foreclosure

Equity is a parallel legal system grounded in conscience, fairness, and moral justice, developed to address the limitations and rigidity of common law. It offers remedies where legal (monetary) relief is insufficient—such as injunctions, constructive trusts, and specific performance. Equity acts upon the person rather than the property (in personam), and is guided by enduring maxims, including: “He who comes into equity must come with clean hands” and “Equity regards as done that which ought to be done.” It ensures that rights are enforced not merely by law, but by what is just and honorable.

Contract by Conduct: Offer, Acceptance, and Equity in Home and Auto Sales

This article explains how contracts can be formed through conduct, communication, and performance — even without a signature — under common law, equity, and the UCC. It highlights how real estate and auto sales can become legally binding when an offer is made, payment is tendered, and the other party accepts by silence or action. Citing UCC §§ 2-204, 2-206, and 1-103, the article shows how equity enforces what "ought to be done" when formalities are absent but intent and performance are clear.

The Power of Equity: How to Secure Your Property Rights Without a Deed

When brokers act, equity responds — even without a signed contract. This article explains how real property rights can vest through conduct, silence, and lawful tender. Learn how equitable title arises when an offer is accepted by behavior, not just by words. Discover how to protect your position through affidavits, UCC filings, and quiet title actions. In equity, what ought to be done is treated as done — and truth leaves a paper trail.

Due Process Violations and Railroading: California’s and Nevada’s Unconstitutional Foreclosure vs. Florida’s Judicial Remedy

In the modern mortgage and foreclosure landscape, few issues more clearly expose the divide between constitutional governance and administrative overreach than the foreclosure processes implemented by the states. Florida, California, and Nevada each represent fundamentally different paths — and philosophies — when it comes to property rights, due process, and lawful standing.

Why You Must Never Mix Fiduciary Roles with ‘Pro Per’ Status in Legal Pleadings

Properly asserting legal capacity in court is not just procedural—it’s foundational. When representing a trust or estate, many plaintiffs unintentionally undermine their own cases by blending fiduciary roles with personal appearances such as “pro per” or “in propria persona.” This confusion often leads to dismissal—not because courts prohibit fiduciaries, but because the capacity is improperly stated. Courts cannot lawfully prevent a duly authorized fiduciary (such as an Executor, Trustee, or Attorney-in-Fact) from asserting rights on behalf of a trust or estate. However, when fiduciaries use personal language or appear to be representing a separate legal entity as themselves, courts may treat the filing as unauthorized practice of law. This article clarifies which capacities are lawful, which combinations to avoid, and how to protect your standing by appearing strictly in a private fiduciary role. In law, it’s not only what you say—but how you say it—that defines whether you are recognized with authority.

W-4, W-2, W-9, and W-8BEN: How IRS Forms Determine Your Tax Status and Legal Standing

Most workers in the U.S. sign a W-4 or W-9 without realizing they’re voluntarily entering into a federal tax contract that defines their labor as taxable "wages" or income. These forms establish U.S. person status and allow employers or payers to withhold taxes and issue reporting forms like the W-2 or 1099. Alternatively, the W-8BEN can be used to lawfully assert foreign status, potentially eliminating or reducing tax withholding and shifting your income outside federal jurisdiction. To use it properly, you must have a valid legal foundation—such as corrected status, a foreign trust or entity, and a private contractual arrangement not subject to statutory employment law. If used incorrectly, the IRS may treat the W-8BEN as fraudulent. Dealing in good faith and clearly expressing your intentions matters. Choosing the right form is more than paperwork — it determines your status, rights, and financial control.

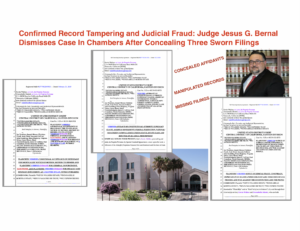

Confirmed Record Tampering and Judicial Fraud: Judge Jesus G. Bernal Dismisses Case In Chambers After Concealing Three Sworn Filings

Three sworn court documents were lawfully submitted and ignored. Judge Jesus G. Bernal concealed them, then dismissed the case in chambers—privately, without hearing, and under color of law. The Plaintiffs filed an unrebutted affidavit establishing judicial fraud and conspiracy. That affidavit stands as law. Due process was denied, and the Constitution disregarded.

Color of Law Crimes: When Sheriffs Ignore Their Oath

Peace officers, including sheriffs, take an oath to uphold the Constitution—but when they exceed their lawful authority, they operate under color of law. Even without malicious intent, incompetence or inadequate training can result in serious civil rights violations. Under 18 U.S.C. § 242, depriving someone of their rights—whether knowingly or through ignorance—is a federal offense. The law is clear: ignorance is no excuse, especially for those entrusted to enforce it.

Credit Processing Mechanisms: How Trusts, Tax Forms & Commercial Law Can Unlock Lawful Refunds and Offsets

This guide explains how credit processing mechanisms like IRS Form 1041, Form 1042, and UCC filings allow for lawful deduction, refund claims, and debt discharge. You’ll learn how to use bad debt deductions under IRC §453, how to treat 1099-OID and 1099-B income, and how structured deposits to banks may qualify as lawful credit tenders. Designed for trusts, estates, and foreign or ecclesiastical entities, this strategy aligns contract law, tax law, and commercial paper. Explore how to convert paper obligations into lawful credits and reclaim financial standing.

When a Home Auction Sale is Void Ab Initio: The Truth About Unauthorized Trustee Sales in Non-Judicial Foreclosures

Discover how loan servicers exploit non-judicial foreclosure to force unauthorized sales—even during active administrative procedures. Learn why a Trustee’s Deed of Sale issued without proper authority is void ab initio, and how it merely transfers a lien, not lawful title. This article explains how placing your home in a private trust protects your property, and how fraud—having no statute of limitations—can render any sale legally null.

Sovereignty by Trust: How a Foreign Trust Qualifies as a Nation Under International Law

A foreign trust can lawfully serve as the foundation of a nation, meeting the core criteria for statehood established by the Montevideo Convention. Possessing legal personality, defined territory, a permanent population, and a governing structure, it functions as a sovereign entity under both contract and treaty law. This article explores how foreign trusts establish legitimate nations with the authority to govern, enter into agreements, and assert independence on the global stage.

Riverside County Retaliation, RICO, and Fraud: Verified Affidavits Confirm Fraud, RICO, and Constitutional Violations by Riverside County’s Michael Hestrin and Miranda Thomson and Riverside County Sheriff

Fraudulent and unsigned charges brought against Kevin Lewis Walker—just days after filing his federal civil rights lawsuit—have been exposed as a retaliatory and criminal act of extortion. Lacking a signature, verified complaint, or injured party, the prosecution itself now stands as prima facie evidence of RICO violations, mail fraud, and abuse of process. The individuals involved—including a newly licensed attorney and the Riverside County DA—are fully liable and accountable under the law.

SERVICES & PRODUCTS

BOOKS, DOCUMENTS, RESOURCES

-

Accepted for Value Process – Doug Riddle

$0.00 Add to cart -

Notice of Default and Opportunity to Cure (Template 001)

$150.00Original price was: $150.00.$0.00Current price is: $0.00. Add to cart -

Constructive Notice of Denial of Consent

$100.00Original price was: $100.00.$0.00Current price is: $0.00. Add to cart -

Notary Protest Template, Breakdown, and Details (Template 1)

$500.00Original price was: $500.00.$0.00Current price is: $0.00. Add to cart -

First National Bank of Montgomery v. Daly (December 7, 1968) – Mortgages are Fraud Null and Void

$0.00 Add to cart -

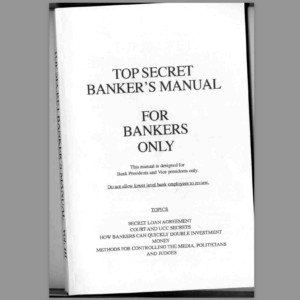

Banker’s Top Secret Manual – 2002

$0.00 Add to cart -

Magnetic Current – Ed Leedskalnin (1945)

$0.00 Add to cart -

Black’s Law Dictionary 2nd Edition – 1910

$0.00 Add to cart -

Black’s Law Dictionary 1st Edition – 1891

$0.00 Add to cart -

Meet Your Strawman/Artificial Entity/Trust: 14th Amendment citizens, Law, Court, Private citizens/Sovereigns

$0.00 Add to cart -

CREDITORS AND THEIR BONDS PLUS THE HIDDEN COMMERCIAL COURT PROCESS

$0.00 Add to cart -

CREDITORS AND THEIR BONDS: Courts, Bonds, and How Everything is Commerce

$0.00 Add to cart

For Smart visionaries

Embrace the Wisdom of Time and Money

In the pursuit of your dreams, remember that money is but a means to an end, a tool in your hands to craft the life you envision. Invest it wisely, not just in financial endeavors, but in experiences that enrich your soul. Time, the most precious currency, is the foundation of your journey. Allocate it with care, for it is the true measure of wealth. Seize each moment, for in its passage lies the essence of a life well-lived. Let your pursuits be guided by purpose, and may every resource at your disposal serve to enhance the tapestry of your existence.